South Carolina Oil Cleanup Services Contract - Self-Employed

Description

How to fill out Oil Cleanup Services Contract - Self-Employed?

Selecting the optimal official document template can be challenging. Clearly, there are numerous options accessible online, but how can you find the official document you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the South Carolina Oil Cleanup Services Contract - Self-Employed, suitable for business and personal needs. All templates are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the South Carolina Oil Cleanup Services Contract - Self-Employed. Use your account to view the official documents you have previously purchased. Navigate to the My documents tab in your account to download another copy of the document you require.

Choose the file format and download the official document template to your device. Complete, edit, print, and sign the acquired South Carolina Oil Cleanup Services Contract - Self-Employed. US Legal Forms is the largest repository of official documents where you can find various document templates. Use the service to download well-structured paperwork that meets state standards.

- First, ensure you have chosen the correct document for the city/region.

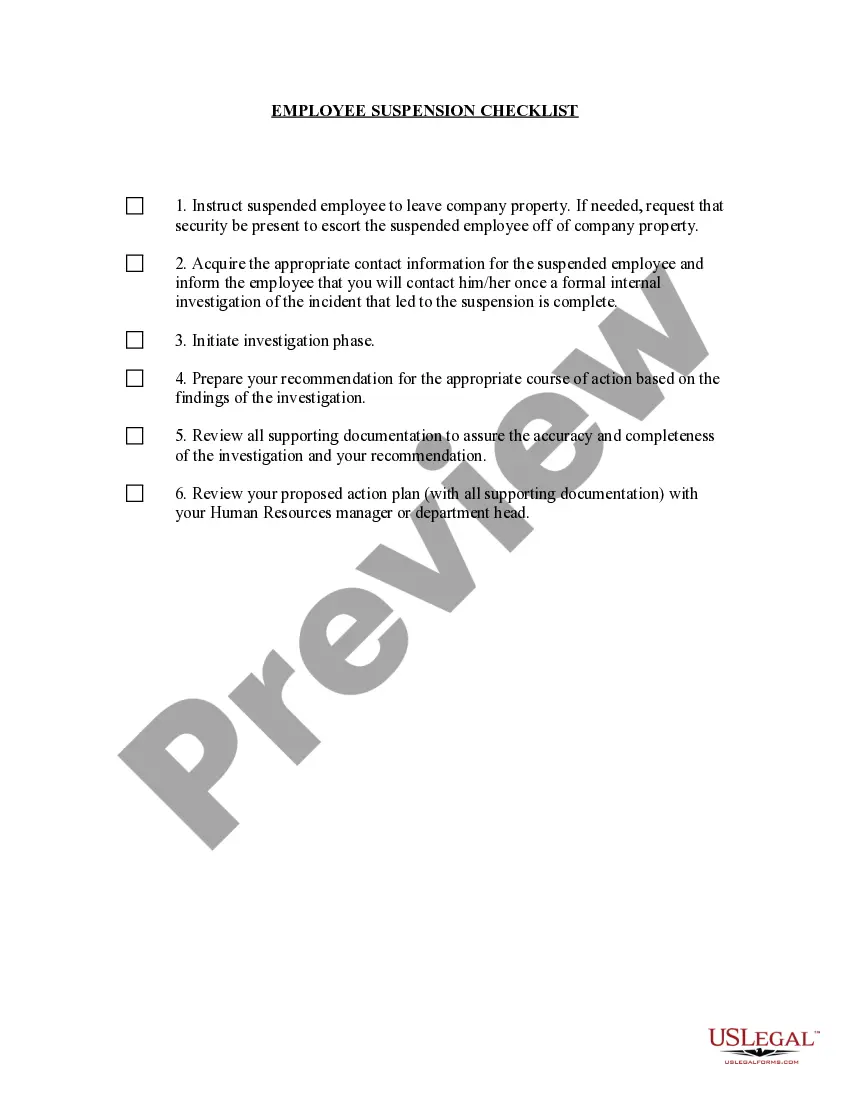

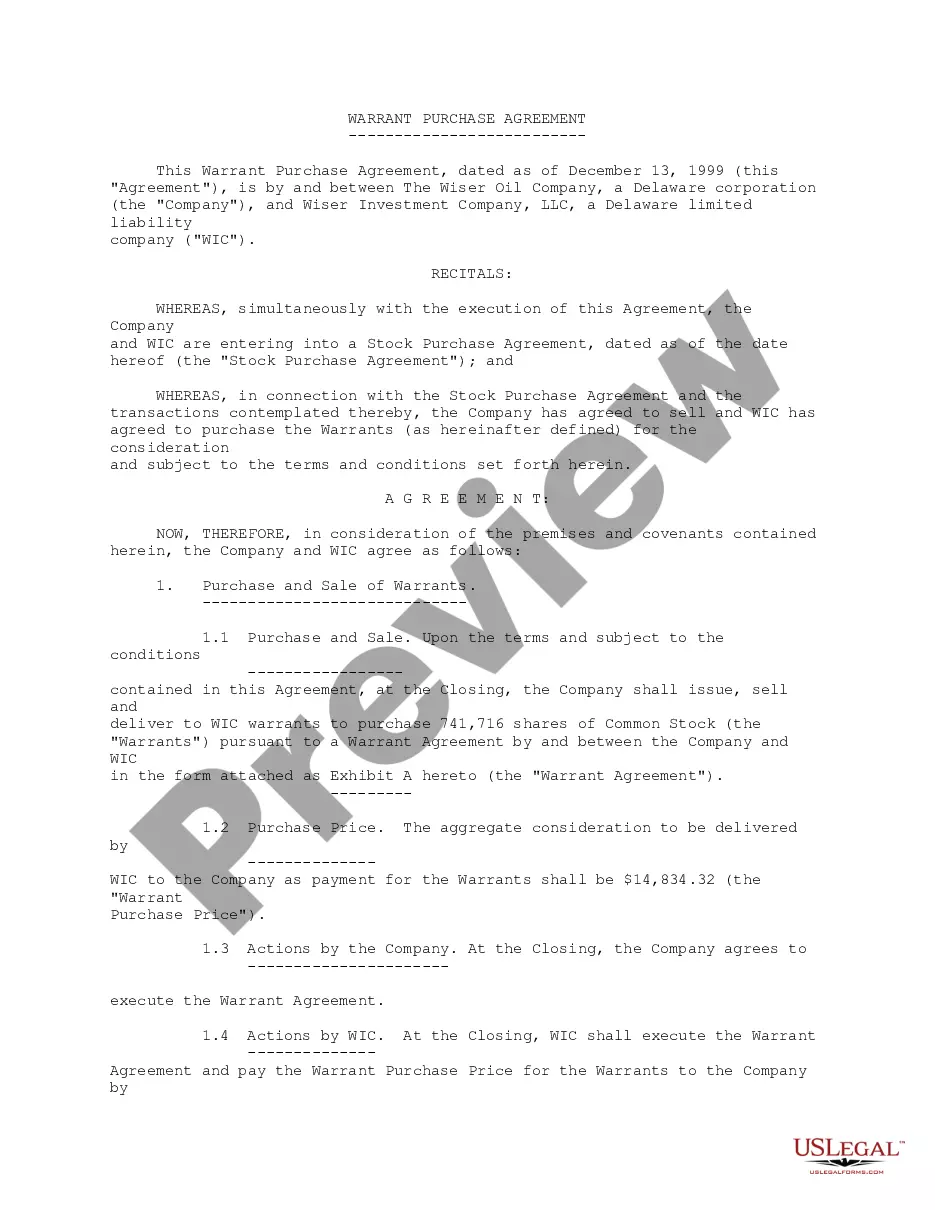

- You can review the document using the Preview button and check the document details to confirm it is suitable for you.

- If the document does not meet your requirements, use the Search field to find the appropriate document.

- Once you are certain the document is correct, click on the Acquire now button to obtain the document.

- Select the pricing plan you want and enter the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

The 5 C's of a contract are clarity, completeness, consideration, competence, and compliance. Each element plays a crucial role in ensuring that your South Carolina Oil Cleanup Services Contract - Self-Employed is valid and enforceable. Clarity and completeness eliminate confusion, while consideration involves understanding what each party will gain. Ensuring competence means all parties are legally able to enter the agreement, and compliance refers to adhering to relevant laws and regulations.

Yes, you can write your own service agreement as a self-employed individual. It is essential to ensure that the South Carolina Oil Cleanup Services Contract - Self-Employed covers all necessary aspects, including the scope of work and payment details. However, using a professional template might save you time and ensure you don't overlook important legal information. Always aim for clarity to protect your interests.

Filling out a service contract involves detailing the services you will provide and the timeline for accomplishing them. When crafting your South Carolina Oil Cleanup Services Contract - Self-Employed, identify payment terms, deliverables, and any special conditions that may apply. Double-check all information for accuracy to avoid confusion later on. Utilizing a platform like uslegalforms can simplify this process with easy-to-use templates.

