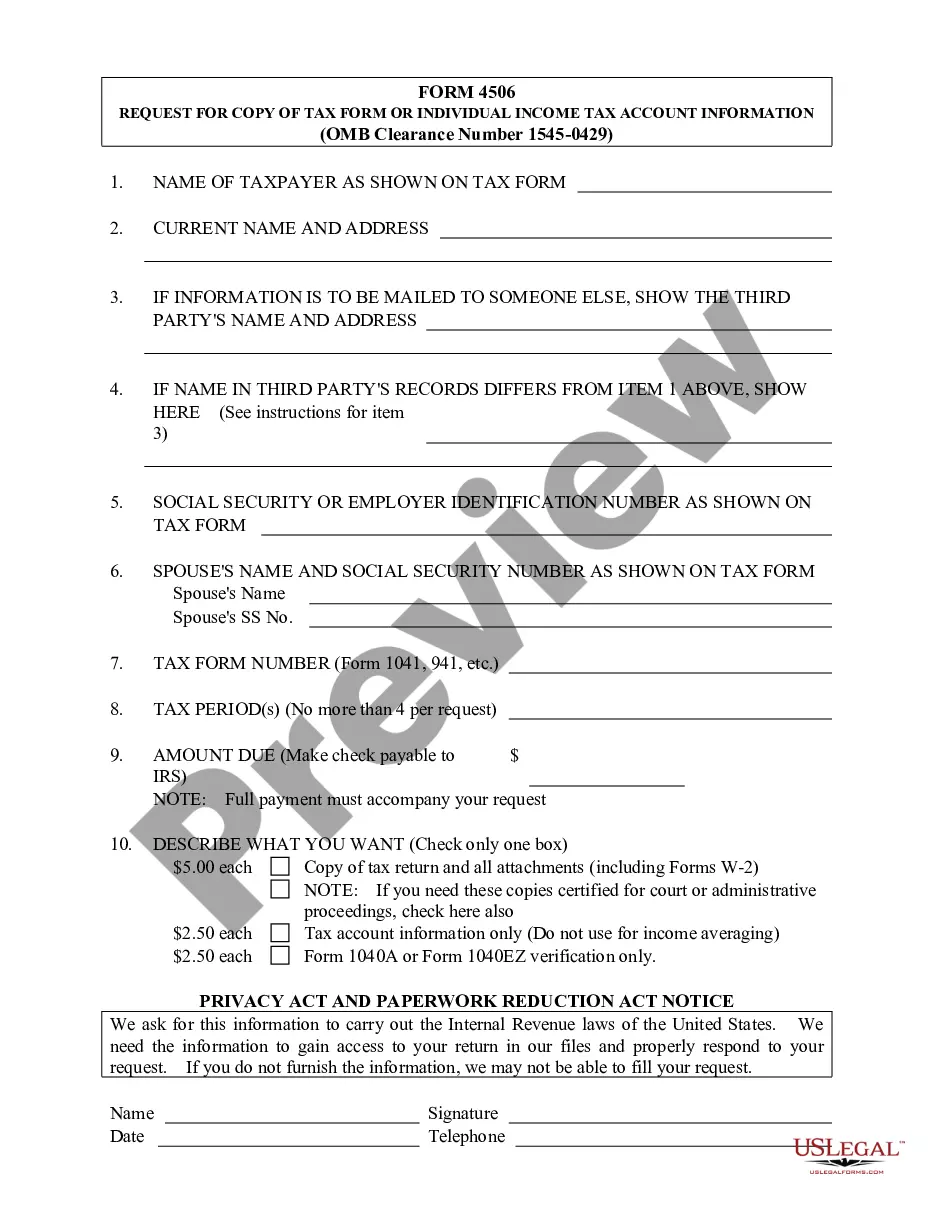

South Dakota Request for Copy of Tax Form or Individual Income Tax Account Information

