South Carolina State of Delaware Limited Partnership Tax Notice

Description

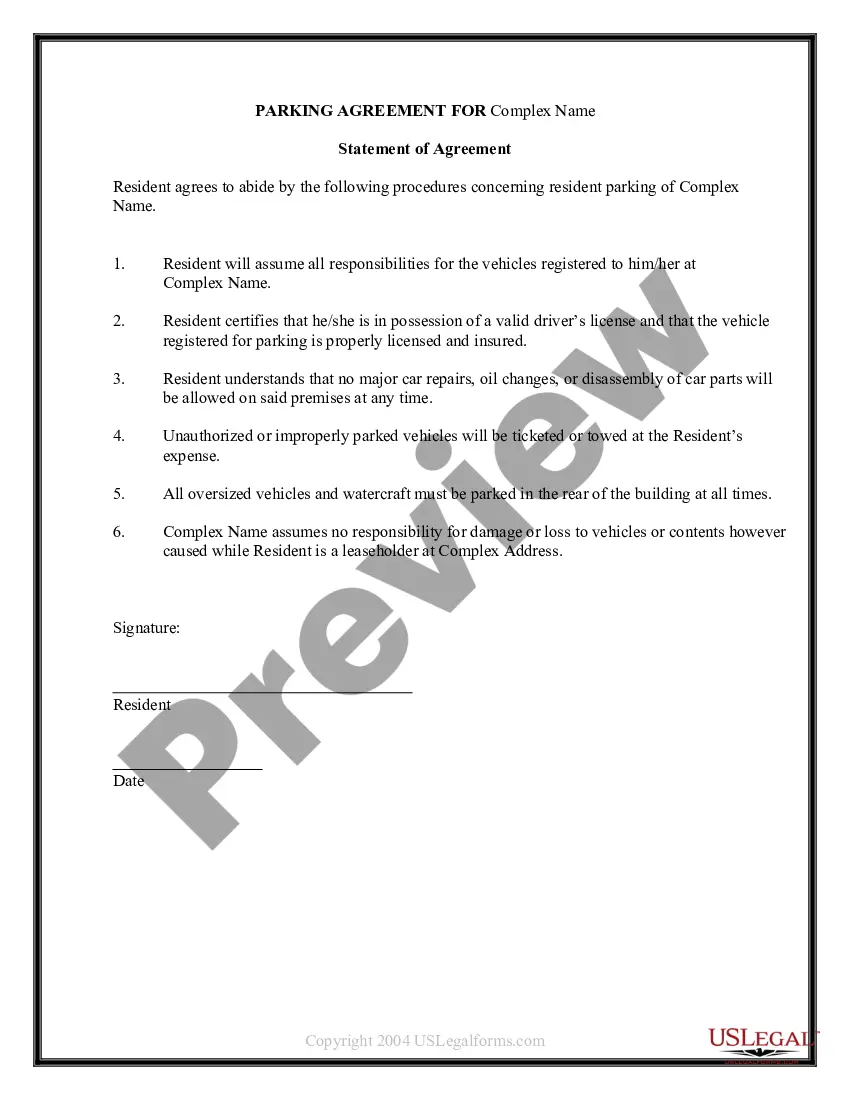

How to fill out State Of Delaware Limited Partnership Tax Notice?

If you have to complete, down load, or print authorized record web templates, use US Legal Forms, the biggest collection of authorized forms, which can be found on the Internet. Use the site`s basic and practical search to find the files you will need. Numerous web templates for enterprise and personal functions are categorized by types and states, or key phrases. Use US Legal Forms to find the South Carolina State of Delaware Limited Partnership Tax Notice with a couple of click throughs.

If you are previously a US Legal Forms consumer, log in for your bank account and click the Acquire switch to obtain the South Carolina State of Delaware Limited Partnership Tax Notice. You may also gain access to forms you in the past delivered electronically from the My Forms tab of your respective bank account.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape to the correct metropolis/country.

- Step 2. Take advantage of the Preview solution to look over the form`s articles. Never forget about to learn the description.

- Step 3. If you are unhappy using the kind, take advantage of the Lookup industry near the top of the monitor to get other types in the authorized kind web template.

- Step 4. Once you have found the shape you will need, click the Get now switch. Select the pricing prepare you choose and add your credentials to register on an bank account.

- Step 5. Procedure the financial transaction. You may use your bank card or PayPal bank account to complete the financial transaction.

- Step 6. Choose the formatting in the authorized kind and down load it on your own product.

- Step 7. Comprehensive, revise and print or signal the South Carolina State of Delaware Limited Partnership Tax Notice.

Each and every authorized record web template you purchase is the one you have eternally. You may have acces to every kind you delivered electronically within your acccount. Select the My Forms section and choose a kind to print or down load yet again.

Contend and down load, and print the South Carolina State of Delaware Limited Partnership Tax Notice with US Legal Forms. There are millions of skilled and state-specific forms you can utilize for your personal enterprise or personal requirements.

Form popularity

FAQ

You may receive a letter from the SCDOR asking you to complete either the Identity Verification Quiz or Individual Code Verification after filing your return. This is just another step we are taking to ensure that fraudsters are not using your information to file a false return and ?steal your refund.

Partnership - The due date can be extended by filing an SC8736 Request for Extension of Time to File South Carolina Return for Fiduciary and Partnership. The SCDOR will also accept a federal Form 7004 marked for South Carolina purposes.

year resident or nonresident of South Carolina should file an SC1040 with a completed Schedule NR (Nonresident Schedule) attached. You can file your South Carolina tax return using one of the following methods: Electronic filing using a professional tax preparer.

Yes! All businesses that are taxed as an S or C corporation must include an initial report (Form CL-1) along with their Articles of Formation, Articles of Organization, or Certificate of Authority to Transact Business in South Carolina. There is a minimum $25 filing fee.

Gains made on investments, whether they were held for more than or less than one year, are subject to the South Carolina income tax rates shown in the table above. Long-term gains, which are held for at least one year, receive a 44% deduction, though. South Carolina does not have an estate or inheritance tax.

Partnerships are Taxed as Pass-Through Entities. South Carolina Partnerships Must File Form 1065. Business Partners Should Include a Schedule K-1 With their Individual Return.

Interest income on obligations of states and political subdivisions other than South Carolina is taxable to South Carolina. In the case of a mutual fund, the percentage of exempt interest income attributable to out-of-state non-federal obligations is also taxable to South Carolina.

A partnership does not pay tax on its income but "passes through" any profits or losses to its partners. Partners must include partnership items on their tax or information returns.