South Dakota Sales Prospect File

Description

How to fill out Sales Prospect File?

You can dedicate multiple hours on the internet searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can download or print the South Dakota Sales Prospect File from our service.

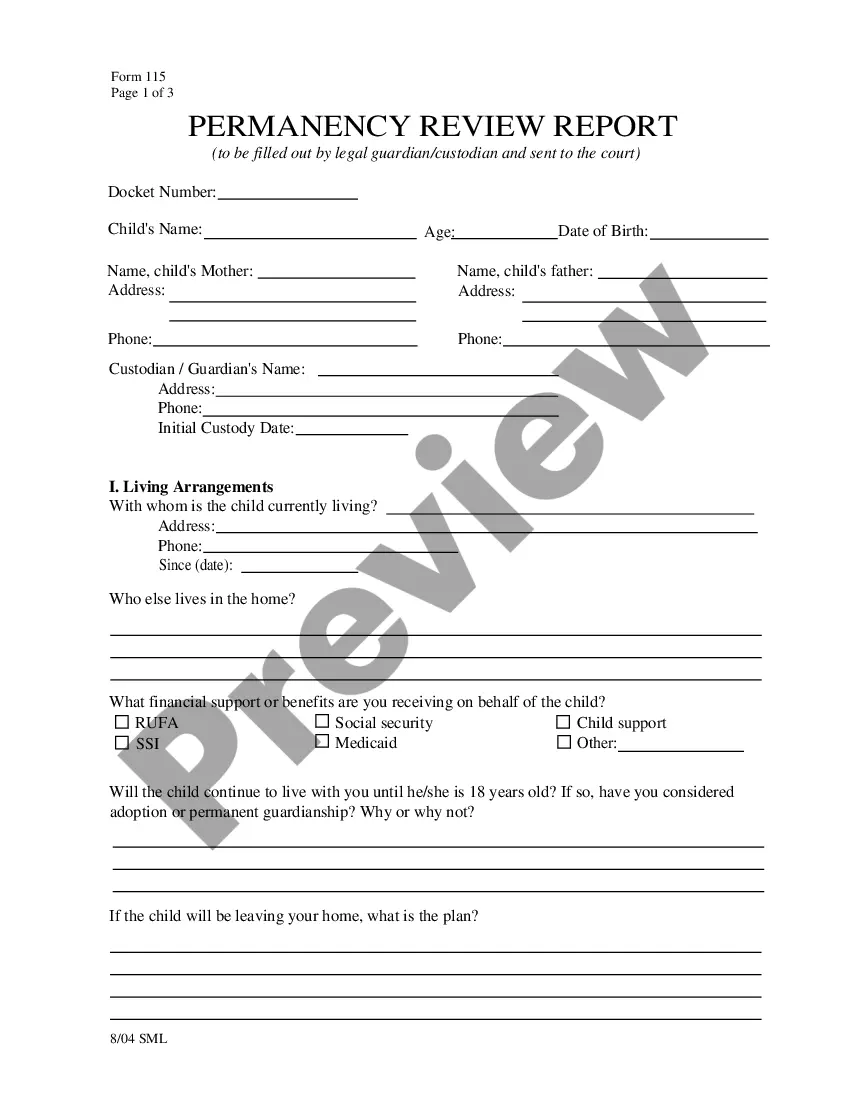

If available, use the Preview feature to inspect the document template as well.

- If you have a US Legal Forms account, you may Log In and select the Obtain option.

- After that, you can fill out, modify, print, or sign the South Dakota Sales Prospect File.

- Every legal document template you receive is yours to keep for a long time.

- To retrieve another copy of the acquired document, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for the region/city of your choice.

- Review the document description to confirm you have chosen the correct template.

Form popularity

FAQ

Yes, South Dakota collects sales tax on the sale of goods and certain services. This tax is vital for funding various state services and infrastructure. As a seller, it’s important to understand your obligations regarding sales tax collection. The South Dakota Sales Prospect File provides insights into tax rates and compliance, helping you stay informed and compliant.

To print a seller's permit in South Dakota, access the online portal of the state’s Department of Revenue. After logging in, navigate to your permits section, where you can select your seller's permit to download and print. Keeping a physical copy on hand is important for your business operations. Utilize the South Dakota Sales Prospect File to stay organized and maintain an audit-ready record.

Printing your seller permit in South Dakota is straightforward. After you have successfully applied and received your permit, you can log into the South Dakota Department of Revenue's online portal. From there, you will have the option to download and print your permit anytime. Remember, proper documentation supports your sales activities, and the South Dakota Sales Prospect File is a valuable resource for managing your records.

To obtain a seller permit in South Dakota, you must register your business with the South Dakota Department of Revenue. The registration process involves providing necessary details about your business structure and operations. Once registered, you can apply for your seller permit online. The South Dakota Sales Prospect File can help you gather the required information efficiently.

In South Dakota, certain services, such as many professional services and some educational and health services, are exempt from sales tax. Understanding these exemptions can help businesses navigate tax obligations effectively. For businesses, the South Dakota Sales Prospect File can assist in distinguishing taxable from exempt sales.

South Dakota has no state income tax to attract businesses and stimulate economic growth. This policy encourages entrepreneurship and investment in the state. By focusing on sales tax and other revenue sources, the state provides a favorable environment for business operations, supported by tools like the South Dakota Sales Prospect File.

Yes, if you operate a business in South Dakota, you are required to file state taxes. This includes submitting sales tax returns based on your business activities. By utilizing the South Dakota Sales Prospect File, you can keep meticulous records to ensure timely and accurate filing.

Submitting sales tax in South Dakota involves filling out the appropriate state tax forms and remitting the payment online or by mail. The process can seem daunting, but leveraging solutions like the South Dakota Sales Prospect File can streamline your sales tax calculations and submission.

Certain individuals, such as those with very low income or specific exemptions, may not need to file a state tax return in South Dakota. However, most businesses must comply with state tax laws. For clarity on your situation, refer to resources like the South Dakota Sales Prospect File.

Filing only federal taxes without submitting state taxes is not permissible in South Dakota. State law requires businesses to file state tax returns in addition to federal ones. To simplify this process, utilize tools such as the South Dakota Sales Prospect File for accurate and organized sales reporting.