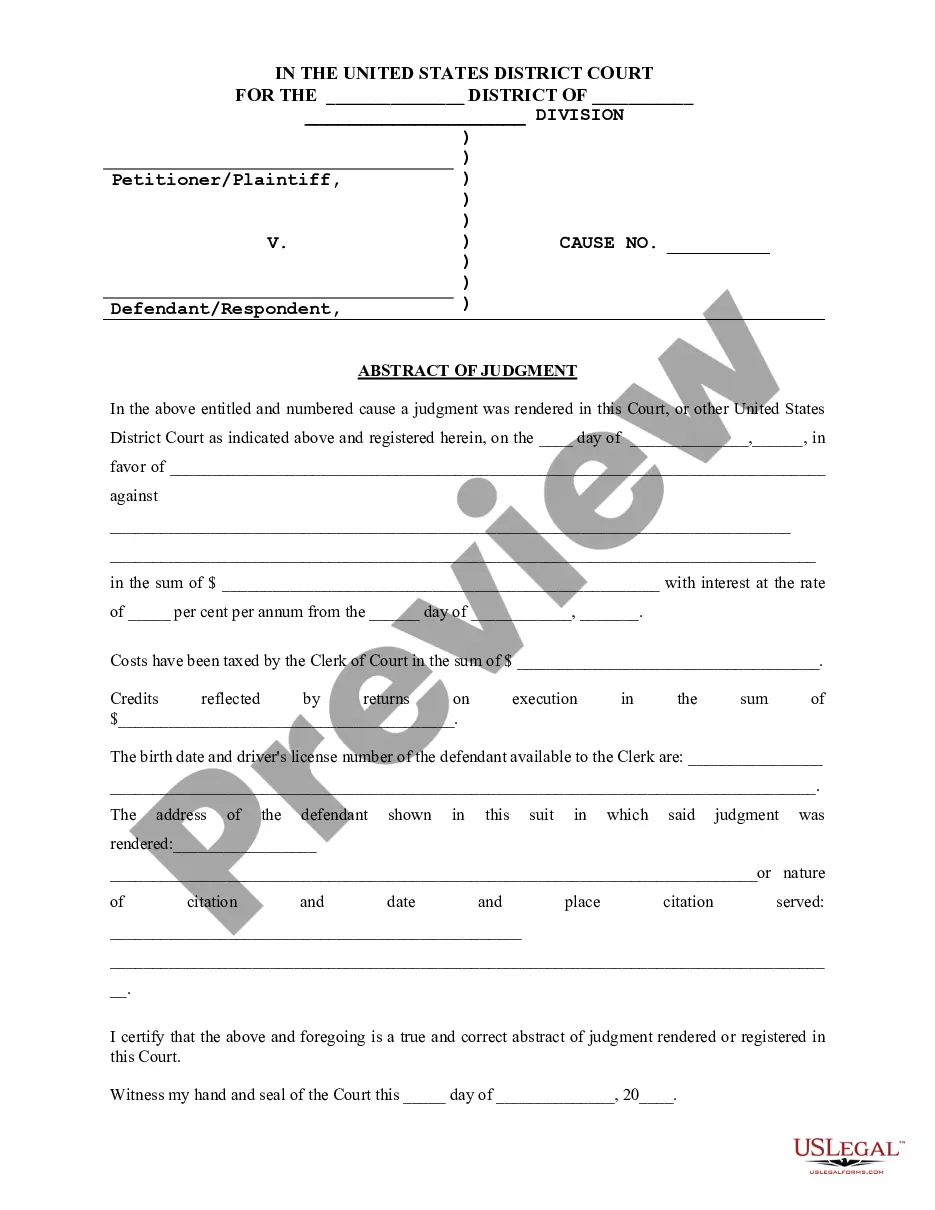

An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.