South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets

Description

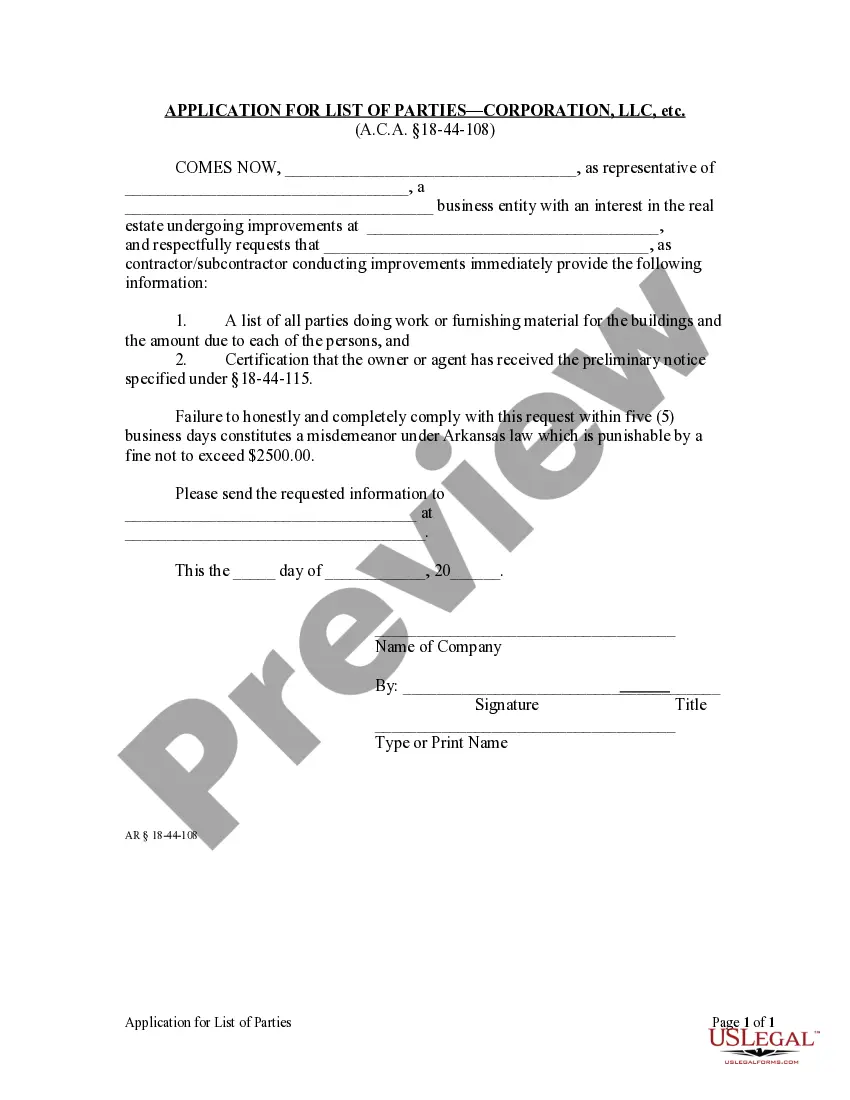

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Selecting the appropriate legal document template can be a challenge.

Clearly, there are numerous templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the South Dakota Bill of Sale by Corporation of all or Nearly all of its Assets, that you can employ for business and personal purposes.

You may preview the form using the Preview button and review the form details to confirm that it is suitable for you.

- All the forms are reviewed by professionals and meet federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the South Dakota Bill of Sale by Corporation of all or Nearly all of its Assets.

- Use your account to browse through the legal forms you may have obtained previously.

- Navigate to the My documents section of your account to secure another copy of the document you desire.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

To fill out a title when selling a car in South Dakota, you need to provide specific information, including the vehicle's make, model, and identification number. Both the seller and buyer must sign the title to formalize the transfer of ownership. Remember to complete a South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets to document the transaction. For clear guidance and templates, consider exploring uslegalforms to ensure all your paperwork is accurate.

Yes, South Dakota typically requires a bill of sale when transferring ownership of certain items, especially vehicles and significant assets. This requirement protects both the seller and buyer by providing a clear record of the transaction. A well-drafted South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets can help avoid future disputes. You can access templates and examples through uslegalforms to simplify the process.

SDCL 32 5B 20 outlines the legal requirements for a South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets. This law is designed to ensure that corporations follow proper procedures when transferring ownership of significant assets. Understanding this statute is crucial for corporations looking to complete a sale legally and efficiently. For further assistance, you can utilize resources from uslegalforms, where you will find helpful templates and guidance.

To print a seller's permit in South Dakota, you should visit the South Dakota Department of Revenue's website. You can apply for a seller's permit online, and once approved, you will receive it via email or through the mail. Having this permit is crucial for tax purposes when selling goods. For businesses, a South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets can also serve as proof of transaction for your records.

While a bill of sale is not strictly required in South Dakota, it is advisable to have one for your records. A bill of sale protects both the buyer and seller by documenting the transaction details. If you're looking to ensure a smooth sale, consider using a South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets, which can clarify ownership and avoid misunderstandings.

To sell a vehicle in South Dakota, you will need to have the vehicle title and a valid identification. Ensure the title is signed over to the buyer and includes all required information. Additionally, providing a bill of sale, like the South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets, can be beneficial for both parties involved in the transaction.

In South Dakota, a bill of sale is not always required but is highly recommended for certain transactions. For vehicle sales, a bill of sale can help document the transfer of ownership and protect both parties. While it may not be mandatory, using a South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets can provide legal assurance during the process.

Yes, you can handwrite a bill of sale in South Dakota. However, it is crucial to ensure that all essential details are included. For better clarity and to avoid potential legal issues, consider using a standardized form, especially for transactions like a South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets where more formal specifications may apply.

To find out who owns a property in South Dakota, you can start by accessing the county assessor's website or office. These resources typically provide property records, including ownership details. Additionally, for significant transfers involving a South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets, searching public records can yield valuable information about ownership history.

A bill of sale is generally legal without notarization, as long as it meets the necessary requirements for the transaction. However, notarization can serve as a safeguard by providing evidence of authenticity. For more complex transactions, such as those involving a South Dakota Bill of Sale by Corporation of all or Substantially all of its Assets, it's advisable to consult with a legal professional or use a verified resource.