South Dakota Change of Beneficiary

Description

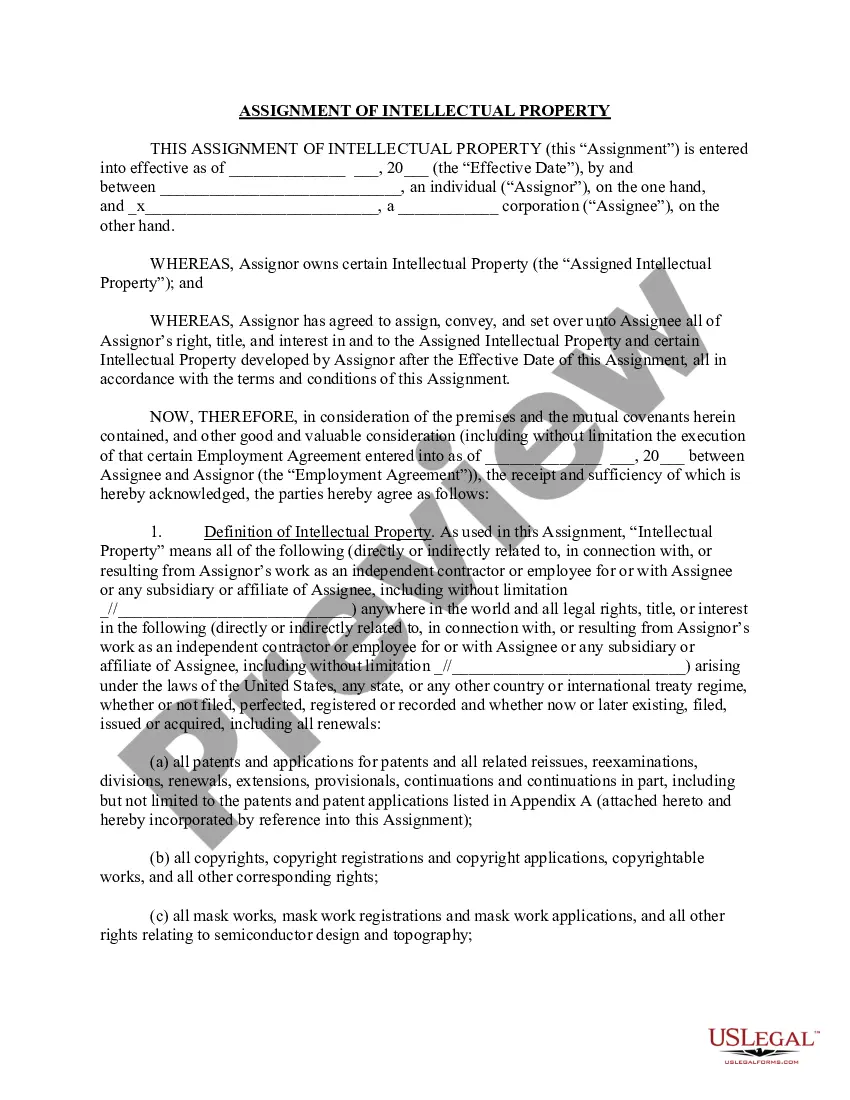

How to fill out Change Of Beneficiary?

Are you currently within a placement that you will need paperwork for possibly business or person purposes just about every day time? There are plenty of legal record themes available on the net, but finding ones you can rely isn`t easy. US Legal Forms delivers a large number of type themes, such as the South Dakota Change of Beneficiary, which are composed to fulfill state and federal requirements.

In case you are presently knowledgeable about US Legal Forms internet site and get a merchant account, simply log in. After that, it is possible to obtain the South Dakota Change of Beneficiary design.

Unless you provide an bank account and want to begin using US Legal Forms, abide by these steps:

- Discover the type you will need and make sure it is for the right city/county.

- Take advantage of the Review switch to examine the form.

- Browse the explanation to actually have chosen the appropriate type.

- In case the type isn`t what you`re searching for, use the Lookup area to find the type that fits your needs and requirements.

- When you discover the right type, just click Acquire now.

- Pick the rates program you need, submit the required details to generate your money, and buy the order with your PayPal or credit card.

- Pick a practical document format and obtain your backup.

Locate each of the record themes you have bought in the My Forms food selection. You can obtain a additional backup of South Dakota Change of Beneficiary whenever, if needed. Just go through the required type to obtain or printing the record design.

Use US Legal Forms, the most comprehensive selection of legal forms, in order to save time and prevent faults. The assistance delivers professionally manufactured legal record themes that you can use for a variety of purposes. Produce a merchant account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Under a joint tenancy with the right of survivorship, each owner effectively owns the whole asset. In other words, each owner shares ownership equally. If one owner dies, the other owner acquires the deceased owner's interest automatically.

In South Dakota, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed allows a property owner to name a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

A South Dakota transfer on death deed allows the owner of real property to transfer their ownership to a designated beneficiary upon their death. It allows the beneficiary to avoid the complicated probate process to complete the transfer.

There are legal problems relating to the transfer by death deed, such as disagreements on the property's legal description, the sufficiency of the deed, or the beneficiary's rights. These disagreements result in expensive and drawn-out court fights.

Because of the Real Property Transfer on Death Act (?the Act?), South Dakotans can also pass their real estate onto beneficiaries, without the real estate going through the probate process.

South Dakota Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with the county register of deeds office before your death. ... The beneficiary's rights. ... Earlier wills or TOD deeds. ... Your rights. ... Medicaid. ... Other creditor claims. ... Revoking the deed.

The beneficiary does not need to take any action until the death of the account owner. It is generally the case that the account owner may change their beneficiary designation at any time (as discussed below), so the interest of the beneficiary does not vest until the death of the account owner.

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.