South Carolina Accredited Investor Suitability

Description

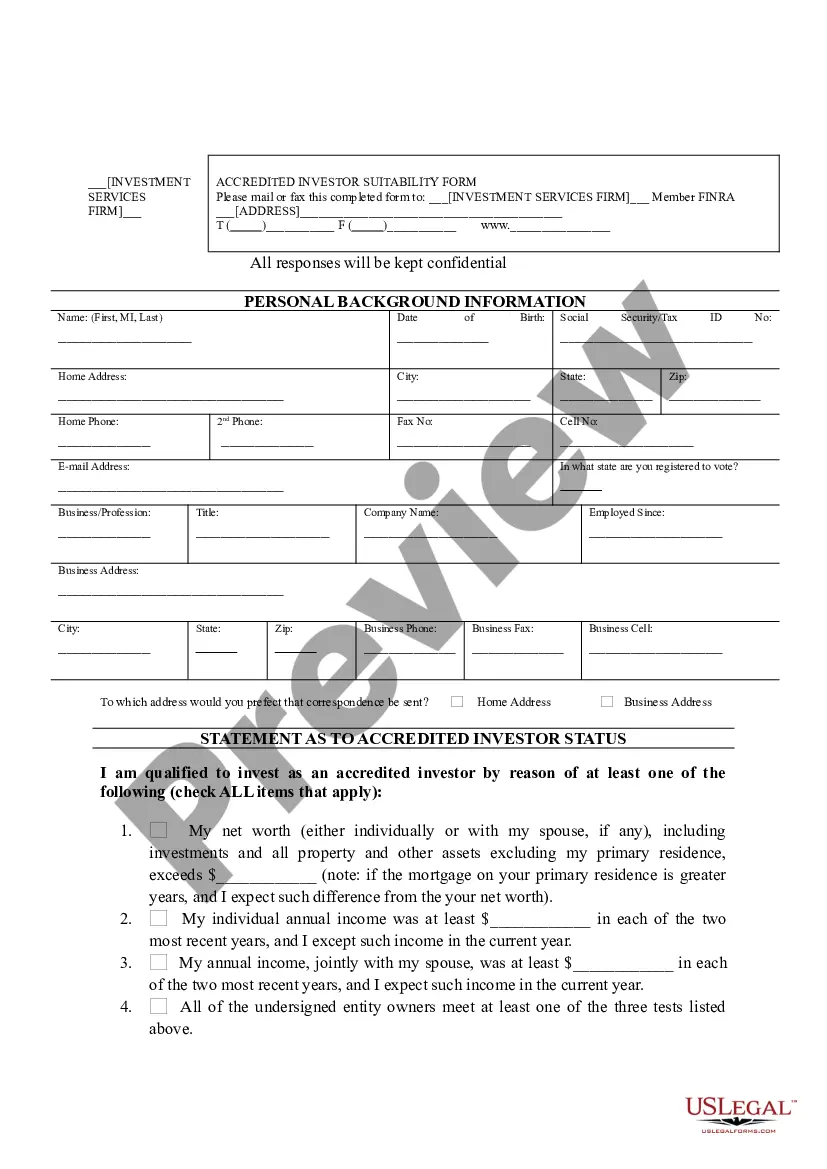

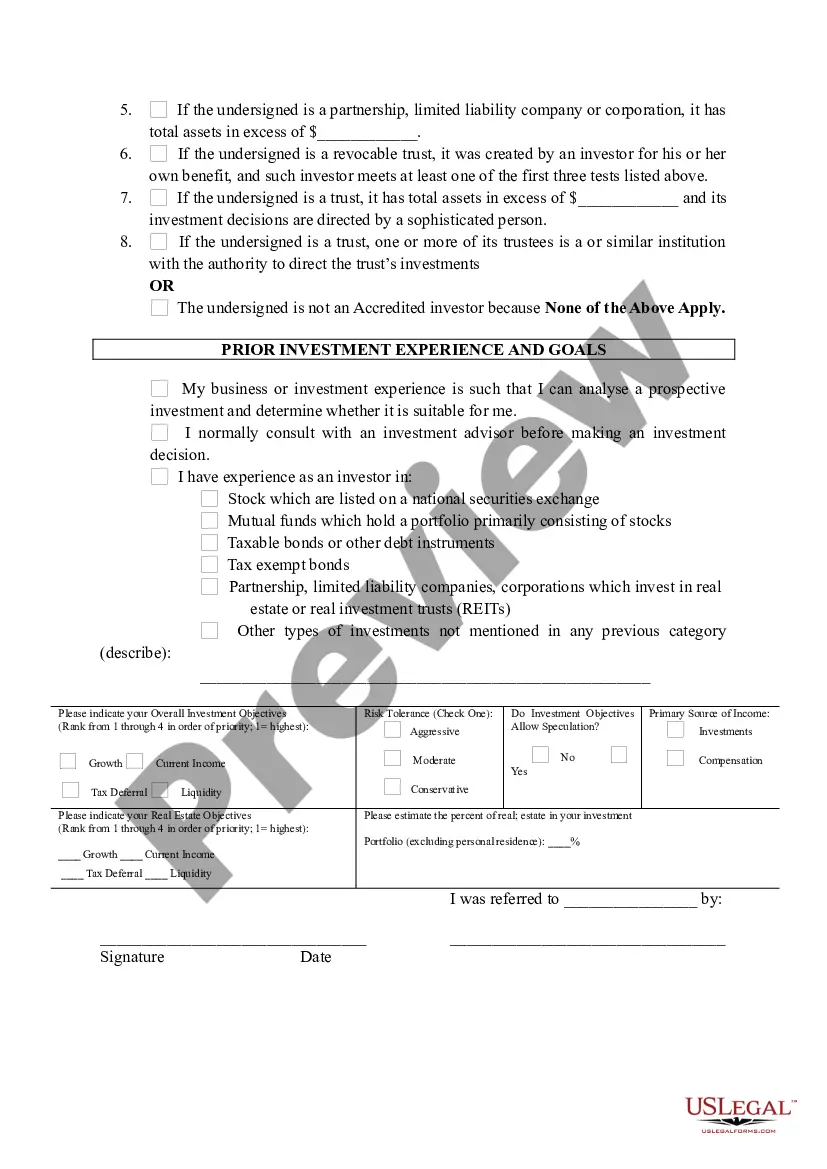

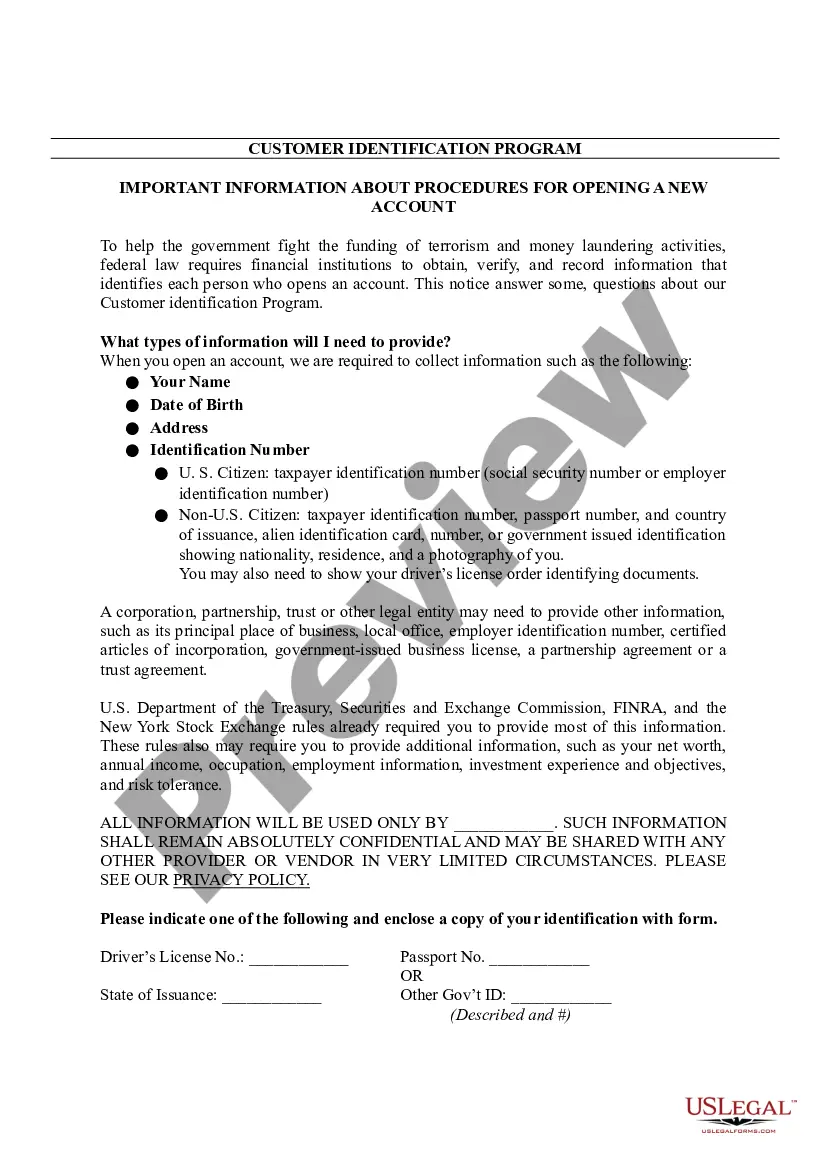

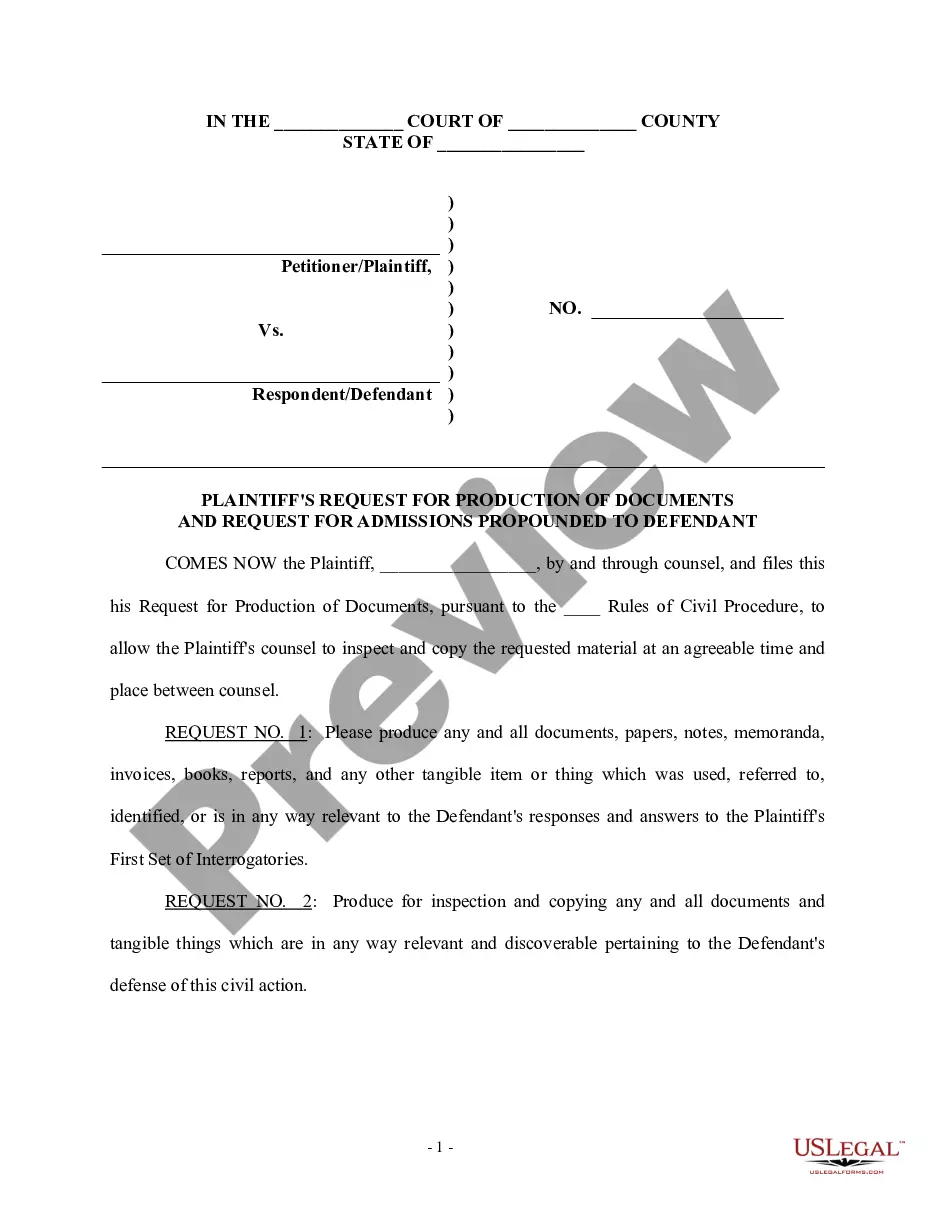

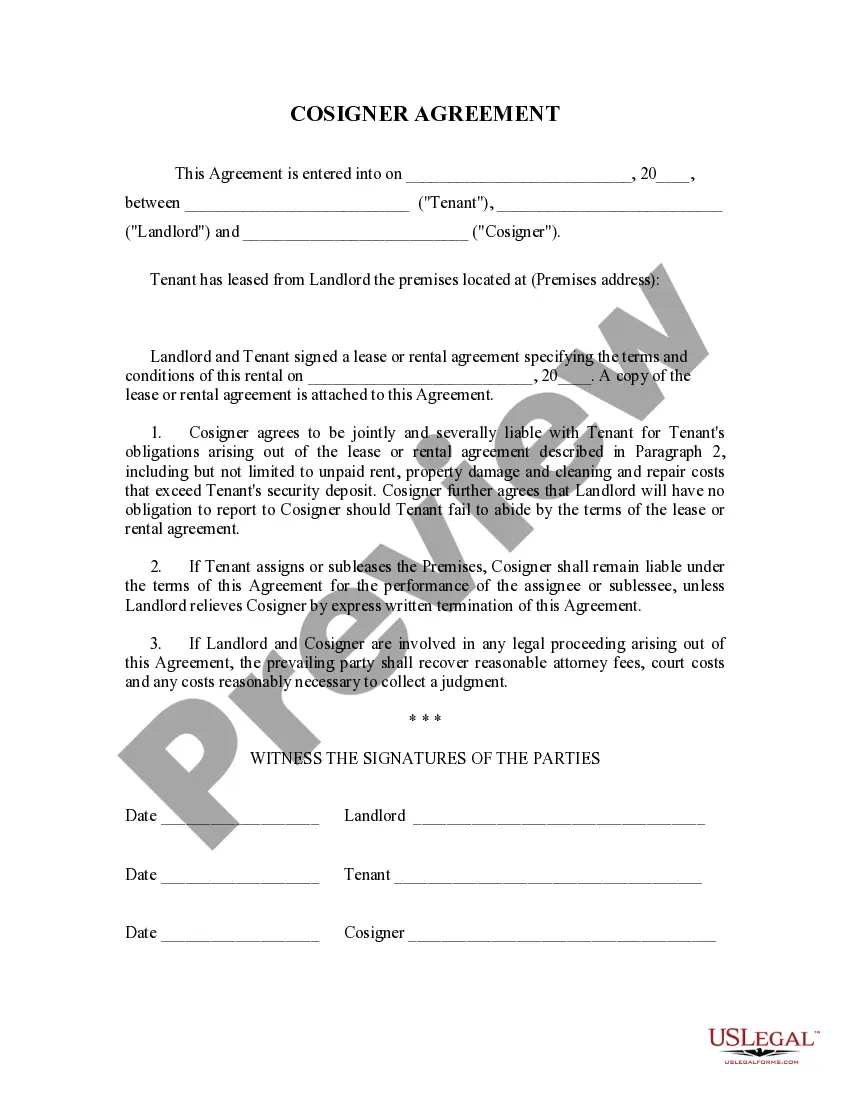

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

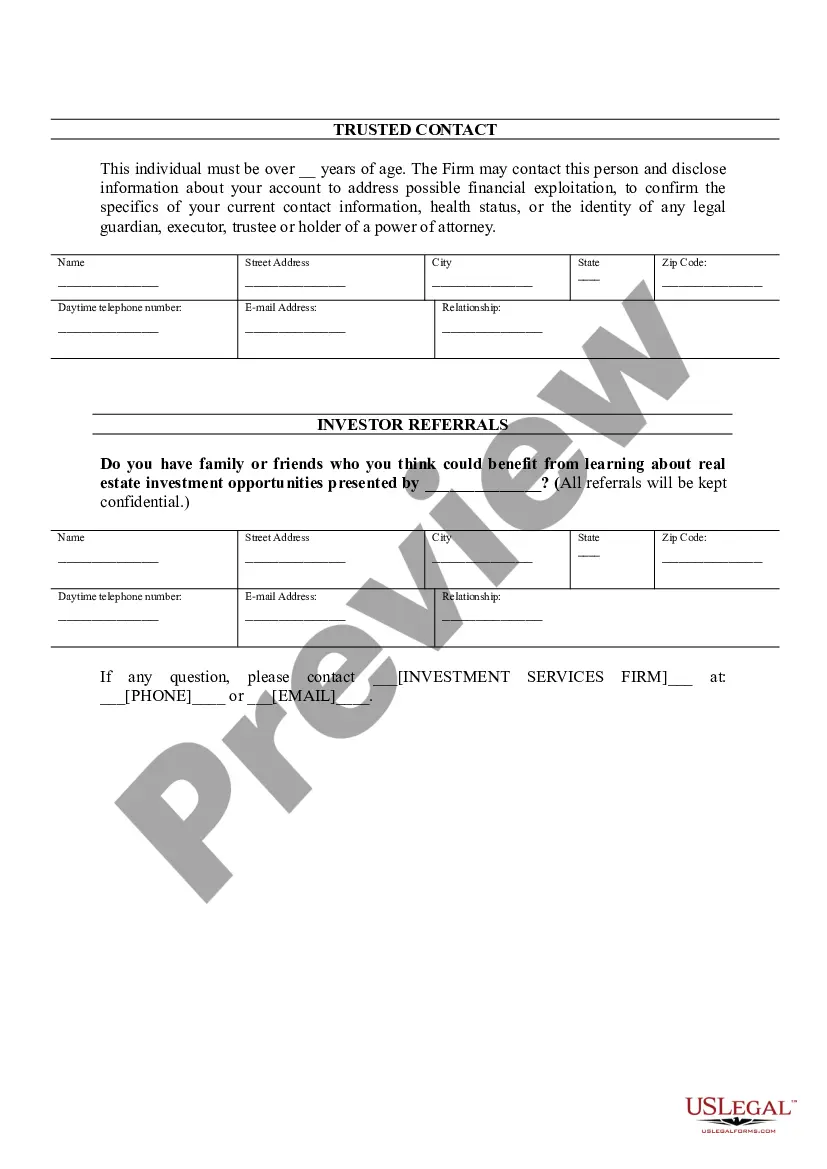

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

US Legal Forms - one of the largest libraries of authorized types in the USA - gives an array of authorized file templates it is possible to down load or printing. Making use of the internet site, you may get thousands of types for organization and individual functions, categorized by types, claims, or keywords and phrases.You will find the newest variations of types much like the South Carolina Accredited Investor Suitability within minutes.

