South Dakota Job Offer Letter for Sole Trader

Description

How to fill out Job Offer Letter For Sole Trader?

If you want to completely download or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you need.

A range of templates for both business and personal purposes are categorized by type and subject, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, select the Purchase now button. Choose your preferred payment plan and provide your details to register for an account.

- Use US Legal Forms to obtain the South Dakota Job Offer Letter for Sole Trader with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the South Dakota Job Offer Letter for Sole Trader.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

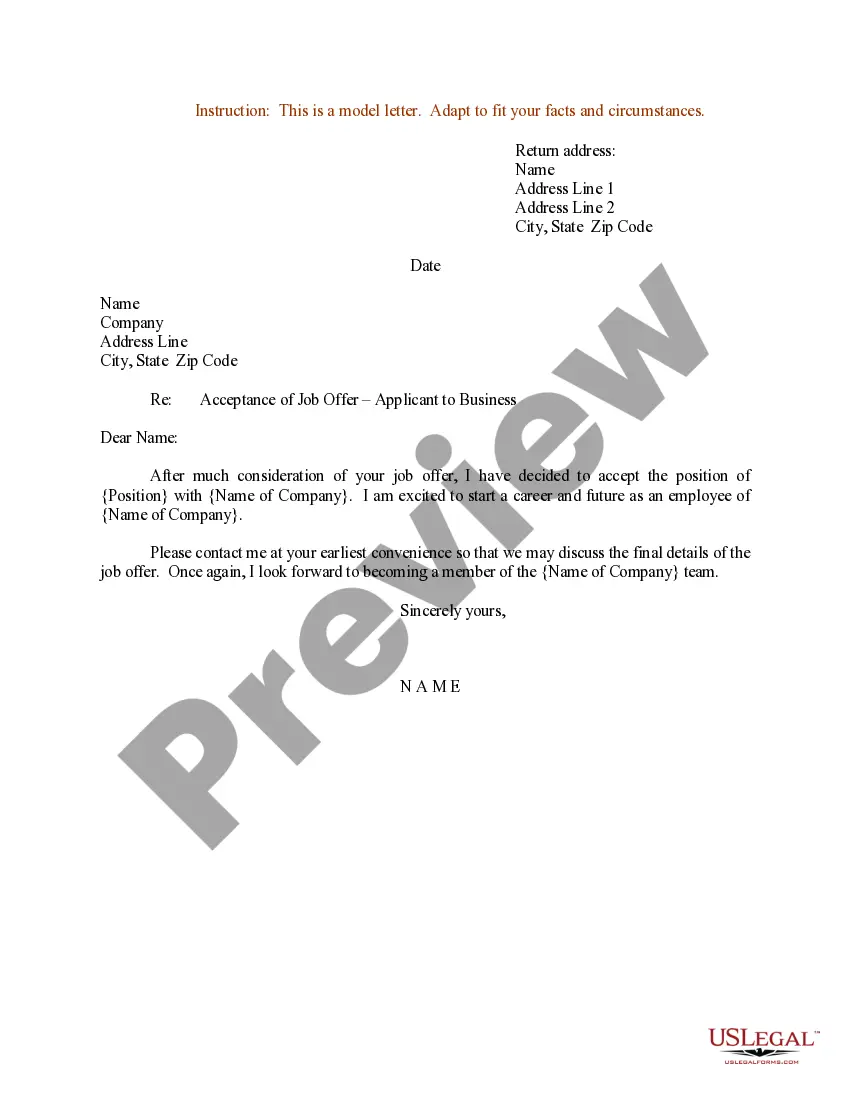

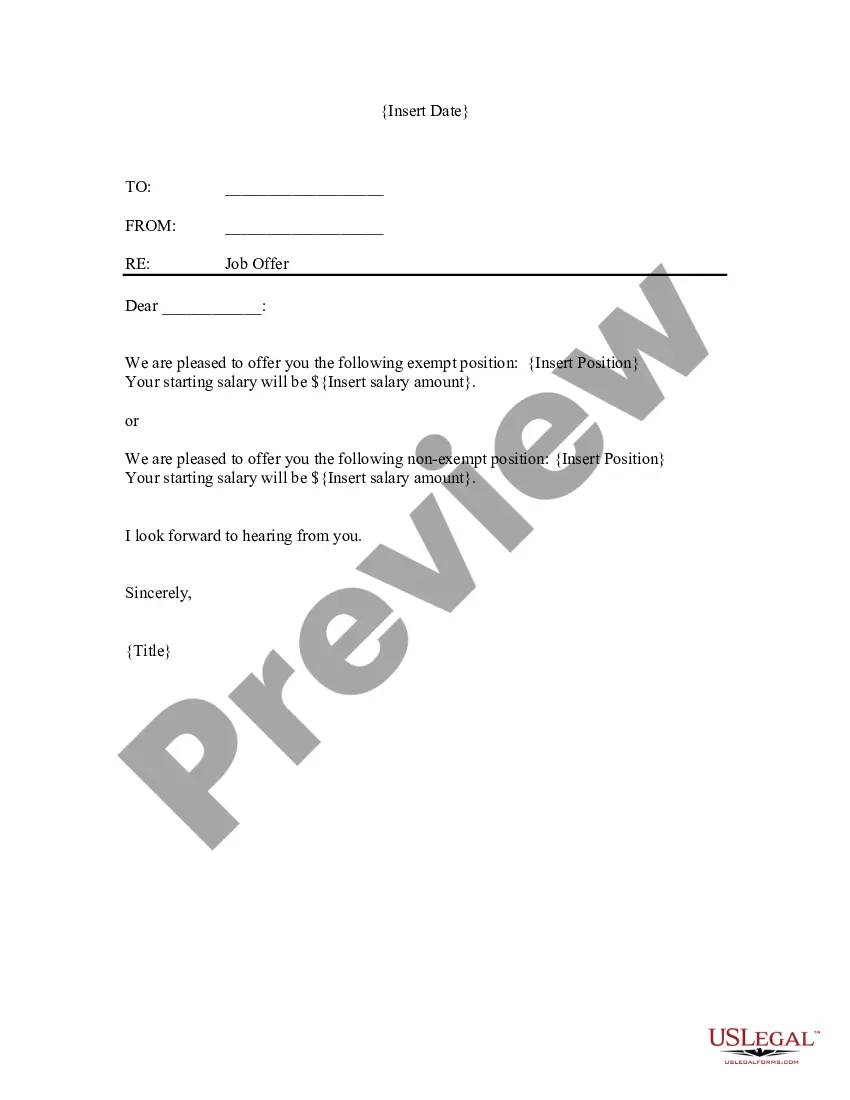

- Step 2. Use the Review feature to browse the form's content. Be sure to read the summary.

Form popularity

FAQ

To determine if a South Dakota Job Offer Letter for Sole Trader is genuine, verify the company's contact information and reach out directly to them. Look for official letterhead and check for any inconsistencies in the content. Additionally, cross-reference the details with the job posting or the company's website for accuracy.

Eligibility RequirementsOwn your own business, be self-employed, or working as an independent contractor.Have a minimum net profit of $4,600 annually.Have a valid license, if required by your occupation.Be able to perform all of your normal duties on a full-time basis at the time your application is submitted.More items...?

