South Dakota Self-Employed Auto Detailing Services Contract

Description

How to fill out Self-Employed Auto Detailing Services Contract?

US Legal Forms - one of the largest collections of legal templates in the USA - provides a diverse selection of legal document formats you can obtain or print.

Through the website, you can discover numerous templates for commercial and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the South Dakota Self-Employed Auto Detailing Services Contract within moments.

If you already have a subscription, Log In and retrieve the South Dakota Self-Employed Auto Detailing Services Contract from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved templates in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the document to your device. Edit. Fill out, modify, and print and sign the downloaded South Dakota Self-Employed Auto Detailing Services Contract. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply visit the My documents section and click on the template you desire. Access the South Dakota Self-Employed Auto Detailing Services Contract with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct template for your locality/state.

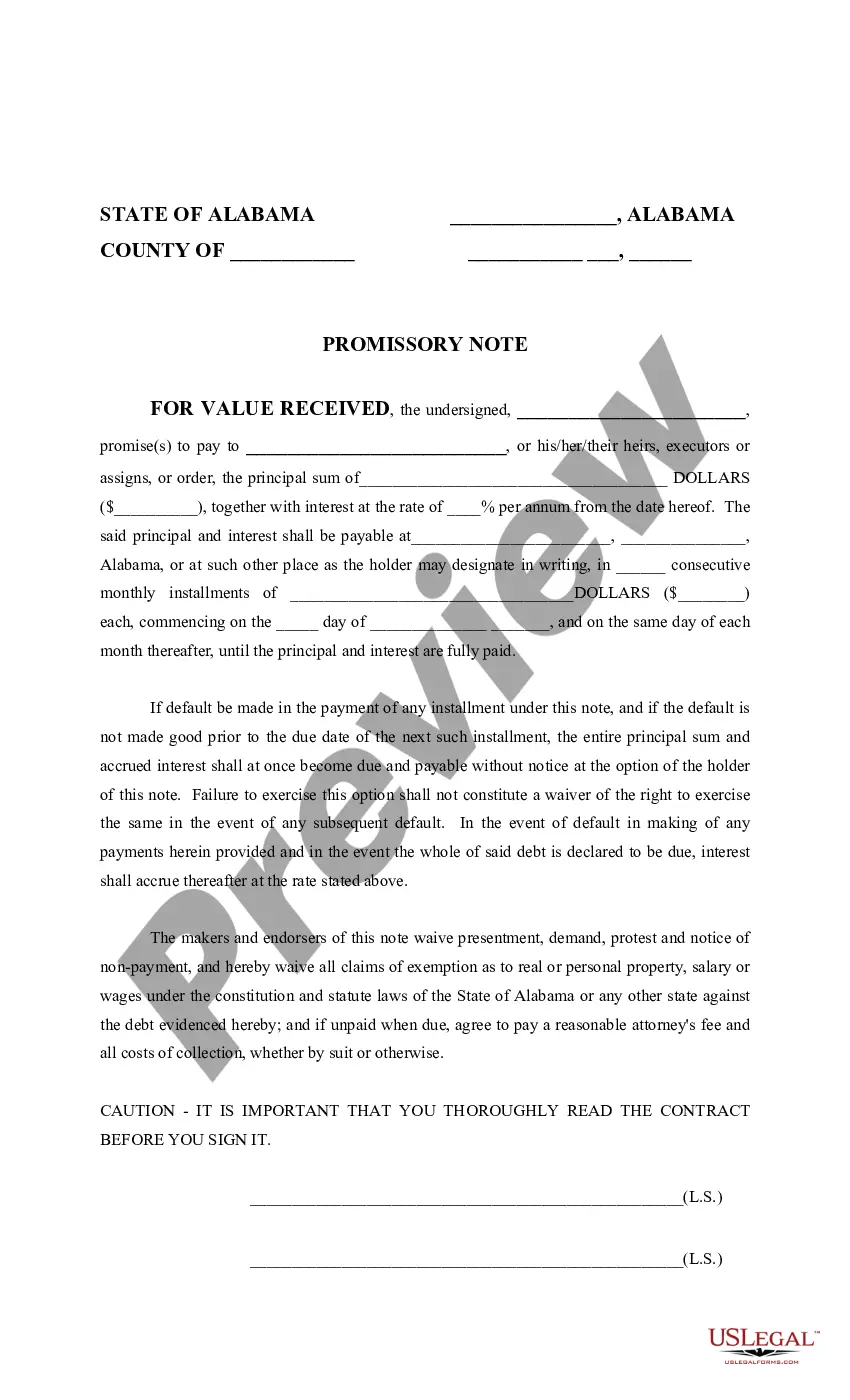

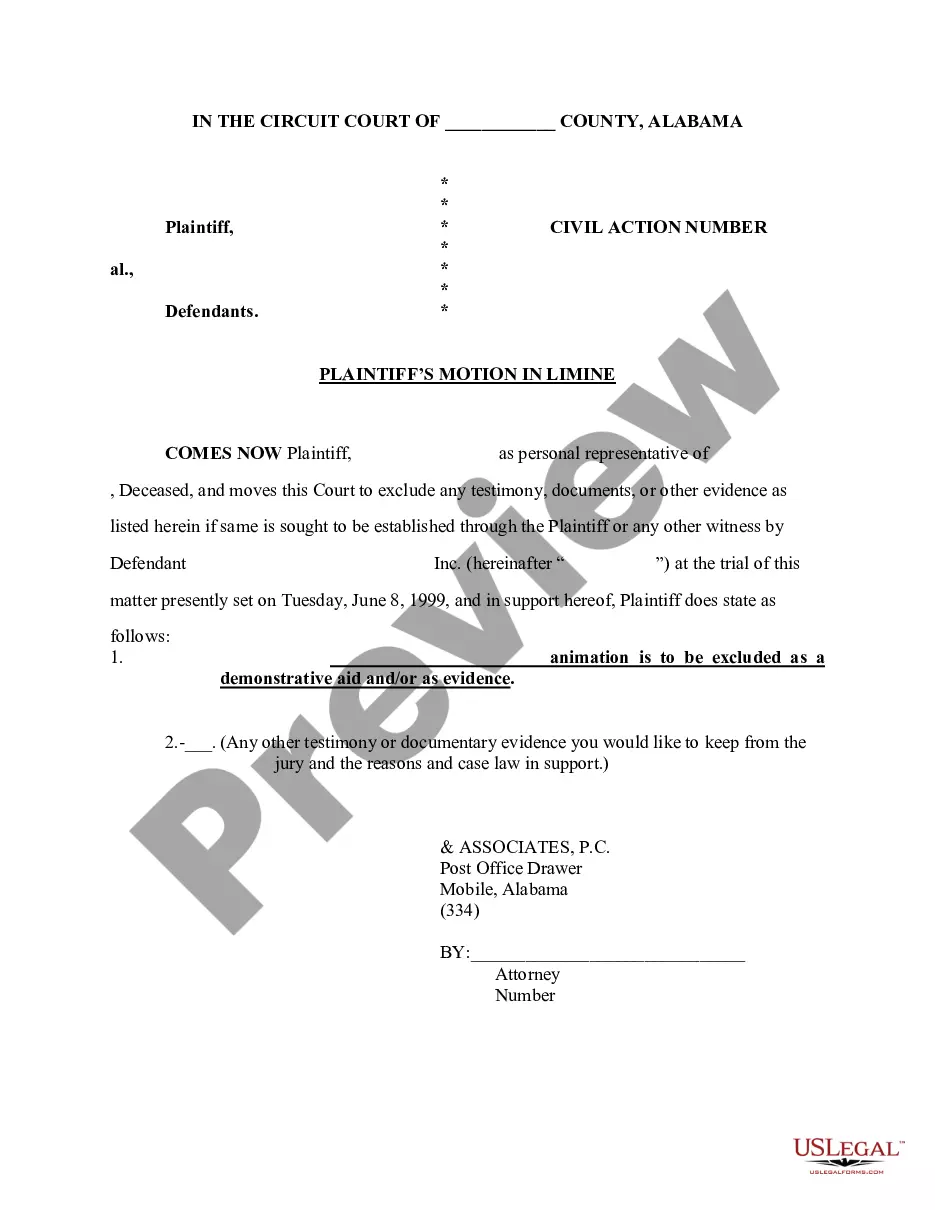

- Click the Preview button to examine the content of the document.

- Review the document description to confirm you have chosen the appropriate template.

- If the document does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Purchase Now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

In South Dakota, detailing cars does not typically require a specific license, but local regulations may apply. It is essential to check your city's requirements to ensure compliance. Using a South Dakota Self-Employed Auto Detailing Services Contract can clarify your legal standing and protect your business. By having a solid contract, you demonstrate professionalism and commitment to following local laws, which can enhance your reputation.

Yes, you can run a car detailing business from home, especially if you have the right equipment and space. Operating from home can save costs, but consider zoning laws and neighborhood regulations. A South Dakota Self-Employed Auto Detailing Services Contract can help structure your services and clarify your business model. This approach can lead to a successful home-based enterprise.

You can start several businesses without a specific license, including services like car detailing, pet sitting, or freelance writing. However, it's wise to research local laws to ensure compliance. A South Dakota Self-Employed Auto Detailing Services Contract can help you outline your business operations and protect your interests, making your startup smoother.

