South Dakota Receipt and Acceptance of Partial Delivery of Goods

Description

How to fill out Receipt And Acceptance Of Partial Delivery Of Goods?

Are you currently in a position where you will need files for possibly organization or specific uses nearly every day? There are a variety of lawful papers themes accessible on the Internet, but locating types you can rely on is not effortless. US Legal Forms delivers 1000s of develop themes, such as the South Dakota Receipt and Acceptance of Partial Delivery of Goods, that happen to be composed to meet state and federal demands.

In case you are presently knowledgeable about US Legal Forms internet site and get an account, just log in. Following that, you may acquire the South Dakota Receipt and Acceptance of Partial Delivery of Goods design.

Unless you have an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Discover the develop you need and make sure it is for the appropriate area/state.

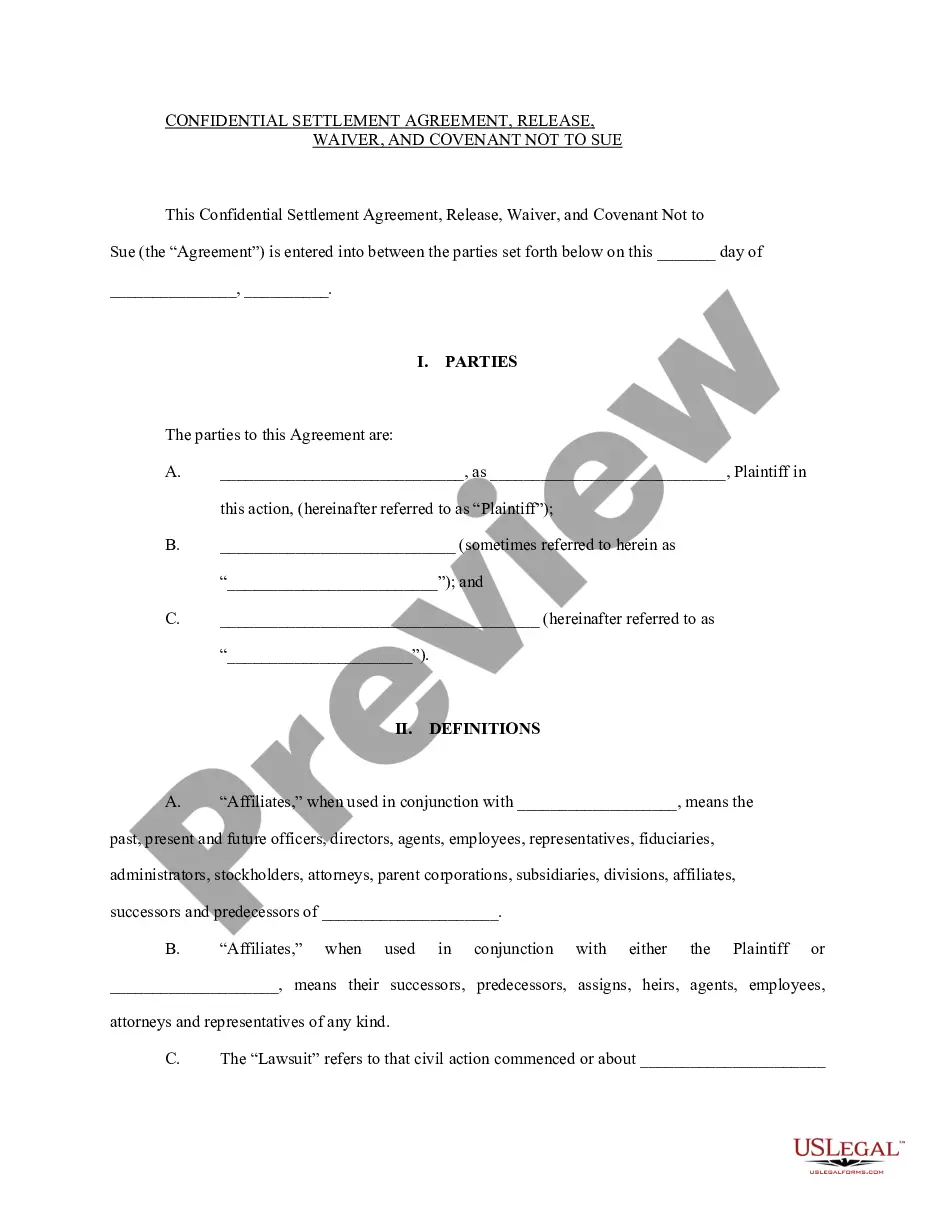

- Utilize the Review option to examine the shape.

- Read the outline to ensure that you have chosen the right develop.

- When the develop is not what you are searching for, take advantage of the Lookup field to find the develop that fits your needs and demands.

- When you obtain the appropriate develop, just click Buy now.

- Opt for the rates plan you desire, submit the desired information to produce your account, and purchase your order with your PayPal or charge card.

- Choose a handy document structure and acquire your version.

Locate each of the papers themes you might have bought in the My Forms food list. You can get a more version of South Dakota Receipt and Acceptance of Partial Delivery of Goods whenever, if required. Just click the essential develop to acquire or printing the papers design.

Use US Legal Forms, probably the most comprehensive assortment of lawful forms, in order to save some time and steer clear of faults. The services delivers skillfully created lawful papers themes which you can use for an array of uses. Create an account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Statute of limitations in contracts for sale. (1)An action for breach of any contract for sale must be commenced within four years after the cause of action has accrued. (2)A cause of action accrues when the breach occurs, regardless of the aggrieved party's lack of knowledge of the breach.

South Dakota was the first state in the nation to abolish the Rule Against Perpetuities ? which prohibited unlimited-duration trusts ? in 1983, clearing the way for the creation of the Dynasty Trust.

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries.

Codified Law 37-24-6 | South Dakota Legislature. 37-24-6. Deceptive act or practice--Violation as misdemeanor or felony. (b) Offering the merchandise for sale at the higher price from which the reduction is taken for at least seven consecutive business days during the sixty-day period prior to the advertisement.

In South Dakota, all misdemeanors carry a lengthy seven-year statute of limitations. Most felonies also have a seven-year statute of limitations. Class A, B, and C felonies do not have any statute of limitations.

Under South Dakota trust law, dynasty trusts offer robust protection against legal claims and financial risks. When assets are transferred into a dynasty trust, they are no longer considered the property of individual beneficiaries.

South Dakota allows for a trust to exist in perpetuity, i.e., for an unlimited duration.

What makes South Dakota special? South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates.