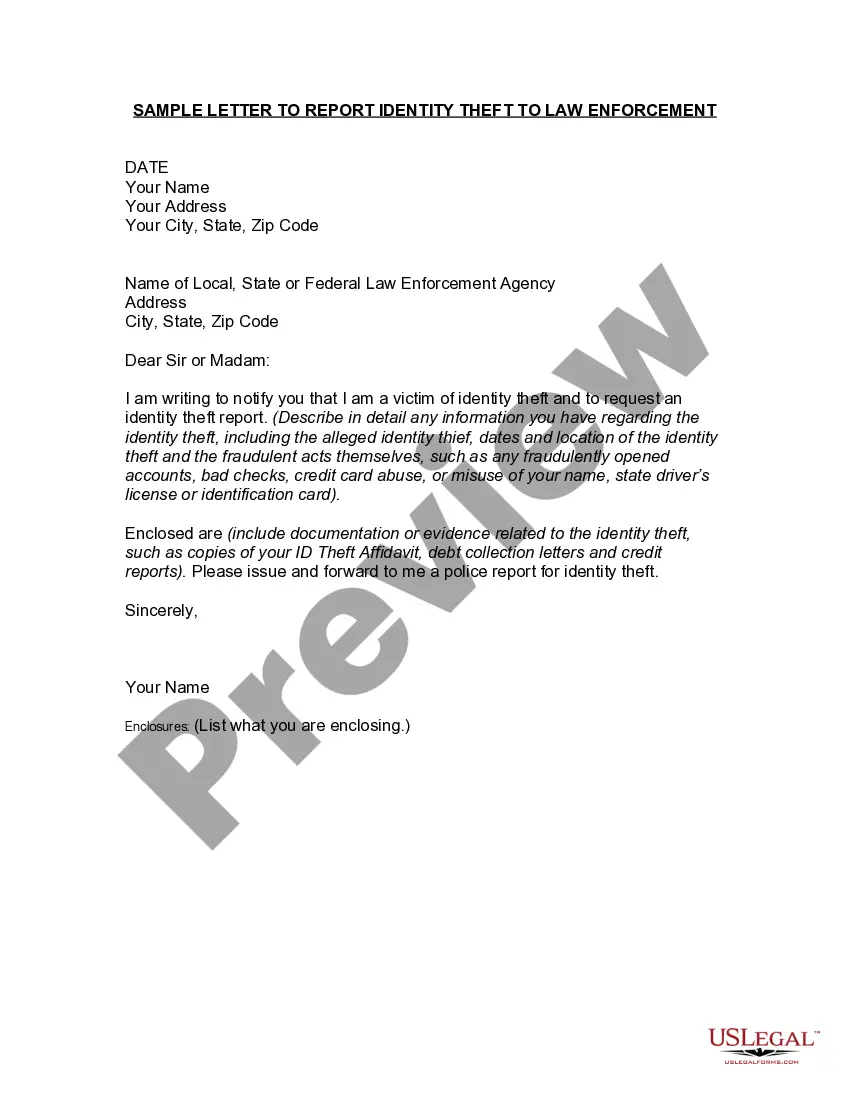

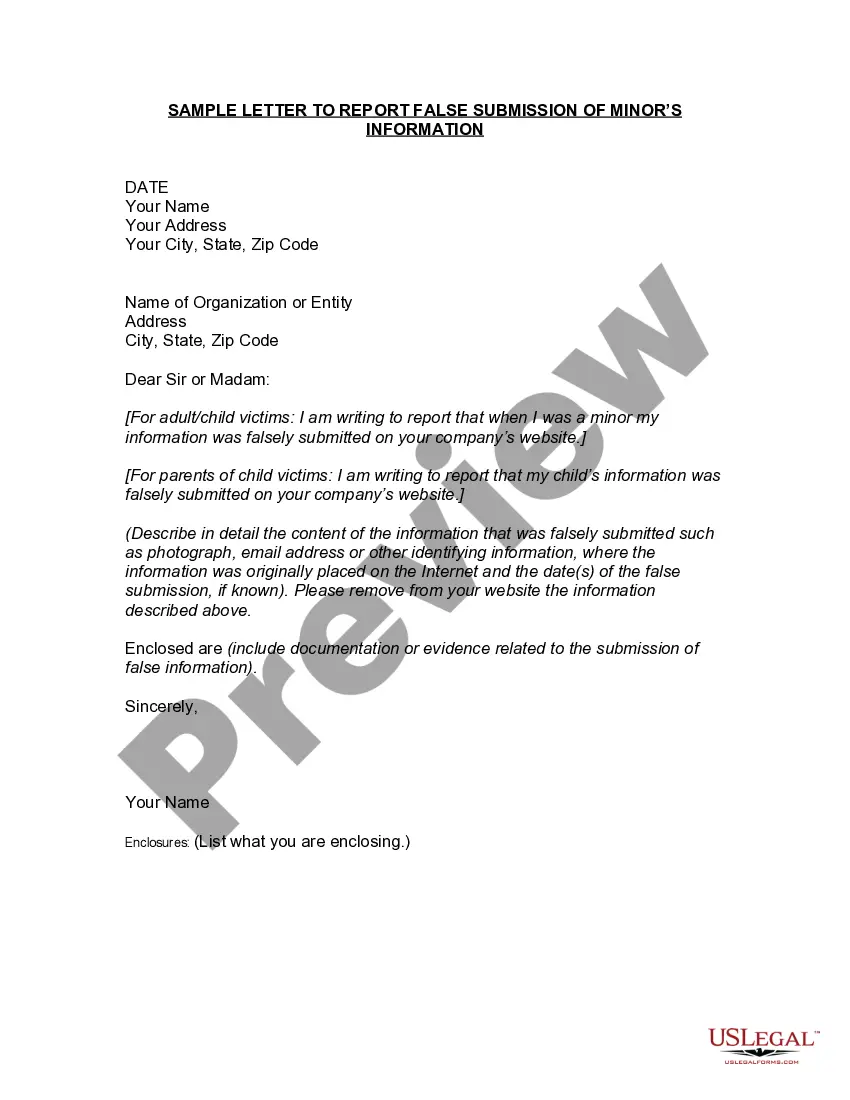

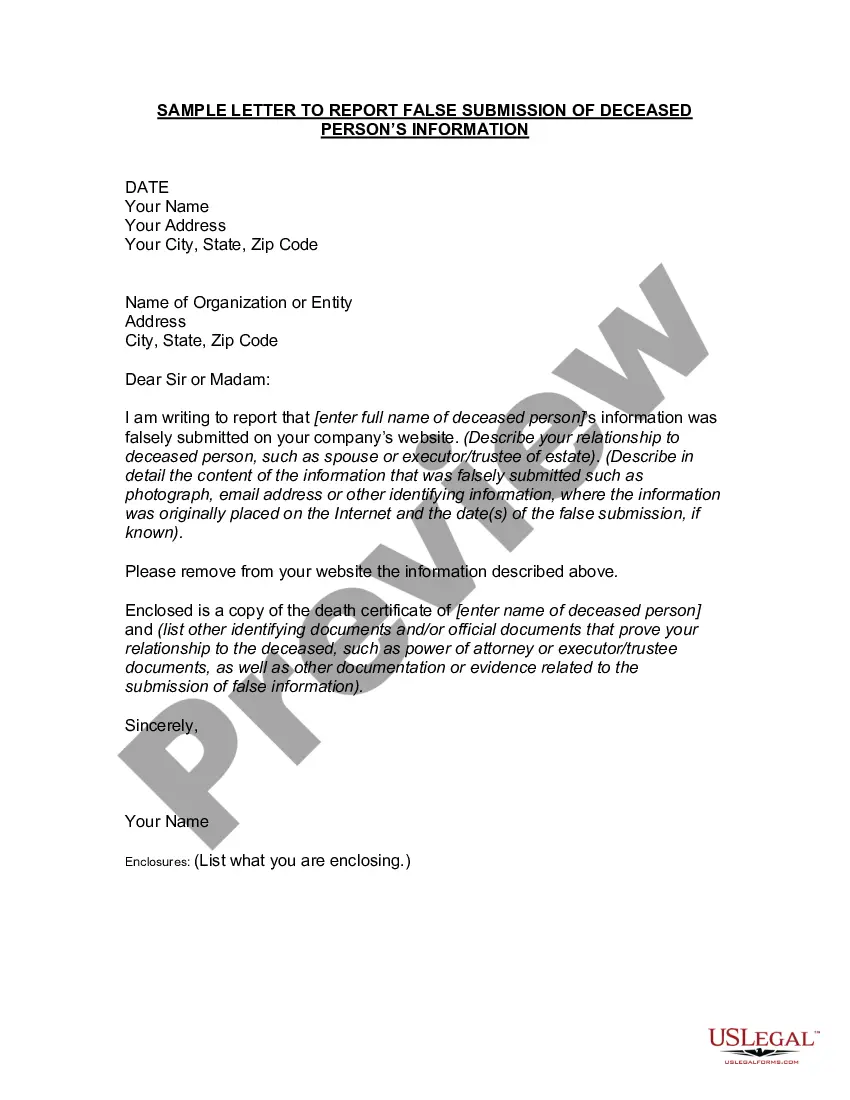

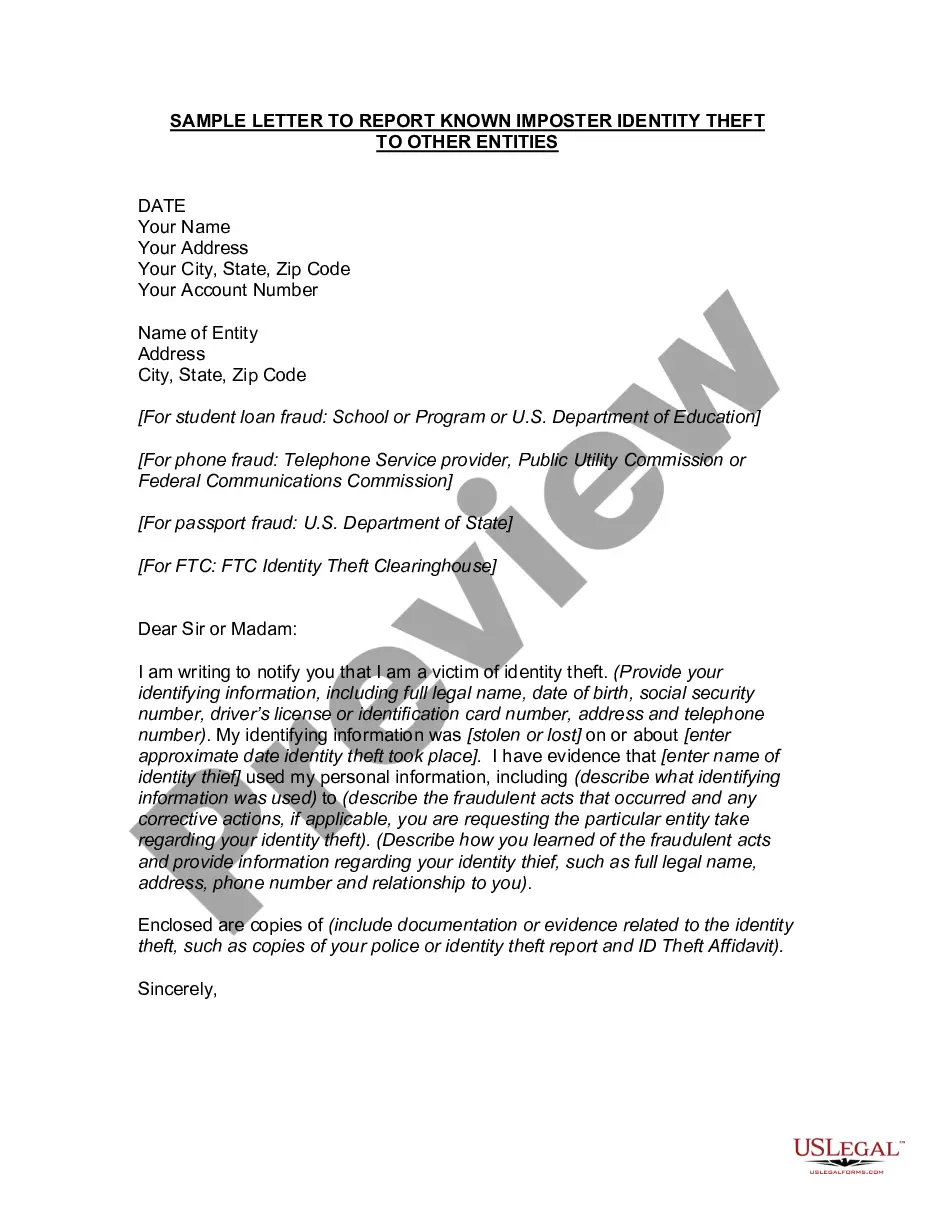

South Dakota Sample Letter to Report False Submission of Information

Description

How to fill out Sample Letter To Report False Submission Of Information?

Are you currently in a situation where you frequently require documents for either business or personal purposes? There are numerous legal document templates accessible online, but finding reliable versions can be challenging. US Legal Forms offers thousands of form templates, including the South Dakota Sample Letter to Report False Submission of Information, which are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the South Dakota Sample Letter to Report False Submission of Information template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Find the form you need and confirm it is for the correct city/county. Use the Preview button to review the form. Check