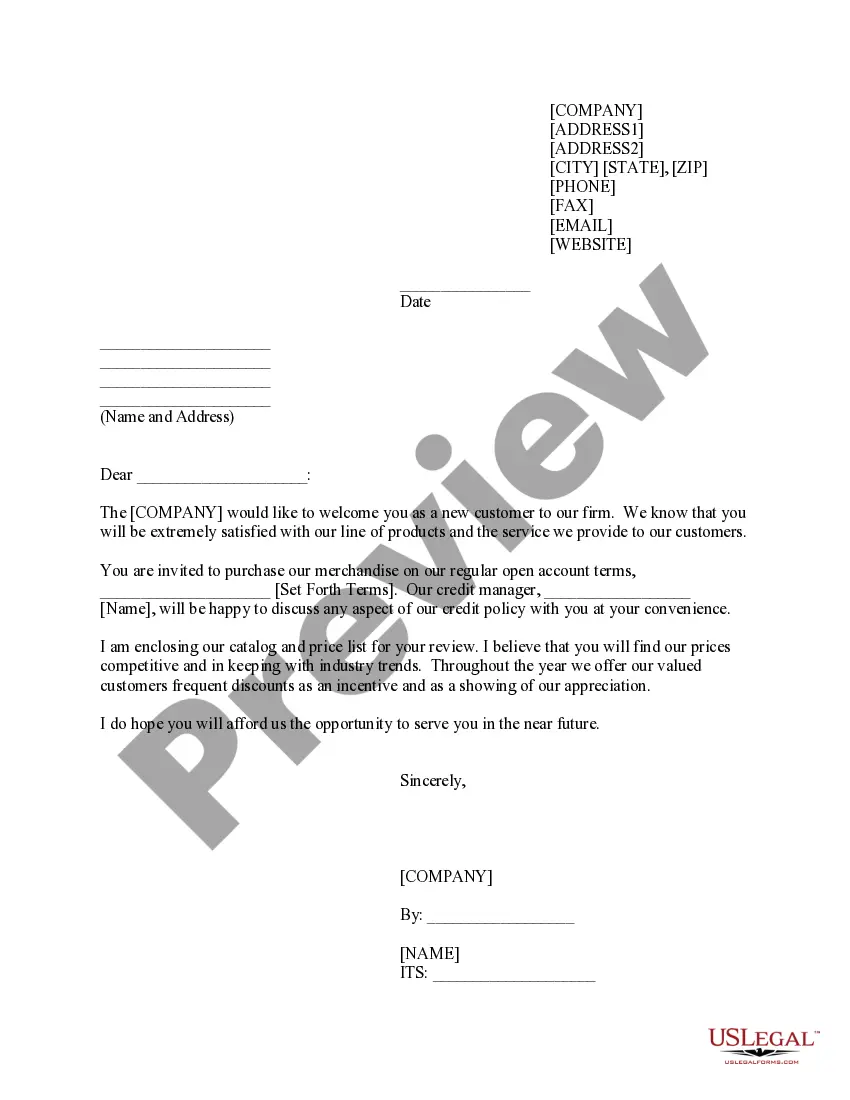

South Dakota Sample Letter for Article of Interest

Description

How to fill out Sample Letter For Article Of Interest?

If you want to full, acquire, or printing legitimate document templates, use US Legal Forms, the biggest selection of legitimate types, that can be found on the Internet. Make use of the site`s easy and hassle-free lookup to find the papers you will need. Numerous templates for organization and specific reasons are sorted by classes and says, or keywords and phrases. Use US Legal Forms to find the South Dakota Sample Letter for Article of Interest within a handful of clicks.

When you are presently a US Legal Forms buyer, log in for your account and click the Download button to have the South Dakota Sample Letter for Article of Interest. You can also gain access to types you previously acquired within the My Forms tab of your own account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for your appropriate city/nation.

