South Dakota Oil Cleanup Services Contract - Self-Employed

Description

How to fill out Oil Cleanup Services Contract - Self-Employed?

Have you ever encountered a circumstance where you require documents for both business or personal reasons almost daily.

There are numerous legitimate document templates available online, but locating trustworthy ones is challenging.

US Legal Forms provides thousands of form templates, such as the South Dakota Oil Cleanup Services Contract - Self-Employed, designed to comply with federal and state requirements.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Choose a convenient paper format and obtain your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the South Dakota Oil Cleanup Services Contract - Self-Employed whenever needed. Just click on the required form to download or print the document template.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the South Dakota Oil Cleanup Services Contract - Self-Employed template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and make sure it corresponds to your specific city/region.

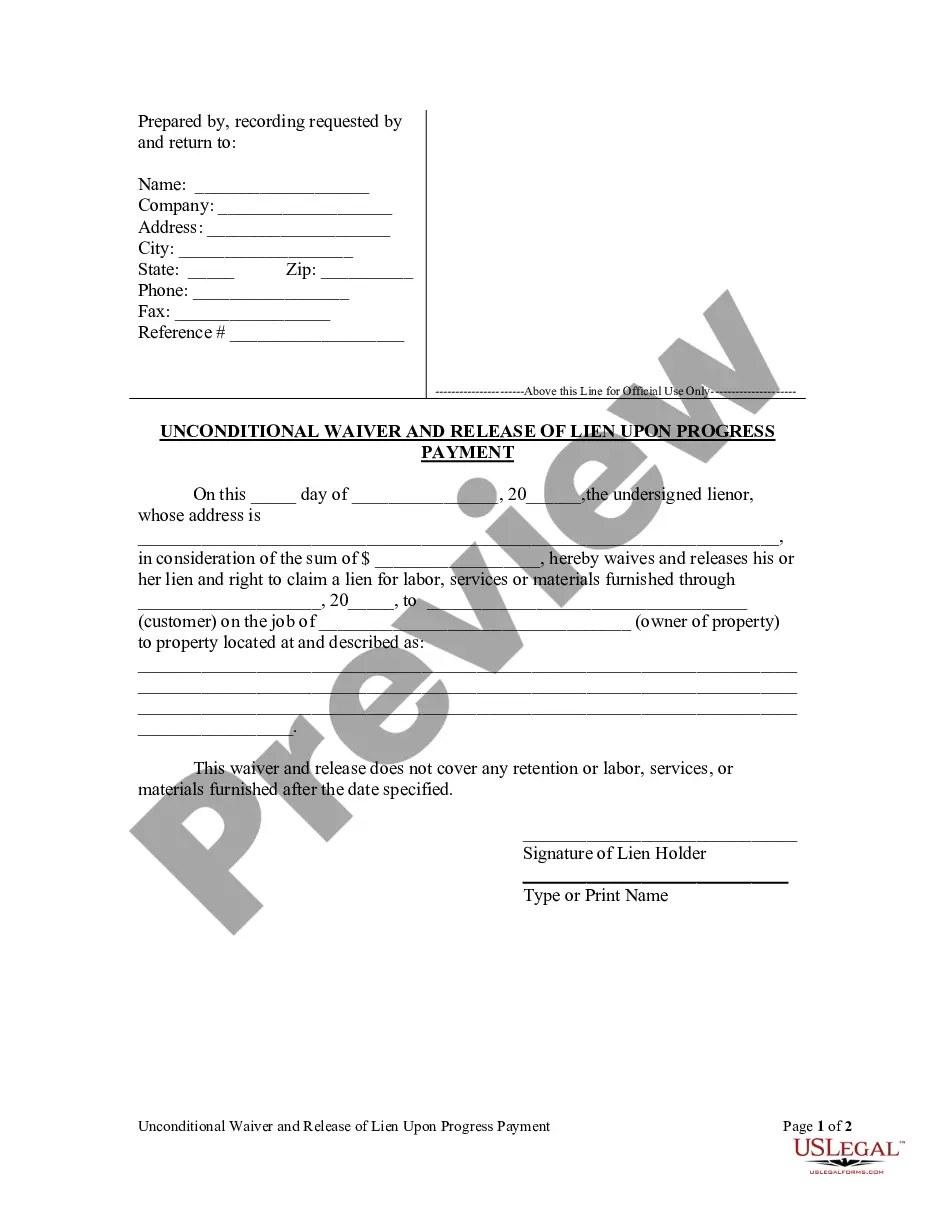

- Use the Preview button to review the form.

