South Dakota Depreciation Schedule refers to a predetermined timetable that outlines the expected rate at which assets depreciate in value over time for tax purposes in the state of South Dakota, USA. The schedule plays a crucial role in calculating depreciation expenses, which are deductible from taxable income, allowing businesses and individuals to offset the decrease in an asset's value over its useful life. One type of South Dakota Depreciation Schedule is the General Depreciation System (GDS), which encompasses a wide range of tangible assets, including buildings, machinery, vehicles, and equipment. Under GDS, assets are assigned specific recovery periods based on their respective classifications defined by the Internal Revenue Service (IRS). Another type is the Alternative Depreciation System (ADS), which provides an alternative method of depreciation for certain assets and taxpayers who elect to use it. ADS typically results in longer recovery periods compared to GDS and is commonly used for properties used predominantly outside the United States or other specific cases. Additionally, South Dakota offers a specific depreciation schedule for farm assets, known as the Farm Business Depreciation Schedule. This schedule allows farmers to depreciate their agricultural assets, such as livestock, farm buildings, and machinery, over predetermined recovery periods designed to match their typical useful lives. Properly following the South Dakota Depreciation Schedule ensures accurate and consistent depreciation calculations, promoting tax compliance and providing businesses and individuals with a fair representation of the value of their assets. Overall, the South Dakota Depreciation Schedule is a vital tool for tax planning, financial reporting, and maintaining the accuracy of depreciation records in the state.

