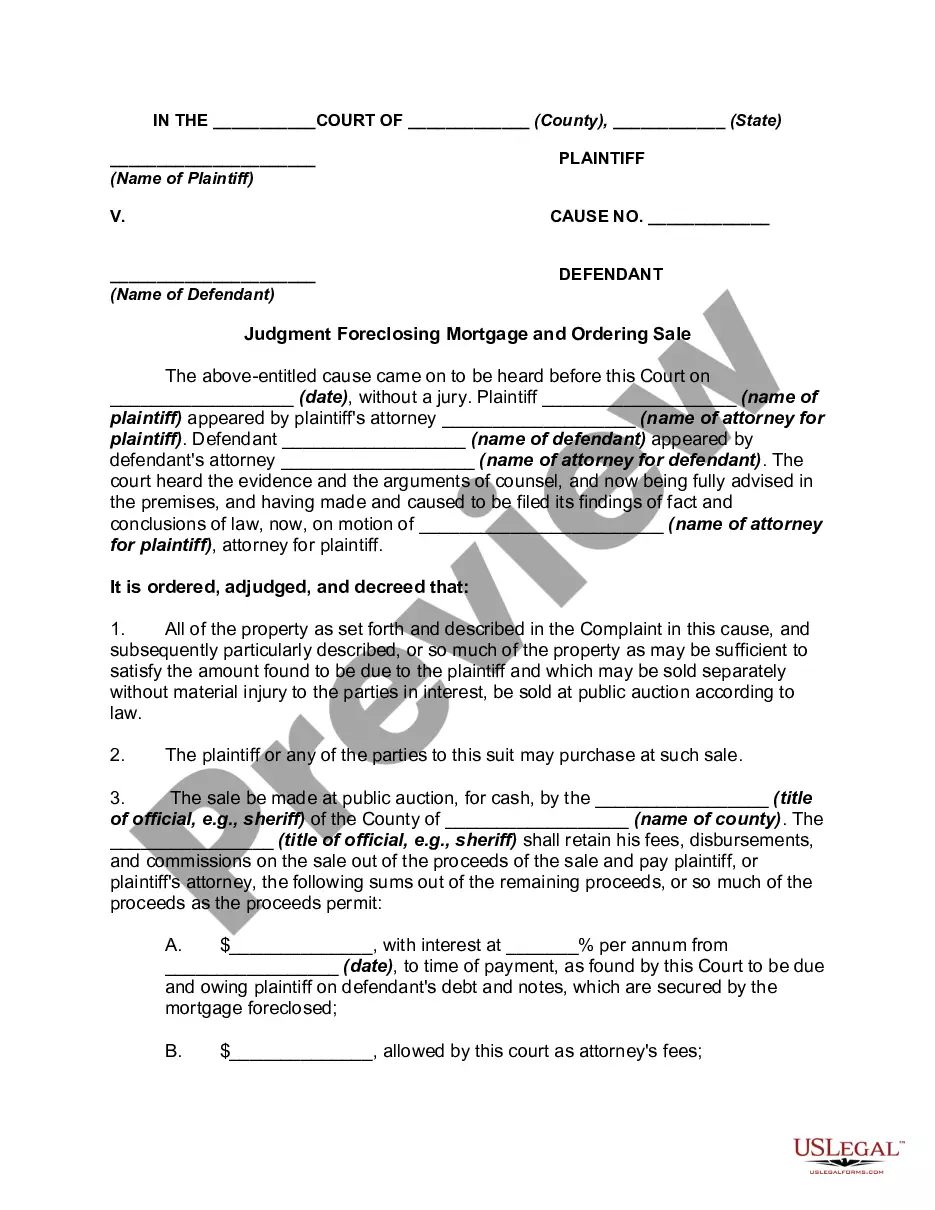

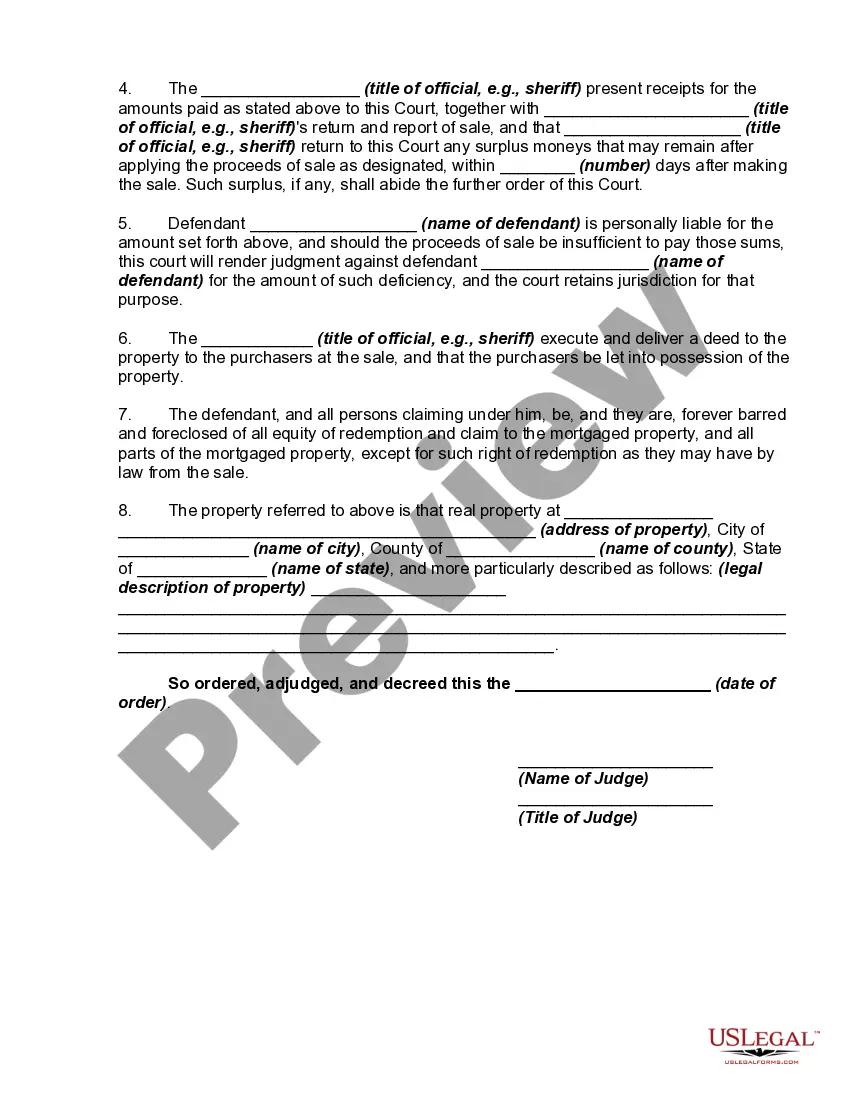

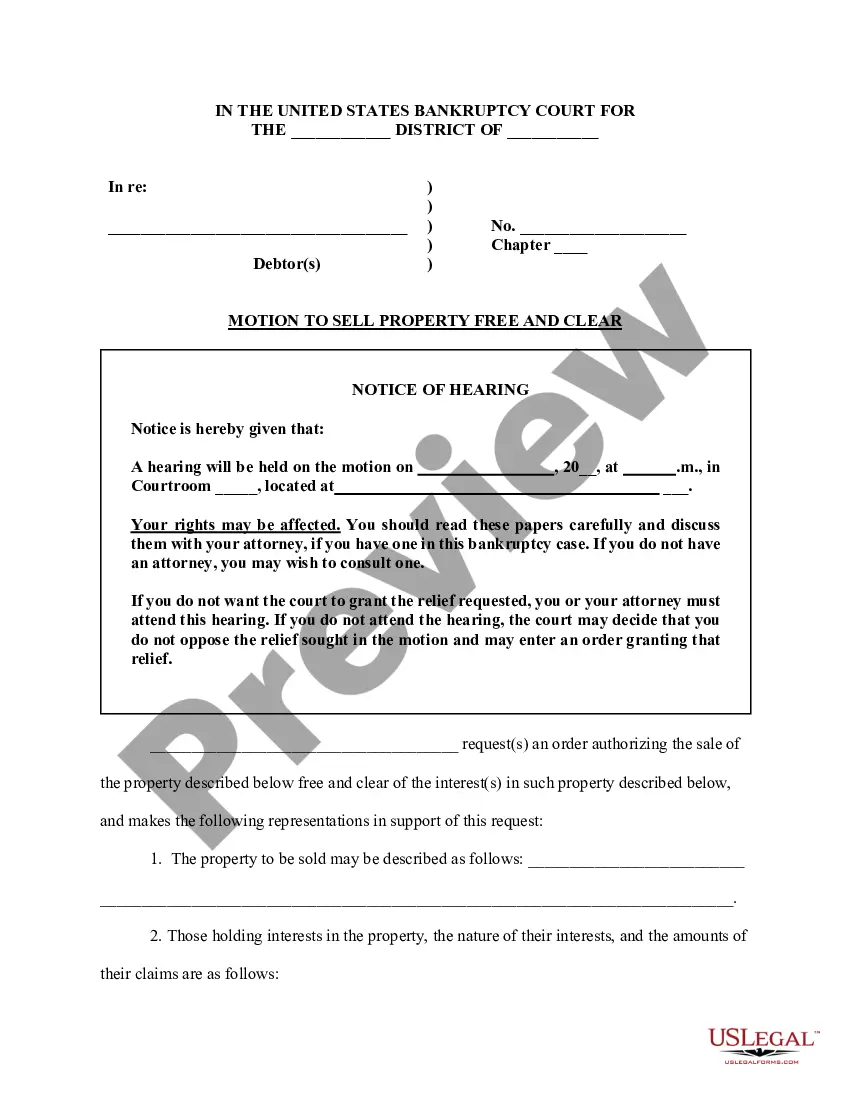

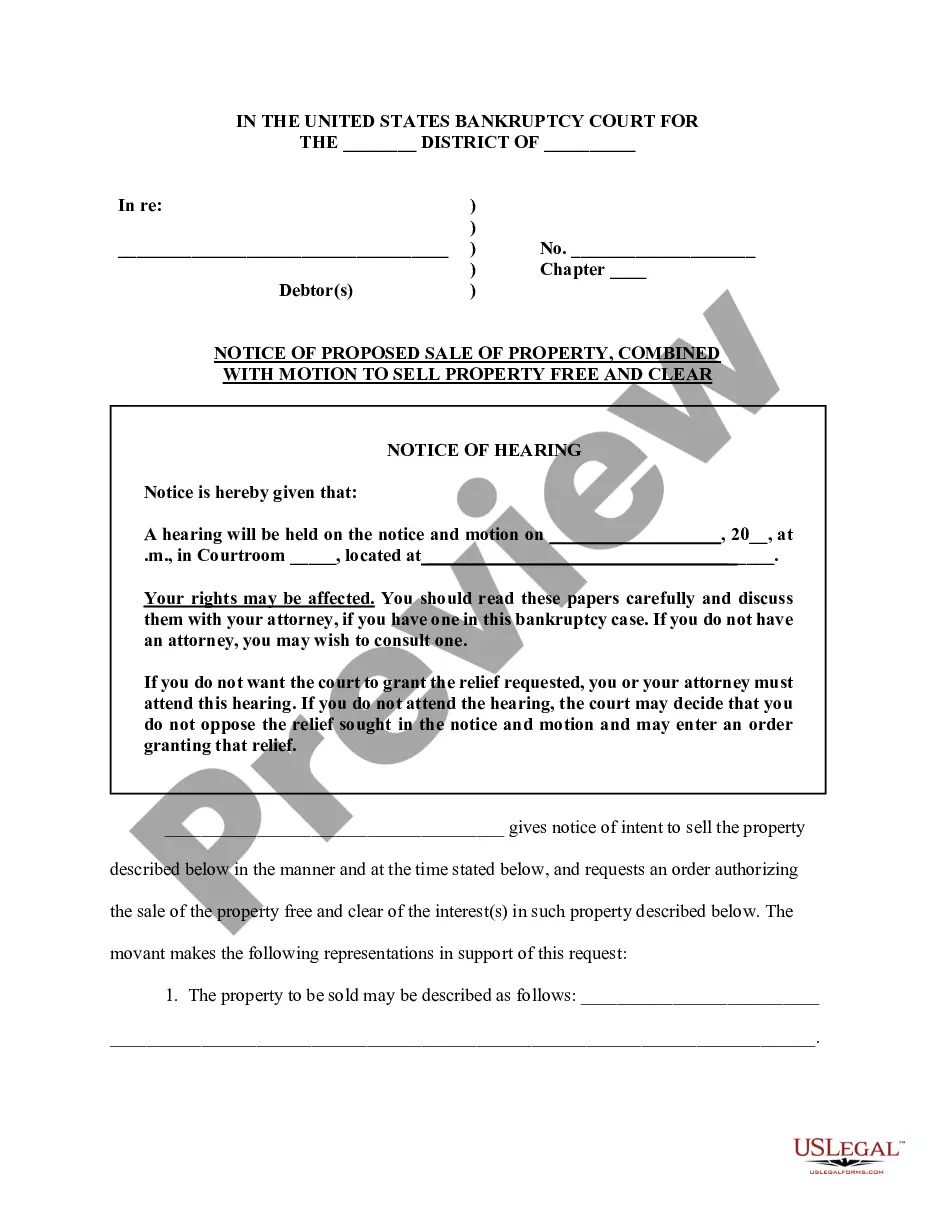

Tennessee Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Judgment Foreclosing Mortgage And Ordering Sale?

Are you within a situation the place you need to have documents for both business or person uses nearly every day? There are a variety of legitimate file web templates available on the Internet, but finding versions you can trust is not straightforward. US Legal Forms gives a large number of form web templates, such as the Tennessee Judgment Foreclosing Mortgage and Ordering Sale , that are written in order to meet state and federal requirements.

If you are presently familiar with US Legal Forms web site and have a merchant account, merely log in. After that, it is possible to down load the Tennessee Judgment Foreclosing Mortgage and Ordering Sale web template.

Should you not come with an accounts and want to begin to use US Legal Forms, follow these steps:

