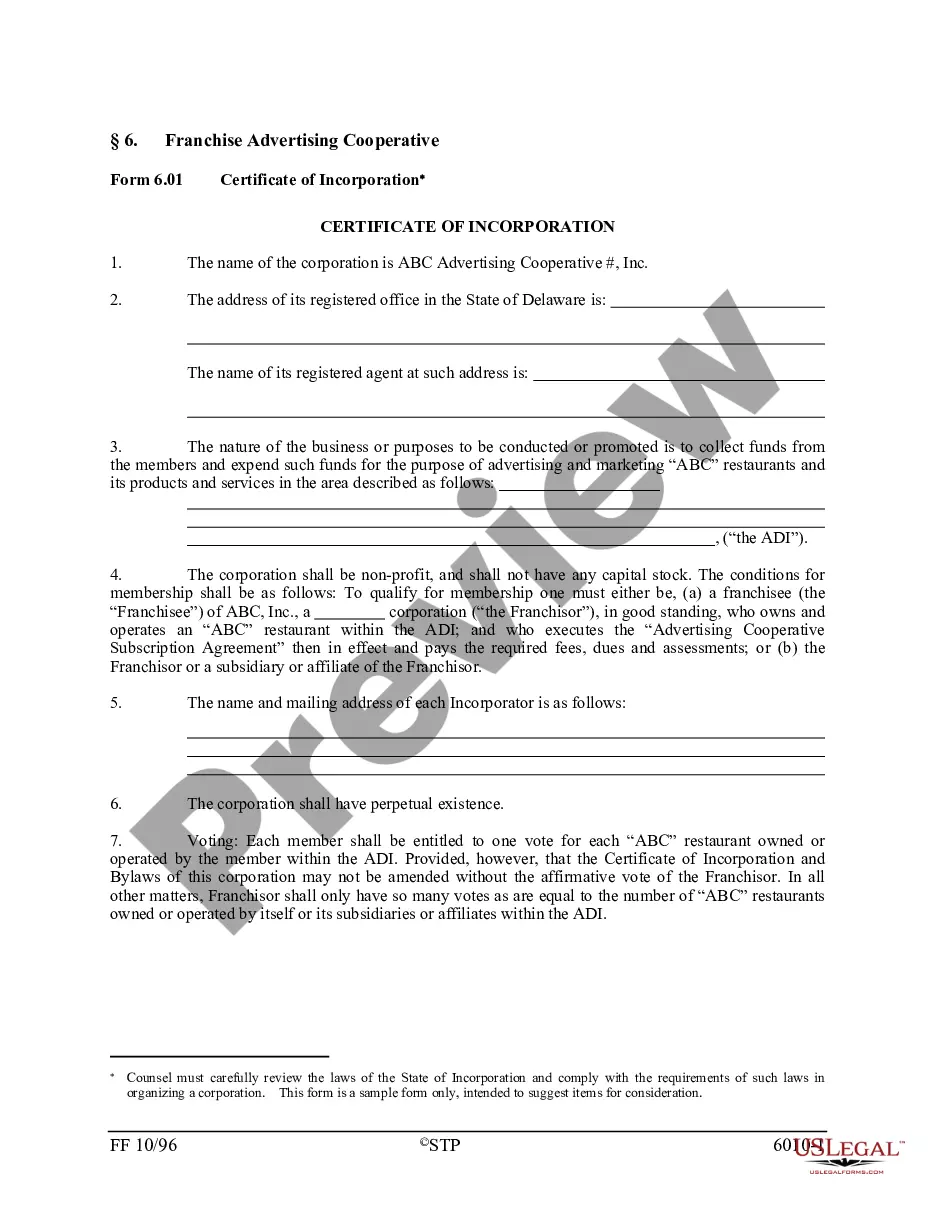

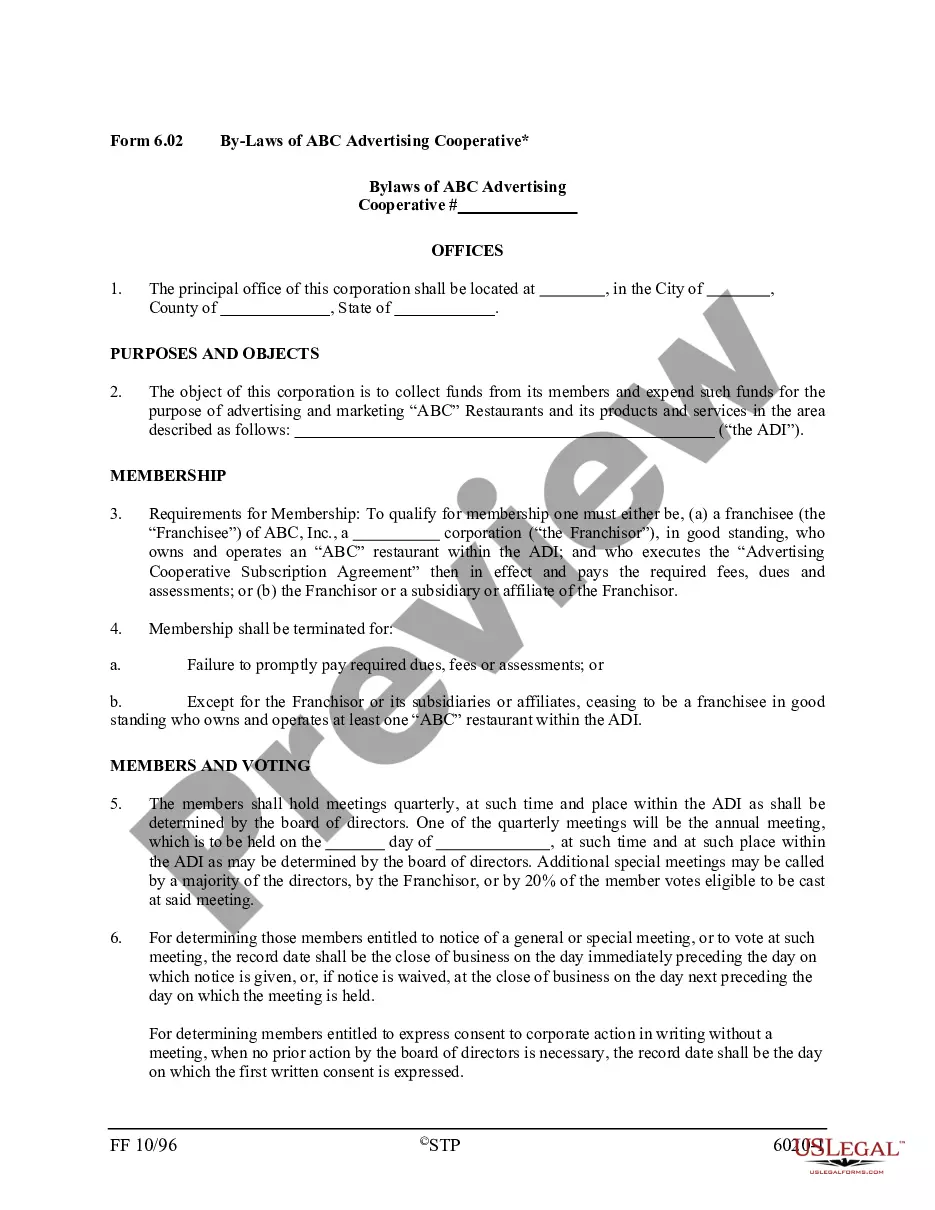

