This due diligence checklist identifies the guidelines and general overview of a corporation by providing information and supportive materials regarding business transactions.

South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview

Description

How to fill out Short Form Checklist And Guidelines For Basic Corporate Entity Overview?

Are you in a situation where you require documents for either business or personal use almost every day.

There are numerous authentic document templates accessible on the internet, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of document templates, such as the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview, designed to comply with federal and state regulations.

Once you locate the correct document, click Buy now.

Choose the pricing plan that you prefer, fill in the necessary details to finalize your payment, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it is for the correct city/state.

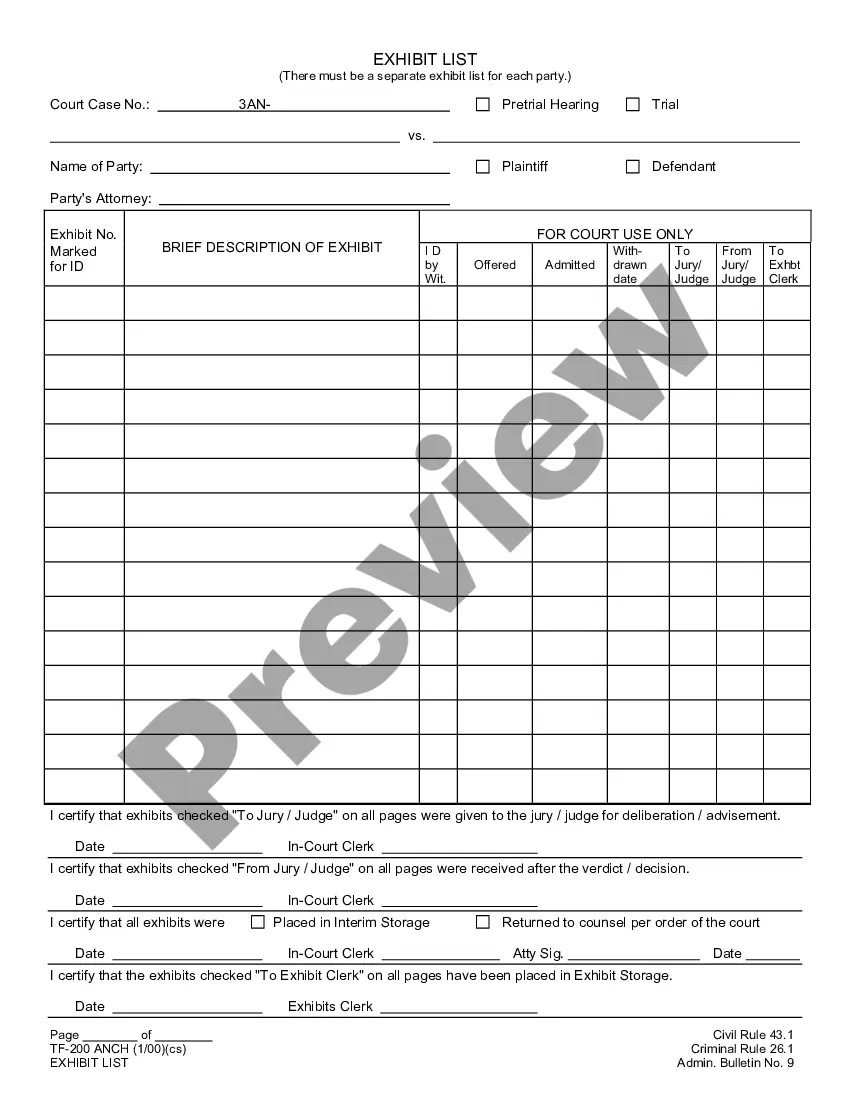

- Utilize the Preview button to examine the document.

- Review the description to confirm that you have chosen the correct form.

- If the form does not meet your expectations, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The primary document needed to incorporate a business is the Articles of Incorporation. This document provides the legal foundation and necessary information for your corporation's registration with the state. By following the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview, you can ensure that your Articles of Incorporation meet all the necessary legal standards.

The most important document to form a corporation remains the Articles of Incorporation, as it signifies the formal creation of your corporation. This document establishes your entity in the eyes of the law and outlines core information essential for operation. Consult the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview for a detailed understanding of its components.

For any company, the most important document is often the operating agreement or bylaws, which govern internal operations and outline the responsibilities of shareholders and officers. This document acts as a roadmap for business conduct and decision-making. The South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview will provide insights on creating an effective operating agreement.

The most important document required to form a corporation is the Articles of Incorporation. This legal document not only initiates the formation process but also provides vital information that defines your corporation's structure and purpose. For thorough guidance, utilize the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview to ensure your filing is complete.

The 183 day rule in South Dakota pertains to state income tax obligations for corporations and indicates that businesses may be subject to state taxes if they conduct activities within the state for 183 days or more in a tax year. Understanding this rule is crucial for compliance and financial planning. The South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview will help you grasp your tax responsibilities in detail.

Yes, South Dakota is a mandatory reporting state, which means corporations must file annual reports to keep their status active. These reports provide updates about the corporation's structure and activities. To navigate this requirement effectively, refer to the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview for specific reporting details.

A document that creates a corporation is typically known as the Articles of Incorporation. This official filing, required by the state, establishes the existence of your corporation and includes essential details such as its name, purpose, and registered agent. Following the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview will ensure you meet all necessary requirements for this document.

The corporate structure document outlines the framework of your corporation, defining its purpose, governance, and the roles of shareholders and directors. It serves as a foundational reference to ensure compliance with state laws, including the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview. This document is essential to promote clarity and accountability within your organization.

Yes, South Dakota requires a business license for most types of businesses operating within the state. The specific requirements vary depending on the business type and its location. As part of the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview, understanding licensing requirements is essential for compliance. You can explore helpful resources and templates on the US Legal Forms platform to ensure you follow all necessary steps.

Creating an annual report involves compiling your LLC's financial information and organizational details for the year. Make sure to include income statements, balance sheets, and any updates regarding your business operations. By following the South Dakota Short Form Checklist and Guidelines for Basic Corporate Entity Overview, you can create a comprehensive and accurate report.