South Dakota Contractor's Schedule Sheet

Description

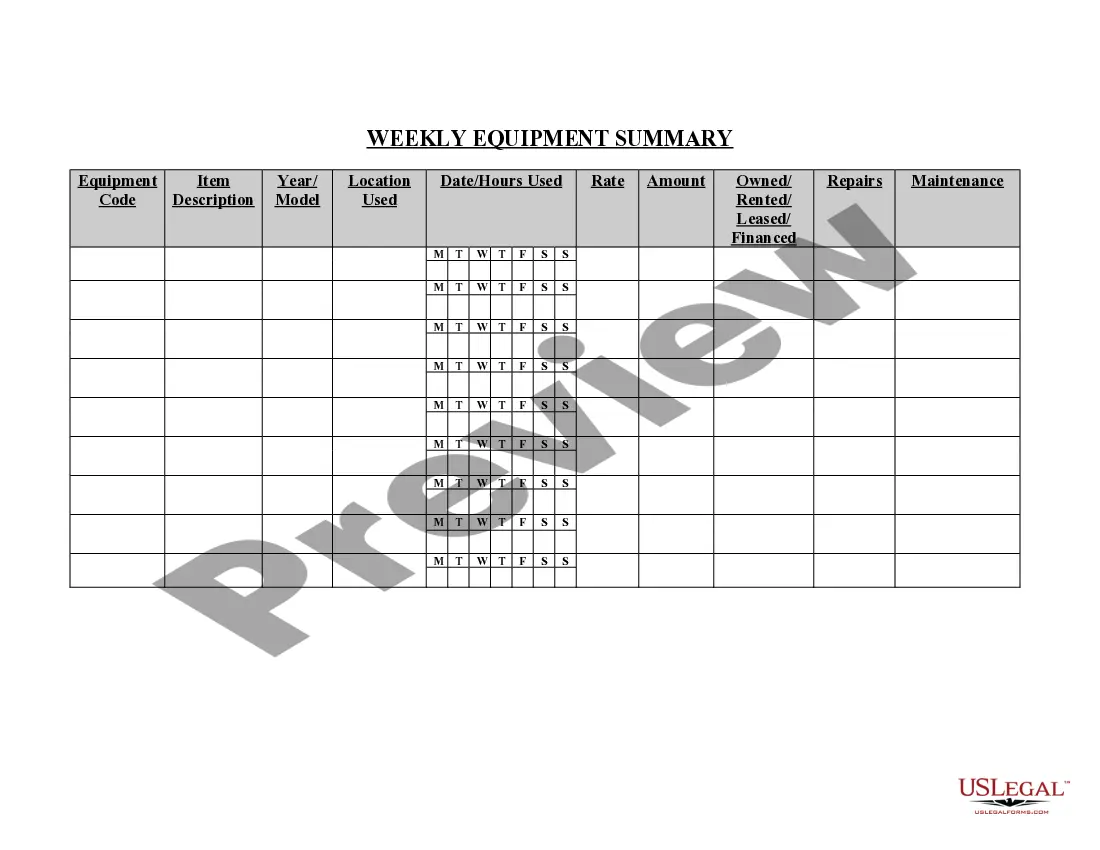

How to fill out Contractor's Schedule Sheet?

Locating the appropriate official document template can be challenging.

Naturally, there are numerous online templates accessible, but how can you acquire the official format you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the South Dakota Contractor's Schedule Sheet, which you can utilize for both business and personal purposes.

If the template does not fulfill your needs, use the Search bar to find the appropriate document. Once you are confident that the form is correct, click on the Get now button to obtain it. Choose the pricing plan you prefer and enter the required information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the official document template to your device. Complete, modify, print, and sign the downloaded South Dakota Contractor's Schedule Sheet. US Legal Forms is the largest collection of official documents, where you can find various paper templates. Utilize the service to download professionally crafted documents that adhere to state requirements.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to receive the South Dakota Contractor's Schedule Sheet.

- Use your account to browse the official templates you have previously ordered.

- Navigate to the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct template for your city/state. You can review the form using the Preview option and read the form description to confirm it is suitable for you.

Form popularity

FAQ

Traditional Goods or Services South Dakota is unique in the fact that almost all services are taxable. The only major service that is exempt from being taxed is construction.

A: Contractors excise tax is a 2% state tax imposed on the gross receipts of all prime contractors engaged in construction services or realty improvement projects in South Dakota. No sales or municipal tax applies to receipts subject to contractors excise tax.

What is South Dakota's Sales Tax Rate? The South Dakota sales tax and use tax rates are 4.5%.

Traditional Goods or Services South Dakota is unique in the fact that almost all services are taxable. The only major service that is exempt from being taxed is construction.

The state of South Dakota has a relatively simple property tax system. Tax rates, set by local government bodies such as municipalities and school districts, are applied to the full market value of residential property. Across the state, the average effective property tax rate is 1.22%.

In the state of South Dakota, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Several examples of of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.