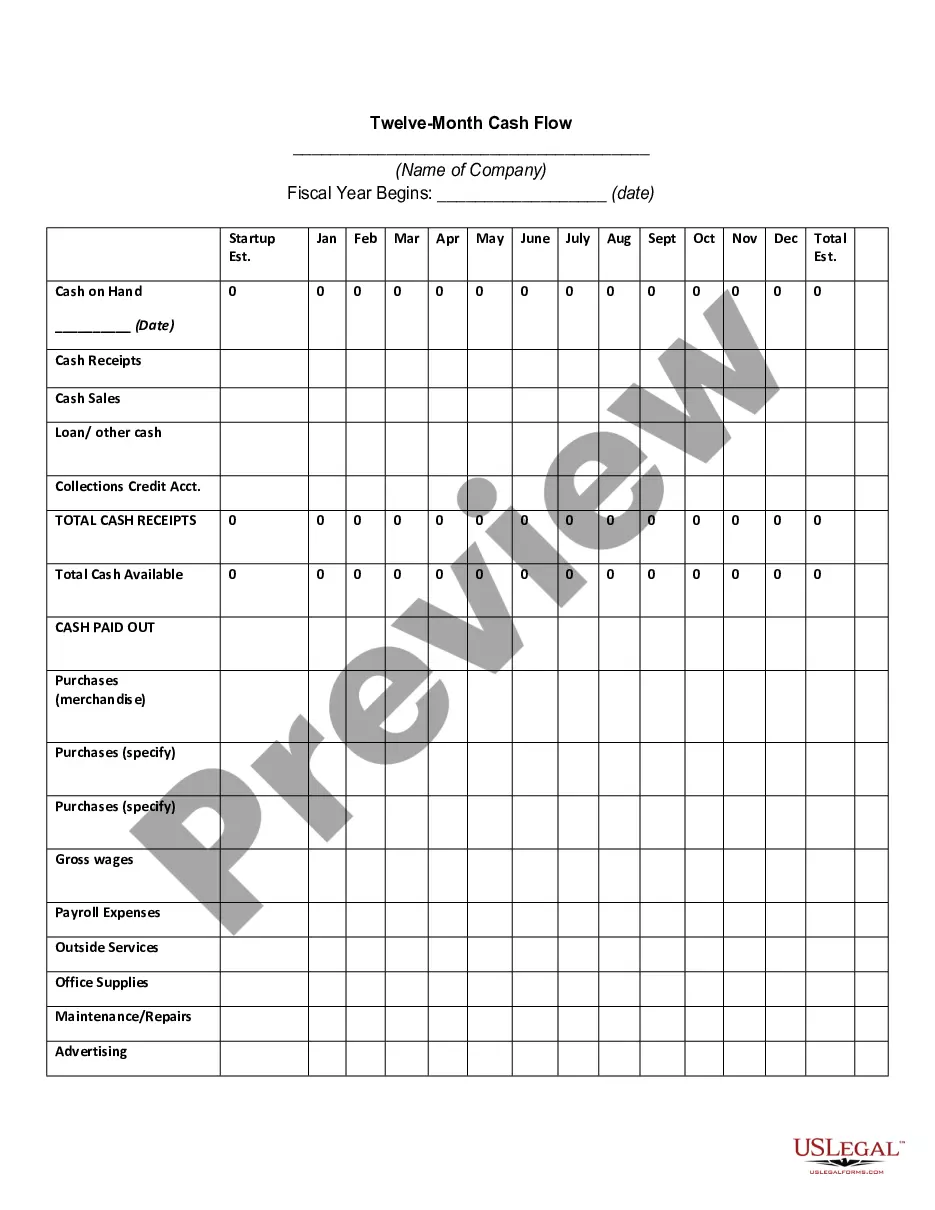

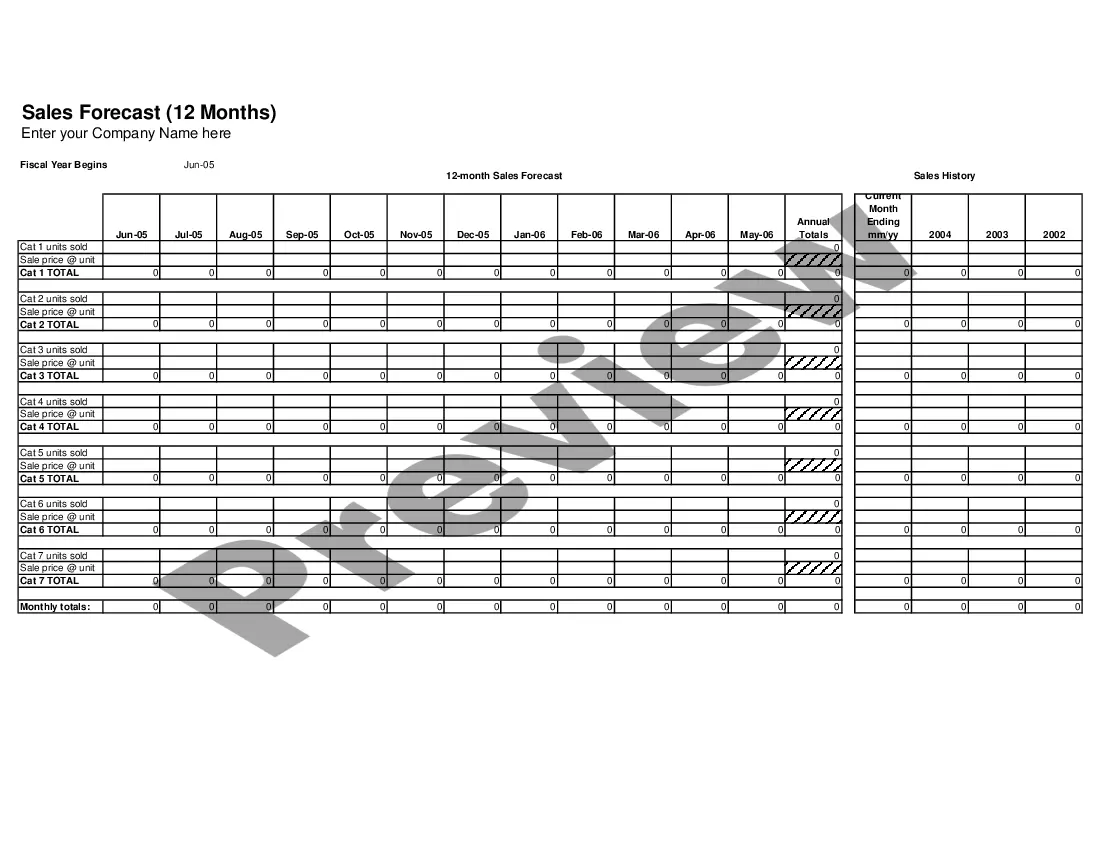

This form can be used for sales planning.

South Dakota Twelve Month Sales Forecast

Description

How to fill out Twelve Month Sales Forecast?

You can spend countless hours online looking for the authentic document template that matches the state and federal regulations you require.

US Legal Forms offers thousands of authentic forms that have been evaluated by professionals.

You can indeed download or print the South Dakota Twelve Month Sales Forecast from the service.

If available, use the Preview button to examine the document template as well. If you want to find another version of the form, use the Search field to locate the template that fits your needs and preferences.

- If you already possess a US Legal Forms account, you may Log In and click the Acquire button.

- Then, you may complete, modify, print, or sign the South Dakota Twelve Month Sales Forecast.

- Every authentic document template you purchase is yours indefinitely.

- To obtain an additional copy of the purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, make sure that you have selected the correct document template for the state/region of your preference.

- Review the form details to ensure you have selected the appropriate form.

Form popularity

FAQ

To generate a sales forecast, collect your sales data over a specific time frame and analyze it for consistent patterns. You can apply the South Dakota Twelve Month Sales Forecast model to assist in this process, developing monthly estimations based on your historical data. Utilizing platforms like US Legal Forms can enhance your forecasting efforts by providing tools and structured templates to streamline your projections.

The formula for a 12 month sales forecast typically involves calculating your average sales over previous months and adjusting for anticipated growth or decline. The South Dakota Twelve Month Sales Forecast incorporates these elements, allowing businesses to predict sales more methodically. It's essential to factor in market conditions and customer behavior to refine your formula for better accuracy.

Estimating monthly sales requires you to review past sales figures and identify trends. With the South Dakota Twelve Month Sales Forecast, you can categorize your sales data by month to create projections that reflect seasonal variations. Using tools and resources from US Legal Forms can support your estimation process, providing templates and insights to make your forecasting more accurate.

To obtain a sales forecast, start with your historical sales data and analyze it for patterns. You can then utilize forecasting methods, like the South Dakota Twelve Month Sales Forecast, to derive future sales outcomes. Platforms like US Legal Forms can provide templates and resources to simplify the forecasting process, helping you create a robust sales projection.

Calculating a sales forecast involves analyzing past sales data and considering factors that may influence future sales, such as market trends and economic indicators. You can apply various methods, including the South Dakota Twelve Month Sales Forecast, which calculates monthly sales based on historical results. By inputting relevant variables into your formula, you can produce accurate sales projections for your business.

