Tennessee Sample Letter to Creditor or Service Provider Regarding Receipt of Bills

Description

How to fill out Sample Letter To Creditor Or Service Provider Regarding Receipt Of Bills?

Choosing the right authorized record web template could be a have a problem. Naturally, there are plenty of themes available on the Internet, but how do you get the authorized type you will need? Utilize the US Legal Forms internet site. The services gives a large number of themes, for example the Tennessee Sample Letter to Creditor or Service Provider Regarding Receipt of Bills, that you can use for company and personal requirements. Each of the types are inspected by professionals and meet federal and state demands.

Should you be previously registered, log in for your bank account and click the Acquire option to find the Tennessee Sample Letter to Creditor or Service Provider Regarding Receipt of Bills. Utilize your bank account to appear with the authorized types you may have purchased previously. Proceed to the My Forms tab of your own bank account and acquire an additional copy in the record you will need.

Should you be a whole new customer of US Legal Forms, allow me to share straightforward guidelines that you should follow:

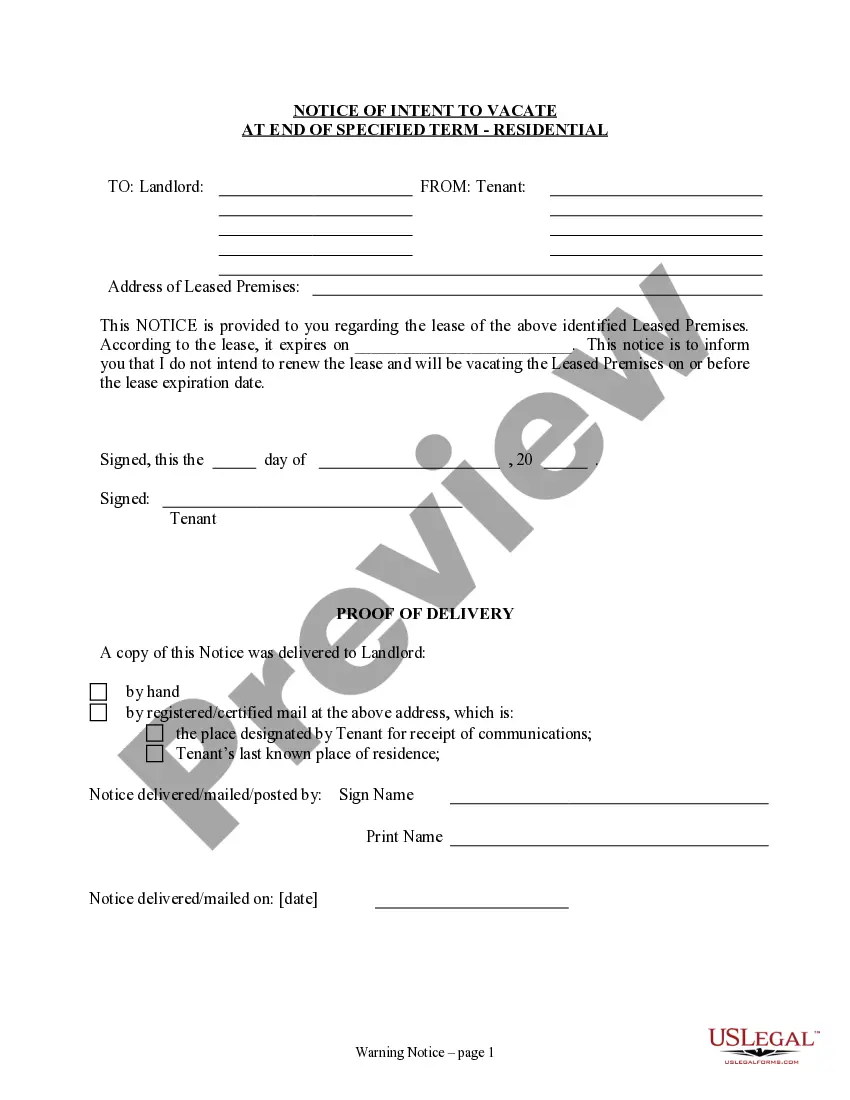

- Initial, make sure you have selected the correct type to your town/state. You may look over the shape utilizing the Review option and look at the shape explanation to guarantee this is the right one for you.

- In case the type is not going to meet your preferences, utilize the Seach area to find the proper type.

- When you are sure that the shape is proper, click on the Get now option to find the type.

- Choose the rates strategy you need and enter in the needed details. Make your bank account and pay money for an order with your PayPal bank account or Visa or Mastercard.

- Pick the file formatting and acquire the authorized record web template for your system.

- Comprehensive, change and produce and indicator the obtained Tennessee Sample Letter to Creditor or Service Provider Regarding Receipt of Bills.

US Legal Forms is definitely the greatest catalogue of authorized types in which you can discover a variety of record themes. Utilize the company to acquire professionally-created documents that follow state demands.

Form popularity

FAQ

Once you have gathered the information you need, contact each creditor, explain your family's situation, and ask for their assistance in working out a solution. Be prepared to explain the following: The reason you cannot pay. Your current income and prospects for future income.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);

I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

Tips for Writing a Hardship Letter Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan. ... Talk to a Financial Coach.

To trigger federal requirements, the written notice must provide the creditor with the following: Account identification information. Identification of the specific bill (or bills) in dispute. A statement that you believe the bill is in error. The reason(s) why the bill is disputed.