The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

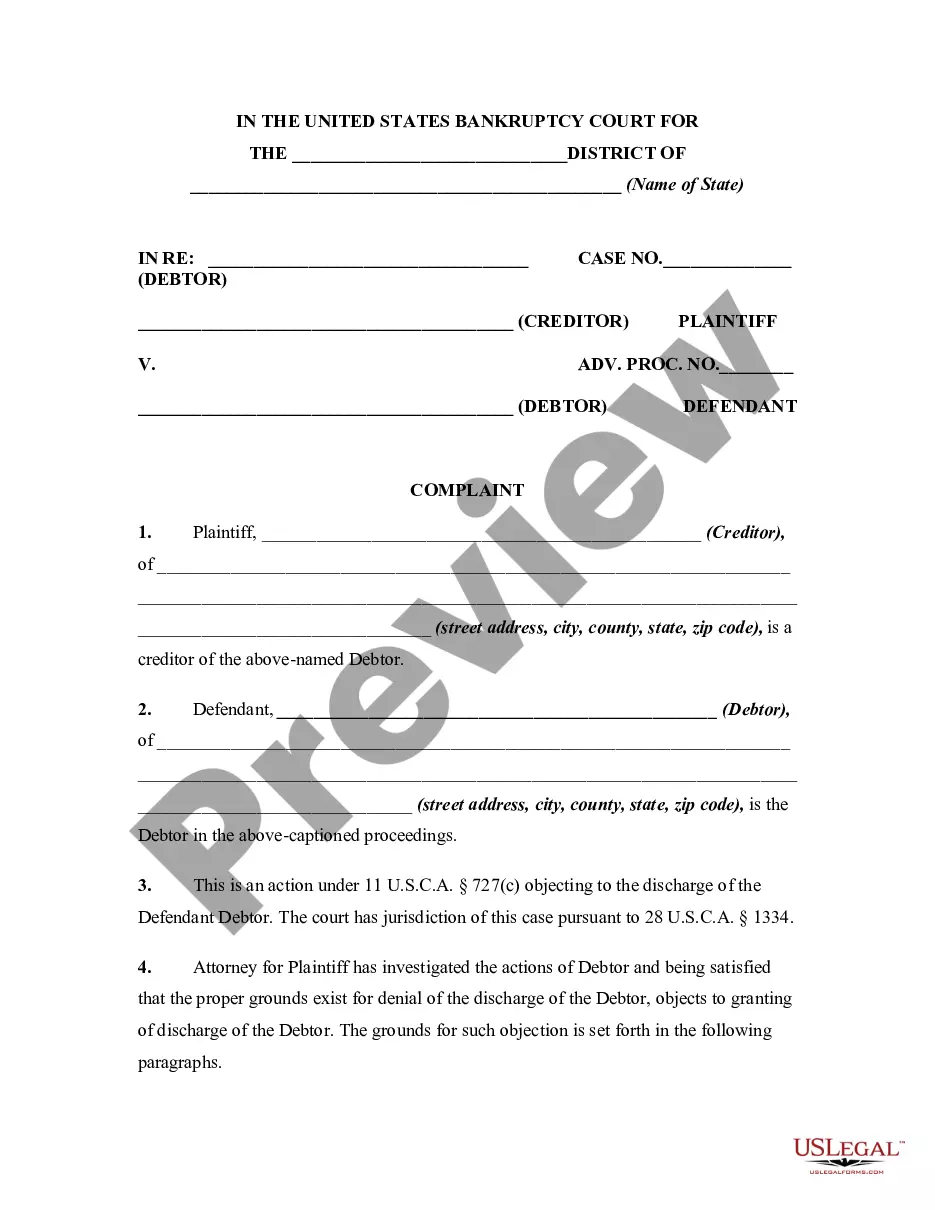

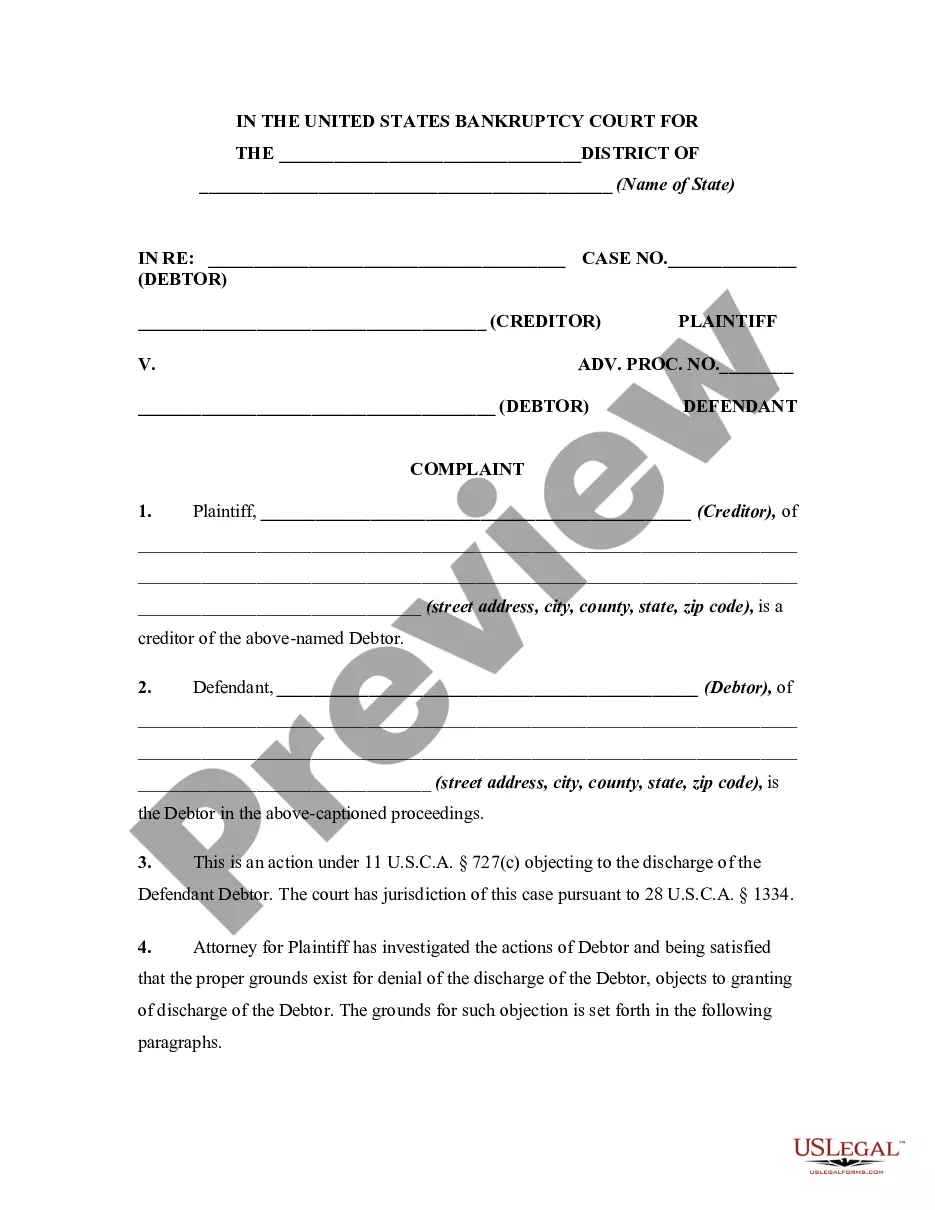

South Dakota Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property Within One Year Preceding