Description

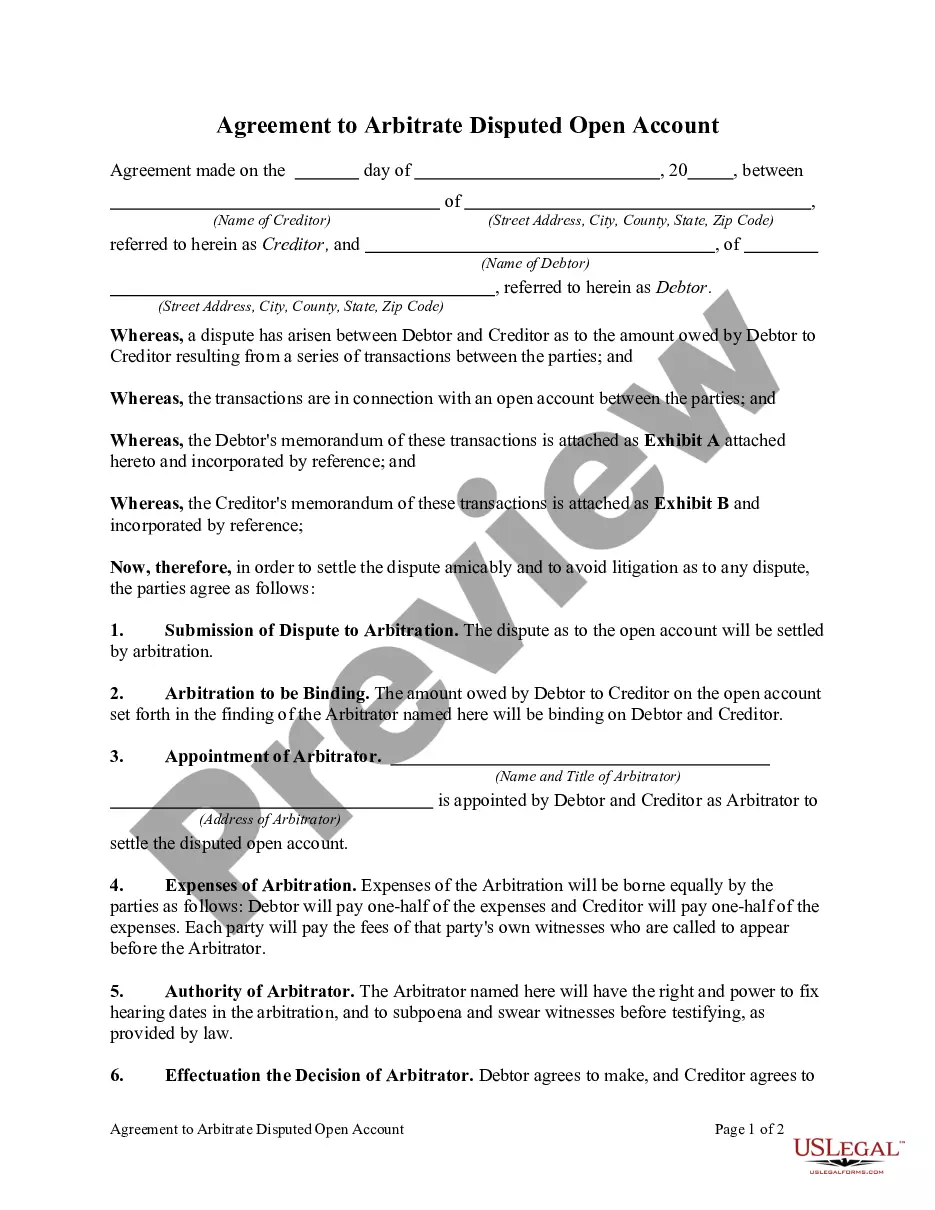

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

You are able to devote time on the web looking for the lawful file web template that fits the federal and state demands you require. US Legal Forms offers a large number of lawful varieties that are examined by specialists. It is possible to acquire or printing the South Dakota Request for Copy of Tax Form or Individual Income Tax Account Information from your assistance.

If you already possess a US Legal Forms account, you are able to log in and then click the Acquire button. After that, you are able to comprehensive, edit, printing, or indication the South Dakota Request for Copy of Tax Form or Individual Income Tax Account Information. Each lawful file web template you get is the one you have permanently. To have one more copy for any bought develop, check out the My Forms tab and then click the related button.

If you use the US Legal Forms website for the first time, follow the simple recommendations beneath:

- Very first, ensure that you have chosen the best file web template to the state/city of your liking. Read the develop description to make sure you have picked the correct develop. If available, make use of the Review button to search from the file web template too.

- If you want to discover one more model in the develop, make use of the Search area to discover the web template that meets your requirements and demands.

- After you have located the web template you need, simply click Purchase now to move forward.

- Choose the pricing prepare you need, enter your references, and register for an account on US Legal Forms.

- Total the financial transaction. You may use your bank card or PayPal account to cover the lawful develop.

- Choose the formatting in the file and acquire it for your gadget.

- Make modifications for your file if needed. You are able to comprehensive, edit and indication and printing South Dakota Request for Copy of Tax Form or Individual Income Tax Account Information.

Acquire and printing a large number of file layouts while using US Legal Forms web site, that offers the most important variety of lawful varieties. Use skilled and state-distinct layouts to handle your business or person needs.

Form popularity

FAQ

To apply for a tax ID number or EIN number South Dakota residents need to fill out the Form SS-4 and submit it to the IRS. You may only apply for one EIN per business day as a responsible party. If you've already applied for an EIN today, you must wait until the next business day to apply for another one.

Since South Dakota does not collect an income tax on individuals, you are not required to file a SD State Income Tax Return. However, you may need to prepare and eFile a Federal Income Tax Return.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

South Dakota doesn't charge a state or corporate income tax, though it does assess a state sales tax. South Dakota is considered a tax-friendly state primarily because it's one of the nine states that don't have their own individual income tax.

South Dakota ? The Land of No Taxation: No state income or capital gains tax. One of the lowest state insurance premium taxes. No intangibles tax. No dividends & interest tax.

Ing to data from the U.S. Census Bureau in 2020, South Dakota had a population of approximately 900,000 people, with over 16 percent of the population over the age of 65. South Dakota is an excellent choice for retirees looking for a low cost of living, abundant outdoor activities, and friendly communities.

The state's tax system is among the most retiree-friendly in the country. It has no income tax, relatively low sales taxes, high property taxes and no estate or inheritance taxes.

South Dakota doesn't charge a state or corporate income tax, though it does assess a state sales tax. South Dakota is considered a tax-friendly state primarily because it's one of the nine states that don't have their own individual income tax.