South Carolina Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

If you wish to be thorough, obtain, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website's straightforward and user-friendly search function to find the documents you need.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

Step 6. Select the format of the legal document and download it on your device. Step 7. Complete, edit, and print or sign the South Carolina Carrier Services Contract - Self-Employed Independent Contractor. Each legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Check the My documents section to select a document for printing or downloading again. Compete and obtain, and print the South Carolina Carrier Services Contract - Self-Employed Independent Contractor with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the South Carolina Carrier Services Contract - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download option to obtain the South Carolina Carrier Services Contract - Self-Employed Independent Contractor.

- You can also find forms you downloaded previously in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

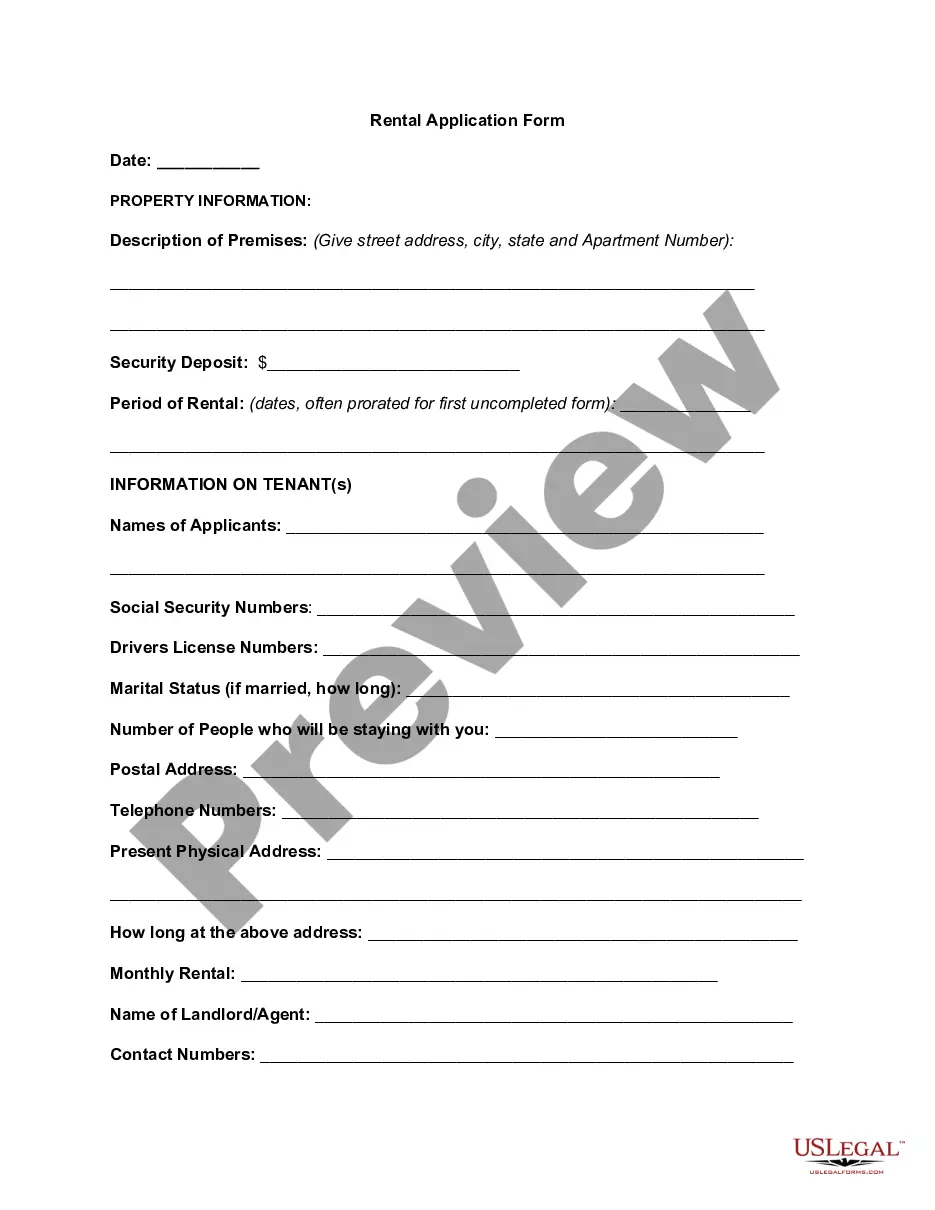

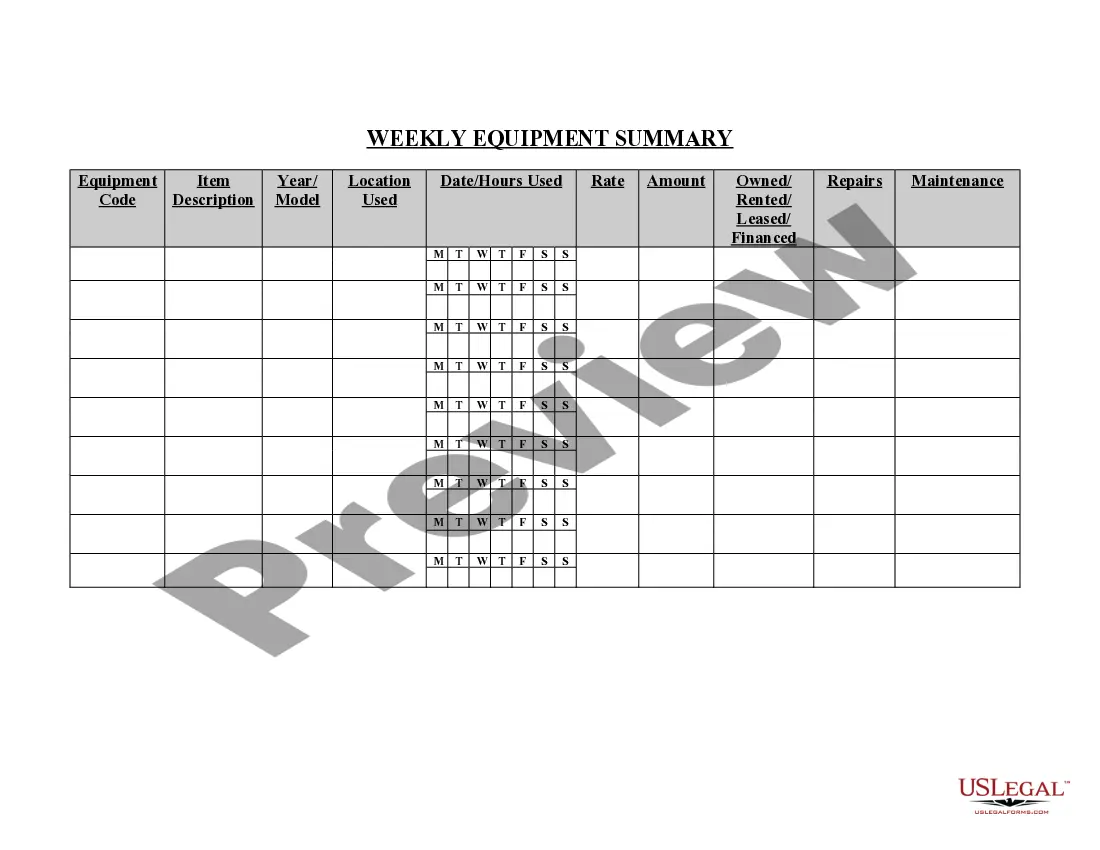

- Step 2. Use the Review feature to examine the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you find the form you need, click the Buy now option. Choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Yes, independent contractors file as self-employed individuals when reporting their income to the IRS. They must complete the appropriate forms to detail income and expenses, typically using Schedule C. This status allows them to deduct certain business expenses, reducing their taxable income. For clarity and compliance, referencing the South Carolina Carrier Services Contract - Self-Employed Independent Contractor can guide your understanding of your responsibilities.

To prove you are an independent contractor, you need to provide documentation that shows your business activities and relationships with clients. Common forms of evidence include contracts, invoices, and correspondence. Additionally, your tax documents should clearly indicate your independent contractor status. A South Carolina Carrier Services Contract - Self-Employed Independent Contractor is a strong tool to validate this status.

An independent contractor agreement in South Carolina outlines the working relationship between a client and a self-employed independent contractor. This document specifies the services to be performed, payment terms, and duties involved. It helps protect both parties by clarifying expectations and responsibilities. Using a well-structured South Carolina Carrier Services Contract - Self-Employed Independent Contractor can simplify this process.

