South Dakota Corporation - Minutes

Description

How to fill out Corporation - Minutes?

If you desire to be thorough, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Employ the site’s straightforward and efficient search to find the forms you require.

Various templates for business and personal purposes are categorized by categories and states, or keywords.

Every legal document template you purchase belongs to you permanently. You will have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Compete and obtain, and print the South Dakota Corporation - Minutes with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to obtain the South Dakota Corporation - Minutes with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to get the South Dakota Corporation - Minutes.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

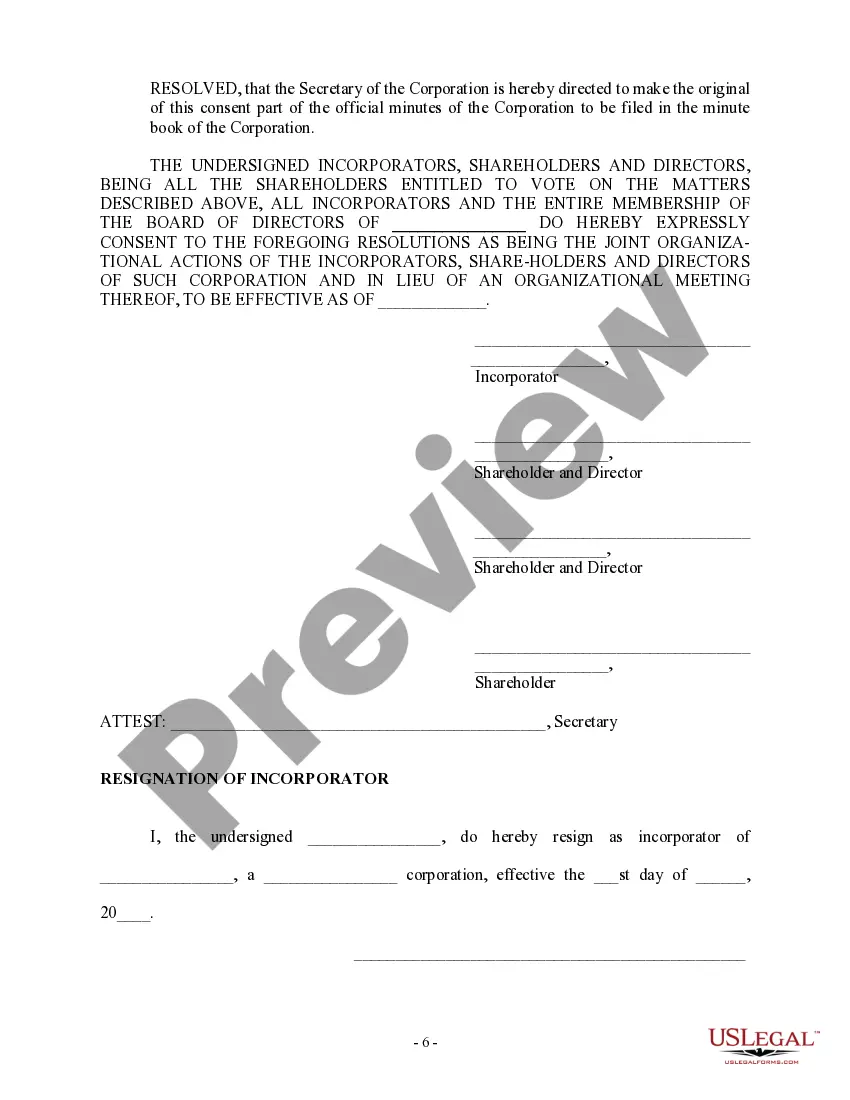

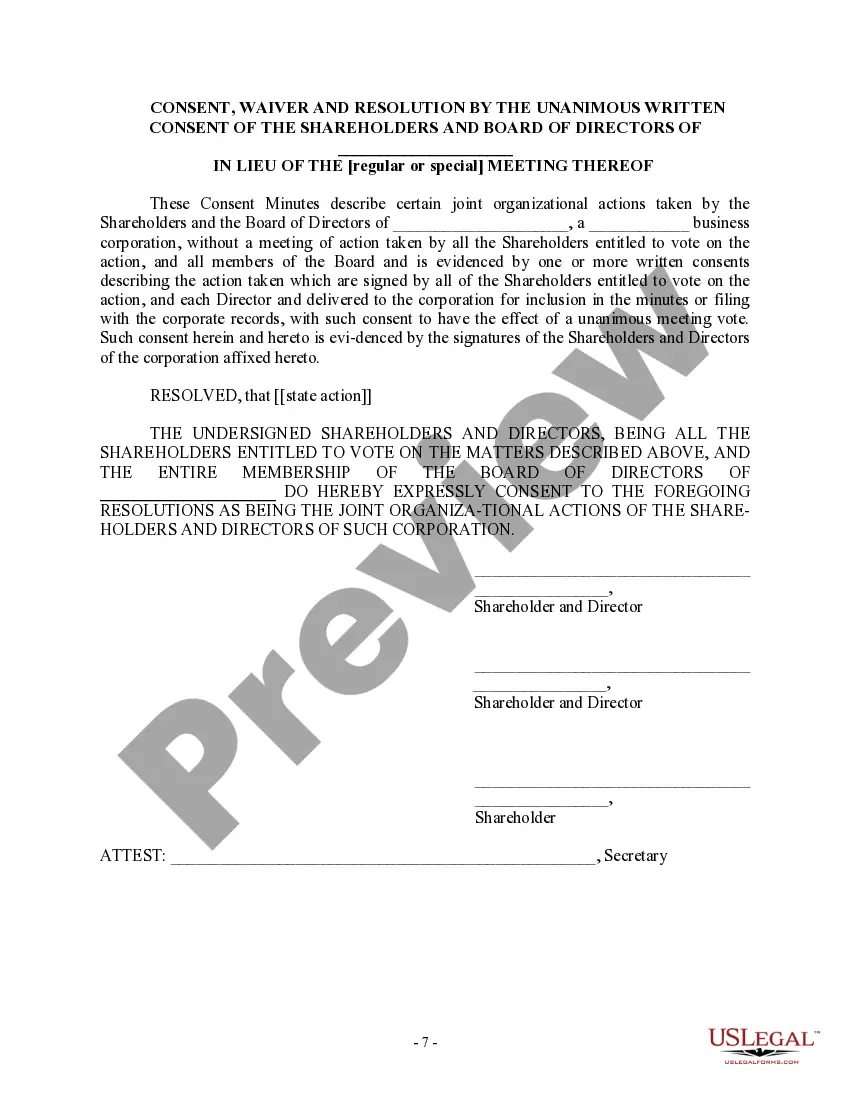

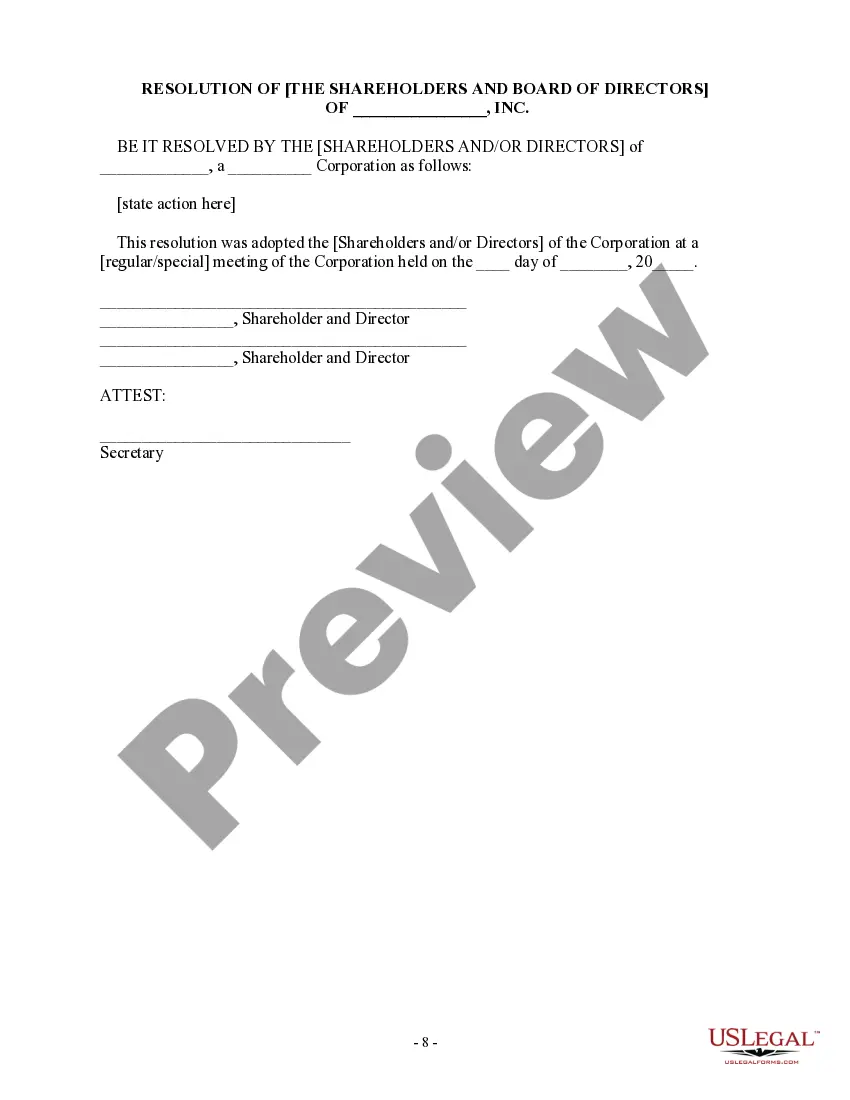

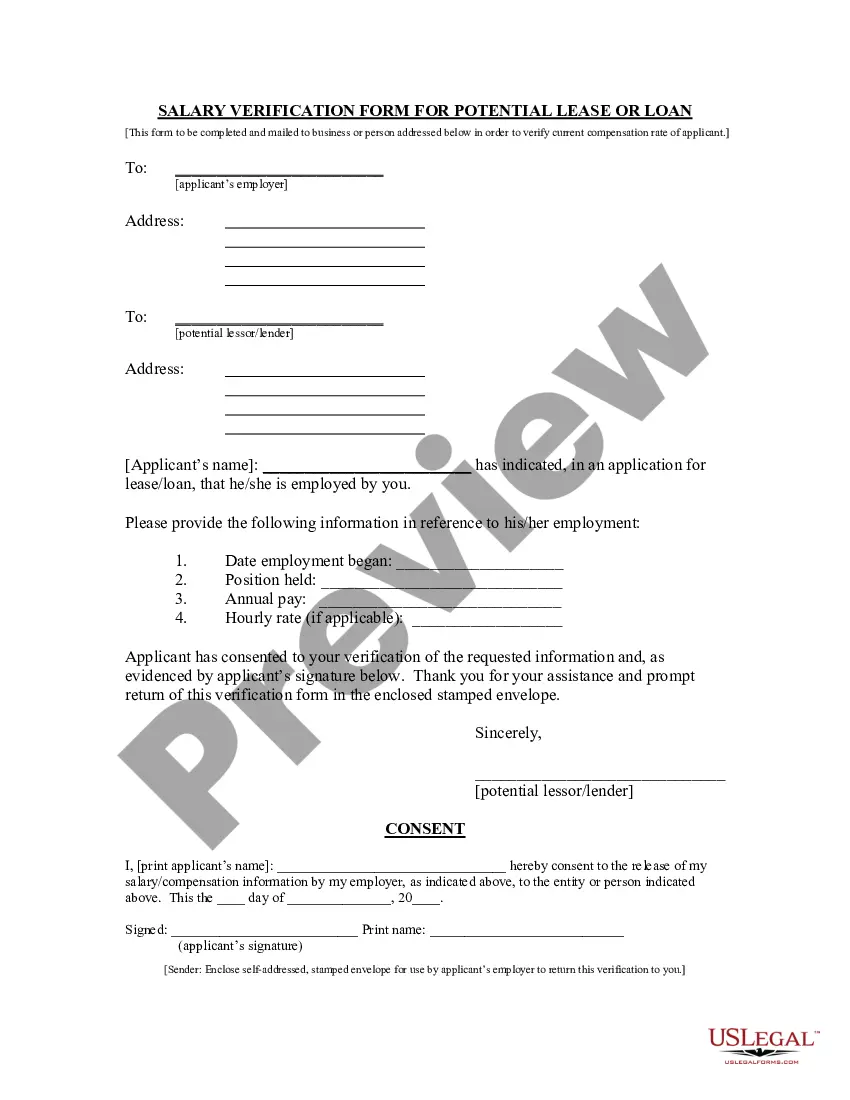

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find different versions of the legal form template.

- Step 4. Once you have located the form you need, select the Buy now button. Choose the pricing plan you prefer and input your credentials to register for an account.