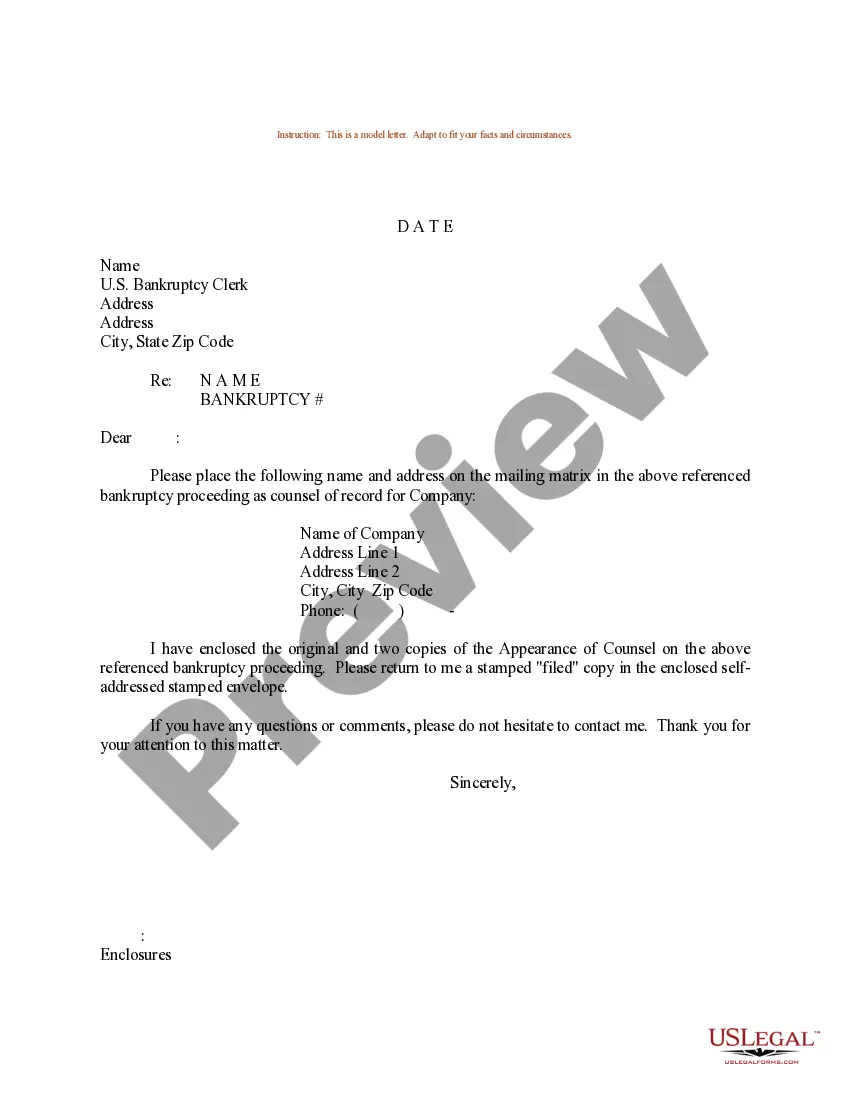

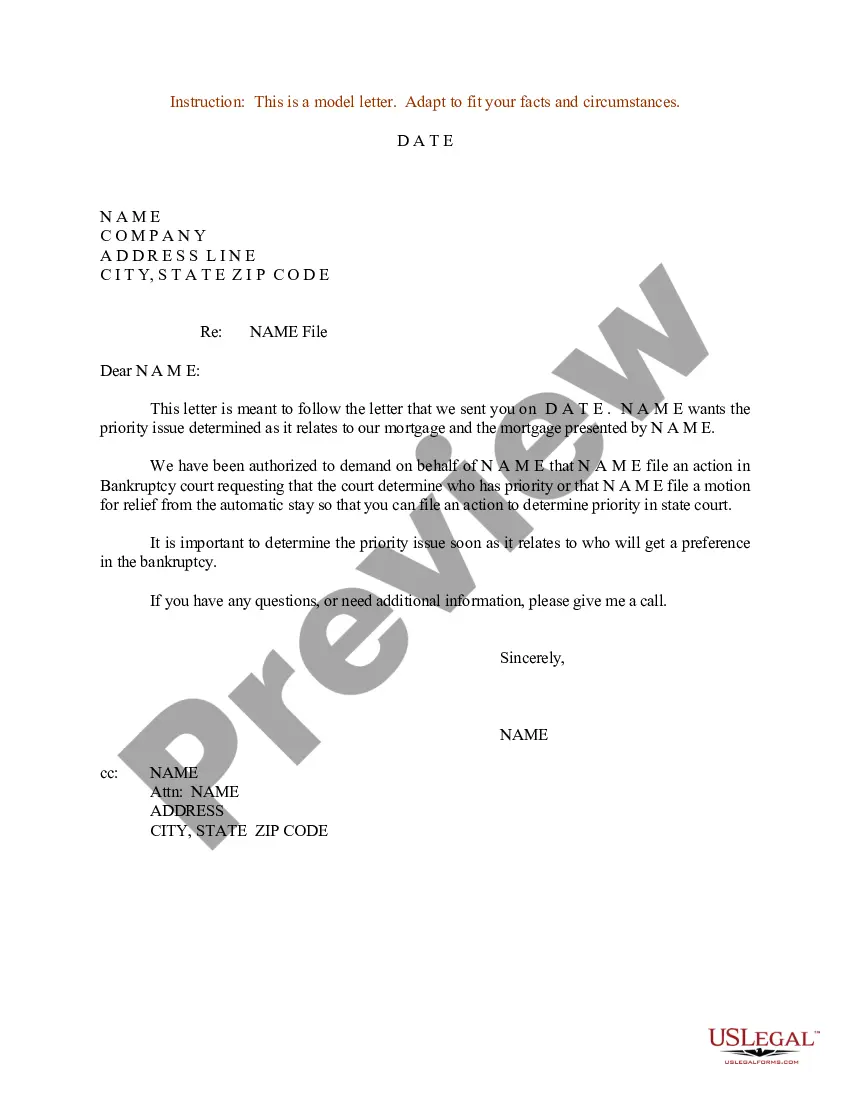

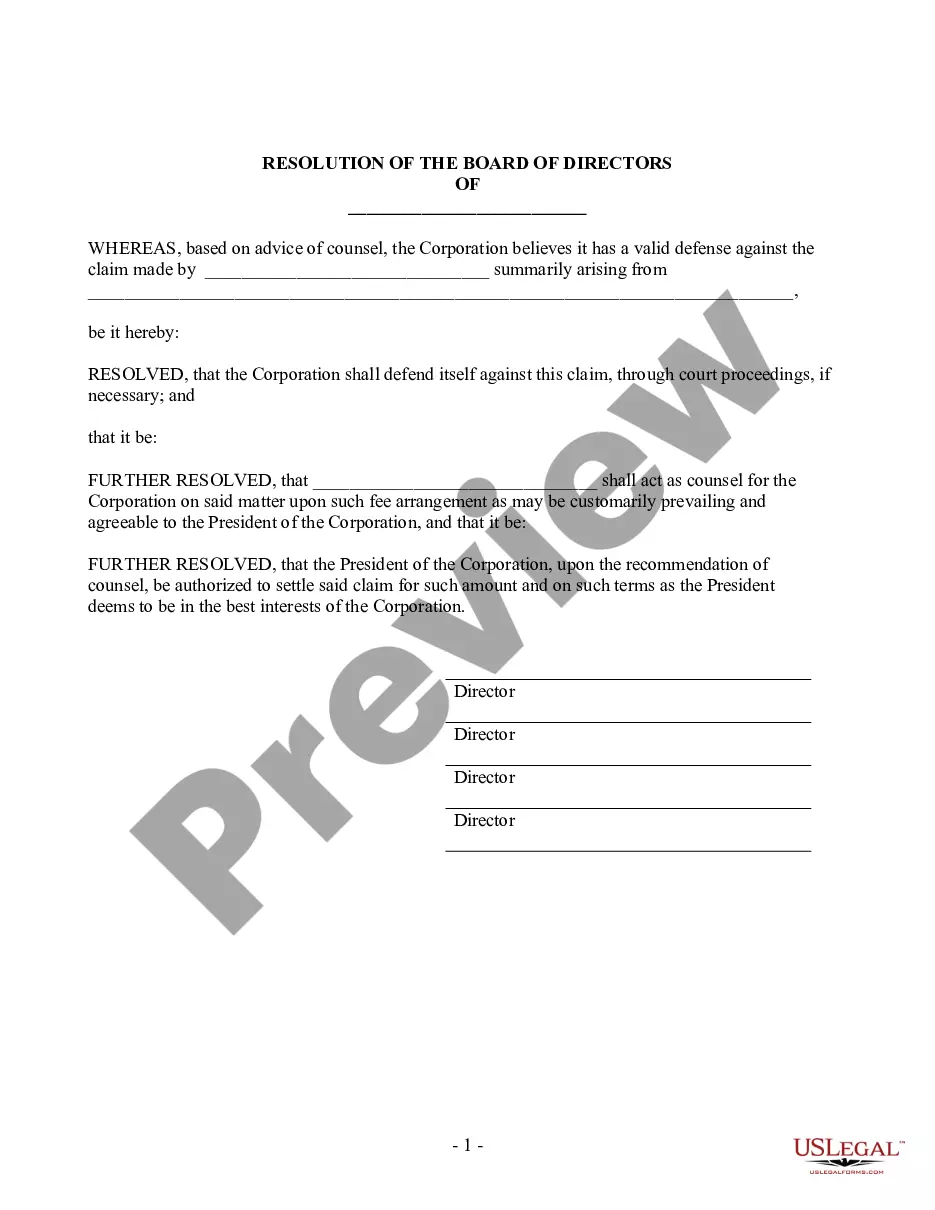

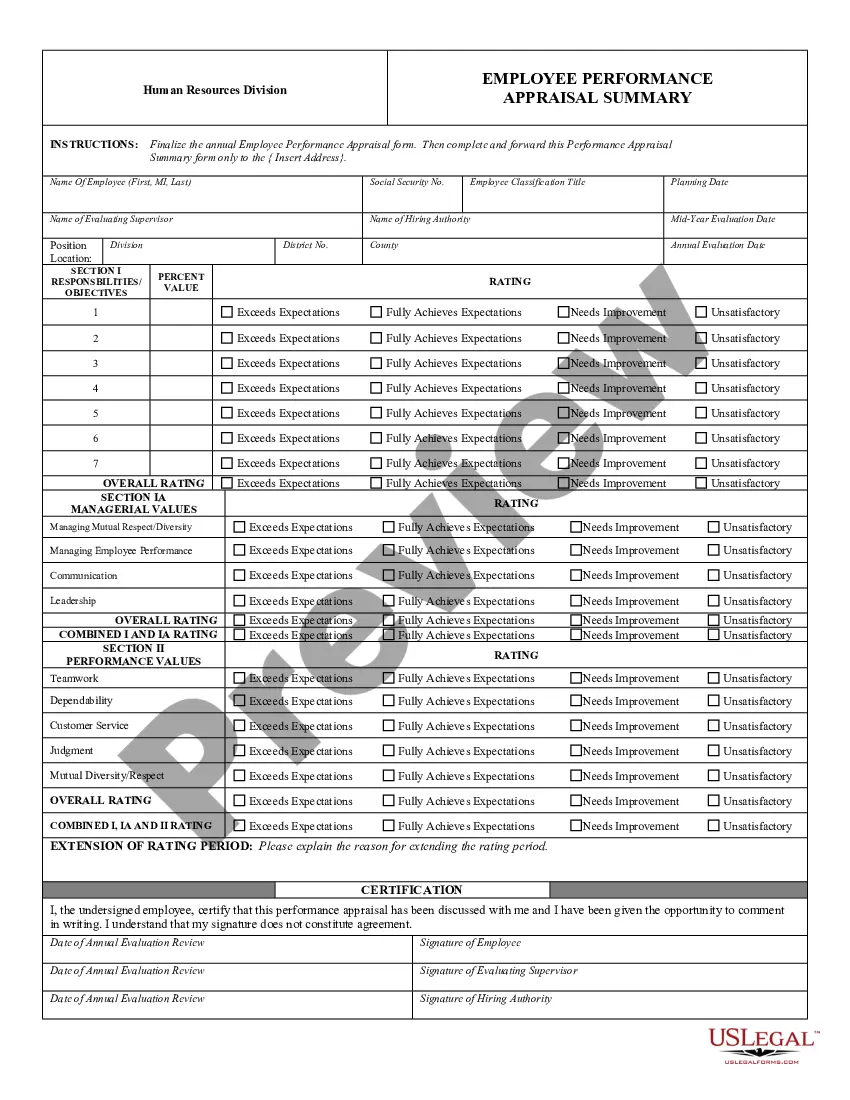

- Step 2. Use the Review method to look over the form`s articles. Don`t forget to see the description.

- Step 3. When you are unsatisfied with the kind, make use of the Look for area near the top of the display screen to get other variations of the legitimate kind web template.

- Step 4. After you have found the shape you will need, select the Buy now button. Select the costs plan you choose and add your references to sign up for an account.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Find the formatting of the legitimate kind and acquire it in your gadget.

- Step 7. Full, edit and printing or indicator the South Dakota Sample Letter for Article of Interest.

Every legitimate document web template you get is your own property for a long time. You have acces to each kind you acquired with your acccount. Click the My Forms segment and choose a kind to printing or acquire once more.

