South Dakota Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

Are you within a place that you need to have files for possibly company or personal purposes virtually every day? There are a variety of authorized file web templates available online, but discovering types you can trust isn`t effortless. US Legal Forms delivers a huge number of form web templates, much like the South Dakota Notice Regarding Introduction of Restricted Share-Based Remuneration Plan, which are written in order to meet state and federal specifications.

When you are previously familiar with US Legal Forms site and possess a merchant account, basically log in. Next, you can obtain the South Dakota Notice Regarding Introduction of Restricted Share-Based Remuneration Plan template.

If you do not come with an bank account and would like to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is for the right metropolis/state.

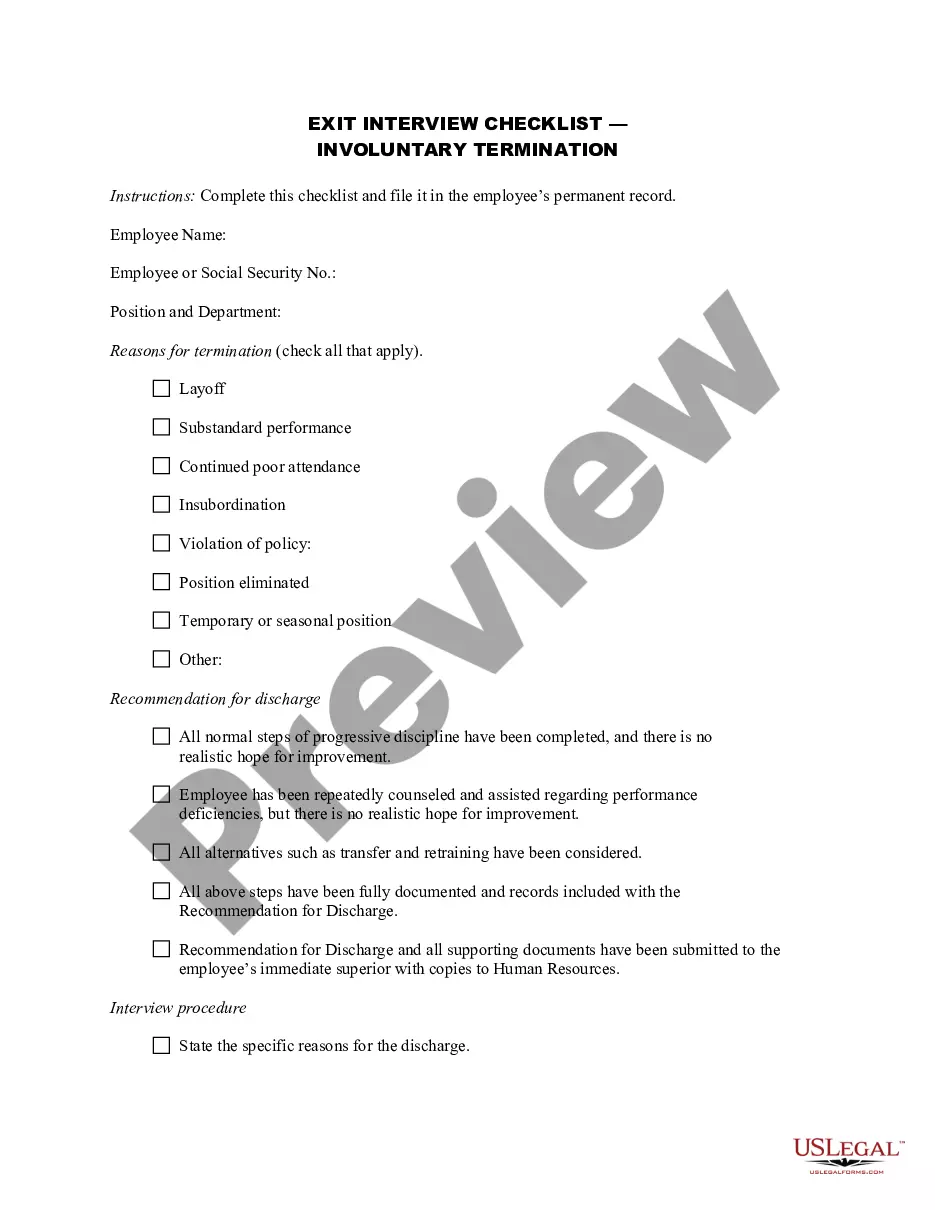

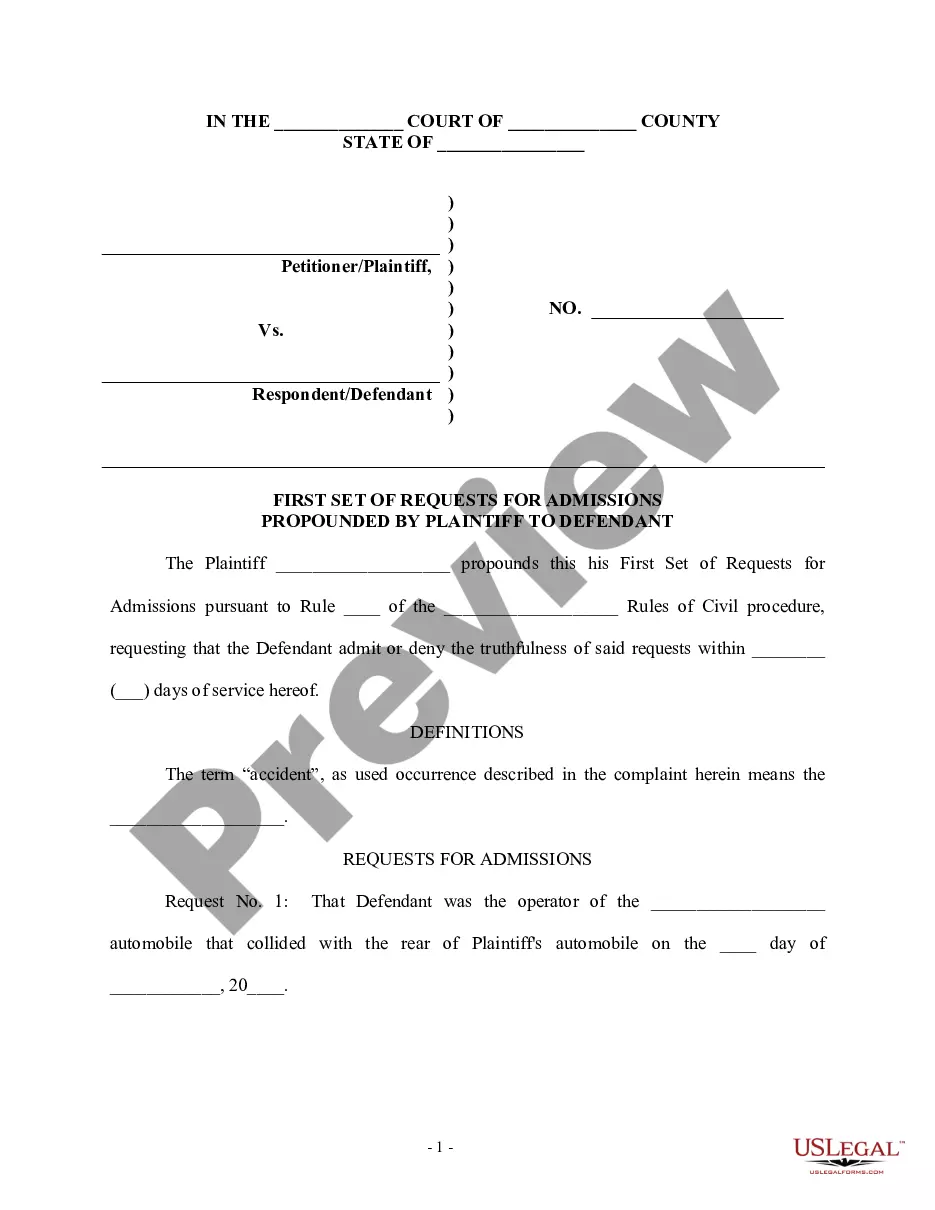

- Utilize the Preview button to examine the shape.

- Look at the explanation to ensure that you have chosen the proper form.

- In case the form isn`t what you are seeking, utilize the Lookup field to get the form that meets your requirements and specifications.

- If you find the right form, click on Acquire now.

- Opt for the pricing prepare you want, fill in the specified details to make your money, and pay for an order using your PayPal or bank card.

- Pick a convenient document structure and obtain your copy.

Get all of the file web templates you might have purchased in the My Forms menu. You can get a further copy of South Dakota Notice Regarding Introduction of Restricted Share-Based Remuneration Plan at any time, if required. Just click the essential form to obtain or printing the file template.

Use US Legal Forms, by far the most comprehensive variety of authorized forms, to conserve time and steer clear of faults. The assistance delivers professionally created authorized file web templates that you can use for a variety of purposes. Make a merchant account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

In South Dakota, the process includes several stages such as validating the deceased's will, compiling an inventory of their assets, settling any outstanding debts or taxes, and finally, distributing the remaining assets among the designated beneficiaries.

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

No. In South Dakota, not all your property may have to go through probate. The assets that do go through probate make up your probate estate. These are usually assets that are titled solely in your name and come under the control of your personal representative (formerly known as an executor).

Does a Power of Attorney need to be notarized, witnessed, and/or recorded in South Dakota? The requirements and restrictions vary by state; however, in South Dakota, if you plan for the agent to handle matters related to children or real estate, then notarization will be required.

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

The amount of the elective share ranges from 3% for marriages lasting more than one but less than two years to 50% for marriages lasting more than 15 years. The augmented estate of the deceased includes: The deceased's non-probate transfers to the spouse and others. All real and personal property in the estate.

You may be able to avoid probate in South Dakota using any of the following strategies: Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

An elective share is the amount of a surviving spouse's lawful share of a deceased spouse's estate. The elective share is also called the spousal elective share, statutory share, spousal share, and forced share.