To create a sales forecast in Excel, you can start by gathering historical sales data. Next, use formulas to apply trends from your data to project future sales. Consider incorporating the South Dakota Twelve Month Sales Forecast model, which helps you establish monthly sales predictions based on previous performance and market conditions. Excel offers various tools to visualize your trends, making your forecast easy to understand.

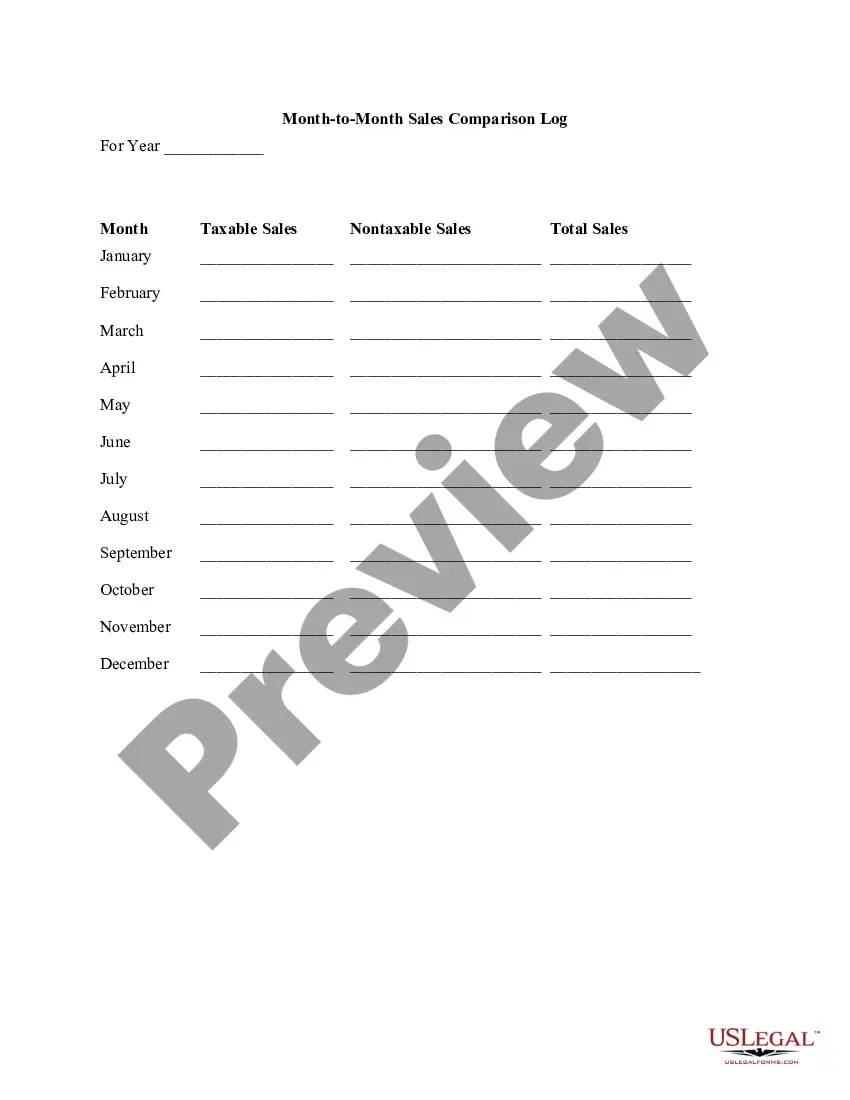

Sales tax exemptions in South Dakota include items such as machinery used in manufacturing, agricultural products, and certain medical supplies. These exemptions are designed to promote growth in key sectors and ease costs for consumers. Knowing what is exempt can significantly impact your financial planning. To effectively manage your finances, leverage a South Dakota Twelve Month Sales Forecast to account for these exemptions.

In South Dakota, certain items are considered tax exempt, including specific goods like food, prescription drugs, and some educational materials. Nonprofit organizations also may qualify for exemptions depending on their activities and purpose. Understanding what qualifies can help you optimize your budget and avoid unnecessary spending. For accurate tracking and compliance, consider incorporating a South Dakota Twelve Month Sales Forecast into your financial practices.

Reporting sales tax in South Dakota involves completing specific forms and submitting them to the state Department of Revenue. Businesses must keep accurate records of all taxable sales to ensure compliance with tax laws. Additionally, it’s advisable to file your reports on time to avoid penalties. Using a South Dakota Twelve Month Sales Forecast can enhance your planning and help you estimate your sales tax obligations.

The annual revenue of South Dakota comes from various sources including sales tax, income tax, and federal funding. In recent years, the state has reported steady growth in revenue, which is crucial for funding essential services and programs. Understanding revenue trends helps businesses and individuals in planning their finances. By examining the South Dakota Twelve Month Sales Forecast, you can make informed financial decisions.