Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees

Description

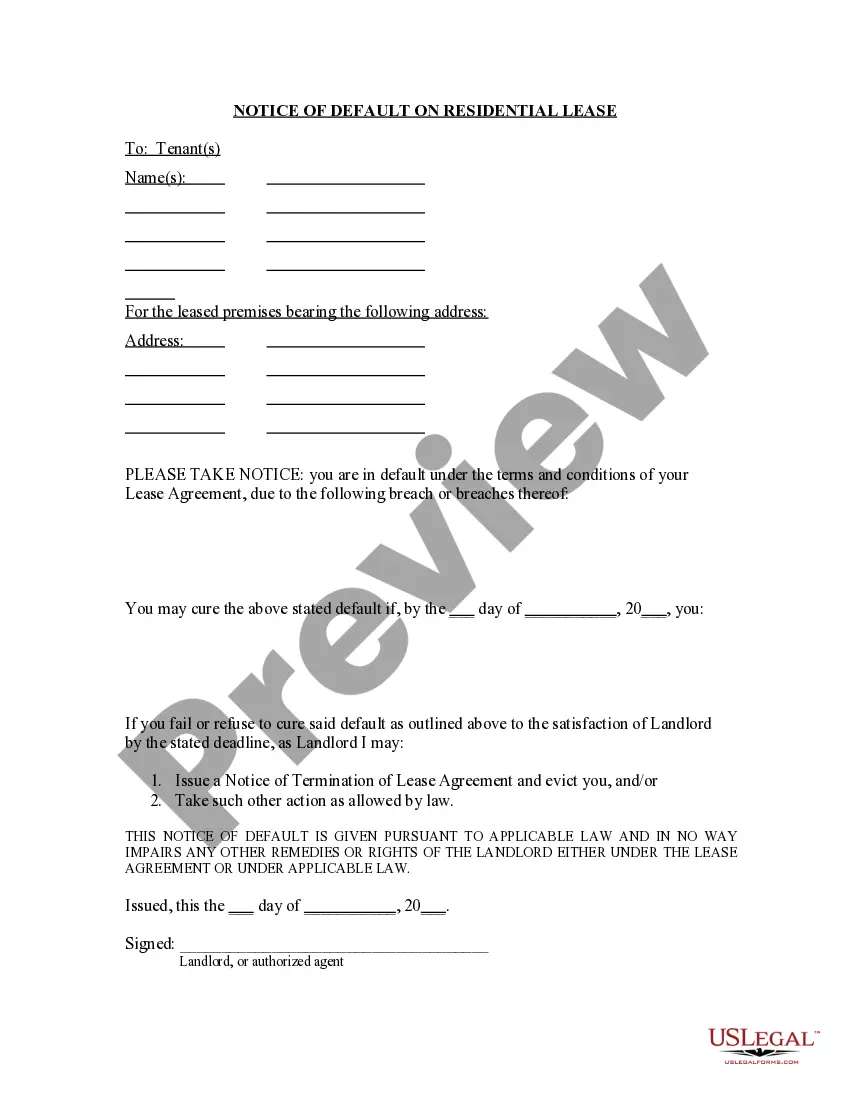

How to fill out Corporate Resolution Establishing A Self-insured Medical Payment Plan For Key Employees?

If you require to fill, acquire, or generate authentic document templates, utilize US Legal Forms, the foremost repository of authentic forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by types and titles, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. Each legal document template you purchase is yours indefinitely. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again. Compete and obtain, and print the Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Leverage US Legal Forms to obtain the Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees with just a few clicks.

- Should you already be a US Legal Forms subscriber, Log In to your account and then click the Download button to access the Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, please follow the instructions provided below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to check the form's content. Remember to read the overview.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions in the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for the account.

Form popularity

FAQ

The Health Insurance Portability and Accountability Act (HIPAA) and the favorable provisions of ERISA have allowed large employers to self-insure employee health care benefits. These acts provide the legal framework that supports the establishment of a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. Understanding these legislative measures can empower employers to take control of their health care benefit offerings.

The Employee Retirement Income Security Act (ERISA) is the key legislation governing health benefit plans for self-insured employers in the United States. ERISA sets the standards for private industry plans and safeguards the establishment of a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. Therefore, employers need to be familiar with ERISA's provisions when designing their plans.

Health insurance companies in the United States are primarily regulated at the state level. Each state has its own insurance department that oversees the operations and practices of health insurers. Consequently, when creating a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, it's important to understand your state's specific regulations and requirements.

Yes, self-funded plans must comply with state laws. However, the Employee Retirement Income Security Act (ERISA) generally preempts state laws for self-funded employer plans. Therefore, while employers can provide a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, they still need to be aware of both federal and state regulations that may apply.

Yes, you can self-insure your car in Tennessee, but it requires meeting specific financial criteria outlined by the state. You must show you can cover liability expenses for damages resulting from an accident. Many businesses find that a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees offers a viable alternative that balances risk management with employee benefits.

Self-insuring means setting aside savings to cover potential costs, rather than purchasing insurance. While it is possible, it requires a financial strategy to ensure you can manage unforeseen expenses. Implementing a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can assist in establishing a predictable and controlled method of managing medical expenses.

Yes, you can insure your vehicle yourself using personal auto insurance policies that you select. This allows you to tailor the coverage to fit your needs and budget. It's essential to research various policies to find one that offers adequate protection. Moreover, businesses might consider a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees to complement their existing vehicle insurance strategies.

In Tennessee, employers are not mandated to provide health insurance, unless they have 50 or more full-time employees. However, offering health benefits can attract and retain key employees. A Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can offer a great alternative to traditional health insurance, enhancing employee satisfaction and loyalty.

Yes, you can insure yourself to drive a car, regardless of ownership. This type of insurance covers liability, which protects you in case of an accident. It's important to have a valid driver’s license and meet state requirements for coverage. For companies, utilizing a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can provide additional health coverage options.

In Tennessee, you can insure a car you don’t own, but there are requirements to consider. You need to have insurable interest, which means you should benefit from the vehicle's protection. This situation often arises when insuring a family member’s or friend’s vehicle. Engaging in a Tennessee Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees may also be beneficial for businesses when evaluating employee benefits.