- Step 5. Fulfill the transaction. You can use your Visa, MasterCard, or PayPal account to complete the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify and print or sign the South Dakota Corporation - Minutes.

Form popularity

FAQ

Creating effective corporation minutes involves documenting key decisions made during meetings and formalizing the structure of your LLC. Start by outlining the meeting's date, attendees, and discussions held. Keeping accurate corporation minutes is essential for maintaining compliance and organization, especially for your South Dakota Corporation - Minutes.

While many states offer benefits for LLC formation, South Dakota stands out due to its lack of corporate income tax and business-friendly laws. These features make it particularly appealing for entrepreneurs looking to maximize their investments. Choosing South Dakota for your LLC ensures efficient management of South Dakota Corporation - Minutes, which contributes to long-term success.

A South Dakota LLC enjoys robust legal protections, which shield personal assets from business liabilities. The state also boasts a business-friendly regulatory environment, encouraging new companies to thrive. When you manage corporation minutes well, you strengthen the foundation of your South Dakota Corporation - Minutes and enhance your business's credibility.

Doing business in a state involves initiating significant activities that connect your company to that state legally and financially. This connection can lead to tax obligations, business registrations, and compliance with state regulations. For your South Dakota Corporation, understanding this concept is crucial for successful operation. Explore uslegalforms for tools and resources that clarify these requirements.

Doing business generally means engaging in commercial activities, such as selling products or services, hiring employees, or having an office space. Each state, including South Dakota, has specific criteria for defining this term. If you operate a South Dakota Corporation, knowing these definitions helps ensure compliance with state laws. Uslegalforms can assist you by providing detailed guidelines.

South Dakota is a state within the United States, and as such, it is owned collectively by the people of South Dakota. The state government manages its lands and resources on behalf of its citizens. If you are considering starting a business in the region, understanding local governance is vital for your South Dakota Corporation. Resources available on uslegalforms can provide insight into navigating state regulations.

While South Dakota does not legally require an operating agreement for an LLC, having one is highly recommended. An operating agreement outlines the structure, management, and operational procedures of your South Dakota Corporation. This document can prevent disputes and clarify roles, enhancing the professionalism of your business. Use uslegalforms to draft an agreement tailored to your needs.

Yes, if you are planning to conduct business activities in South Dakota, you must register your business with the state. Registration establishes your South Dakota Corporation legally, allowing you to operate and access various benefits. If you need assistance, uslegalforms offers comprehensive resources to help streamline the registration process.

Doing business in South Dakota includes having a physical presence, such as an office or employees, or conducting regular business activities within the state. This status requires compliance with South Dakota's laws, including taxation and reporting obligations. If you operate a South Dakota Corporation, be sure to understand these requirements to maintain your business's good standing. Consult uslegalforms for guidance on compliance.

In South Dakota, corporate minutes do not need to be filed with the state. However, maintaining accurate minutes is crucial for your South Dakota Corporation. These minutes serve as an official record of decisions and actions taken by your board, which can protect your corporation’s legal status. Using platforms like uslegalforms can help you create and keep track of these important documents.