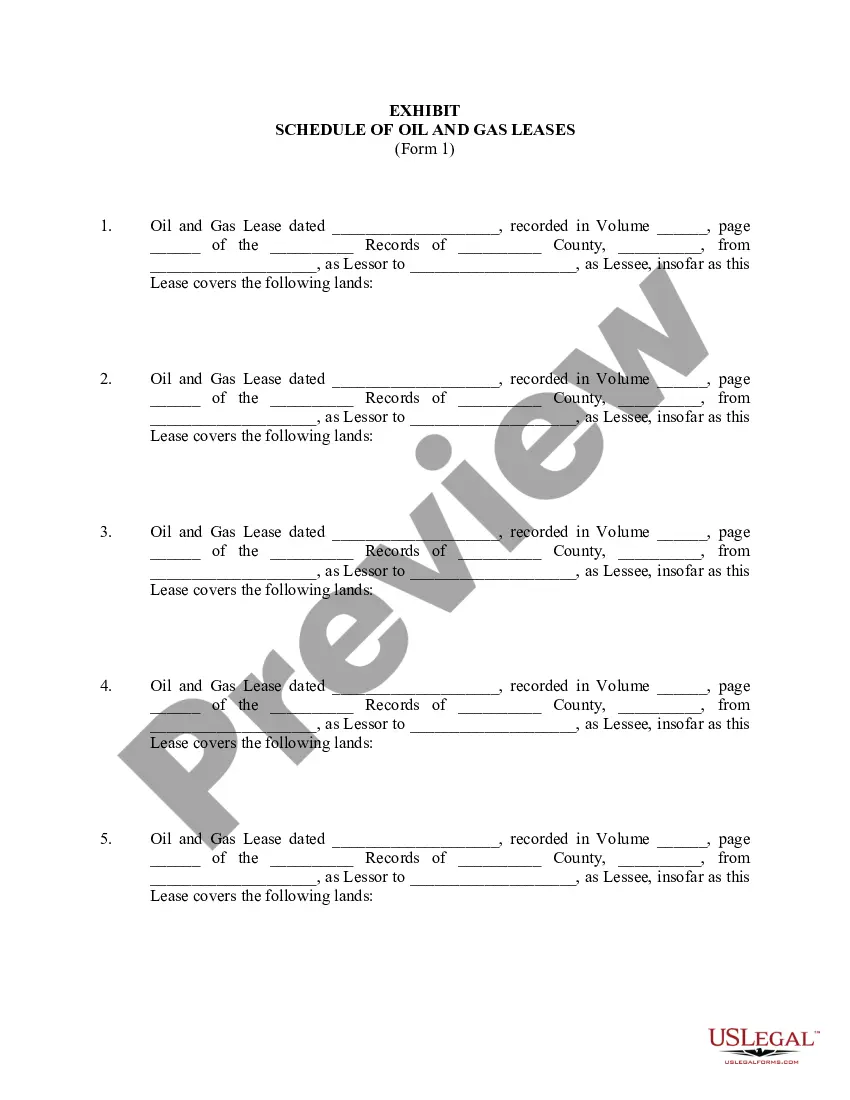

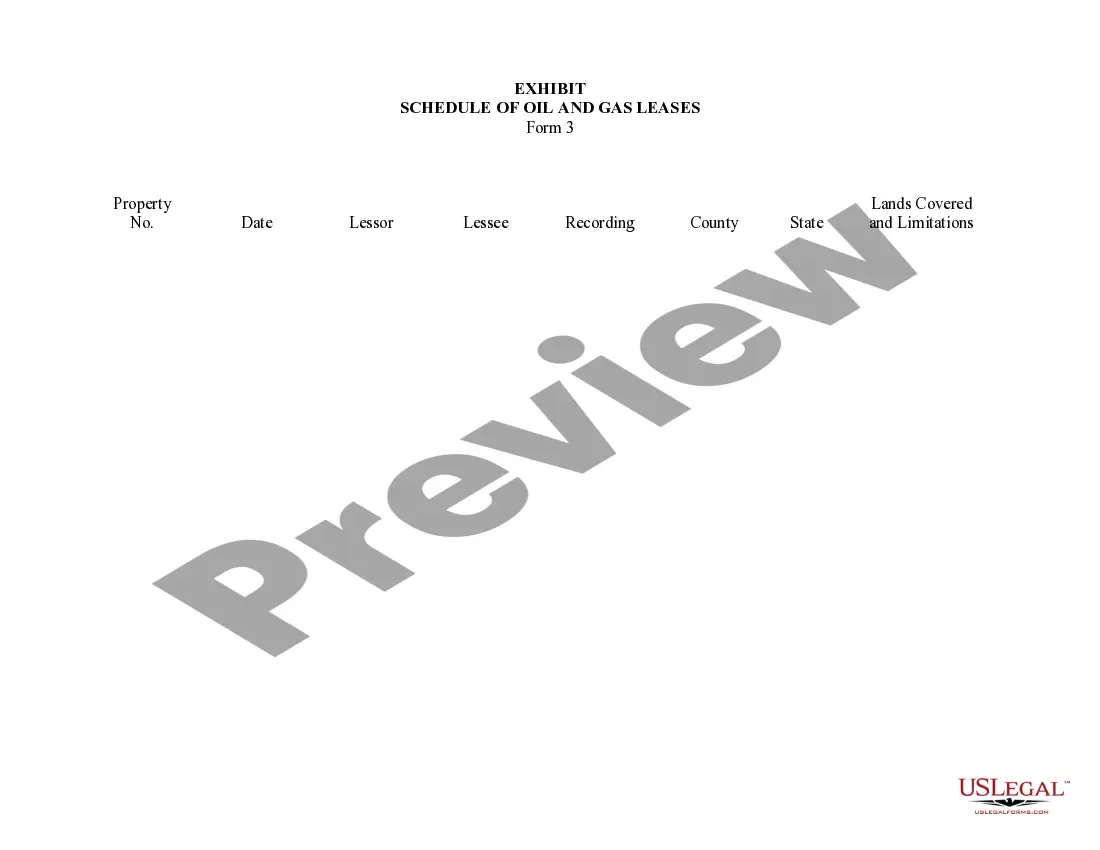

South Carolina Exhibit Schedule of Oil and Gas Leases Form 2

Description

How to fill out Exhibit Schedule Of Oil And Gas Leases Form 2?

Finding the right lawful record web template can be quite a have a problem. Obviously, there are plenty of web templates available online, but how would you obtain the lawful kind you require? Take advantage of the US Legal Forms internet site. The service offers a large number of web templates, such as the South Carolina Exhibit Schedule of Oil and Gas Leases Form 2, which you can use for business and personal demands. Every one of the varieties are examined by specialists and fulfill state and federal demands.

In case you are already signed up, log in to your profile and click the Download option to get the South Carolina Exhibit Schedule of Oil and Gas Leases Form 2. Make use of your profile to look with the lawful varieties you may have purchased earlier. Go to the My Forms tab of your profile and acquire another duplicate of the record you require.

In case you are a brand new end user of US Legal Forms, listed here are easy directions that you should comply with:

- Initially, make sure you have chosen the correct kind to your town/area. It is possible to examine the shape utilizing the Preview option and browse the shape information to ensure it is the best for you.

- When the kind does not fulfill your preferences, utilize the Seach discipline to obtain the appropriate kind.

- Once you are sure that the shape would work, click the Acquire now option to get the kind.

- Pick the pricing plan you want and enter in the necessary information and facts. Make your profile and buy your order utilizing your PayPal profile or charge card.

- Choose the data file file format and down load the lawful record web template to your product.

- Comprehensive, revise and print out and indicator the attained South Carolina Exhibit Schedule of Oil and Gas Leases Form 2.

US Legal Forms is the largest library of lawful varieties where you can see a variety of record web templates. Take advantage of the service to down load expertly-created papers that comply with express demands.

Form popularity

FAQ

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Search online database of new and updated oil and gas leases. Use Enverus analytics to focus search on specific geographies, lease dates and contract terms, production record and leasing costs.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

A royalty is the percentage of revenue paid to the federal government by energy companies from the sale of oil, gas, or coal extracted from the nation's public lands. The current royalty rate officially charged for oil, gas, and coal drilled or mined from U.S. public lands is 12.5 percent.

The Federal onshore oil and gas rate is 16.67% for leases issued after August 16, 2022. However, there are a few exceptions, including different royalty rates on older leases, reduced royalty rates on certain oil leases with declining production, and increased royalty rates for reinstated leases.

The primary term on average is 3 years. Companies can add a 2-year extension if they wish. The company that executed the lease uses this time period to achieve drilling the well. Once that is completed, the secondary term begins and lasts for as long as the well is producing.

