South Dakota Fireplace Contractor Agreement - Self-Employed

Description

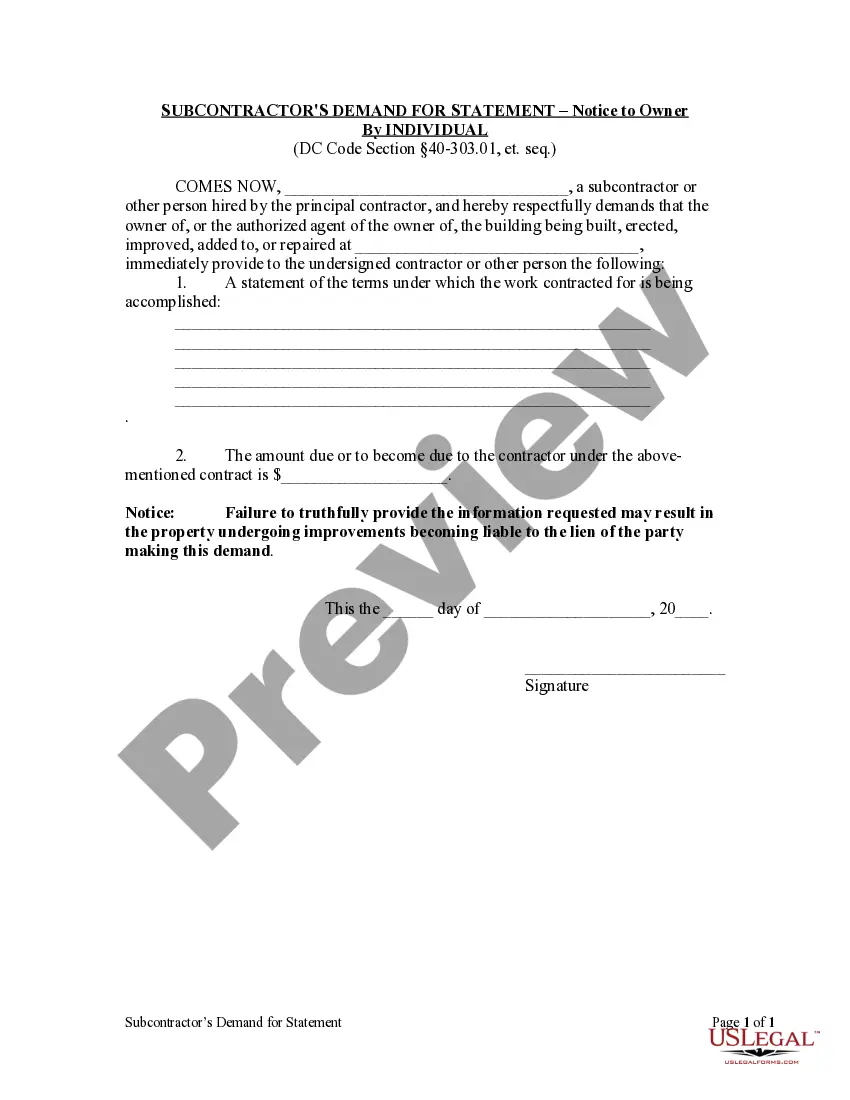

How to fill out Fireplace Contractor Agreement - Self-Employed?

It is feasible to spend several hours online searching for the appropriate legal document template that meets the state and federal standards you need.

US Legal Forms offers a vast array of legal forms that have been vetted by professionals.

You can obtain or create the South Dakota Fireplace Contractor Agreement - Self-Employed through our service.

If available, utilize the Preview button to view the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and specifications. Once you’ve found the template you want, click Buy now to proceed. Select your desired pricing plan, enter your information, and register for a free account on US Legal Forms. Complete the transaction using your Visa, Mastercard, or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make any necessary modifications to your document. You can fill out, edit, sign, and print the South Dakota Fireplace Contractor Agreement - Self-Employed. Download and print thousands of document templates using the US Legal Forms site, which provides the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and then click the Download button.

- Afterward, you can fill out, modify, print, or sign the South Dakota Fireplace Contractor Agreement - Self-Employed.

- Each legal document template you purchase is yours indefinitely.

- To acquire an additional copy of the form you've bought, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you've selected the correct document template for your chosen area/city.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

Creating an independent contractor agreement involves outlining key terms that define the scope of work, payment structure, and responsibilities. Begin by detailing the project specifics, then include clauses regarding confidentiality and dispute resolution. Using a South Dakota Fireplace Contractor Agreement - Self-Employed template from USLegalForms can simplify this process and ensure that your agreement meets state compliance requirements. This tool not only saves you time but also provides peace of mind.

To fire an independent contractor without a contract, it's best to communicate your decision clearly and professionally. Document your reasons for termination, ensuring that they comply with any verbal agreements or work expectations. While the South Dakota Fireplace Contractor Agreement - Self-Employed typically outlines terms, the absence of a contract means you should focus on maintaining a respectful dialogue. Consider consulting a legal professional to ensure that your actions align with local regulations.

To file excise tax, you typically need to use Form 720 with the IRS, depending on the type of excise tax you owe. It’s vital to gather all relevant documentation regarding your earnings and expenses, especially if they relate to your South Dakota Fireplace Contractor Agreement - Self-Employed. Keeping detailed records will simplify this process and help ensure accuracy in your filings.

Yes, construction labor is generally taxable in South Dakota. This means that as a self-employed contractor, you need to prepare for sales tax implications on the services you offer. When crafting your South Dakota Fireplace Contractor Agreement - Self-Employed, be sure to include information regarding these tax responsibilities to avoid future compliance issues.

While you cannot completely avoid self-employment tax, there are legal strategies to minimize it. Deductions for business expenses related to your South Dakota Fireplace Contractor Agreement - Self-Employed can reduce your taxable income. Consulting with a tax professional can provide tailored advice to optimize your tax obligations.

Self-employment taxes are triggered when your net earnings from self-employment reach $400 or more in a tax year. Running a business, such as contracting fireplaces in South Dakota, will typically meet this threshold. Therefore, when drafting your South Dakota Fireplace Contractor Agreement - Self-Employed, be aware that these taxes are a necessary consideration in your financial obligations.

Yes, South Dakota does have a self-employment tax, which is part of the federal tax structure. This tax applies to self-employed individuals regardless of the state they operate in. When creating a South Dakota Fireplace Contractor Agreement - Self-Employed, ensure that you account for this tax to budget accurately for your business expenses.

In South Dakota, specific regulations govern contractor licenses, depending on the type of work performed. Generally, contractors must obtain necessary licenses or permits to operate legally, especially for specialized services like fireplace installation. For those working under a South Dakota Fireplace Contractor Agreement - Self-Employed, understanding these requirements can help ensure compliance. US Legal Forms can assist you in finding the right licensing information and necessary documentation.

Writing an independent contractor agreement requires clarity and precision. Start by outlining the scope of work, payment terms, and deadlines. It's essential to include provisions that address confidentiality and dispute resolution. If you are focused on creating a South Dakota Fireplace Contractor Agreement - Self-Employed contract, consider using online platforms like US Legal Forms to ensure you cover all legal bases.