If you have a membership, log in and down load South Carolina Accredited Investor Suitability from the US Legal Forms library. The Obtain option can look on each and every kind you look at. You get access to all earlier downloaded types within the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, allow me to share simple instructions to obtain began:

- Make sure you have picked out the best kind for the metropolis/county. Go through the Preview option to examine the form`s information. See the kind information to actually have chosen the proper kind.

- When the kind doesn`t match your needs, utilize the Lookup discipline on top of the screen to discover the the one that does.

- Should you be happy with the shape, validate your selection by simply clicking the Buy now option. Then, choose the rates prepare you favor and supply your qualifications to sign up on an accounts.

- Approach the financial transaction. Make use of your credit card or PayPal accounts to complete the financial transaction.

- Choose the format and down load the shape on your gadget.

- Make adjustments. Complete, modify and printing and sign the downloaded South Carolina Accredited Investor Suitability.

Each design you included with your bank account does not have an expiry day and is yours permanently. So, if you would like down load or printing an additional backup, just visit the My Forms portion and click on in the kind you will need.

Obtain access to the South Carolina Accredited Investor Suitability with US Legal Forms, probably the most considerable library of authorized file templates. Use thousands of specialist and express-certain templates that satisfy your small business or individual requirements and needs.

Form popularity

FAQ

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

An accredited investor is a person or entity that is allowed to participate in investments not registered with the SEC. These are typically high-net-worth individuals and companies with the means and experience to trade private, riskier investments.

Accredited Investor Requirements Qualifying as an accredited investor is dependent on individual investors possessing at least one of the following: Net worth: A net worth exceeding $1 million, excluding the value of the primary residence, either individually or jointly with a spouse.

Both are designations of investors that are permitted to invest in non-public investments. The difference between the two is that accredited investors must meet certain income, net worth or securities licensing criteria, while a qualified purchaser must simply have more than $5 million to make a large investment.

For most cases, an Accredited Investor is an individual whose income is over $200,000/year (for single persons) or $300,000/year (for married couples) or has a net worth over $1,000,000 not including equity in their principal residence.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.