- Check the details to ensure you have chosen the correct form.

- If the form does not meet your requirements, use the Lookup field to find the form that suits your needs.

- Once you locate the correct form, click on Purchase now.

Form popularity

FAQ

In South Dakota, you generally do not need a specific license to work as a handyman, but this can depend on the scope of the work. Some projects may require permits or adherence to local laws. If you’re aiming for a South Dakota Oil Cleanup Services Contract - Self-Employed, it’s wise to verify any legal requirements. For clarity and support, uslegalforms can provide the information you need.

Yes, obtaining a contractor's license in South Dakota is a common requirement for construction-related work. This license can vary depending on the type of work and location, so being informed is crucial. If you plan to engage in a South Dakota Oil Cleanup Services Contract - Self-Employed, make sure you meet the necessary licensing criteria. Uslegalforms offers up-to-date resources to assist you.

A contractor typically oversees larger projects and often requires specific licensing and bonding. On the other hand, a handyman performs smaller jobs that usually do not need extensive licensing. If you're pursuing a South Dakota Oil Cleanup Services Contract - Self-Employed, understanding the distinction can help you choose the right path for your business. Rely on uslegalforms to ensure your contract fits your needs.

Yes, South Dakota requires most businesses to have a business license, which ensures that you comply with local laws. This is relevant for those operating under a South Dakota Oil Cleanup Services Contract - Self-Employed. This license helps legitimize your operations and provides accountability. Always consult uslegalforms to ensure you're taking the right steps.

While you cannot completely eliminate self-employment tax, you can take steps to minimize it legally. Strategies include maximizing deductions related to your South Dakota Oil Cleanup Services Contract - Self-Employed, such as business expenses and contributions to retirement accounts. Staying informed about tax law changes and consulting with professionals can help you navigate this landscape effectively. Consider using tools like US Legal Forms to stay in compliance and explore deduction opportunities.

Filing excise tax in South Dakota requires you to complete specific forms and submit them to the Internal Revenue Service. Typically, this involves reporting your excise tax liabilities in a timely manner to avoid penalties. If you engage in a South Dakota Oil Cleanup Services Contract - Self-Employed, ensure you are familiar with any applicable excise taxes related to your work. Utilizing US Legal Forms can streamline this process and provide forms tailored to your needs.

Self-employment taxes are triggered when your net earnings from self-employment exceed a specific threshold. In South Dakota, this often includes income from contracts and freelance work, such as a South Dakota Oil Cleanup Services Contract - Self-Employed. It is crucial to monitor your earnings closely, as exceeding the limit can lead to additional tax obligations. Staying informed about these triggers helps you manage your finances effectively.

Yes, South Dakota does impose a self-employment tax on individuals who are self-employed. This tax is primarily used to fund Social Security and Medicare. If you are working on a South Dakota Oil Cleanup Services Contract - Self-Employed, it’s important to factor this into your financial planning. Be sure to keep detailed records of your income and expenses for accurate tax calculations.

In South Dakota, a contractor license may not be required at the state level for all types of work. However, certain local jurisdictions might have their regulations. If you offer South Dakota Oil Cleanup Services under a contract, verify the local rules to ensure compliance. Consider accessing resources through US Legal Forms to simplify this process and find necessary licensing information.

In South Dakota, the self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. This tax generally amounts to 15.3% of your net earnings. For those engaged in a South Dakota Oil Cleanup Services Contract - Self-Employed, understanding this tax is crucial, as it impacts your overall earnings. You should consider consulting with a tax professional to ensure compliance and optimize your tax obligations.