South Dakota Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company

Description

How to fill out Registration Rights Agreement Between Visible Genetics, Inc. And The Purchasers Of Common Shares Of The Company?

If you wish to total, download, or print out authorized papers layouts, use US Legal Forms, the most important variety of authorized types, that can be found on the Internet. Make use of the site`s basic and convenient research to discover the paperwork you will need. Numerous layouts for organization and person purposes are categorized by groups and claims, or search phrases. Use US Legal Forms to discover the South Dakota Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company within a couple of click throughs.

When you are presently a US Legal Forms buyer, log in in your accounts and then click the Download option to get the South Dakota Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company. You can even access types you in the past downloaded in the My Forms tab of your respective accounts.

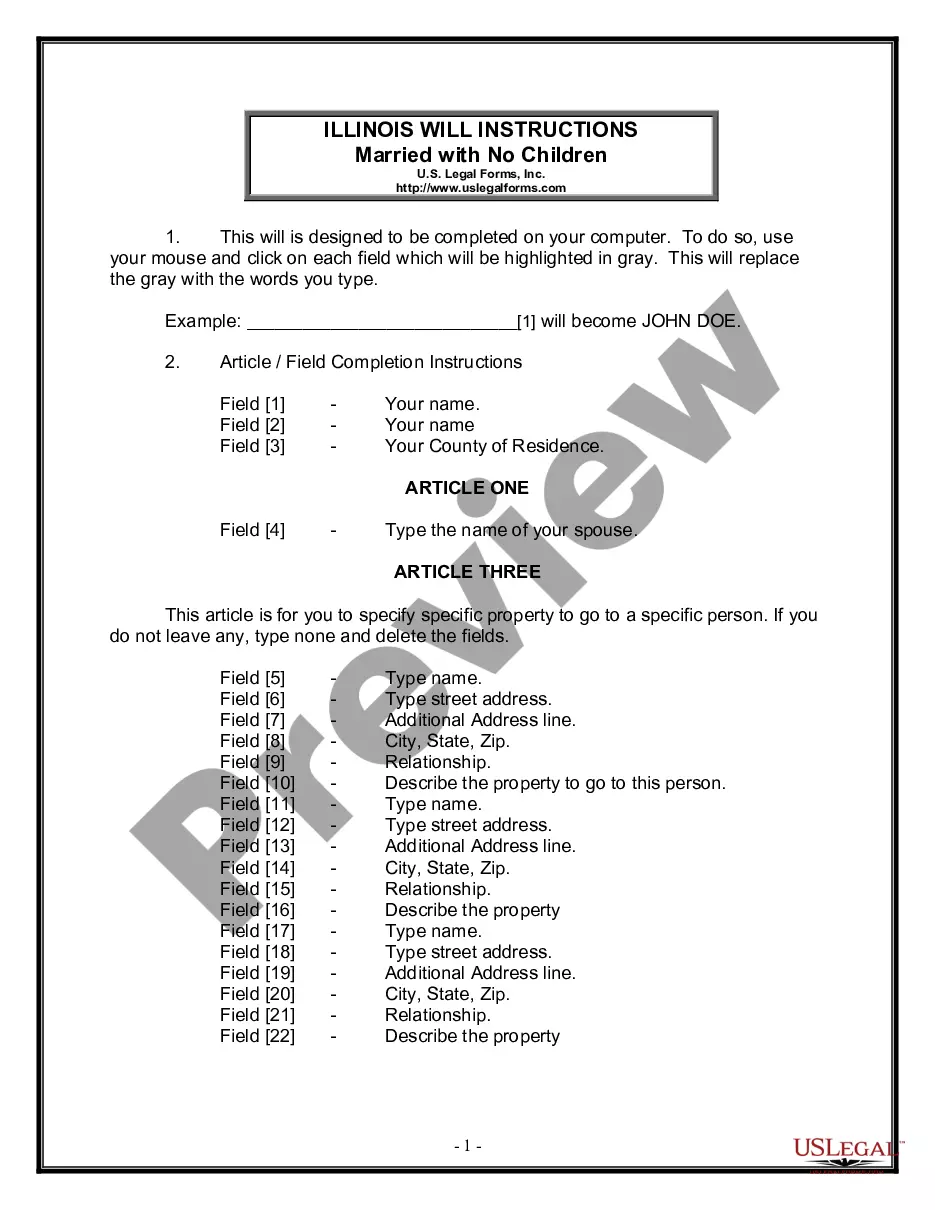

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape to the appropriate metropolis/country.

- Step 2. Use the Preview choice to examine the form`s content. Don`t overlook to read the information.

- Step 3. When you are unhappy with the kind, take advantage of the Search area towards the top of the display screen to get other types in the authorized kind design.

- Step 4. After you have found the shape you will need, click on the Acquire now option. Choose the pricing prepare you prefer and include your credentials to register on an accounts.

- Step 5. Approach the deal. You may use your bank card or PayPal accounts to perform the deal.

- Step 6. Find the file format in the authorized kind and download it in your gadget.

- Step 7. Total, edit and print out or signal the South Dakota Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company.

Each and every authorized papers design you acquire is your own forever. You have acces to every single kind you downloaded in your acccount. Go through the My Forms portion and choose a kind to print out or download again.

Contend and download, and print out the South Dakota Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company with US Legal Forms. There are thousands of expert and status-certain types you may use for your personal organization or person requires.

Form popularity

FAQ

With demand registration rights, investors have a right to force a company to register shares with the SEC. Once registered, the shareholders can then sell their shares to outside investors and exit the company.

This is when you use an existing contract to acquire the same commodities or services at the same or lower price from another public entity contract.

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

There are two primary categories of registration rights: demand and piggyback rights. With demand registration rights, investors have a right to force a company to register shares with the SEC. Once registered, the shareholders can then sell their shares to outside investors and exit the company.

Piggyback registration rights, where the investor is entitled to register its securities when either the company or another investor initiates the registration. Holders of piggyback rights are allowed to include their securities in a registration initiated by the company or another investor.

One type of registration rights?known as demand rights?allows investors to force a company to go public. Piggyback rights, another type, allow investors to have their shares included in a liquidity event.

Registration rights, if exercised, can force a privately-held company to become a publicly-traded company. One type of registration rights?known as demand rights?allows investors to force a company to go public. Piggyback rights, another type, allow investors to have their shares included in a liquidity event.