Description

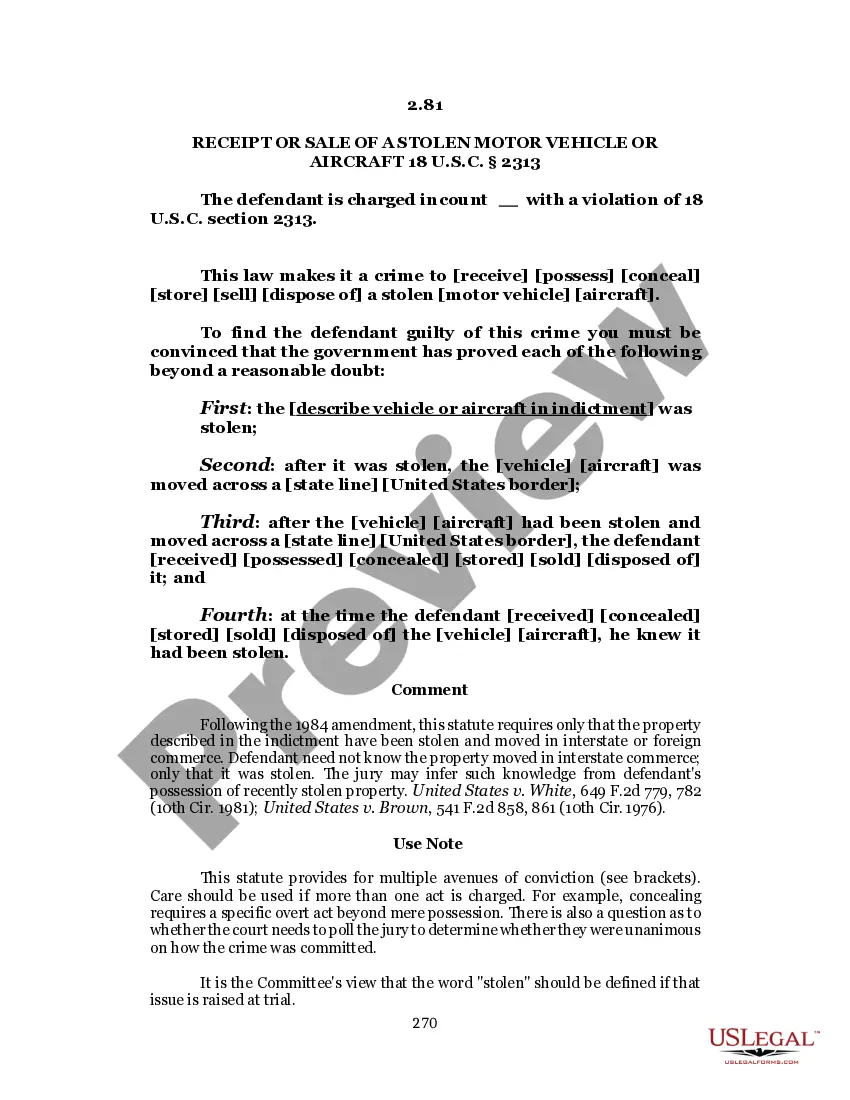

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceeding For Transfer, Removal, Destruction, Or Concealment Of Property Within One Year Preceding?

US Legal Forms - one of several largest libraries of authorized kinds in the USA - offers an array of authorized file web templates you are able to down load or produce. Utilizing the website, you can find a large number of kinds for business and personal functions, categorized by classes, states, or search phrases.You can get the newest variations of kinds just like the South Dakota Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property in seconds.

