Tennessee Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

Are you presently in the location where you will require documentation for possibly business or particular purposes almost every workday.

There are numerous legal document templates accessible online, but locating forms you can trust is challenging.

US Legal Forms offers a vast array of templates, such as the Tennessee Retirement Cash Flow, that are created to comply with federal and state regulations.

Select the pricing plan you want, complete the required details to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient paper format and download your copy.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Tennessee Retirement Cash Flow template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

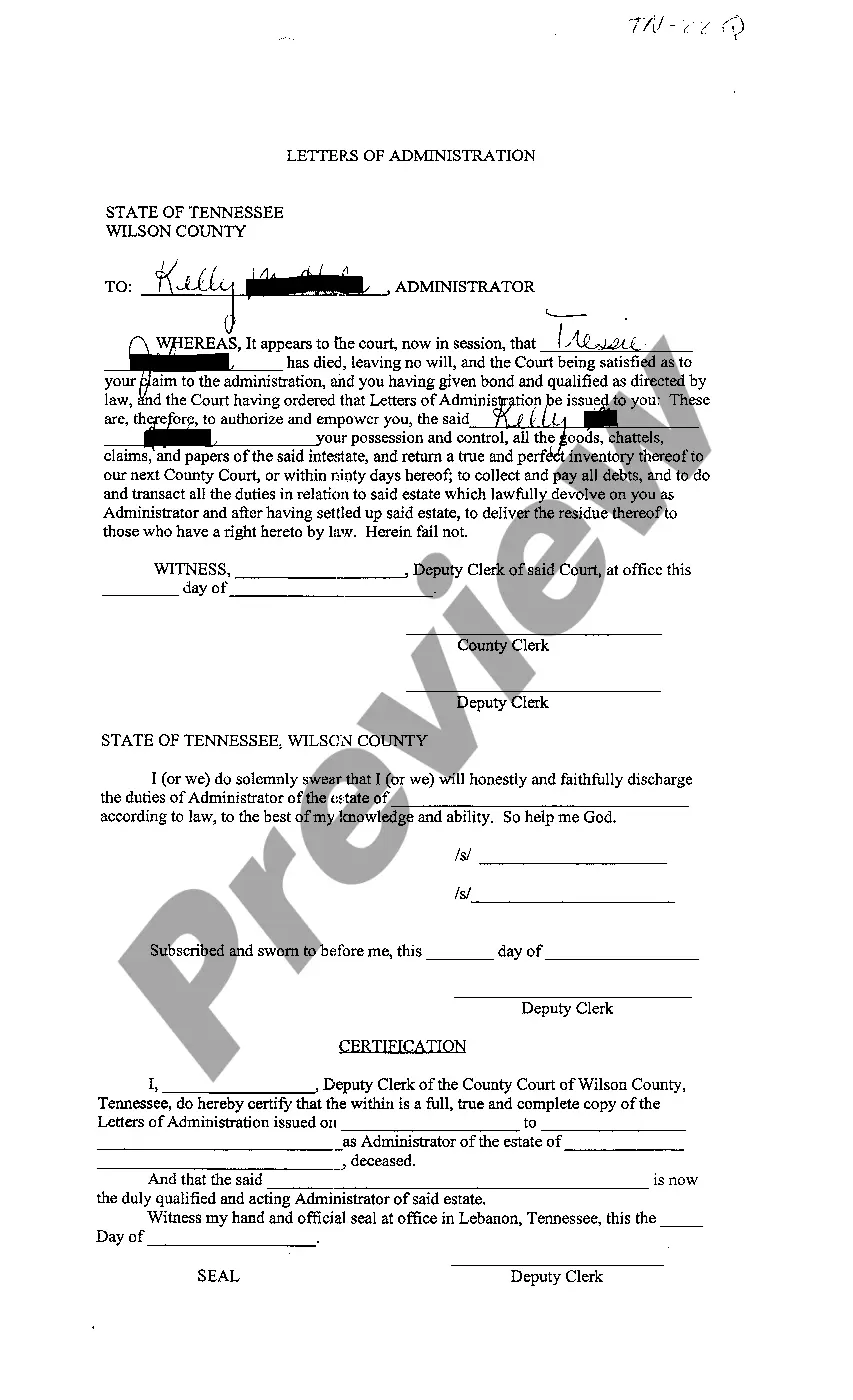

- Utilize the Preview option to examine the document.

- Review the information to confirm you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

- Whenever you find the right form, simply click Buy now.

Form popularity

FAQ

To calculate your Tennessee state retirement benefits, start by determining your final salary average over your highest earning years. Next, multiply that figure by your total years of service and the benefit factor specific to your retirement plan. For a precise calculation, consider using the tools provided by platforms like uslegalforms, which can simplify the process.

Tennessee. Retirement Income: Tennessee's income tax is very limited; it only covers interest and dividends. As a result, retirees in the Volunteer State don't pay tax on their 401(k), IRA or pension income.

A vested member is one who has accrued enough years of service to receive a retirement benefit once all eligibility requirements are met. Most local governments have also adopted this provision. 2022 Lifetime monthly benefits payable to vested members at retirement. 2022

Teachers contribute 5% of salary out of each paycheck to the pension fund. The average retirement benefit is $35,122 per year, or $2,927 per month. The pension covers 73,449 active school employees and 41,828 retired school employees and beneficiaries.

In Tennessee, average retirement spending stands at an estimated $902,530 - the seventh lowest among states. Goods and services in the state are 7.8% less expensive than they are, on average, nationwide, and life expectancy at age 65 is 17.9 years to 82.9, compared to 19.5 years to 84.5 across the country as a whole.

The mild climate, lower cost of housing, good healthcare facilities, and pretty views of the great smoky mountains make Tennessee a great place in terms of quality of life.

According to their data, Tennessee is the 23rd worst place to retire. The state received a score of 80, getting positive reviews for being tax-friendly for retirees and a low cost of living. However, the state received low marks for its high assault rate per capita and for a less than ideal climate for retirees.

TCRS provides a lifetime monthly benefit as determined by a formula specified in state law. The formula for computing a monthly retirement benefit consists of a member's Average Final Compensation (AFC), years of creditable service, and the benefit accrual factor, which are described below.

Retired teachers and state employees who have been on the TCRS retired payroll for at least 12 consecutive months, as of July 1, 2021, will receive a 1.4% cost-of-living adjustment. Retirees of local governments who have authorized COLAs will receive the same increase.

Tennessee is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are not taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.