South Dakota Sample Letter for Tax Deeds

Description

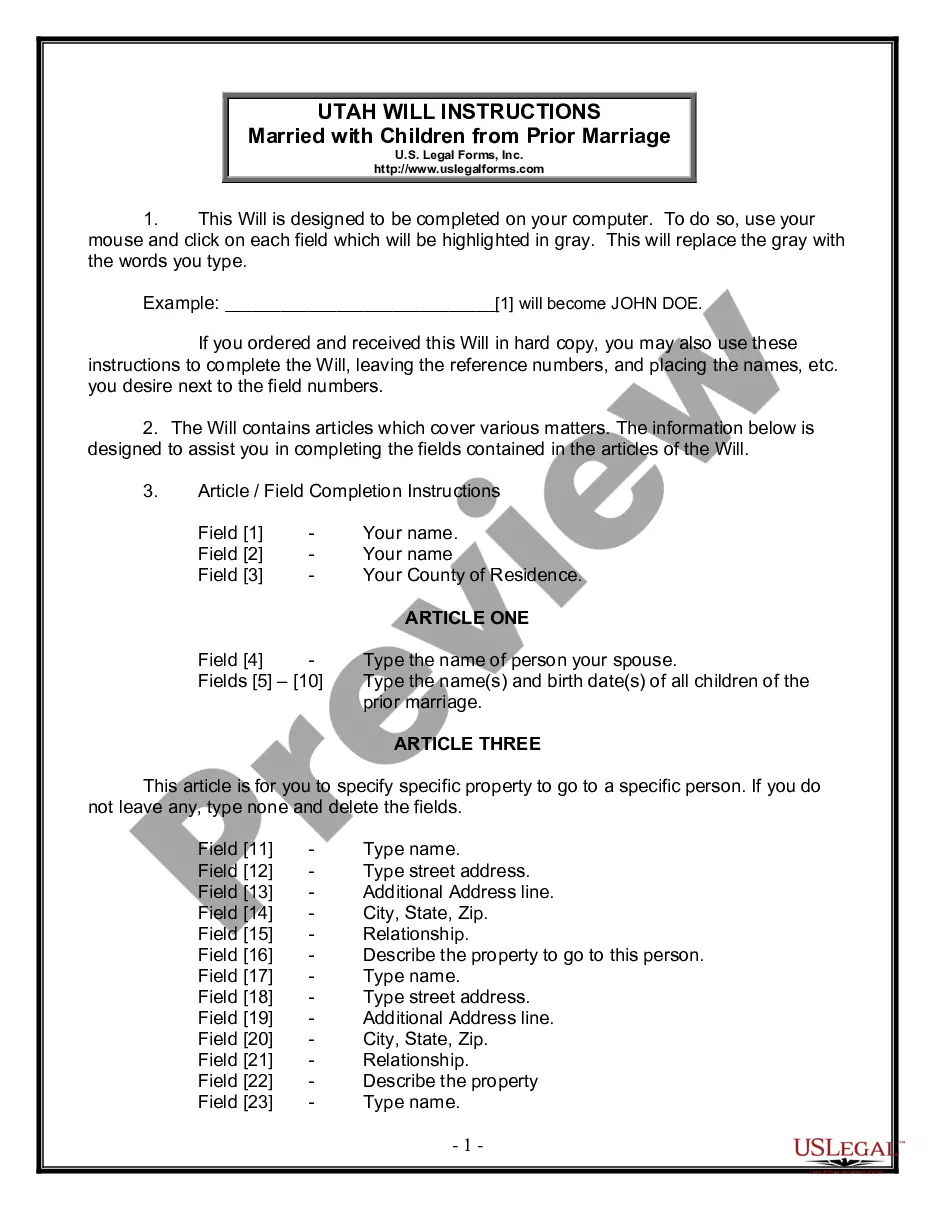

How to fill out Sample Letter For Tax Deeds?

US Legal Forms - one of the largest collections of official documents in the United States - provides a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest templates such as the South Dakota Sample Letter for Tax Deeds within moments.

If you already possess a membership, Log In and retrieve the South Dakota Sample Letter for Tax Deeds from your US Legal Forms repository. The Download button will appear on each template you view. You can access all previously downloaded documents in the My documents section of your account.

Select the format and download the document to your device.

Make modifications. Fill out, edit, print, and sign the downloaded South Dakota Sample Letter for Tax Deeds.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct document for your city/region. Click the Review button to examine the document's content.

- Check the document details to confirm that you have selected the right template.

- If the document doesn’t meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking on the Purchase now button. Then, choose the pricing plan you prefer and provide your information to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

South Dakota counties can choose to sell or keep tax liens on delinquent properties. Three years after a tax lien certificate is sold, the lienholder may then apply for a tax deed, which grants absolute title to the lienholder. The property owner has the right to redeem until the tax deed is issued.

The state's tax system is among the most retiree-friendly in the country. It has no income tax, relatively low sales taxes, high property taxes and no estate or inheritance taxes.

This is because it has state-level regulations that allow trusts to continue in perpetuity, devoid of state income tax as well as capital gains taxes, and helped by court-sealed records. Compared to its competitors, South Dakota's key businesses are banking as well as health care.

Past due returns and payments can be made online through EPath. This system will automatically calculate interest and penalty for you. If you do not have an online filing account through EPath you can contact the department at (800) 829-9188 for the return forms and to assist with calculating interest and penalty.

Signing Requirements § 43-25-26: The grantor must sign South Dakota quitclaim deeds before a notary public or a subscribing witness. Recording Requirements § 43-28-1: Quitclaim deeds must be recorded with the County Register of Deeds's Office in the county where the real property is located. Transfer Tax § 43-4-21: $.

South Dakota counties can choose to sell or keep tax liens on delinquent properties. Three years after a tax lien certificate is sold, the lienholder may then apply for a tax deed, which grants absolute title to the lienholder. The property owner has the right to redeem until the tax deed is issued.

Since South Dakota does not collect an income tax on individuals, you are not required to file a SD State Income Tax Return. However, you may need to prepare and eFile a Federal Income Tax Return.

South Dakota does not have a personal income tax, so there is no withholding.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.