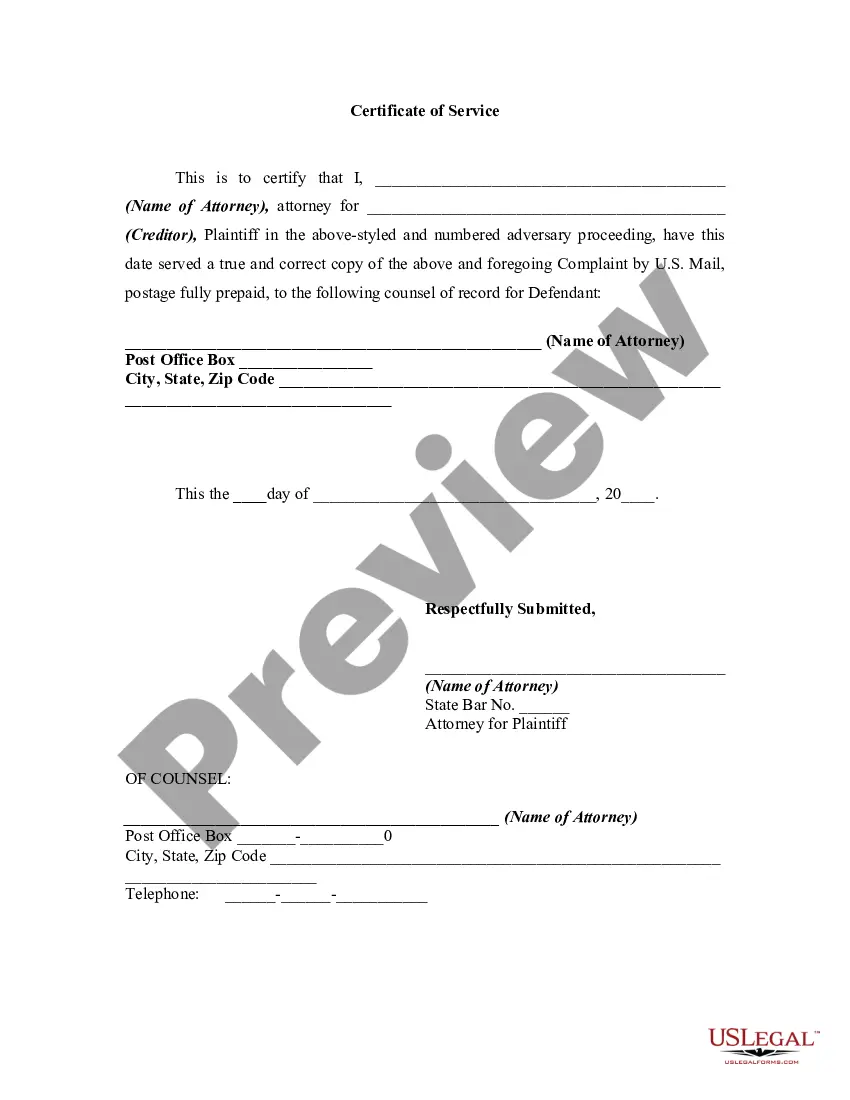

If you currently have a subscription, log in and down load South Dakota Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property from the US Legal Forms local library. The Down load option will show up on each and every kind you perspective. You have access to all previously downloaded kinds within the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, here are simple guidelines to obtain started off:

- Be sure you have chosen the proper kind for the area/region. Click the Review option to review the form`s articles. Look at the kind description to actually have selected the correct kind.

- In case the kind does not match your specifications, take advantage of the Research industry near the top of the display to discover the the one that does.

- In case you are content with the form, affirm your selection by clicking on the Get now option. Then, select the prices program you like and offer your accreditations to register for the profile.

- Approach the deal. Make use of your Visa or Mastercard or PayPal profile to perform the deal.

- Find the file format and down load the form on your own gadget.

