South Dakota Notice That Oil and Gas Lease Was Acquired by Agent For Principal

Description

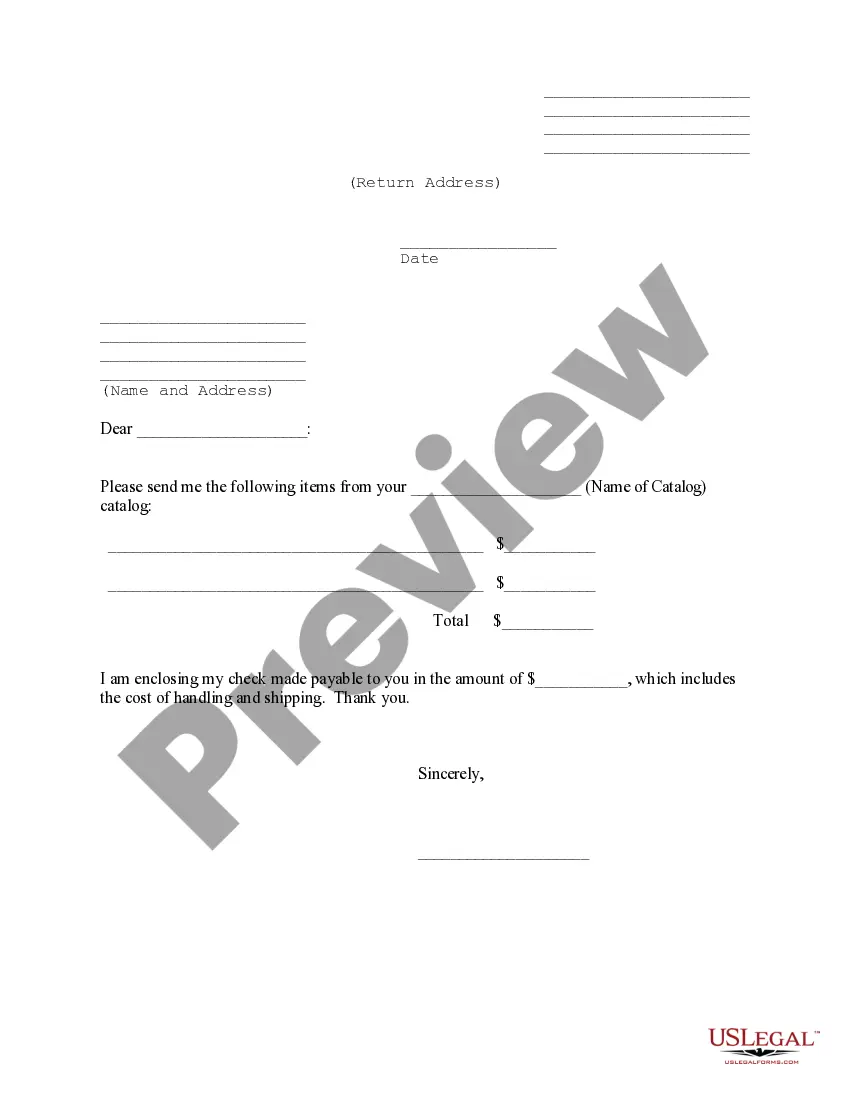

How to fill out Notice That Oil And Gas Lease Was Acquired By Agent For Principal?

Are you within a place in which you will need files for sometimes company or individual reasons just about every working day? There are a variety of legal file layouts accessible on the Internet, but locating ones you can rely is not easy. US Legal Forms gives a large number of develop layouts, like the South Dakota Notice That Oil and Gas Lease Was Acquired by Agent For Principal, that are composed to meet federal and state needs.

When you are presently informed about US Legal Forms website and get an account, just log in. After that, you can down load the South Dakota Notice That Oil and Gas Lease Was Acquired by Agent For Principal format.

Unless you have an profile and would like to begin to use US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is for the right city/state.

- Make use of the Preview option to examine the shape.

- Browse the information to actually have selected the appropriate develop.

- In the event the develop is not what you are searching for, utilize the Search area to discover the develop that fits your needs and needs.

- When you find the right develop, click Get now.

- Choose the pricing plan you need, fill out the specified details to create your money, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Select a handy document format and down load your version.

Find all of the file layouts you possess bought in the My Forms food selection. You may get a additional version of South Dakota Notice That Oil and Gas Lease Was Acquired by Agent For Principal any time, if necessary. Just click on the required develop to down load or print the file format.

Use US Legal Forms, probably the most comprehensive assortment of legal varieties, to save some time and stay away from faults. The support gives appropriately produced legal file layouts that can be used for a range of reasons. Make an account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

Codified Law 43-32-35 | South Dakota Legislature. 43-32-35. Service animal documentation requirements. The supporting documentation shall confirm the tenant's disability and the relationship between the tenant's disability and the need for the requested accommodation.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

59-12-4. Execution of power of attorney. A power of attorney shall be signed by the principal or in the principal's conscious presence by another individual directed by the principal to sign the principal's name on the power of attorney.

Non-Apportionment Rule The rule?followed in the majority of states?that royalties accruing under a lease on property that has been subdivided after the lease grant are not to be shared by the owners of the various subdivisions but belong exclusively to the owner of the subdivision where the producing well is located.

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.