The most common proof of employment is an employment verification letter from an employer that includes the employee's dates of employment, job title, and salary. It's also often called a "letter of employment," a "job verification letter," or a "proof of employment letter."

Acceptable documents can include paycheck stubs, state or federal employer identification numbers, business licenses, tax documents, business receipts or a signed affidavit. This documentation must be provided within 90 days of the initial application or when requested by ODJFS, whichever is later.

The most common proof of employment is an employment verification letter from an employer that includes the employee's dates of employment, job title, and salary. It's also often called a "letter of employment," a "job verification letter," or a "proof of employment letter."

If you applied for PUA in 2020 and are still collecting in 2021, you just need a single document that shows you were working at some point between January 2019 and your application for PUA. It could be pay stubs, tax documents, contracts, business licenses, letters, etc.

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

Documents that could be used to prove employment or plans for employment include, but are not limited to: paycheck stubs, earnings and leave statements, W-2 forms, letters offering employment, or statements or affidavits (with the employer's name and contact information) verifying an employment offer.

Acceptable 2019 or 2020 income documents, depending on the year you filed your claim, may include one or more of the following:Federal tax return (IRS Form 1040, Schedule C or F).State tax return (CA Form 540).W-2.Paycheck stubs.Payroll history.Bank receipts.Business records.Contracts.More items...?