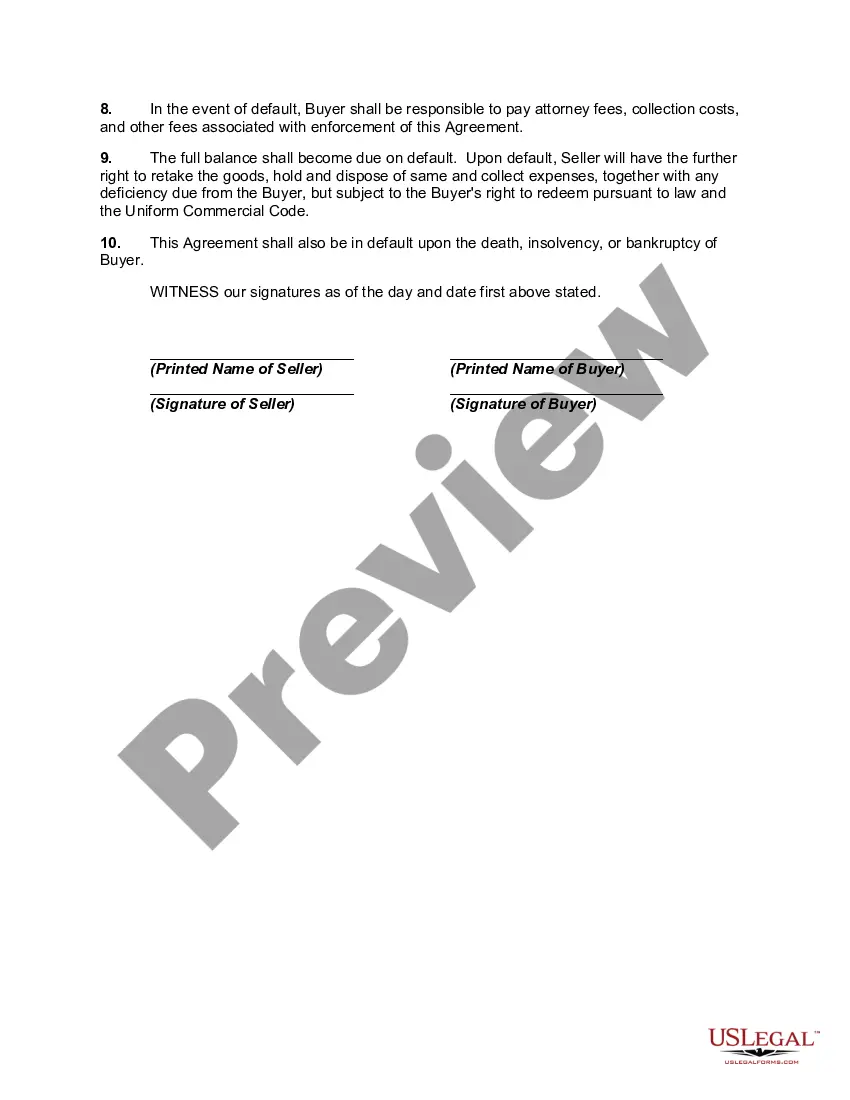

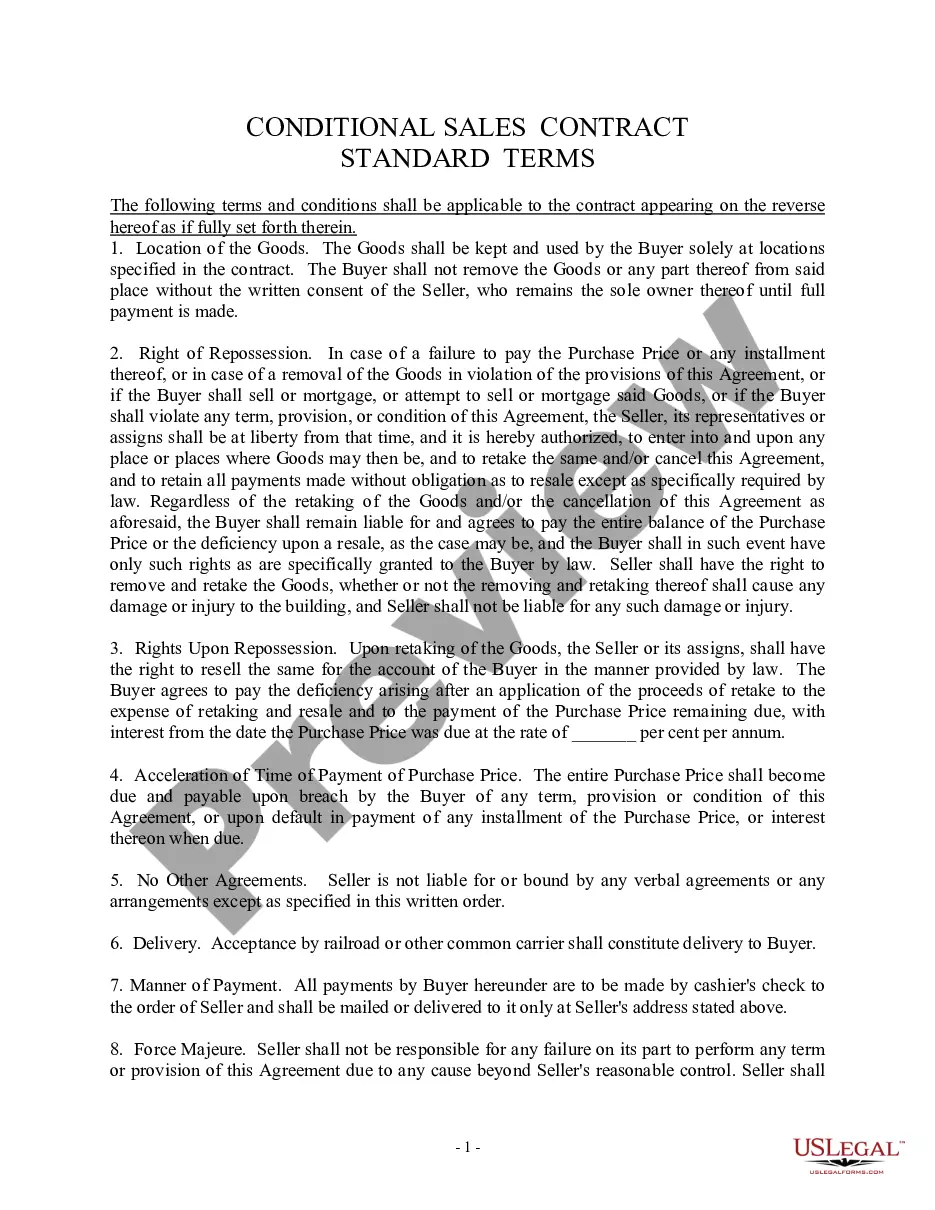

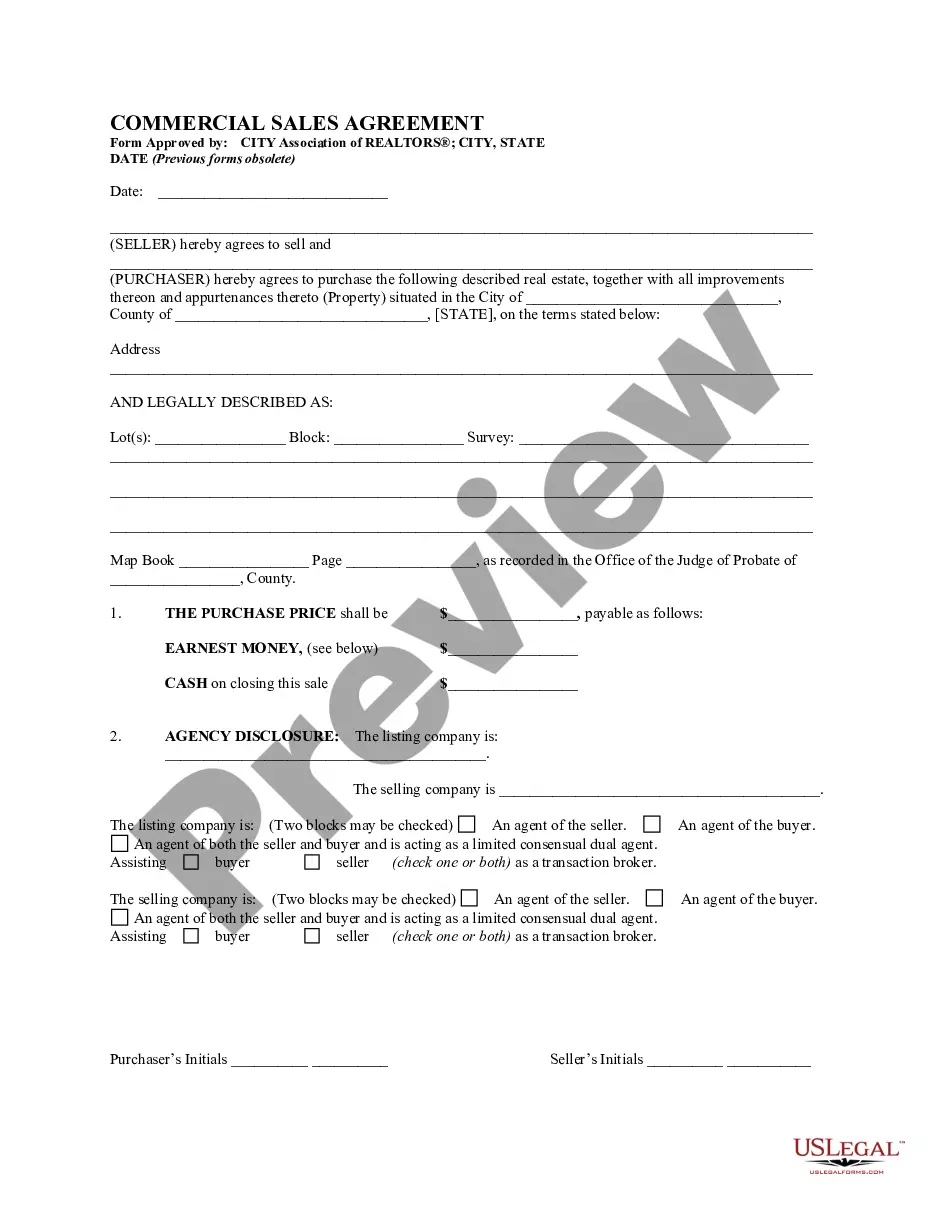

A conditional sales contract is sometimes used in commercial finance, whereby the seller retains title to the goods through a purchase money security interest. Ownership passes to the purchaser when the installments are fully paid.

Tennessee Conditional Sales Contract

Description

How to fill out Conditional Sales Contract?

You might invest hours online seeking the legal document template that meets the state and federal requirements you need.

US Legal Forms offers an extensive selection of legal templates that have been reviewed by experts.

You can download or print the Tennessee Conditional Sales Contract from our platform.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Afterward, you can complete, modify, print, or sign the Tennessee Conditional Sales Contract.

- Every legal document template you obtain is your own asset permanently.

- To obtain another copy of a purchased form, navigate to the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions provided below.

- Firstly, ensure that you have chosen the correct document template for the state/region of your choice.

- Review the form description to confirm you have selected the appropriate template.

Form popularity

FAQ

The frequency of filing sales tax in Tennessee depends on your total sales volume. Most businesses will need to file either monthly, quarterly, or annually. It's crucial to check with the Tennessee Department of Revenue for your specific filing status. Keeping a Tennessee Conditional Sales Contract can assist in organizing your transactions for smoother tax filing.

To file sales and use tax in Tennessee, you must first register for a seller’s permit through the Tennessee Department of Revenue. Once registered, you can file your sales tax return online or by mail. Be sure to keep accurate records of your sales and purchases, as this information will be vital for your filing. Utilizing a Tennessee Conditional Sales Contract can help clarify tax responsibilities when it comes to selling goods in the state.

