South Dakota Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

Have you been in a placement in which you will need paperwork for possibly organization or personal functions nearly every working day? There are tons of authorized file web templates available online, but discovering ones you can rely on isn`t effortless. US Legal Forms offers a large number of develop web templates, just like the South Dakota Clauses Relating to Dividends, Distributions, that happen to be composed in order to meet federal and state demands.

Should you be presently informed about US Legal Forms web site and possess a free account, simply log in. Afterward, you can down load the South Dakota Clauses Relating to Dividends, Distributions format.

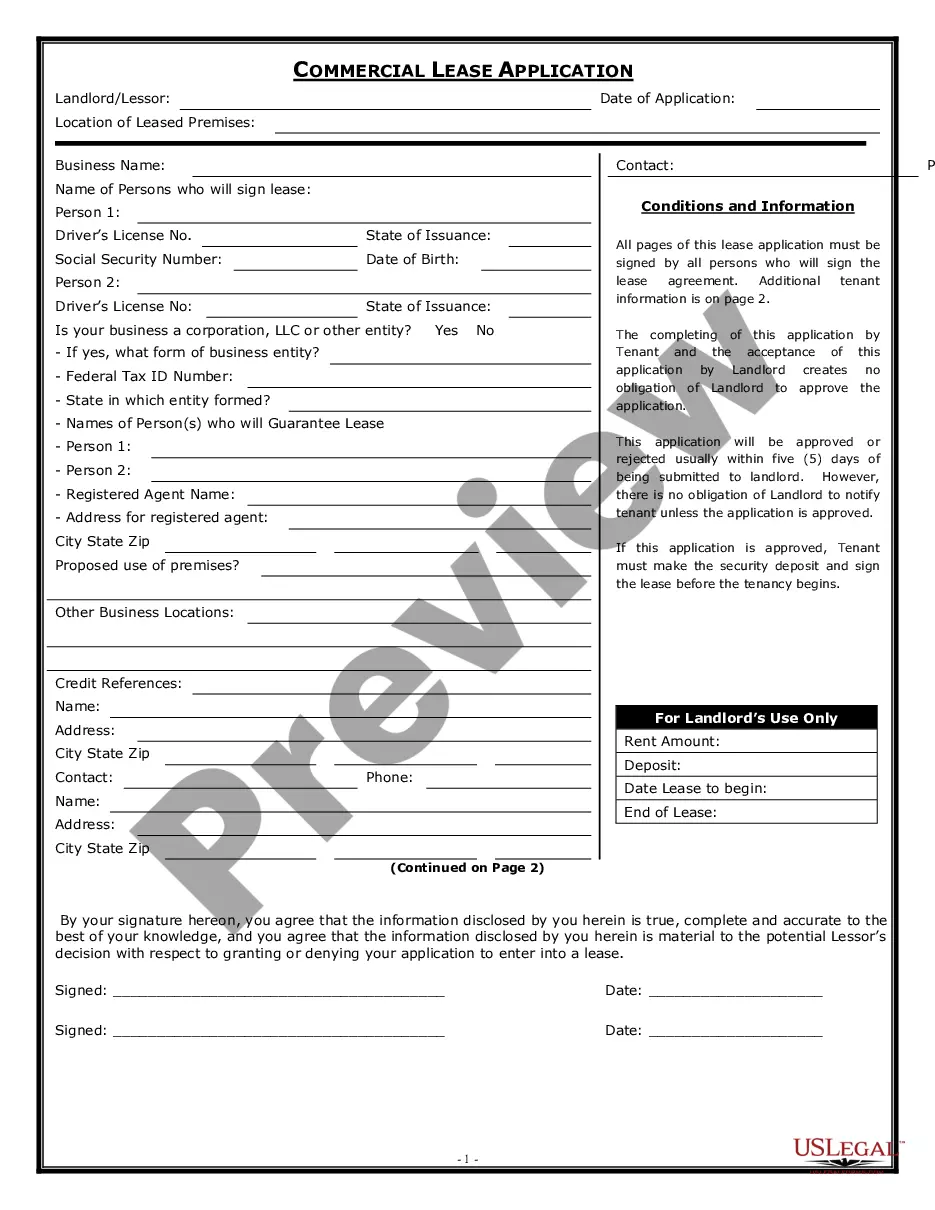

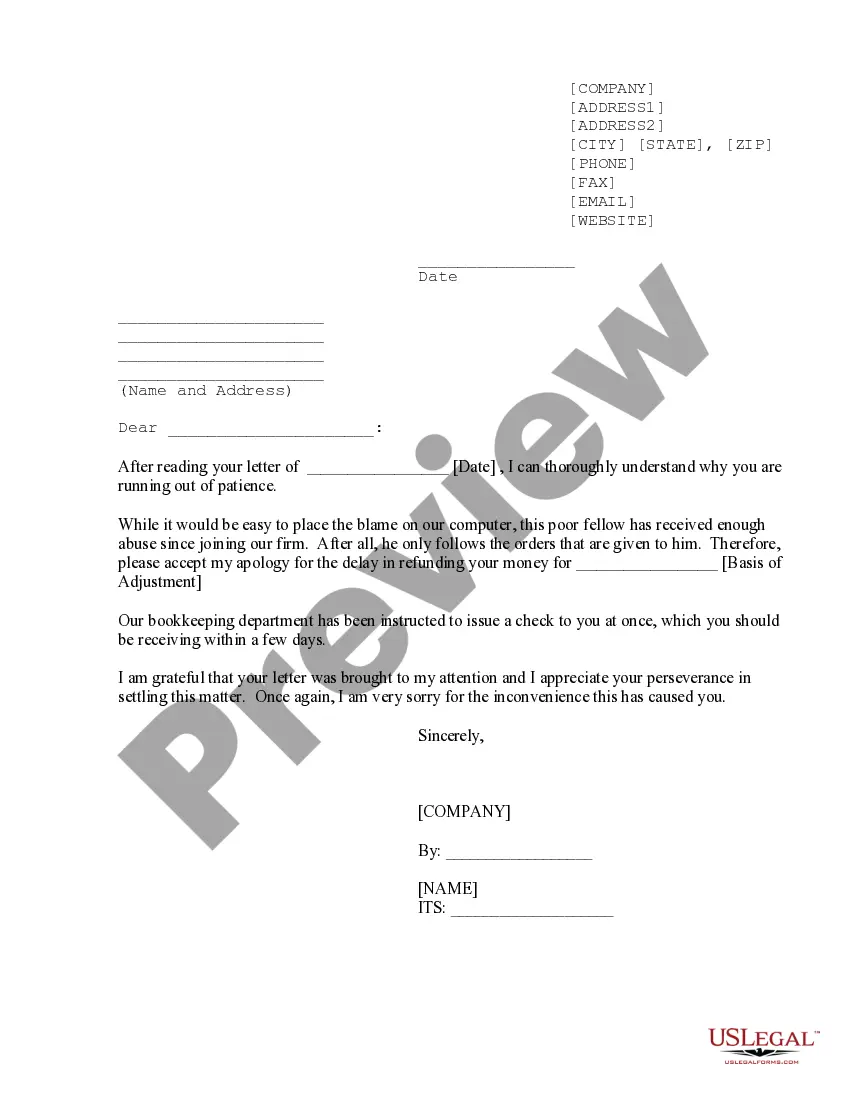

Should you not provide an accounts and want to begin using US Legal Forms, abide by these steps:

- Find the develop you will need and make sure it is to the proper metropolis/state.

- Use the Review switch to check the form.

- Browse the information to ensure that you have selected the proper develop.

- If the develop isn`t what you are seeking, make use of the Research discipline to obtain the develop that suits you and demands.

- Whenever you obtain the proper develop, click on Get now.

- Opt for the costs strategy you want, submit the specified information to create your account, and pay for the transaction utilizing your PayPal or credit card.

- Select a hassle-free file structure and down load your backup.

Discover each of the file web templates you possess bought in the My Forms food list. You can get a extra backup of South Dakota Clauses Relating to Dividends, Distributions any time, if needed. Just go through the necessary develop to down load or printing the file format.

Use US Legal Forms, by far the most substantial collection of authorized varieties, to save lots of some time and stay away from mistakes. The service offers appropriately made authorized file web templates which can be used for a variety of functions. Create a free account on US Legal Forms and initiate generating your lifestyle a little easier.

Form popularity

FAQ

While the tax is net income-based, SDCL 10-43-90 imposes a minimum financial institution tax specific to South Dakota chartered trust companies. The minimum financial institution tax applied to South Dakota chartered trust companies is tiered over the first five years of operations.

South Dakota was the first state in the nation to abolish the Rule Against Perpetuities ? which prohibited unlimited-duration trusts ? in 1983, clearing the way for the creation of the Dynasty Trust.

South Dakota's privacy statute provides for a total seal forbidding the release of trust information, including names of settlors, beneficiaries, and the contents of a trust, to the public during litigation.

Asset Protection Trusts South Dakota was the first state to enact a discretionary trust statute designed to protect trust assets from creditors. This statutory protection also applies to self-settled trusts, these being trusts settled by a transferor of which the transferor is a beneficiary.

Dynasty Trusts can last forever (at least in South Dakota). This provides you with the opportunity to protect your loved ones for generations to come - providing long lasting security.

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries.