Tennessee Individual Credit Application

What is this form?

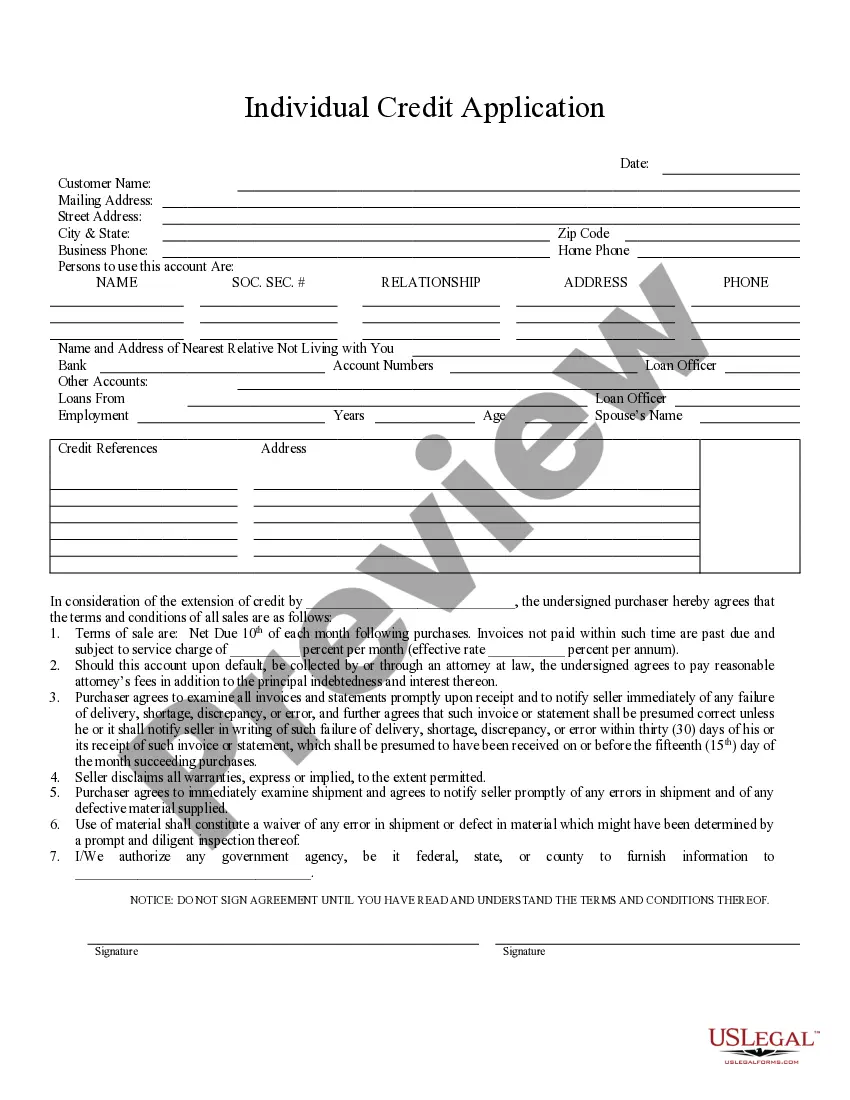

The Individual Credit Application is a legal document used by individuals seeking to obtain credit for purchases. It outlines the terms of repayment, default provisions, and your permission for the seller to obtain personal information if necessary. This form is designed specifically for personal credit requests, distinguishing it from business credit applications by focusing on individual purchasers.

What’s included in this form

- Details of the purchaser, including name and contact information.

- Terms of sale, including payment due dates and service charges for late payment.

- Provisions regarding default and collection actions, including attorney fees.

- Clauses that require the purchaser to inspect and immediately report any defects or errors in shipments.

- Authorization for the seller to obtain necessary personal information from government agencies.

- Disclaimer of warranties by the seller, highlighting that no warranties are implied unless otherwise stated.

When this form is needed

You should use the Individual Credit Application when you are planning to make a purchase on credit and the seller requires a formal application process. This form is commonly used in retail and service industries where buyers need to establish credit terms before completing significant transactions.

Who can use this document

This form is ideal for:

- Individuals seeking to make large purchases on credit.

- Consumers looking to establish or expand their credit with a retailer or service provider.

- Anyone required by a seller to complete a credit application before agreeing to sales terms.

Instructions for completing this form

- Identify the seller by entering their business name at the top of the form.

- Fill in your personal details, including your full name, address, and contact information.

- Specify the terms of payment as required, including the repayment due date.

- Review and sign the document to confirm your agreement with the terms.

- Submit the completed form to the seller to initiate the credit process.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to read the terms before signing, which can lead to misunderstandings about repayment obligations.

- Incomplete personal information, which may delay the credit approval process.

- Not notifying the seller about discrepancies or errors in a timely manner.

Benefits of completing this form online

- Convenience of filling out the form at your own pace without needing to visit a physical location.

- Easy access to the form that can be downloaded and printed for immediate use.

- Reliability of having a legally drafted template that complies with standard practices.

Looking for another form?

Form popularity

FAQ

The only forms of taxable income in Tennessee are interest and dividend income, and this law is being phased out in 2021 and beyond. However, regardless of this tax, it does not cover interest or dividends earned by retirement accounts, such as a 401(k) or an IRA.

4% of taxable income for tax years beginning January 1, 2017. 3% of taxable income for tax years beginning January 1, 2018. 2% of taxable income for tax years beginning January 1, 2019. 1% of taxable income for tax years beginning January 1, 2020.

Under Tennessee law, the Commissioner of Revenue is authorized to extend the deadline for filing a return whenever the IRS extends a federal filing date for a specified group of taxpayers. The extensions will automatically apply.

General Instructions The guidelines for obtaining a Tennessee tax extension are as follows: If you have a valid Federal extension (IRS Form 7004) and you owe zero state tax, you will automatically be granted a Tennessee tax extension.

There is no income tax on wages in this state. Therefore, the Tennessee income tax rate is 0%. It does have, however, a flat 1 to 2% tax rate that applies to income earned from interest and dividends. Tennessee levies tax on other items, outside of income.

No Tennessee State Income TaxTennessee is one of the seven states that does not impose an income tax. Taxpayers are not required to file a state return or pay tax on their wages and monetary bonuses. The only income subject to tax is investment dividends and interest.

Income tax is generally levied at a state-level on the income you earn within a tax year. Yet, Tennessee is one of several states that doesn't levy a state-level income tax on personal income. Business income and real property taxes as well as sales taxes are levied in Tennessee.

The only forms of taxable income in Tennessee are interest and dividend income, and this law is being phased out in 2021 and beyond. However, regardless of this tax, it does not cover interest or dividends earned by retirement accounts, such as a 401(k) or an IRA.

No Tennessee State Income Tax Tennessee is one of the seven states that does not impose an income tax. Taxpayers are not required to file a state return or pay tax on their wages and monetary bonuses. The only income subject to tax is investment dividends and interest.