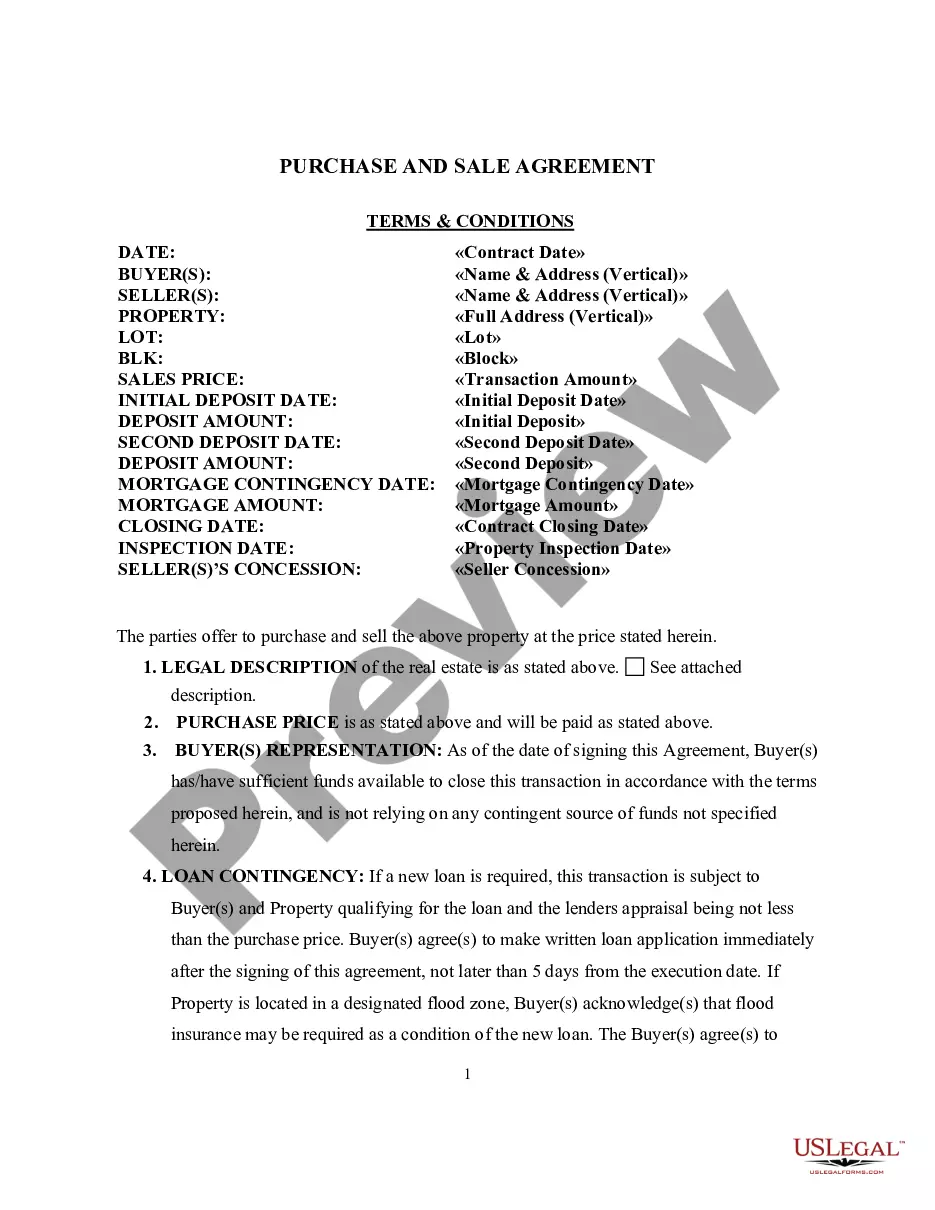

To fill out a Tennessee car title when selling, ensure you have the current title in hand, and complete the assigned sections correctly. Include the buyer's information, odometer reading, and your signature as the seller. It’s also beneficial to detail any conditions of the sale, as noted in your Tennessee Conditional Sales Contract, to facilitate a smooth transfer of ownership.

Yes, conditional contracts are generally enforceable as long as they meet valid legal requirements. For instance, a Tennessee Conditional Sales Contract binds both parties to its terms, ensuring that conditions must be fulfilled for the contract to remain valid. It’s always advisable to seek legal counsel to understand your rights and responsibilities under such contracts.

You can pull out of a conditional contract, especially if the conditions are not satisfied. However, it’s critical to understand the specific terms of your Tennessee Conditional Sales Contract, which may contain penalties or required notice periods. Consulting with a legal professional can provide guidance on how to proceed without facing negative repercussions.

To get out of a conditional offer, carefully review the conditions outlined in your contract, as these will dictate your options. If the conditions have not been met, you may be able to withdraw without consequences. However, if you need to cancel for other reasons, it’s wise to communicate with the other party and consider the implications of breaking the agreement in a Tennessee Conditional Sales Contract.

Yes, a seller can cancel a contingent contract if the buyer does not meet the specified conditions, such as obtaining financing or completing an inspection satisfactorily. However, it’s essential to review the terms outlined in the Tennessee Conditional Sales Contract, as there may be legal obligations that both parties must adhere to before cancellation. Consulting a legal expert can provide clarity on your specific situation.

A conditional sales contract is a specific agreement where the sale is contingent upon certain conditions being met. In the case of a Tennessee Conditional Sales Contract, ownership of the item remains with the seller during the payment period. This setup ensures that if the buyer does not comply with the terms, the seller retains the right to reclaim the item. For those looking to draft a contract, uslegalforms provides valuable resources to help create effective conditional sales agreements.

The main difference between a sale and a conditional sale lies in ownership transfer. In a traditional sale, ownership transfers immediately upon payment, whereas in a conditional sale, ownership remains with the seller until certain conditions are satisfied. A Tennessee Conditional Sales Contract exemplifies this, making it clear that the seller retains rights until the buyer completes all payments. This structure can provide added protection for sellers.

A conditional sales contract is an agreement where the buyer takes possession of an item, but ownership remains with the seller until the buyer fulfills specific conditions. In a Tennessee Conditional Sales Contract, these conditions often involve payment schedules and compliance with terms outlined in the contract. This type of contract provides security for the seller while allowing the buyer to use the property before full payment.