South Dakota Depreciation Schedule

Description

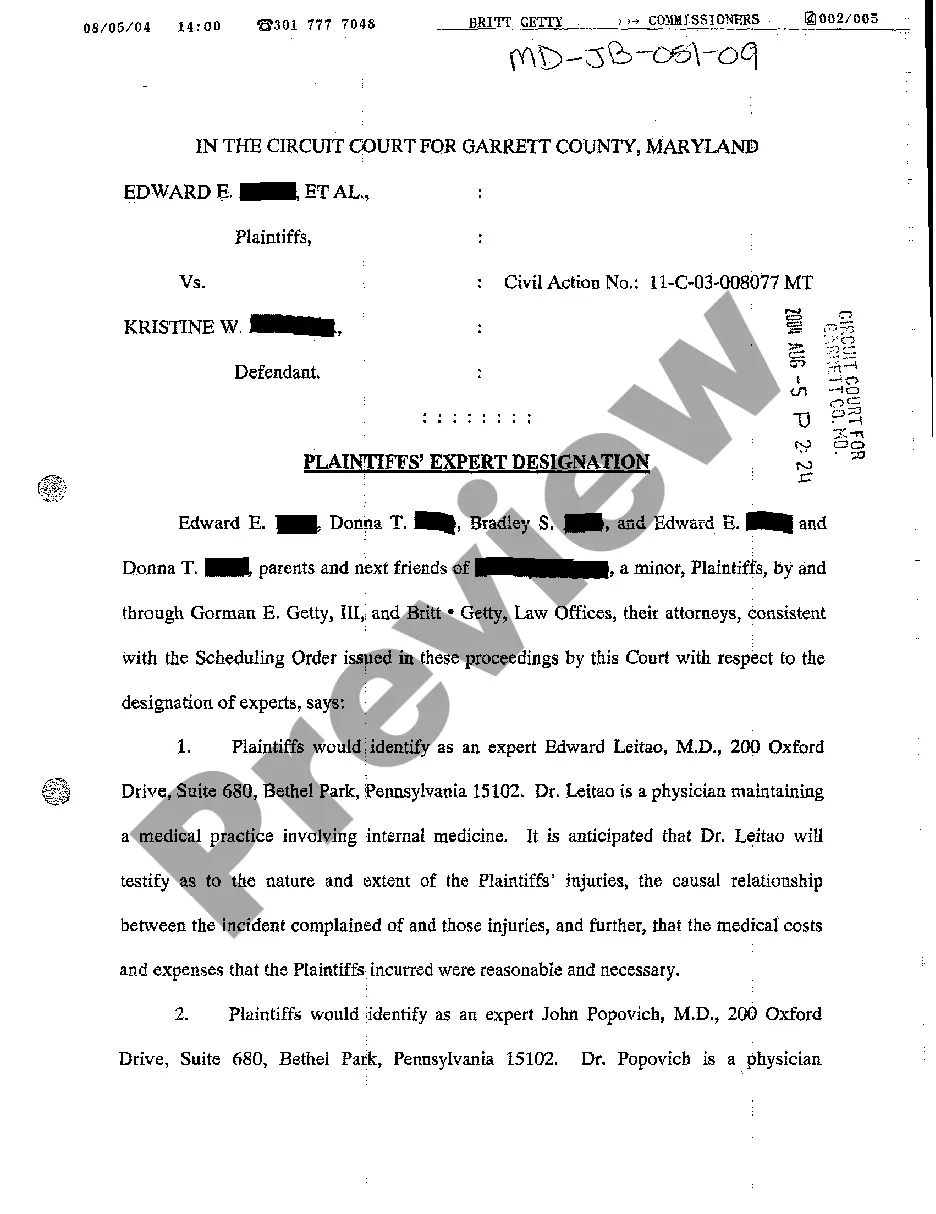

How to fill out South Dakota Depreciation Schedule?

Choosing the best legitimate papers format might be a have difficulties. Needless to say, there are plenty of themes available on the net, but how would you find the legitimate kind you require? Make use of the US Legal Forms site. The service gives thousands of themes, like the South Dakota Depreciation Schedule, that you can use for organization and personal needs. All of the varieties are checked out by experts and fulfill federal and state requirements.

If you are previously registered, log in for your bank account and click on the Down load button to get the South Dakota Depreciation Schedule. Make use of bank account to look from the legitimate varieties you might have bought earlier. Visit the My Forms tab of your bank account and acquire yet another version of the papers you require.

If you are a brand new consumer of US Legal Forms, listed below are simple guidelines for you to adhere to:

- Initially, make certain you have chosen the correct kind for your metropolis/state. It is possible to look over the form utilizing the Preview button and study the form outline to ensure this is the best for you.

- In the event the kind fails to fulfill your expectations, use the Seach area to find the right kind.

- When you are positive that the form is suitable, select the Acquire now button to get the kind.

- Pick the prices program you desire and type in the essential details. Build your bank account and pay money for an order with your PayPal bank account or bank card.

- Choose the file file format and download the legitimate papers format for your product.

- Full, modify and print and signal the received South Dakota Depreciation Schedule.

US Legal Forms will be the greatest catalogue of legitimate varieties in which you can find different papers themes. Make use of the company to download expertly-made files that adhere to express requirements.

Form popularity

FAQ

States that have adopted the new bonus depreciation rules:Alabama.Alaska.Colorado.Delaware.Illinois.Kansas.Louisiana.Michigan.More items...

Depreciation CalculationDetermine the basis of the property.Determine the percentage of business use (vehicles and offices)Multiply the basis by the percentage of business use.Subtract from the result amount deducted under Section 179.Multiply the result by 100% (in 2022) for special depreciation allowance.More items...

For qualified property placed in service in 2018 (2019 for long-production-period property), the amount is 40%. The rate drops to 30% for qualified property placed in service in 2019 (2020 for long-production-period property). After that, bonus depreciation is scheduled to expire.

WASHINGTON The Treasury Department and the Internal Revenue Service today released the last set of final regulations implementing the 100% additional first year depreciation deduction that allows businesses to write off the cost of most depreciable business assets in the year they are placed in service by the

First year depreciation = (M / 12) ((Cost - Salvage) / Life) Last year depreciation = ((12 - M) / 12) ((Cost - Salvage) / Life) And, a life, for example, of 7 years will be depreciated across 8 years.

California does not conform to the federal special or bonus depreciation for qualified property acquired and placed in service.

The 100% bonus depreciation amount remains in effect from September 27, 2017 until January 1, 2023. After that, first-year bonus depreciation goes down as follows: 80% for property placed in service after December 31, 2022 and before January 1, 2024.

Summary. State tax bonus depreciation deductions allow income taxpayers to claim depreciation of business or income-producing property at a higher percentage the first year the property is in service.

Summary. State tax bonus depreciation deductions allow income taxpayers to claim depreciation of business or income-producing property at a higher percentage the first year the property is in service.