While formal qualifications are not required to become a car detailer, having skills and knowledge about car care is crucial. Training can enhance your efficiency and service quality. Additionally, using a South Dakota Self-Employed Auto Detailing Services Contract can clarify expectations and responsibilities, ensuring you provide excellent service to your clients.

In South Dakota, you generally do not need a specific license to start a car detailing business. However, it's essential to check local regulations as some areas may have particular requirements. Following the guidelines in a South Dakota Self-Employed Auto Detailing Services Contract can help you understand any necessary permits or registrations. Being informed can pave the way for a successful venture.

When considering a tip for a $200 car detail, a common guideline is to tip between 15% to 20%. This means you would typically tip between $30 to $40. Tipping reflects your satisfaction with the service provided, and it can motivate detailers to maintain high standards. Remember, if you are using a South Dakota Self-Employed Auto Detailing Services Contract, it can help ensure quality service.

Contract labor in South Dakota is usually not subject to sales tax unless it involves the sale of tangible goods or services that are taxable. When entering into a South Dakota Self-Employed Auto Detailing Services Contract, it is beneficial to understand the nature of your services. Consulting with a tax professional can provide clarity on how your contract labor may be affected by sales tax regulations.

In South Dakota, a contractor license is generally required for specific construction-related services but may not apply to auto detailing. However, it is crucial to check local regulations to ensure compliance. When establishing a South Dakota Self-Employed Auto Detailing Services Contract, verify whether any licensing requirements apply to your business to avoid potential legal issues.

The self-employment tax in South Dakota is a federal tax that applies to individuals who work for themselves. This tax funds Social Security and Medicare, and it is important to factor it into your earnings when operating under a South Dakota Self-Employed Auto Detailing Services Contract. Keeping accurate records of your income and expenses will help you calculate your self-employment tax effectively.

Service labor is typically not taxable in South Dakota unless it is associated with the sale of tangible personal property. This distinction is important when you draft a South Dakota Self-Employed Auto Detailing Services Contract. By clearly outlining the services and products involved, you can determine the tax implications and ensure compliance with state laws.