South Carolina Waiver of the Right to be Spouse's Beneficiary

Description

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

Are you in a situation where you require documents for potential business or specific tasks almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust is not simple.

US Legal Forms offers thousands of form templates, including the South Carolina Waiver of the Right to be Spouse's Beneficiary, which are designed to comply with federal and state regulations.

Once you find the right form, click on Buy now.

Select the pricing plan you prefer, enter the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the South Carolina Waiver of the Right to be Spouse's Beneficiary template.

- If you do not have an account and want to begin using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it's for the correct city/area.

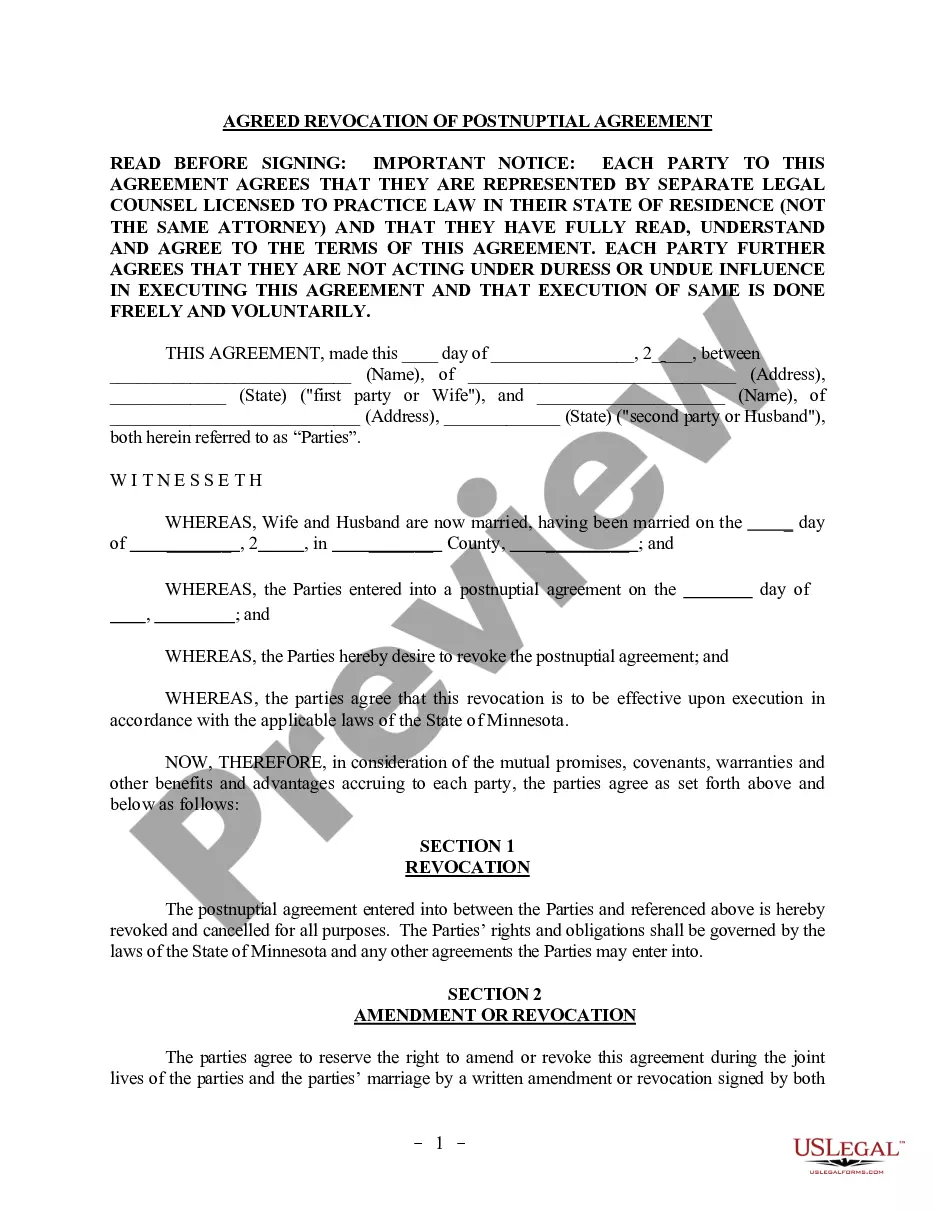

- Utilize the Preview button to review the form.

- Check the information to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to search for the form that fits your needs.

Form popularity

FAQ

Regardless of whether you are engaged or how long your relationship may have been, they would not be considered your spouse legally and therefore would only inherit if you named them in a will.

If you live in South Carolina and die without a valid will and have only a surviving spouse (but no children), your spouse gets everything. If you have children and you die intestate in South Carolina, your spouse inherits half of your estate while your children get the other half evenly.

Family members, including spouses, are generally not responsible for paying off the debts of their deceased relatives. That includes credit card debts, student loans, car loans, mortgages and business loans. Instead, any outstanding debts would be paid out from the deceased person's estate.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

In most cases you will not be responsible to pay off your deceased spouse's debts. As a general rule, no one else is obligated to pay the debt of a person who has died. There are some exceptions and the exceptions vary by state.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

While you can disinherit your children, in South Carolina you cannot completely disinherit your spouse. This is to protect the surviving spouse from being left destitute and a burden on the state.

When real estate is not held jointly, and someone dies, it must generally pass through their estate. If the deceased had a will, the will would dictate the distribution of their estate to beneficiaries (presumably your mother, in your father's case).

What debt is forgiven when you die? Most debts have to be paid through your estate in the event of death. However, federal student loan debts and some private student loan debts may be forgiven if the primary borrower dies.

Spousal Inheritance Laws in South Carolina A surviving spouse is entitled to the elective share, or one-third of the decedent's estate by law.