South Dakota Fuel Delivery And Storage Services - Self-Employed

Description

How to fill out Fuel Delivery And Storage Services - Self-Employed?

Are you currently in a situation where you require documents for both professional or personal reasons almost every day? There are many legal document templates available online, but locating ones you can trust is challenging. US Legal Forms offers a vast array of form templates, including the South Dakota Fuel Delivery And Storage Services - Self-Employed, which are designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can obtain the South Dakota Fuel Delivery And Storage Services - Self-Employed template.

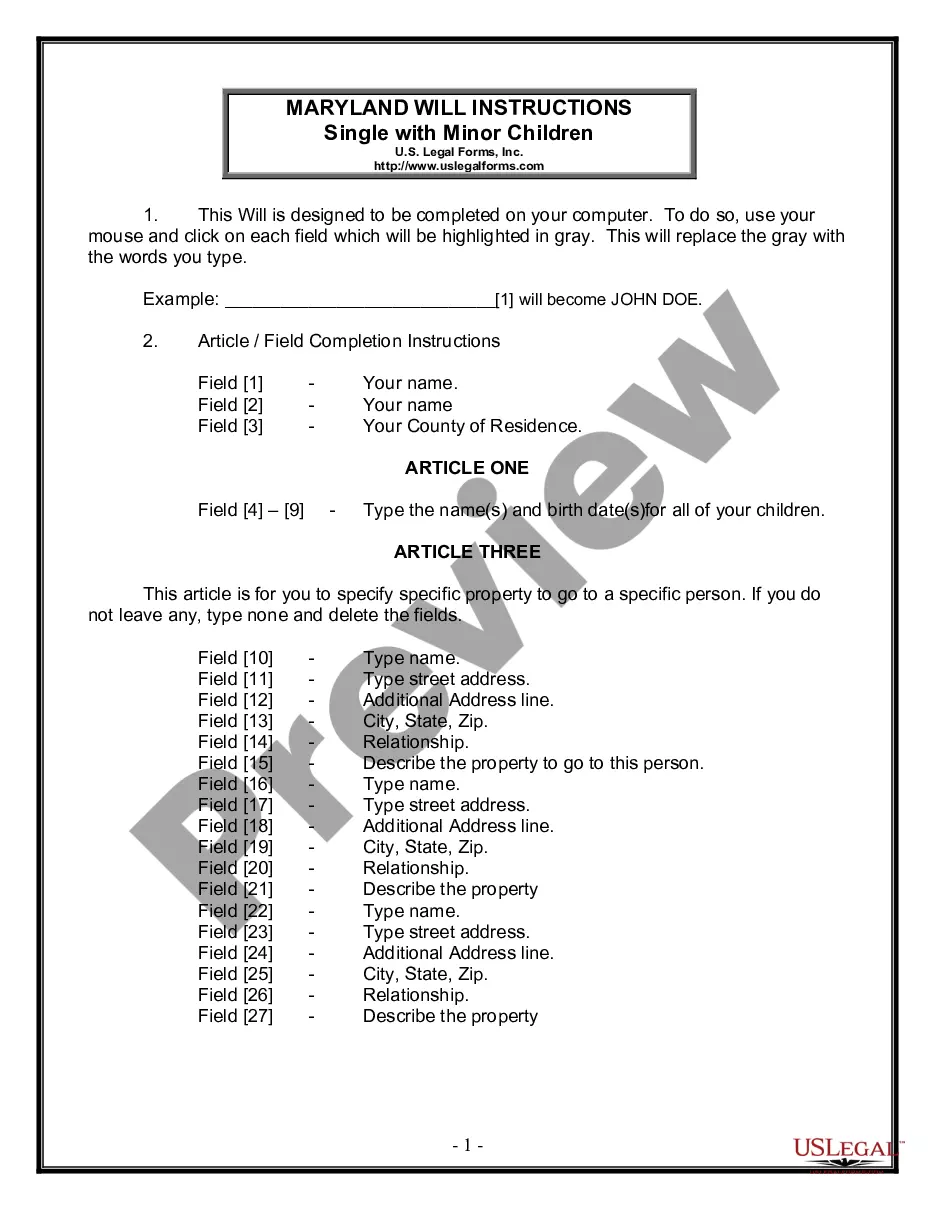

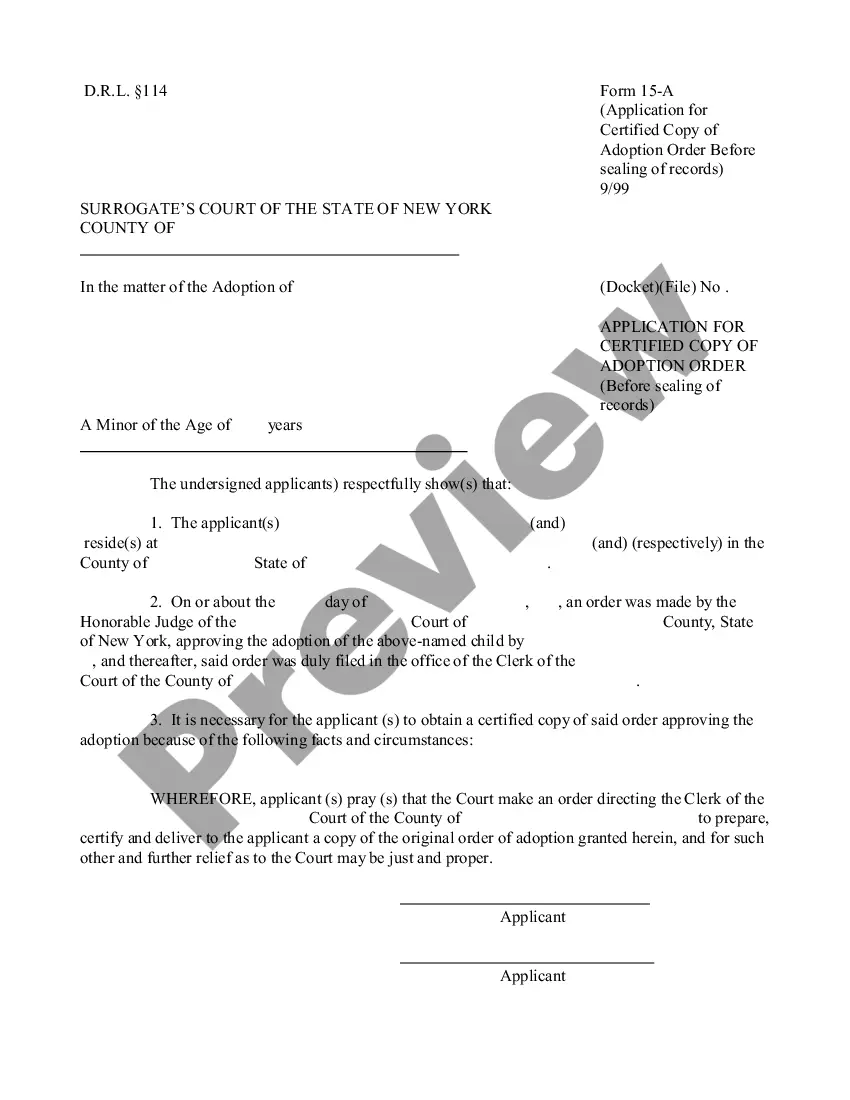

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the document you need and ensure it is for the correct city/county. Use the Preview button to review the document. Read the description to ensure you have selected the correct form. If the document is not what you are looking for, utilize the Search field to find the form that meets your needs and specifications. If you find the right document, click Purchase now. Choose the payment plan you want, fill out the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard. Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of South Dakota Fuel Delivery And Storage Services - Self-Employed at any time, if necessary. Just select the required document to download or print the template.

- Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors.

- The service provides properly crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

To launch a fuel delivery business, you will need essential equipment such as a fuel truck, storage tanks, and safety gear. Additionally, you must secure licenses and permits specific to South Dakota Fuel Delivery And Storage Services - Self-Employed. It’s also important to establish relationships with reliable fuel suppliers. Utilizing USLegalForms can help you understand and fulfill the legal obligations faster, allowing you to focus on growing your business.

The 183-day rule in South Dakota determines residency for taxation purposes. If you live or work in the state for more than 183 days, you're generally considered a resident for tax purposes. As a self-employed individual operating in South Dakota Fuel Delivery and Storage Services, understanding this rule can impact your tax status and obligations.

The tax rate for self-employment in South Dakota is generally around 15.3% on your net earnings. This includes both Social Security and Medicare taxes. It's advisable to set aside funds throughout the year based on your earnings from South Dakota Fuel Delivery and Storage Services to cover these taxes when they are due.

