South Carolina Statement of Financial Affairs - Form 7

Description

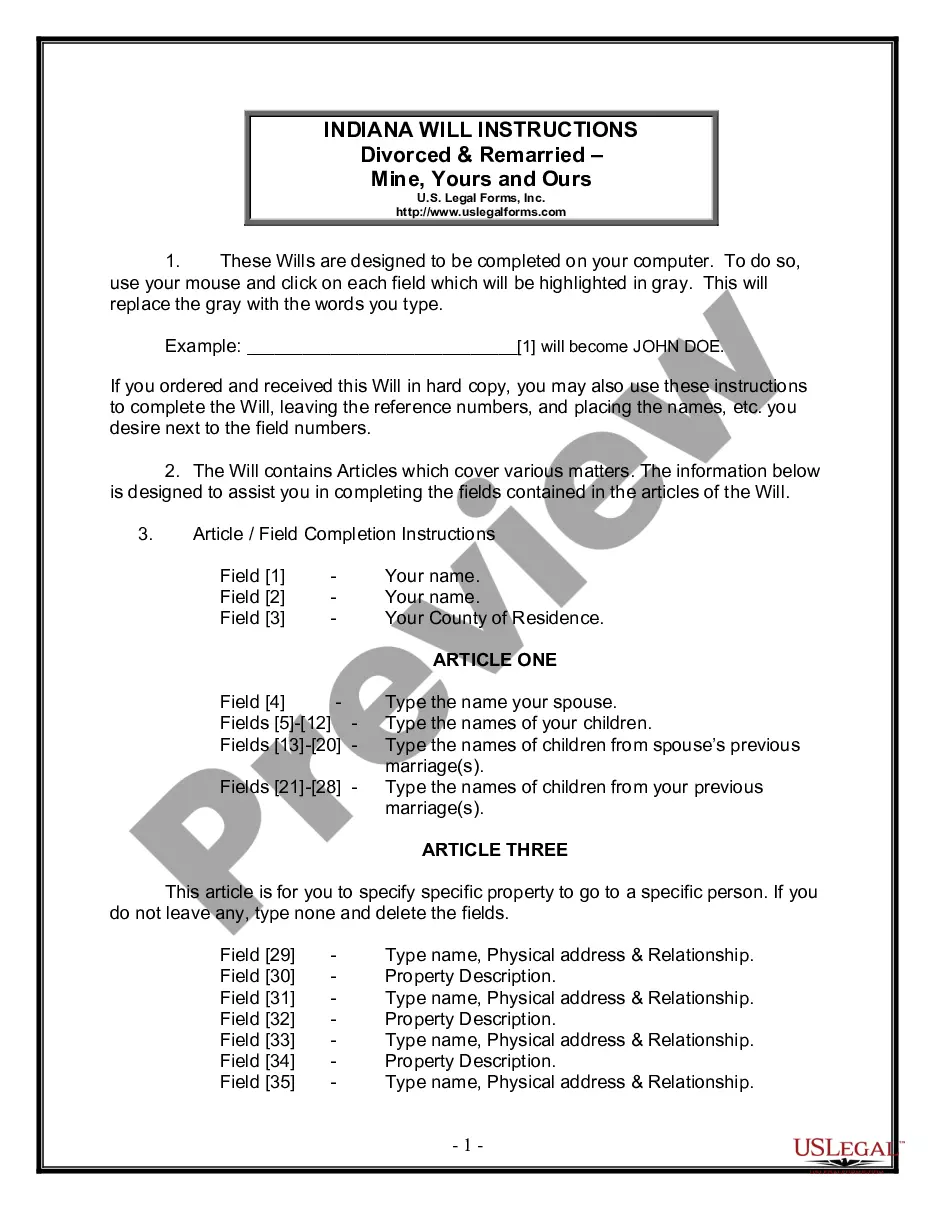

How to fill out Statement Of Financial Affairs - Form 7?

US Legal Forms - one of the most significant libraries of lawful types in the United States - offers a wide array of lawful file web templates it is possible to obtain or print. Utilizing the web site, you will get 1000s of types for organization and personal reasons, sorted by classes, says, or keywords and phrases.You can get the most up-to-date models of types such as the South Carolina Statement of Financial Affairs - Form 7 within minutes.

If you currently have a registration, log in and obtain South Carolina Statement of Financial Affairs - Form 7 from the US Legal Forms library. The Download button will show up on each and every type you look at. You get access to all previously saved types inside the My Forms tab of the account.

If you want to use US Legal Forms for the first time, listed below are easy guidelines to get you started:

- Be sure you have chosen the right type for the city/county. Click the Review button to review the form`s articles. Look at the type information to actually have selected the appropriate type.

- If the type doesn`t suit your specifications, take advantage of the Search area towards the top of the display screen to get the the one that does.

- When you are content with the shape, verify your choice by simply clicking the Get now button. Then, opt for the pricing prepare you like and offer your qualifications to sign up to have an account.

- Method the transaction. Make use of your charge card or PayPal account to complete the transaction.

- Select the structure and obtain the shape on your own device.

- Make modifications. Load, edit and print and indication the saved South Carolina Statement of Financial Affairs - Form 7.

Each format you included in your account lacks an expiry particular date and is yours forever. So, if you want to obtain or print yet another backup, just proceed to the My Forms portion and click in the type you want.

Obtain access to the South Carolina Statement of Financial Affairs - Form 7 with US Legal Forms, by far the most substantial library of lawful file web templates. Use 1000s of professional and express-distinct web templates that satisfy your business or personal needs and specifications.

Form popularity

FAQ

The increase may not change your circumstances since a Chapter 7 bankruptcy is based on your financial circumstances at the time of your filing. A trustee may not have any right to new income you earned after you file.

Filing for bankruptcy can be a challenging experience, but it's also an opportunity for a fresh financial start. The road to financial recovery after bankruptcy is about establishing healthy spending habits and rebuilding your credit. As you move forward, focus on budgeting, saving, and avoiding debt whenever possible.

You should not spend any money or dispose of any assets you own when you file your Chapter 7 bankruptcy case. Without court approval, the Chapter 7 Trustee can force the recipient to return the money or property. However, the income you receive after filing your case is yours to use.

The statement of financial affairs (SOFA) is intended to capture a historical view of the debtor's finances. Once completed, the SOFA provides creditors with a summary of the debtor's financial history, transactions, and operations over certain periods of time before the petition date.

The U.S. bankruptcy code doesn't specify a minimum dollar amount someone must owe to make them eligible for a qualified filing. In short, any debt is enough debt. More important than the size of your debt is the size of your income. How much money you earn affects whether you qualify for Chapter 7.

Two things happen immediately once you file for bankruptcy: you're assigned a trustee, and actions by creditors against you immediately (though temporarily in some cases) stop.

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

However, there are certain restrictions and limitations on what you can and cannot do after filing for Chapter 7 bankruptcy. Avoid Spending Outside Your Income Levels. ... You Cannot Neglect Your Alimony & Child Support Obligations After Chapter 7. ... You Cannot Ignore Student Loans. ... You Cannot Eliminate Most Tax Debt.