the description to make sure you have selected the right form. If the form is not what you are looking for, use the Search field to find the form that meets your requirements. Once you locate the correct form, click Purchase now. Choose the pricing plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the South Dakota Sample Letter to Report False Submission of Information at any time, if needed. Just select the required form to download or print the document template.

- Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that can be used for various purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

For information regarding a specific legal issue affecting you, please contact an attorney in your area. While residents of all states use the same forms to file their federal income tax returns, state income tax forms differ from state to state.

Since South Dakota does not collect an income tax on individuals, you are not required to file a SD State Income Tax Return. However, you may need to prepare and eFile a Federal Income Tax Return.

South Dakota's Human Relations Act makes it illegal for an employer to refuse to hire a person, to discharge or lay off an employee, harass or to treat persons differently in the terms and conditions of employment because of race, color, creed, religion, sex, ancestry, disability or national origin.

If you are filing a medical complaint, click here to print, sign and mail our HIPAA release form. If you are not sure if your complaint requires a HIPAA form, please feel free to contact our office by calling 605-773-4400.

You can file a complaint against a contractor with the South Dakota Attorney General. Online: To file a complaint online, visit the complaint form and fill out the requested information. Once completed, you can submit the form.

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

South Dakota does not have a personal income tax, so there is no withholding.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.