An independent service contract is an agreement where one party provides services to another while maintaining independence in performance. This type of contract outlines the scope of work, payment terms, and responsibilities of both parties. Utilizing a South Carolina Carrier Services Contract - Self-Employed Independent Contractor helps in creating a clear framework for such agreements, ensuring that all legal and operational aspects are covered.

Yes, an independent contractor is inherently considered self-employed. This means they operate their own business, set their rates, and handle their taxes. This self-employment status is often formalized through a South Carolina Carrier Services Contract, which clarifies the relationship and expectations with clients.

South Carolina law defines an independent contractor primarily by the level of control they have over their work operations. It ensures that independent contractors, including those under a South Carolina Carrier Services Contract - Self-Employed Independent Contractor, are responsible for their taxes and that they do not receive the same benefits as employees. Familiarizing yourself with these laws is vital to ensure compliance and protect your rights.

Yes, a delivery driver can be classified as an independent contractor in South Carolina, provided they meet specific criteria. They must manage their delivery schedules and expenses independently, reflecting the characteristics of self-employment. Under a South Carolina Carrier Services Contract, this arrangement can benefit both the driver and the company by offering flexibility and streamlined operations.

Independent contractors in South Carolina must meet specific legal requirements, including proper tax classification and compliance with labor laws. You need to maintain control over how you complete your work, distinguishing yourself from employees. A well-structured South Carolina Carrier Services Contract - Self-Employed Independent Contractor outlines these terms and clarifies your responsibilities and rights.

In South Carolina, you can perform a limited amount of contracting work without a license, typically up to $5,000 in total costs for residential projects. However, for larger projects or specific types of work, obtaining a license is recommended. Understanding these limits is crucial as an independent contractor under a South Carolina Carrier Services Contract. Be sure to check local regulations, as they may vary across different jurisdictions.

Attracting clients for your courier business requires a mix of marketing and relationship-building. Leverage social media, local community boards, and word-of-mouth referrals to promote your services. A South Carolina Carrier Services Contract - Self-Employed Independent Contractor can enhance your reputation and instill confidence in potential clients, helping you close more deals.