South Carolina Declaration of Election by Lessor to Convert Royalty Interest to Working Interest

Description

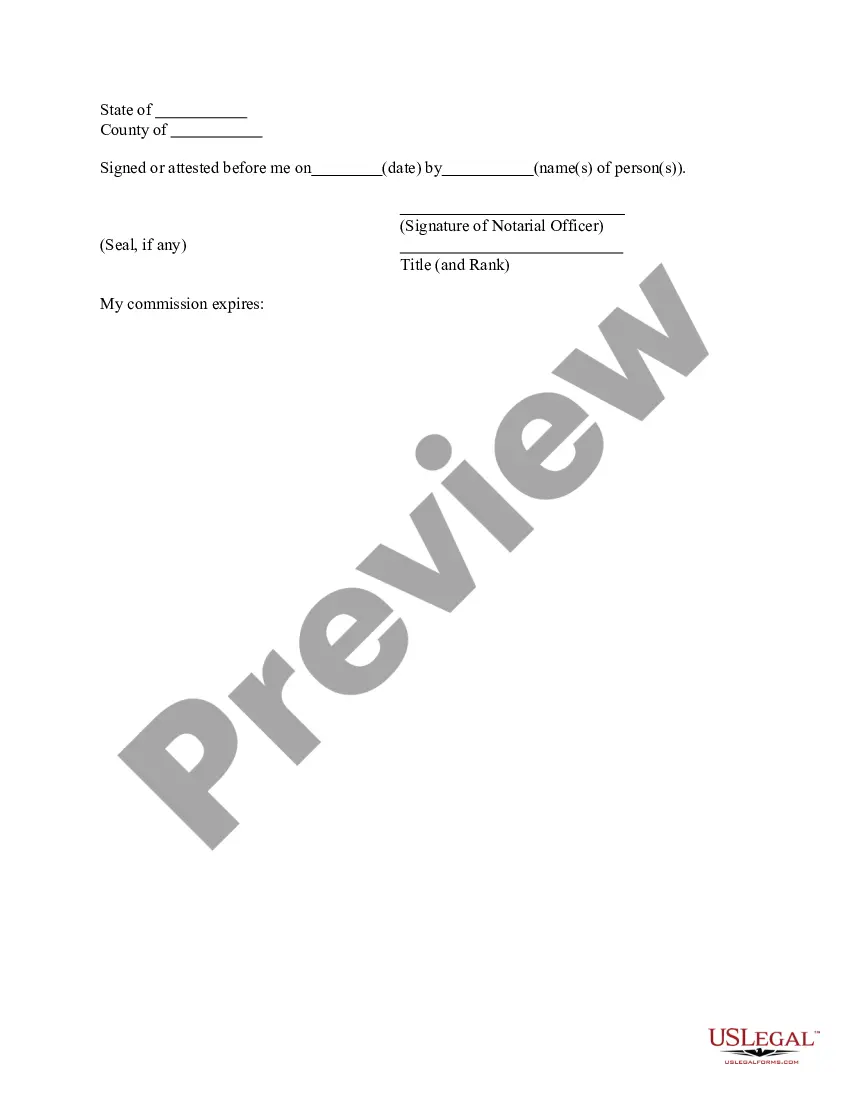

How to fill out Declaration Of Election By Lessor To Convert Royalty Interest To Working Interest?

US Legal Forms - one of many biggest libraries of lawful forms in the USA - provides a wide range of lawful file layouts you are able to obtain or print out. While using website, you can find a large number of forms for organization and specific purposes, sorted by categories, suggests, or search phrases.You can get the latest versions of forms much like the South Carolina Declaration of Election by Lessor to Convert Royalty Interest to Working Interest in seconds.

If you already have a monthly subscription, log in and obtain South Carolina Declaration of Election by Lessor to Convert Royalty Interest to Working Interest through the US Legal Forms catalogue. The Download key can look on every kind you perspective. You have accessibility to all earlier saved forms inside the My Forms tab of the accounts.

If you would like use US Legal Forms initially, listed here are basic recommendations to get you began:

- Make sure you have picked the best kind for the area/county. Click on the Review key to review the form`s content material. Look at the kind description to ensure that you have chosen the proper kind.

- In case the kind doesn`t match your requirements, make use of the Lookup area towards the top of the screen to discover the one who does.

- In case you are pleased with the form, confirm your decision by clicking the Acquire now key. Then, opt for the costs prepare you prefer and offer your qualifications to register to have an accounts.

- Procedure the deal. Make use of bank card or PayPal accounts to complete the deal.

- Pick the file format and obtain the form in your product.

- Make modifications. Complete, change and print out and indicator the saved South Carolina Declaration of Election by Lessor to Convert Royalty Interest to Working Interest.

Each and every format you included with your account lacks an expiry date and is also the one you have forever. So, in order to obtain or print out yet another version, just proceed to the My Forms segment and click in the kind you want.

Gain access to the South Carolina Declaration of Election by Lessor to Convert Royalty Interest to Working Interest with US Legal Forms, one of the most comprehensive catalogue of lawful file layouts. Use a large number of professional and express-particular layouts that meet your business or specific requires and requirements.

Form popularity

FAQ

A working interest is a type of investment in oil and gas operations. In a working interest, investors are liable for ongoing costs associated with the project but also share in any profits of production. Both the costs and risks of a working interest are extremely high.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

What is the difference between working interest and royalty interest? Working interests are oil and gas investments that give owners the right to exploit the resources on a property. Royalty interests are the rights belonging to the landowner who leased out the property to the working interest owner.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.