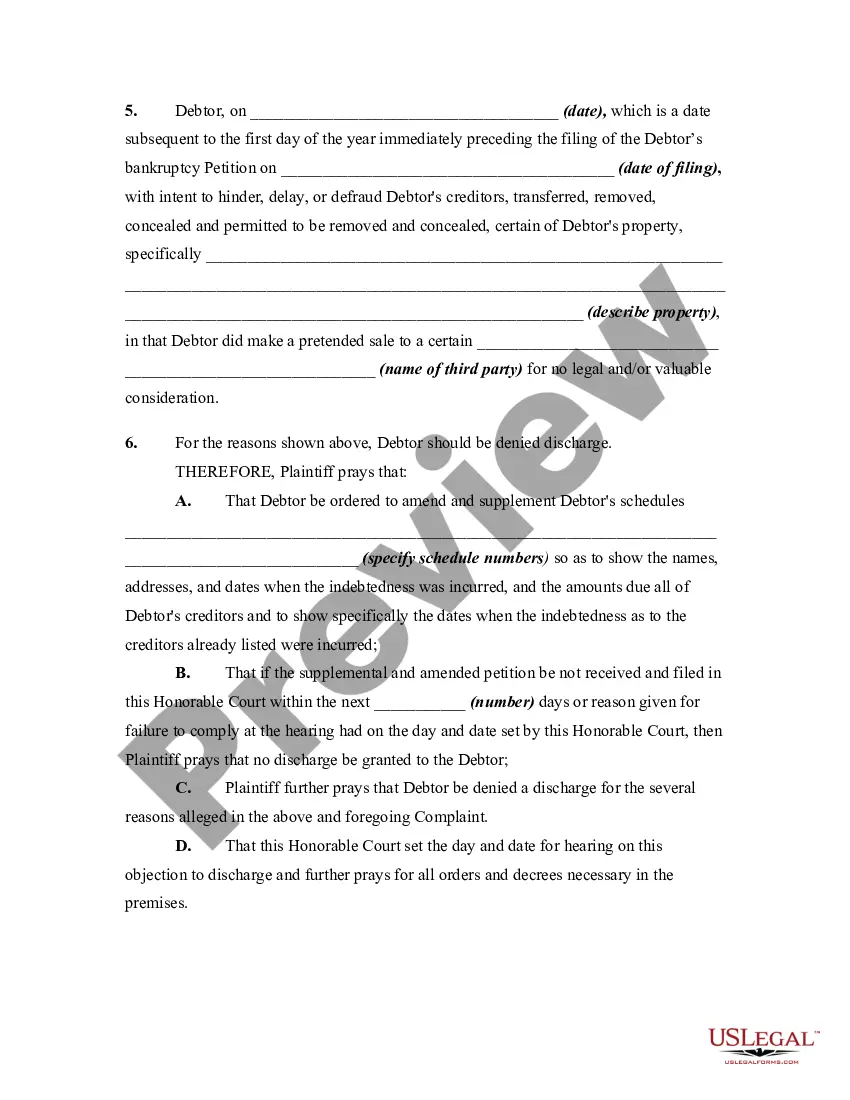

- Make alterations. Fill up, revise and produce and signal the downloaded South Dakota Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property.

Every format you put into your money lacks an expiry particular date and is also the one you have forever. So, if you want to down load or produce an additional copy, just visit the My Forms portion and then click in the kind you will need.

Obtain access to the South Dakota Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property with US Legal Forms, the most comprehensive local library of authorized file web templates. Use a large number of expert and state-specific web templates that satisfy your company or personal requires and specifications.

Form popularity

FAQ

A trustee is appointed to take control of certain assets of the debtor, bring these assets into the estate, and sell or distribute these assets for the benefit of creditors. Some assets will remain with the debtor if these assets are determined to be exempt from distribution to creditors.

If the liability of one party to another has been determined by verdict or order or judgment, but the amount or extent of the liability remains to be determined by further proceedings, the party adjudged liable may make an offer of judgment, which shall have the same effect as an offer made before trial if it is served ...

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

If you became entitled to receive the funds before you filed and you reported them on your bankruptcy forms, you will be able to keep any portion of them that is covered by a bankruptcy exemption. The trustee can seize the rest.

Non-exempt Property. Anything that isn't protected in bankruptcy is considered non-exempt and, in Chapter 7, can be sold by the trustee to pay off creditors.

Chapter 7, entitled Liquidation, contemplates an orderly, court-supervised procedure by which a trustee takes over the assets of the debtor's estate, reduces them to cash, and makes distributions to creditors, subject to the debtor's right to retain certain exempt property and the rights of secured creditors.

§ 15-35-810. A judgment becomes a lien on real property for a period of 10 years. S.D. Codified Laws § 15-16-7.

A trustee is appointed to take control of certain assets of the debtor, bring these assets into the estate, and sell or distribute these assets for the benefit of creditors. Some assets will remain with the debtor if these assets are determined to be exempt from distribution to creditors.