South Dakota Personnel Payroll Associate Checklist

Description

How to fill out Personnel Payroll Associate Checklist?

Selecting the finest authentic document template can be a challenge. Naturally, there are numerous templates accessible online, but how do you locate the authentic type you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the South Dakota Personnel Payroll Associate Checklist, which can be utilized for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to download the South Dakota Personnel Payroll Associate Checklist. Use your account to review the legal forms you may have previously acquired. Navigate to the My documents tab in your account to retrieve another copy of the document you require.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received South Dakota Personnel Payroll Associate Checklist. US Legal Forms is the largest repository of legal documents where you can find a wide array of document templates. Use the service to obtain professionally crafted documents that comply with state guidelines.

- First, ensure that you have selected the correct form for your area/state.

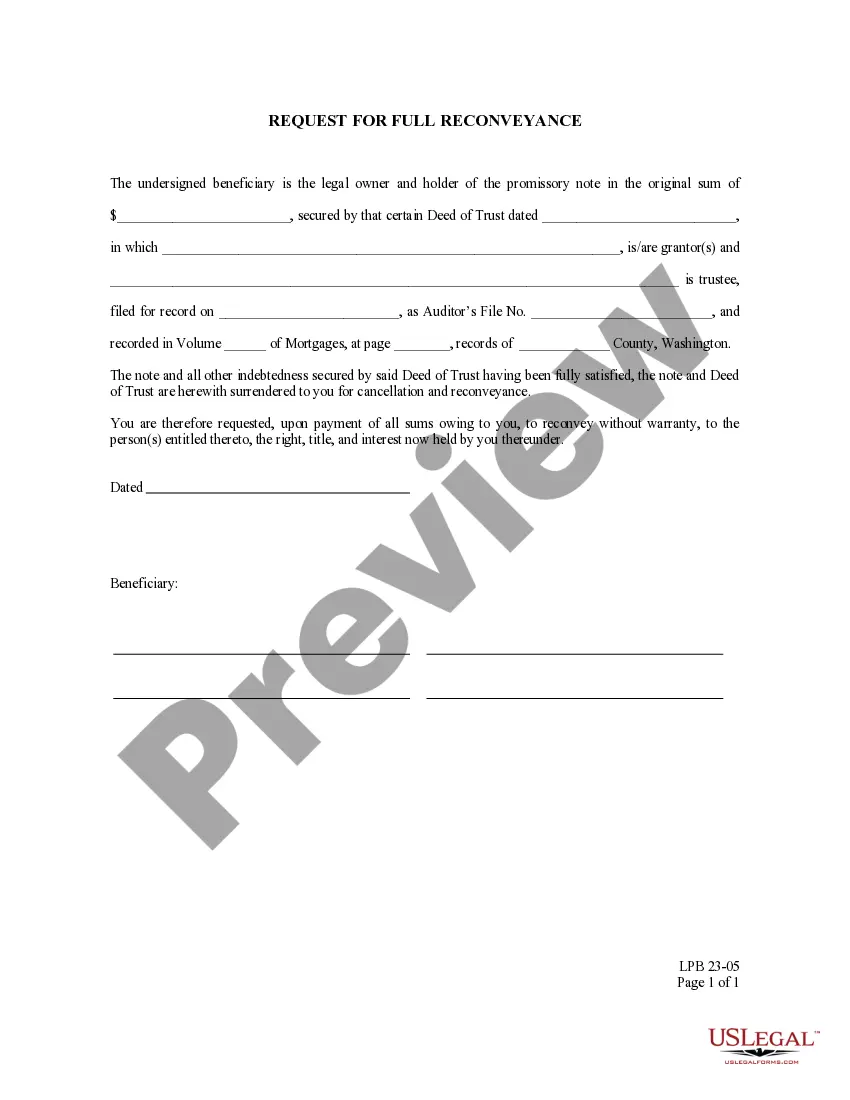

- You can view the form using the Preview button and examine the form details to confirm it is suitable for you.

- If the form does not meet your criteria, utilize the Search field to find the right form.

- Once you are confident that the form is appropriate, click on the Acquire now button to download the form.

- Select the pricing plan you prefer and enter the required information.

- Create your account and complete the payment using your PayPal account or credit card.

Form popularity

FAQ

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

How to process payrollStep 1: Establish your employer identification number.Step 2: Collect relevant employee tax information.Step 3: Choose a payroll schedule.Step 4: Calculate gross pay.Step 5: Determine each employee's deductions.Step 6: Calculate net pay, and pay your employees.More items...

Four Steps In Setting Up Your Small Business Payroll SuccessUnderstanding the responsibilities of your managing your payroll.Choosing the right payroll system for your particular company.Ensuring that your employees are paid correctly.Paying payroll taxes and filing tax forms.

Employer Identification Number (EIN)State/Local Tax ID Number.State Unemployment ID Number.Employee Addresses and SSNs.I-9.W-4.State Withholding Allowance Certificate.Department of Labor (DOL) Records.More items...?04-Sept-2017

How to process payrollStep 1: Establish your employer identification number.Step 2: Collect relevant employee tax information.Step 3: Choose a payroll schedule.Step 4: Calculate gross pay.Step 5: Determine each employee's deductions.Step 6: Calculate net pay, and pay your employees.More items...

Basic Payroll StepsSign up for an Employer Identification Number. In short, this is the number the IRS uses to identify your business.Request that each employee complete Form W-4.Settle on a payroll schedule.Calculate and withhold the proper amount of taxes.Pay taxes.

Here are 10 steps to help you set up a payroll system for your small business.Obtain an Employer Identification Number (EIN)Check whether you need state/local IDs.Independent contractor or employee.Take care of employee paperwork.Decide on a pay period.Carefully document your employee compensation terms.More items...