South Dakota Letter to Debt Collector - Only Contact My Attorney

Description

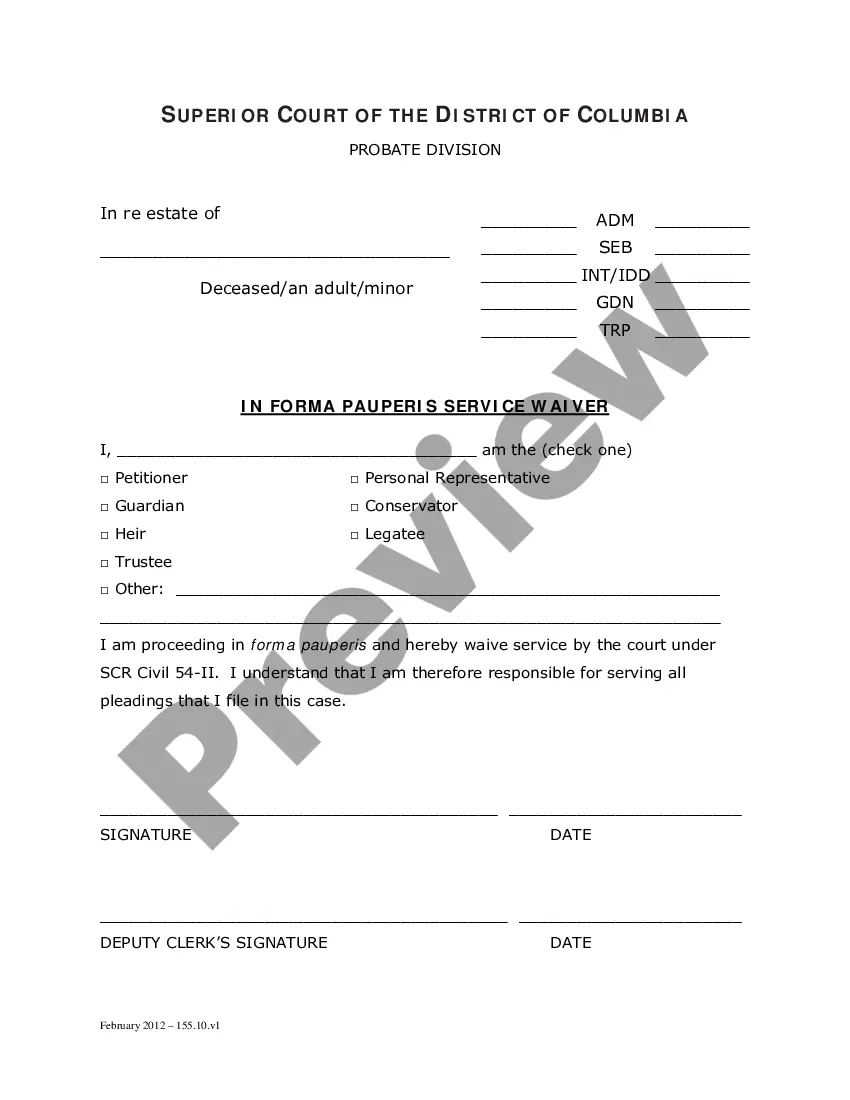

How to fill out Letter To Debt Collector - Only Contact My Attorney?

If you want to full, acquire, or print legitimate record layouts, use US Legal Forms, the greatest variety of legitimate varieties, that can be found on the Internet. Make use of the site`s easy and handy search to find the paperwork you want. Different layouts for enterprise and individual functions are sorted by types and says, or search phrases. Use US Legal Forms to find the South Dakota Letter to Debt Collector - Only Contact My Attorney with a handful of mouse clicks.

When you are previously a US Legal Forms customer, log in in your account and then click the Down load key to get the South Dakota Letter to Debt Collector - Only Contact My Attorney. You may also accessibility varieties you earlier delivered electronically from the My Forms tab of your respective account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the form to the proper town/nation.

- Step 2. Make use of the Review solution to check out the form`s information. Do not forget about to see the information.

- Step 3. When you are not satisfied with all the form, use the Look for area on top of the display screen to discover other variations of your legitimate form format.

- Step 4. When you have identified the form you want, click the Acquire now key. Pick the pricing plan you prefer and put your qualifications to register for an account.

- Step 5. Method the financial transaction. You can use your credit card or PayPal account to finish the financial transaction.

- Step 6. Select the file format of your legitimate form and acquire it on your own system.

- Step 7. Complete, modify and print or indicator the South Dakota Letter to Debt Collector - Only Contact My Attorney.

Every legitimate record format you purchase is yours for a long time. You might have acces to each and every form you delivered electronically with your acccount. Click on the My Forms portion and choose a form to print or acquire yet again.

Contend and acquire, and print the South Dakota Letter to Debt Collector - Only Contact My Attorney with US Legal Forms. There are millions of specialist and state-particular varieties you may use for your personal enterprise or individual needs.

Form popularity

FAQ

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.

Four Steps to Take if You Received a Debt Collection Letter From a Lawyer Carefully Review the Letter to Determine the Claim. ... Consider Sending a Debt Validation Request. ... Gather and Organize All Relevant Financial Documents and Records. ... Be Proactive: Debt Does Not Go Away on its Own.

If you're not sure that the debt is yours, write the debt collector and dispute the debt or ask for more information. If the debt is yours, don't worry. Decide on the total amount you are willing to pay to settle the entire debt and negotiate with the debt collector for the rest to be forgiven.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Tell the debt collector that you'll call them back as soon as you verify the information. Review your bills and bank statements to confirm if the debt is yours. This may also help you confirm if the amount you owe is correct. You can ask the collection agency to contact you only in writing.

A debt collector may not contact you at inconvenient times or places, such as before 8 in the morning or after 9 at night, unless you agree to it. And collectors may not contact you at work if they;re told (orally or in writing) that you're not allowed to get calls there.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.