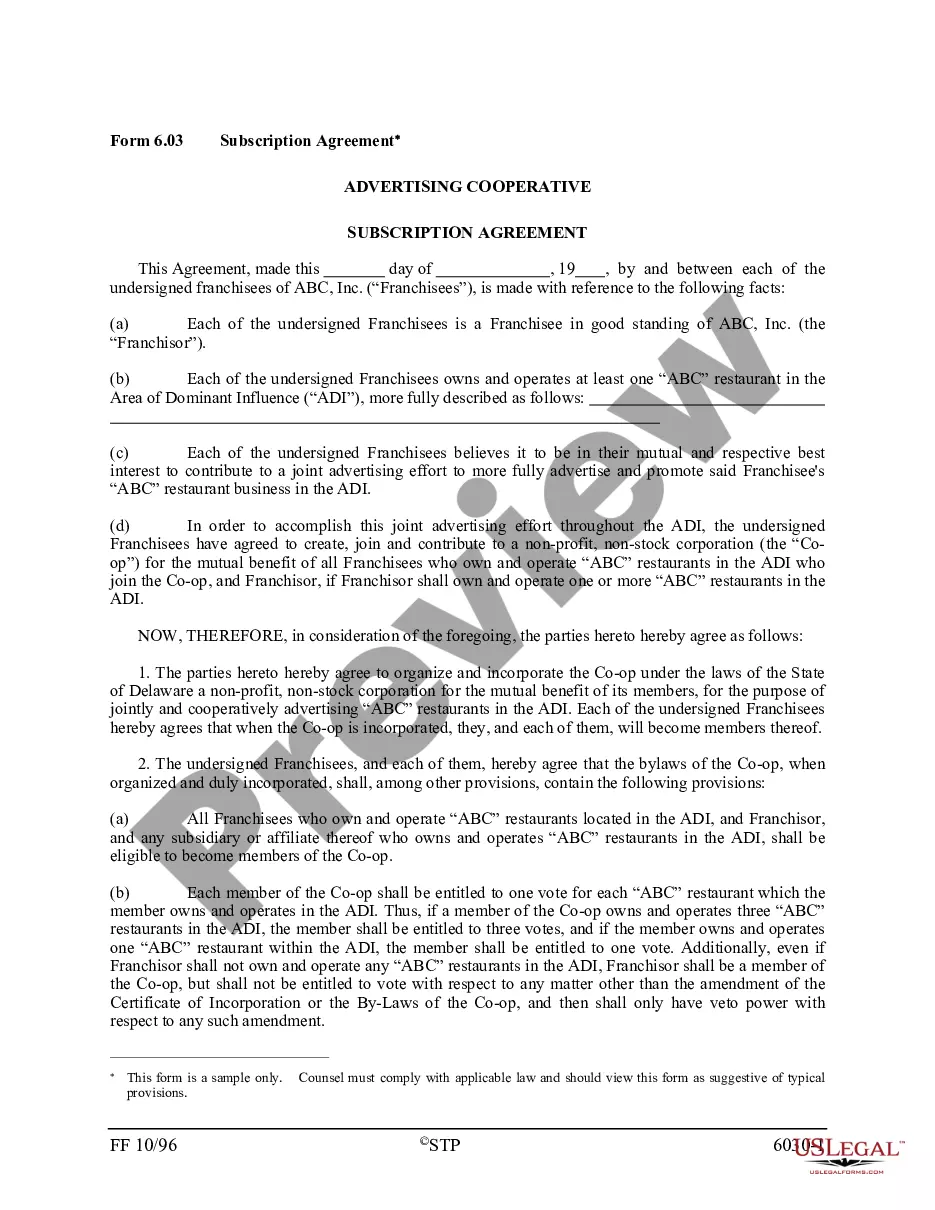

South Carolina Certificate of Incorporation for a Franchise Advertising Cooperative