To write a simple contract agreement, start by clearly defining the parties involved and the scope of work. Specify the terms, including payment details and deadlines, in the context of a South Carolina Oil Cleanup Services Contract - Self-Employed. Ensure both parties review the document carefully, as clarity can prevent disputes. Remember, a well-documented agreement lays the foundation for a successful working relationship.

The independent contractor law in South Carolina defines a self-employed individual as someone who controls their work and is not an employee of a company. Understanding this law is crucial when entering into a South Carolina Oil Cleanup Services Contract - Self-Employed, as it outlines your obligations and rights. Contractors must comply with tax regulations and may need to consider insurance coverage for their operations. By staying informed, you can better navigate your responsibilities as a self-employed individual.

Oil spills are typically cleaned up by trained environmental professionals, including self-employed contractors specializing in South Carolina oil cleanup services. These experts use state-of-the-art methods and equipment to control and remediate spills efficiently. Their role is vital in protecting the environment and ensuring compliance with regulatory standards.

The Voluntary Cleanup Program (VCP) in South Carolina allows property owners and developers to voluntarily clean up contaminated sites under state guidance. This program can significantly benefit self-employed workers in oil cleanup services by providing a clear framework for addressing environmental issues. The VCP fosters collaboration between professionals and state authorities to enhance community safety.

Yes, South Carolina offers various debt relief programs aimed at assisting residents struggling with financial burdens. For self-employed individuals, understanding these options can provide necessary support during tough times, especially when managing operational costs related to oil cleanup projects. Resources are available to help navigate these financial solutions effectively.

To report an oil spill in South Carolina, you should contact the Department of Health and Environmental Control's Emergency Response program. Timing is crucial, as immediate notification ensures a swift response to mitigate environmental damage. Self-employed cleanup professionals can assist in addressing spills efficiently, using their expertise in South Carolina oil cleanup services.

The number one cause of death in South Carolina is heart disease, which impacts many families statewide. Understanding health trends is vital for contractors in the oil cleanup sector, as environmental conditions can affect community well-being. By providing effective South Carolina oil cleanup services, self-employed professionals contribute to healthier surroundings and overall public safety.