South Carolina Self-Employed Part Time Employee Contract

Description

How to fill out Self-Employed Part Time Employee Contract?

Are you presently in a circumstance where you will require documents for both organizational or specific purposes nearly every time.

There are many legal form templates available online, but finding ones you can rely on isn't straightforward.

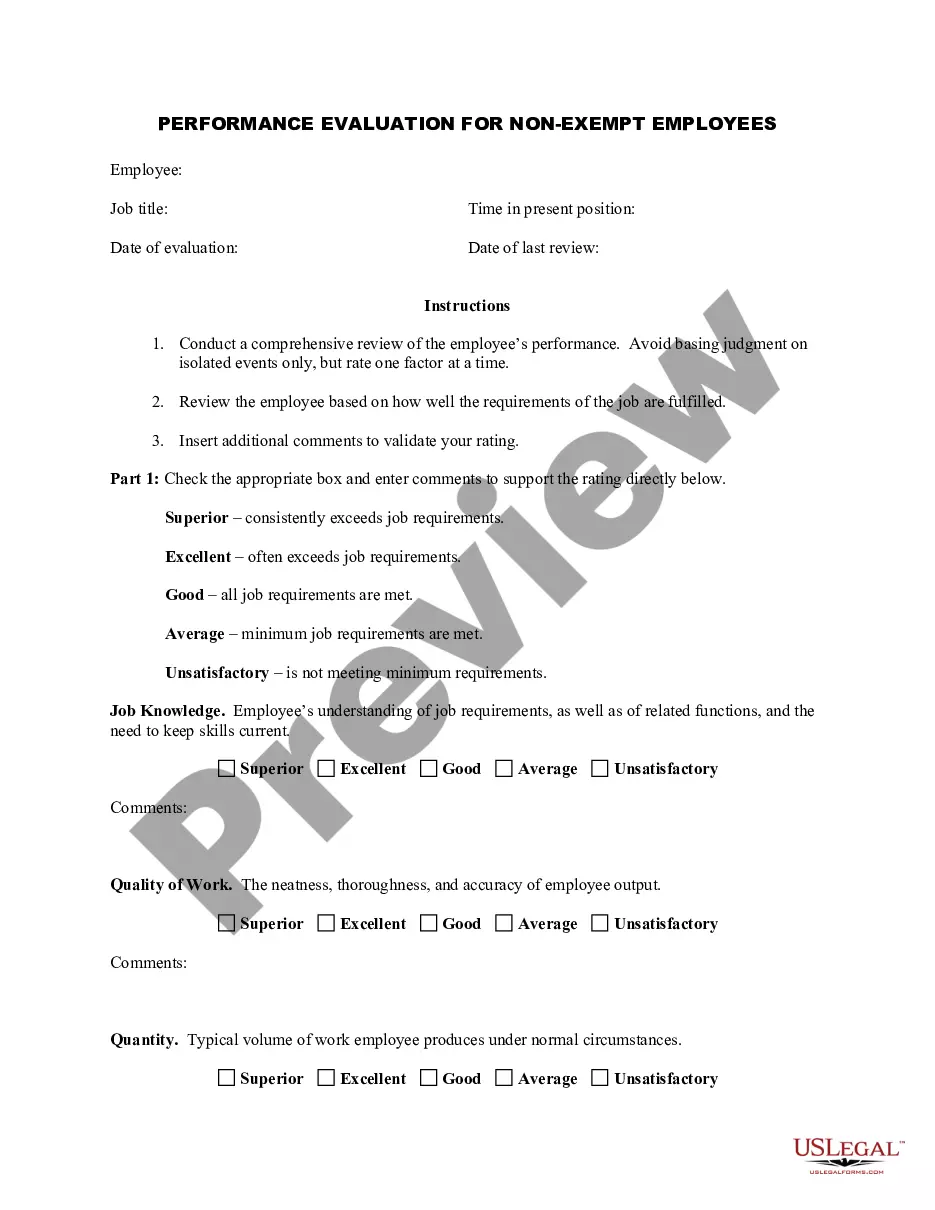

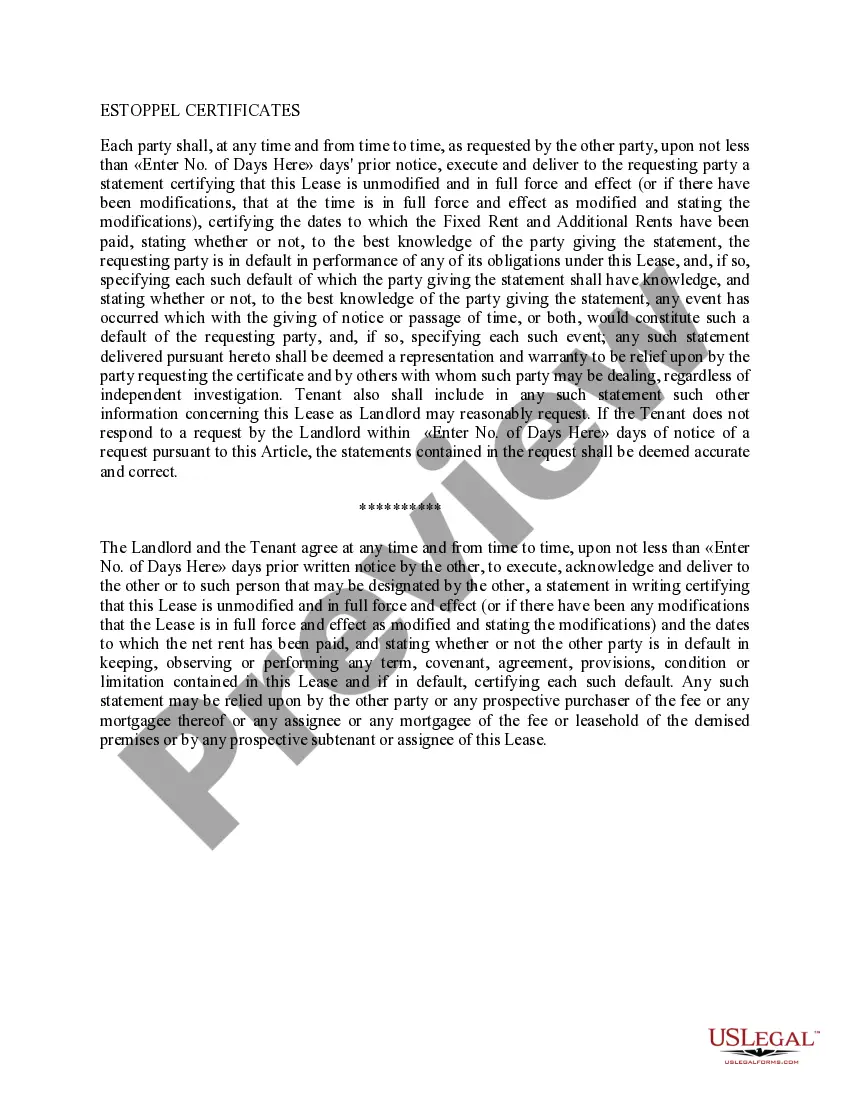

US Legal Forms provides an extensive collection of form templates, such as the South Carolina Self-Employed Part-Time Employee Contract, which can be tailored to meet state and federal standards.

Once you find the right form, click on Get now.

Select a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and have a free account, simply Log In.

- Subsequently, you can download the South Carolina Self-Employed Part-Time Employee Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you require and ensure it corresponds to the correct city/state.

- Use the Preview button to examine the form.

- Review the description to confirm that you have chosen the appropriate form.

- If the form isn't what you're looking for, utilize the Research field to find the form that aligns with your needs.

Form popularity

FAQ

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

employed person is an independent contractor or a sole proprietor who reports selfemployment income. Selfemployed people work for themselves in a variety of trades, professions, and occupations rather than working for an employer.

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

Yes. Even part time staff must have a contract. The law applies if employees: Have a fixed employment period.

Part-time job While freelancers are self-employed, part-time workers are still considered to be a part of the company and eligible for corporate benefits. Part timers work 30 hours per week or less and are involved in the vast amount of workflows, unlikely freelancers who work on a particular projects.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Step 3: Last Employer Self-employed individuals may enter "self-employed" for the last employer's name and include his/her own address and contact information in lieu of the "last employer's address and contact information."