Description

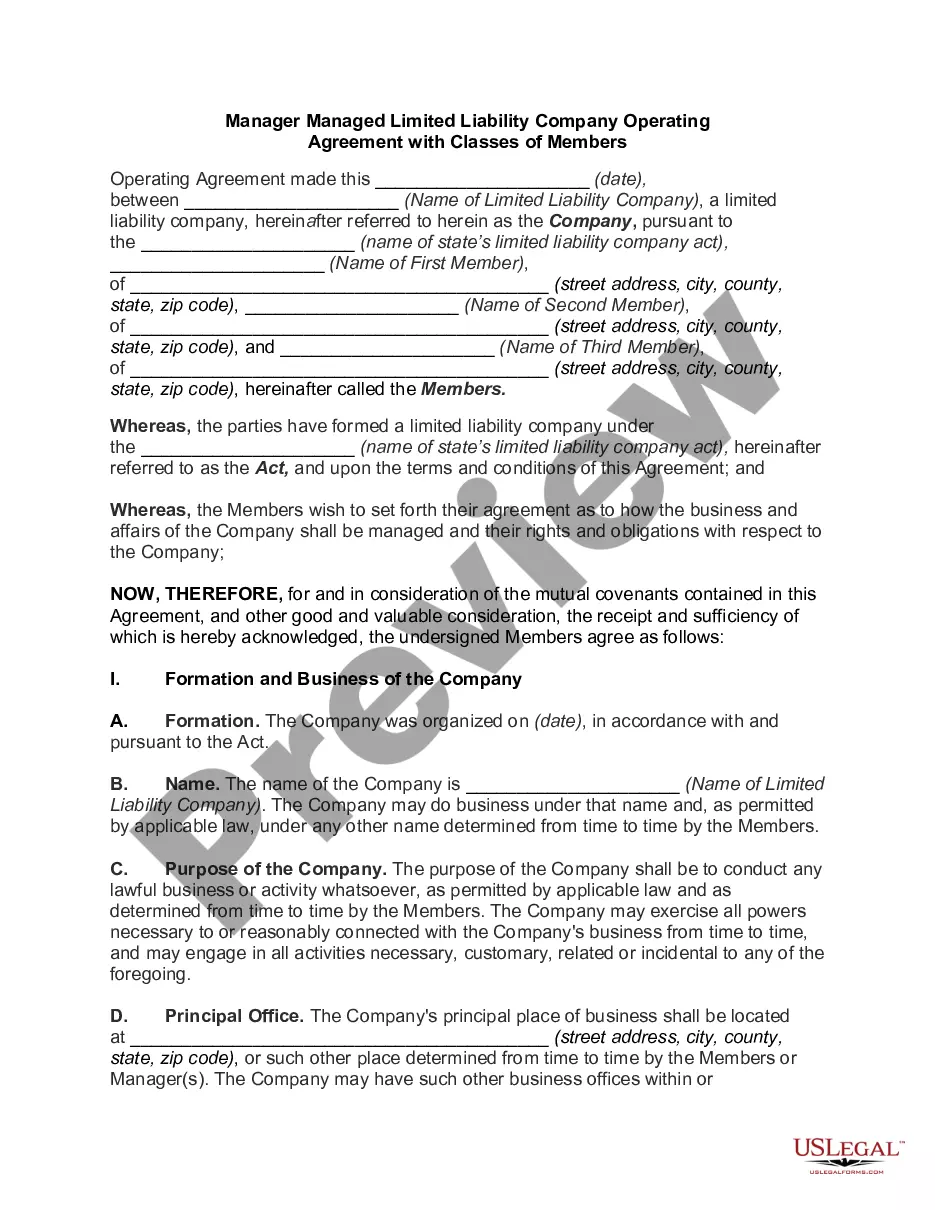

How to fill out Certificate Of Incorporation For A Franchise Advertising Cooperative?

You may invest time on the Internet looking for the legal papers format that fits the state and federal specifications you will need. US Legal Forms offers a huge number of legal types which are analyzed by professionals. It is possible to download or print out the South Carolina Certificate of Incorporation for a Franchise Advertising Cooperative from the assistance.

If you have a US Legal Forms bank account, you are able to log in and click the Acquire option. Following that, you are able to comprehensive, modify, print out, or sign the South Carolina Certificate of Incorporation for a Franchise Advertising Cooperative. Every single legal papers format you purchase is yours forever. To acquire an additional backup associated with a purchased type, visit the My Forms tab and click the related option.

Should you use the US Legal Forms internet site for the first time, stick to the simple recommendations under:

- Initial, make certain you have selected the proper papers format for your state/area of your choice. Browse the type description to make sure you have chosen the correct type. If available, use the Review option to check with the papers format too.

- If you wish to get an additional model of the type, use the Look for discipline to find the format that fits your needs and specifications.

- Upon having found the format you need, just click Buy now to carry on.

- Find the prices strategy you need, type in your qualifications, and register for your account on US Legal Forms.

- Complete the transaction. You may use your bank card or PayPal bank account to purchase the legal type.

- Find the formatting of the papers and download it to your gadget.

- Make adjustments to your papers if possible. You may comprehensive, modify and sign and print out South Carolina Certificate of Incorporation for a Franchise Advertising Cooperative.

Acquire and print out a huge number of papers web templates utilizing the US Legal Forms web site, that provides the biggest collection of legal types. Use skilled and condition-particular web templates to handle your business or personal requirements.

Form popularity

FAQ

Although South Carolina is not a franchise registration state, it has enacted Business Opportunity Laws that, if triggered, require the filing of a notice and, potentially, the registering of your franchise offering as a business opportunity.

South Carolina LLC Costs - Summary LLC Filing fee$110Registered agent (optional)$199 ? $400Reserve business name (optional)$25Filing a DBA (optional)$10 for limited partnerships No cost (and no filing requirement) for all other types of businessesOperating agreement (optional)$0 to $1,0001 more row

An attorney licensed to practice law in South Carolina must sign articles of incorporation for a business corporation. Articles of incorporation for a business corporation must be accompanied by a Cl-1 form.

South Carolina does not require LLCs to file an annual report. Taxes. For complete details on state taxes for South Carolina LLCs, visit Business Owner's Toolkit or the State of South Carolina . Federal tax identification number (EIN).

CL-1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue. $25.00.

By default, South Carolina LLCs are taxed as pass-through entities, meaning the business does not pay any sort of LLC income tax. Instead, the member or members of the LLC pays for the LLC's losses and revenue on their personal income taxes and pay the state's graduated income tax rate ranging from 0% to 7%.