Contend and acquire, and printing the South Dakota Sample Letter for Article of Interest with US Legal Forms. There are many skilled and condition-specific types you may use for your personal organization or specific requirements.

Form popularity

FAQ

How do you dissolve/terminate a South Dakota Limited Liability Company? To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.

To change your registered agent in South Dakota, you must complete and file a Statement of Change of Registered Agent form with the South Dakota Secretary of State. The South Dakota Statement of Change of Registered Agent must be submitted by mail or in person and costs $10 to file.

There is no threshold to reach before a license is needed; if you are operating a taxable business, a license is needed. If you are conducting business in South Dakota you need a license even if you do not have a physical location.

The first step is to file a form called the Amended Articles of Organization with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in South Dakota. The filing fee for the Amended Articles of Organization in South Dakota is $60.

Starting an LLC in the Mount Rushmore State comes with its own unique financial dynamics. South Dakota stands out as an attractive option for business owners due to its lack of state income tax.

How do you dissolve/terminate a South Dakota Limited Liability Company? To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.

There are three things necessary for a valid affidavit, and all three must be present at the same time: (1) the affiant, (2) the notary, and (3) the document.

LLC members' income is taxed at the federal self-employment tax rate of 15.3% (12.4% for social security and 2.9% for Medicare). South Dakota does not levy state personal or corporate income taxes, though the LLC will most likely need to pay state sales and local taxes, as well as industry-specific taxes.