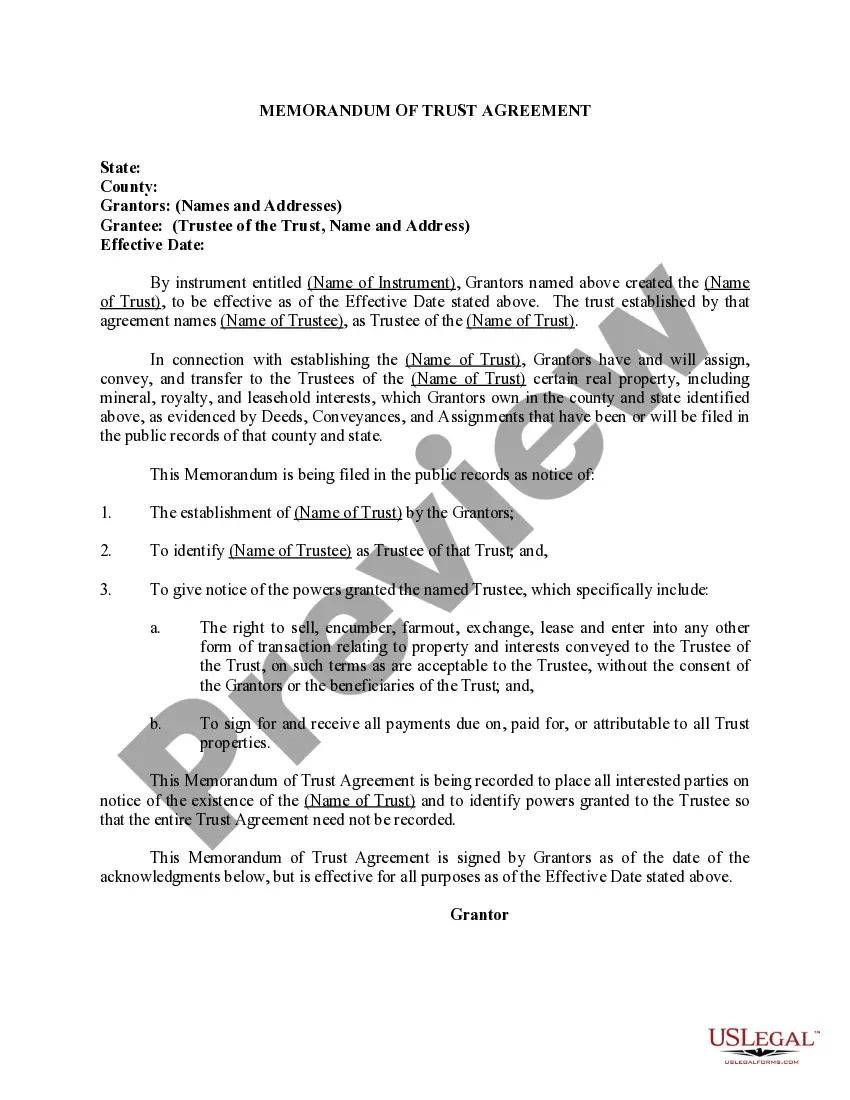

South Dakota Memorandum of Trust Agreement

Description

How to fill out Memorandum Of Trust Agreement?

Finding the right legal record format can be quite a struggle. Naturally, there are a variety of web templates available on the net, but how do you discover the legal kind you need? Take advantage of the US Legal Forms site. The support gives 1000s of web templates, including the South Dakota Memorandum of Trust Agreement, that can be used for business and personal requirements. Each of the varieties are checked out by professionals and fulfill state and federal demands.

Should you be previously signed up, log in to the accounts and click on the Obtain button to get the South Dakota Memorandum of Trust Agreement. Utilize your accounts to search from the legal varieties you have ordered earlier. Proceed to the My Forms tab of your own accounts and have another backup of your record you need.

Should you be a brand new end user of US Legal Forms, here are basic directions for you to adhere to:

- Very first, ensure you have selected the appropriate kind for your personal city/county. You can examine the form making use of the Preview button and browse the form explanation to ensure this is basically the best for you.

- In the event the kind is not going to fulfill your preferences, utilize the Seach area to get the right kind.

- Once you are positive that the form is suitable, click on the Acquire now button to get the kind.

- Opt for the prices prepare you want and enter the necessary information and facts. Design your accounts and pay money for the transaction utilizing your PayPal accounts or bank card.

- Choose the document structure and down load the legal record format to the system.

- Comprehensive, edit and produce and indication the attained South Dakota Memorandum of Trust Agreement.

US Legal Forms will be the most significant catalogue of legal varieties for which you can find a variety of record web templates. Take advantage of the service to down load expertly-created documents that adhere to condition demands.

Form popularity

FAQ

In addition to no state income tax, South Dakota doesn't charge capital gains tax for assets held in the trust. This means that the trust can grow in value while remaining tax-free?an important wealth-building benefit. South Dakota isn't a state that inflicts estate or inheritance tax.

The cost of setting up a trust in South Dakota varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

Anyone can set up a trust regardless of income level if they have significant assets worth protecting. You can start a trust fund for as little as $100 in initial deposit and a few hundred dollars in fees, but if you have $100,000 or more and own real estate, then a trust might be beneficial to protect your assets.

You create a living trust during your lifetime by signing a trust agreement which is a legal document that directs how property transferred to the trust will be managed, when and to whom the income and principal from the trust will be paid, and to whom the trust property will be distributed when you die.

If you would like to create a living trust in South Dakota, you need to create a written trust agreement and sign it before a notary public. To make the trust effective, you must transfer your assets into it. A revocable living trust is a popular estate planning option. It may be an option that will work for you.

Nonresident individuals who wish to take advantage of South Dakota's favorable trust laws may do so by naming a South Dakota resident trustee (whether an individual or a corporate trustee) and allowing the assets to be administered in the state.

The most significant tax advantage offered by South Dakota is that it does not collect income tax. This fact, combined with all the other trust laws, is what makes South Dakota such an attractive jurisdiction to establish trusts originating from other states.

South Dakota is a pure no income/capital gains tax state for trusts. However, if income is distributed from the trust to a beneficiary, the distributed income is generally taxed at the beneficiary's personal rates in his/her tax residence jurisdiction.