- Get the form you require and ensure it is for your appropriate area/state.

- Take advantage of the Preview button to analyze the shape.

- Look at the outline to actually have selected the appropriate form.

- In case the form is not what you`re seeking, take advantage of the Lookup field to obtain the form that suits you and requirements.

- If you find the appropriate form, just click Buy now.

- Pick the pricing strategy you need, fill out the specified information to create your money, and buy the transaction making use of your PayPal or credit card.

- Choose a hassle-free paper format and down load your backup.

Get all the file web templates you have purchased in the My Forms food list. You can obtain a additional backup of Tennessee Judgment Foreclosing Mortgage and Ordering Sale whenever, if necessary. Just select the needed form to down load or produce the file web template.

Use US Legal Forms, one of the most extensive variety of legitimate varieties, in order to save some time and steer clear of errors. The services gives appropriately produced legitimate file web templates which you can use for a selection of uses. Create a merchant account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

Foreclosure in Tennessee In the State of Tennessee, the minimum time a debt on a property has to be unpaid in order for the mortgage holder to enter foreclosure proceedings is six months. Foreclosure also cannot be initiated over any debt less than 200 dollars.

Basically, when a bank forecloses and there is a shortfall CMHC steps in to make sure the bank gets their money back. CMHC pays out the bank and then has what is called a ?subrogated? claim against the client. This means CMHC will take over from the bank and sue the client to try to collect on the shortfall.

In a judicial foreclosure, the lender can get a deficiency judgment to collect any money they're owed after the sale. In a judicial foreclosure, after the judge orders the sale of a home, it's usually auctioned off to the highest bidder.

The difference between the sale price and the total debt is called a deficiency. For example, if you owe $20,000 on your car loan and the lender sells or auctions your auto for $15,000, the deficiency amount that you are still required to pay is $5,000.

A deficiency judgment is a court order allowing a lender to collect additional money from a debtor who has defaulted on a loan if selling the property that secured the loan isn't sufficient to pay off the entire debt.

How can I avoid a deficiency judgment? If you are able to stop the foreclosure process, you'll be able to avoid a deficiency judgment. If a foreclosure is unavoidable, a homeowner may be able to negotiate with their lender so that any deficiency is forgiven after the foreclosure is complete.

In Tennessee, the borrower gets two years after the foreclosure to redeem the property unless the mortgage or deed of trust expressly waives the right of redemption, which these documents frequently do.

A foreclosure means that the lender takes control of a property after the borrower misses multiple mortgage payments. This is also referred to as defaulting on the loan. In doing so, the borrower is breaking the mortgage contract they signed with their lender.