South Dakota Corporate Resolution for Sole Owner

Description

How to fill out Corporate Resolution For Sole Owner?

If you wish to be thorough, acquire or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you require.

Different templates for business and personal uses are sorted by type and state, or keywords.

Step 4. After identifying the form you need, click the Buy now option. Choose your preferred pricing plan and enter your details to create the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the South Dakota Corporate Resolution for Sole Owner.

- Use US Legal Forms to find the South Dakota Corporate Resolution for Sole Owner with just a few clicks.

- If you are currently a client of US Legal Forms, sign in to your account and then click the Download option to obtain the South Dakota Corporate Resolution for Sole Owner.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate area/state.

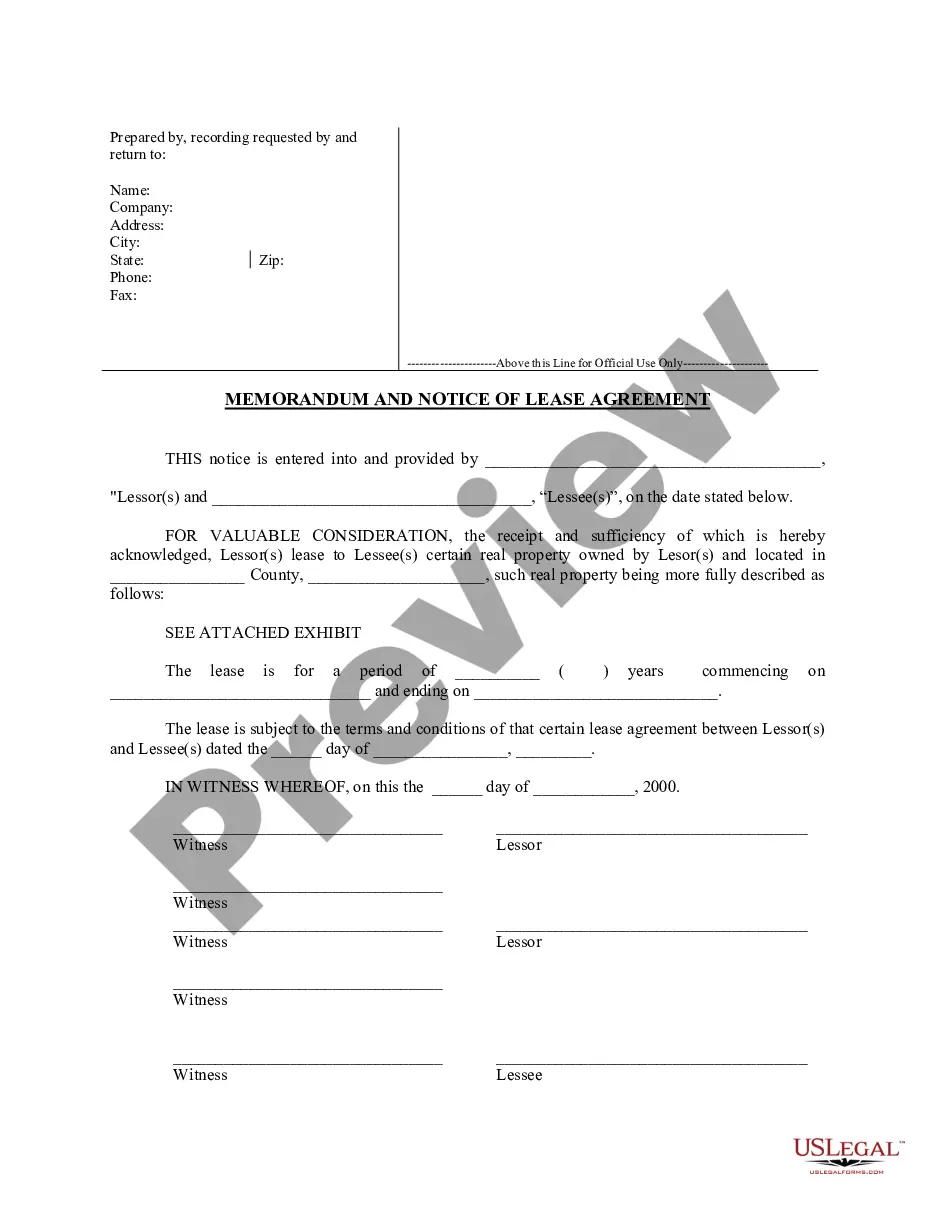

- Step 2. Use the Review feature to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

An S corporation separates you from your company completely, for both operational and tax purposes. The business is its own entity, and you as the owner are the sole shareholder and an employee. That division, however, comes with operational costs.

The bylaws establish all of the rules and functions of the corporation. South Dakota requires all corporations to adopt bylaws. Your corporate bylaws may include: A clear statement of your business purpose.

After all, corporations need to have boards of directors and hold shareholder meetings -- which sounds more like a room full of suits than a single person working from home. However, all states do allow corporations to have just one owner. You can be the sole shareholder, director and officer for your company.

The owners of a corporation are shareholders (also known as stockholders) who obtain interest in the business by purchasing shares of stock. Shareholders elect a board of directors, who are responsible for managing the corporation.

You amend the articles of your South Dakota Corporation by submitting the completed Amendment to Articles of Incorporation form in duplicate by mail or in person, along with the filing fee to the South Dakota Secretary of State.

Shareholders are actual owners of a corporation, while the board of directors manages the corporation.

Even if your business has only one owneryouit can still be legally organized as a corporation, with you as the sole shareholder as well as the president and director. One-owner corporations are common.

The shareholders own the corporation and are responsible for electing the directors. This is done when the corporation is first formed and usually continues on an annual basis.