The word tender has been defined as an offer of money or goods in payment or satisfaction of a debt or other obligation. An offer to perform is a tender. A tender involves an unconditional offer by a person making the tender to pay an amount in lawful currency that is at least equal to the amount owing in a specified debt. The purpose of tender is to close a transaction so that the person making the tender may be relieved of further liability for the debt or obligation.

South Dakota Letter Tendering Payment in Order to Settle a Disputed Claim

Description

How to fill out Letter Tendering Payment In Order To Settle A Disputed Claim?

Are you presently in the placement the place you will need papers for sometimes company or person purposes virtually every working day? There are plenty of legal record layouts available online, but discovering ones you can rely is not effortless. US Legal Forms gives a huge number of form layouts, just like the South Dakota Letter Tendering Payment in Order to Settle a Disputed Claim, that are published to meet state and federal specifications.

When you are already acquainted with US Legal Forms internet site and have your account, basically log in. After that, it is possible to obtain the South Dakota Letter Tendering Payment in Order to Settle a Disputed Claim web template.

If you do not come with an account and wish to begin using US Legal Forms, follow these steps:

- Discover the form you will need and ensure it is to the correct metropolis/area.

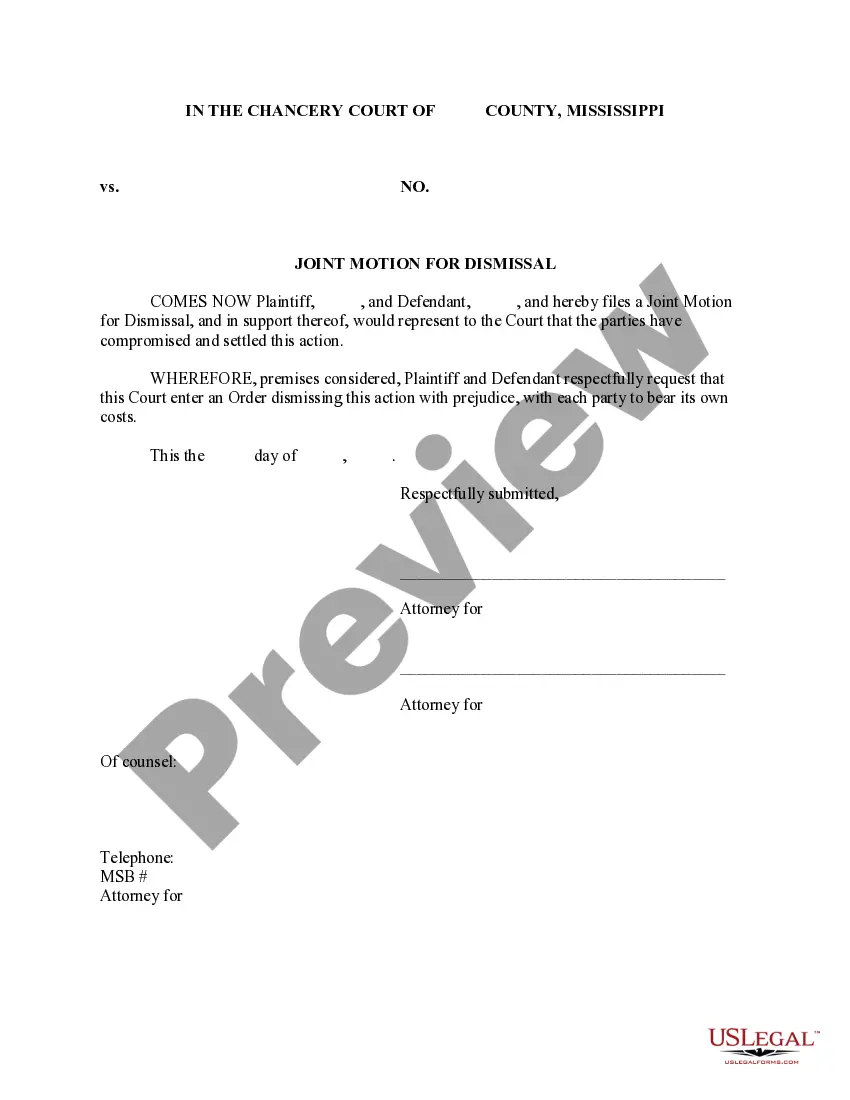

- Utilize the Preview switch to review the shape.

- Browse the explanation to actually have chosen the appropriate form.

- In case the form is not what you`re seeking, take advantage of the Lookup area to discover the form that fits your needs and specifications.

- Whenever you discover the correct form, click on Get now.

- Opt for the prices plan you need, submit the necessary details to produce your money, and buy your order utilizing your PayPal or credit card.

- Choose a handy data file format and obtain your duplicate.

Find each of the record layouts you may have bought in the My Forms menu. You can obtain a extra duplicate of South Dakota Letter Tendering Payment in Order to Settle a Disputed Claim whenever, if possible. Just select the necessary form to obtain or produce the record web template.

Use US Legal Forms, the most comprehensive variety of legal varieties, in order to save efforts and steer clear of errors. The assistance gives professionally made legal record layouts which can be used for a range of purposes. Create your account on US Legal Forms and commence creating your way of life a little easier.