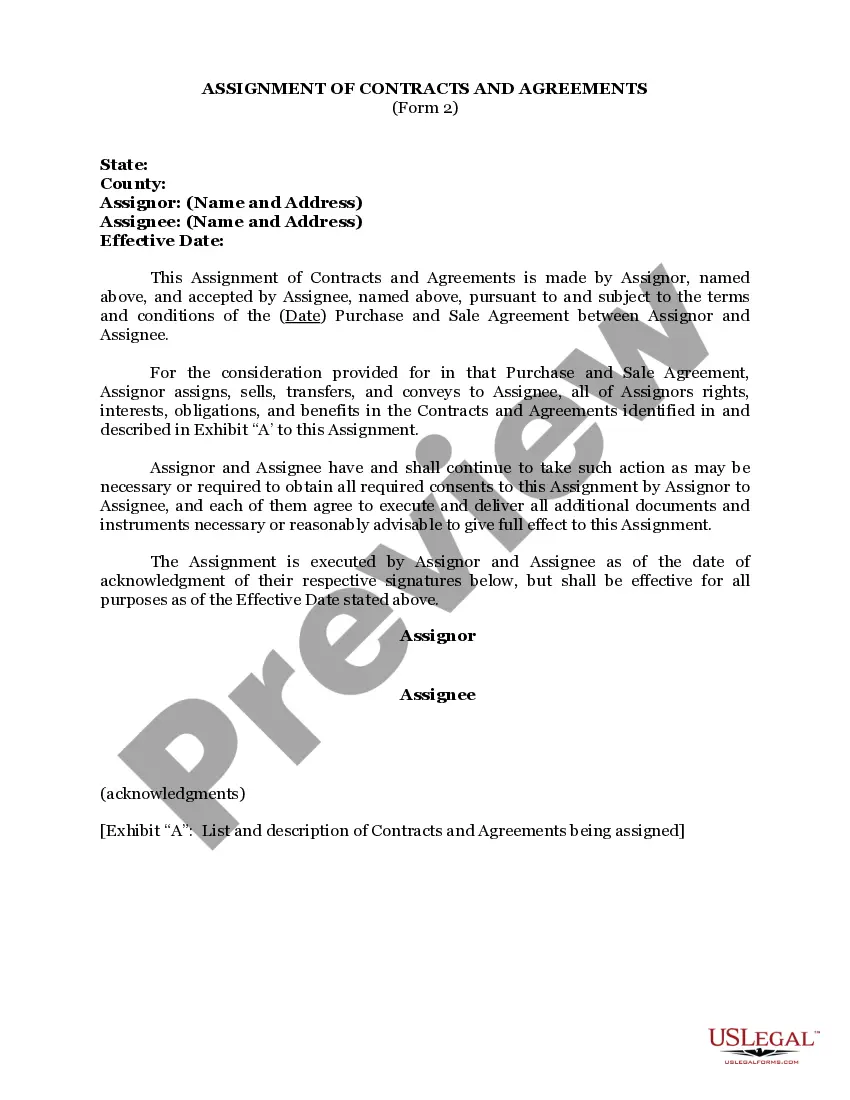

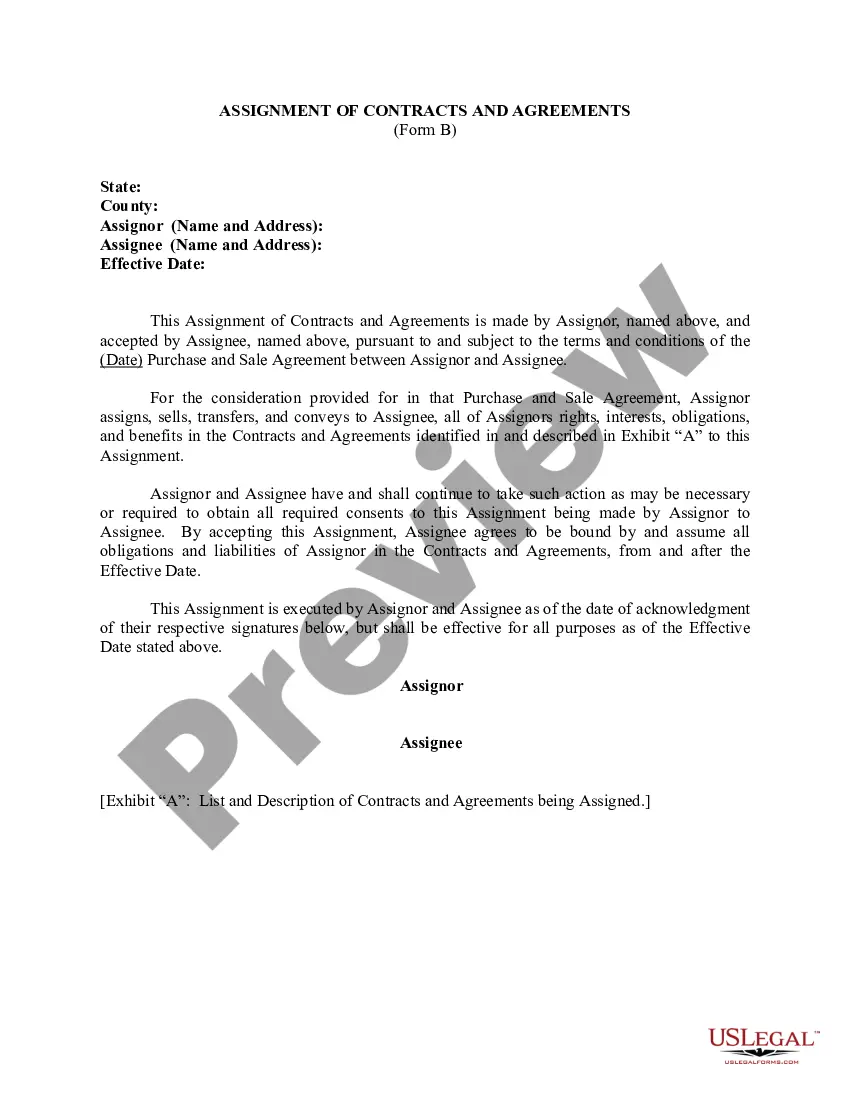

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

Royalties on private lands are influenced by state rates. They generally range from 12?25 percent. Before negotiating royalty payments on private land, careful due diligence should be conducted to confirm ownership.