South Dakota Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees

Description

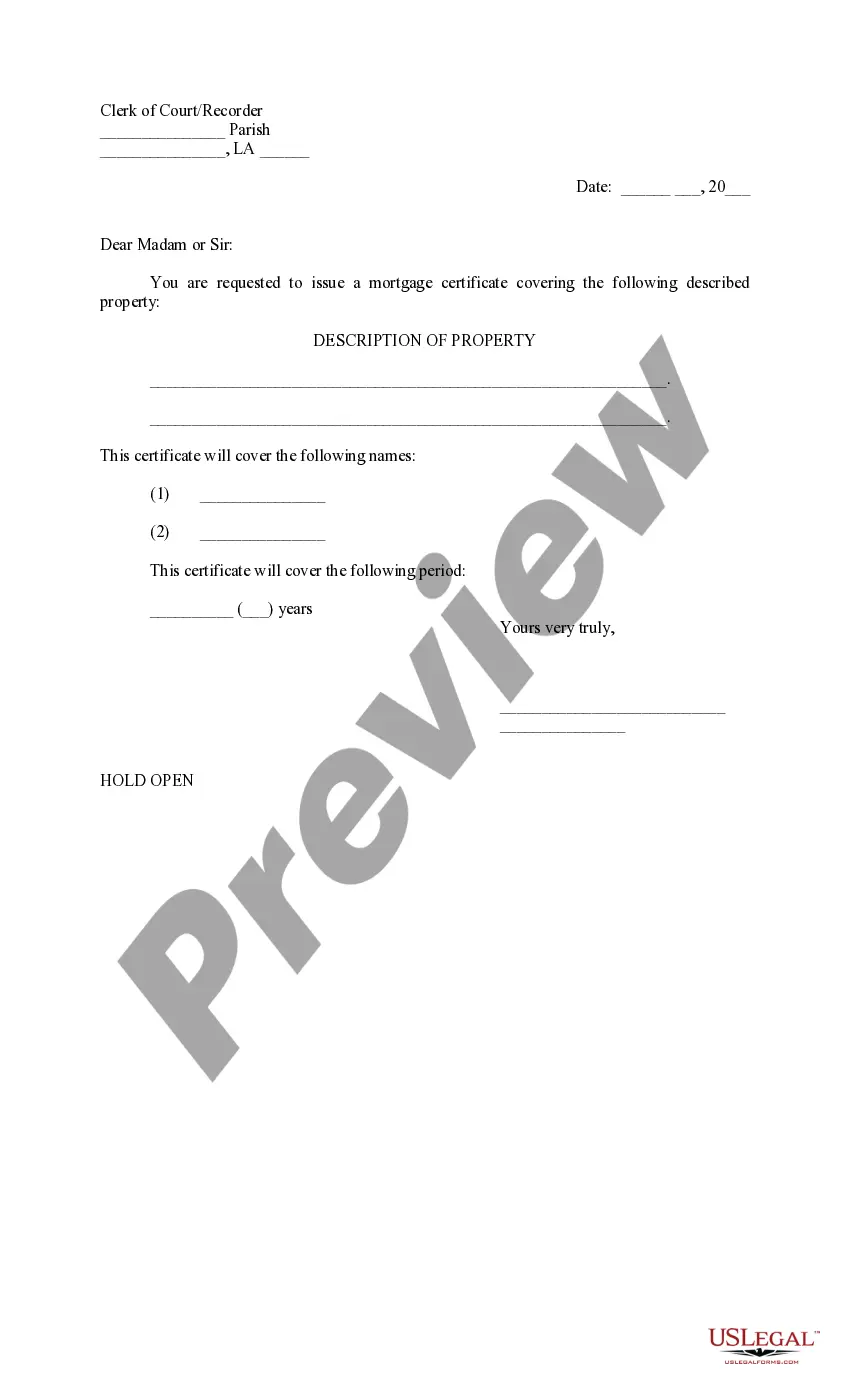

How to fill out Deferred Compensation Agreement By First Florida Bank, Inc. For Key Employees?

US Legal Forms - one of many biggest libraries of lawful kinds in America - provides an array of lawful document web templates you can download or print. Using the website, you can find a huge number of kinds for enterprise and individual uses, sorted by types, claims, or keywords.You can find the newest versions of kinds such as the South Dakota Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees within minutes.

If you already possess a registration, log in and download South Dakota Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees through the US Legal Forms library. The Download switch will show up on every form you perspective. You gain access to all previously delivered electronically kinds inside the My Forms tab of your account.

If you want to use US Legal Forms for the first time, allow me to share simple instructions to help you get started off:

- Make sure you have picked out the correct form for your personal area/state. Click the Review switch to analyze the form`s information. Browse the form description to actually have chosen the right form.

- When the form does not satisfy your requirements, make use of the Look for discipline towards the top of the display to find the one which does.

- If you are satisfied with the form, validate your choice by clicking the Acquire now switch. Then, select the rates strategy you want and give your accreditations to sign up to have an account.

- Process the deal. Make use of charge card or PayPal account to finish the deal.

- Pick the format and download the form in your device.

- Make adjustments. Load, change and print and sign the delivered electronically South Dakota Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees.

Every single web template you included with your bank account lacks an expiration time and is also the one you have forever. So, if you want to download or print yet another copy, just proceed to the My Forms segment and click about the form you require.

Obtain access to the South Dakota Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees with US Legal Forms, one of the most substantial library of lawful document web templates. Use a huge number of skilled and condition-distinct web templates that meet your organization or individual needs and requirements.

Form popularity

FAQ

You can take penalty-free withdrawals from your 457 account at any age after you leave your job. Most other types of retirement-savings plans assess a 10% penalty if you withdraw money before age 55 or 59½, depending on when you leave your job.

You can request a loan by logging in to your DCP account, completing a Loan Application Form, or calling the Service Center at 844-523-2457.

The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $22,500 in 2023 ($20,500 in 2022; $19,500 in 2020 and 2021; $19,000 in 2021).

The 457 plan is a retirement savings plan and you generally cannot withdraw money while you are still employed. When you leave employment, you may withdraw funds; leave them in place; transfer them to a 457, 403(b) or 401(k) of a new employer; or roll them into an Individual Retirement Account (IRA).

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

The Florida Deferred Compensation Plan is a supplemental retirement plan for employees of the State of Florida, including OPS employees and employees of the State University System, State Board of Administration, Division of Rehab and Liquidation, Special Districts*, and Water Management Districts* [established under ...

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.