Self-employment taxes kick in when your net earnings exceed a certain threshold, typically around $400 in South Dakota. As you engage in your South Dakota Fuel Delivery and Storage Services, tracking your income and expenses can help you determine when these taxes become applicable. Keeping accurate records ensures compliance and simplifies tax filing.

Yes, South Dakota generally requires a business license for most self-employed individuals. Obtaining a license will help you operate your South Dakota Fuel Delivery and Storage Services legally and can lend credibility to your enterprise. Be sure to check local regulations, as requirements can vary from one city or county to another.

While you cannot completely avoid self-employment tax, there are legal strategies to minimize it. Deductions, such as business expenses related to your South Dakota Fuel Delivery and Storage Services, can reduce your taxable income. Consulting a tax professional can help you explore legitimate avenues for reducing your tax burden.

Yes, South Dakota has self-employment tax, which applies to individuals earning income from self-employment. This tax is critical for funding Social Security and Medicare services. As someone involved in South Dakota Fuel Delivery and Storage Services - Self-Employed, it is vital to plan for this tax in your financial forecasts.

The self-employment tax in South Dakota generally refers to a combined rate of 15.3% on net earnings. This tax covers Social Security and Medicare contributions for self-employed individuals. Since you are self-employed in South Dakota Fuel Delivery and Storage Services, it's important to understand your tax obligations clearly. Consulting resources or professionals can help navigate these specifics.

Yes, there are several apps designed to deliver fuel directly to your location. These apps are part of the innovative solutions emerging in the South Dakota Fuel Delivery And Storage Services - Self-Employed sector, allowing customers to order fuel with just a few taps on their phones. However, when choosing a service, make sure to verify their reliability and customer reviews to ensure you receive quality service. Apps continue to change the landscape of fuel delivery, making it easier and more convenient for users.

Getting into the fuel delivery business involves several steps, particularly in the realm of South Dakota Fuel Delivery And Storage Services - Self-Employed. First, understand the regulatory requirements, as they vary by region. Next, develop a solid business plan that outlines your services, target market, and operational strategies. Consider leveraging platforms like uslegalforms to access the necessary legal documents and guidance to simplify your entry into the market.