South Carolina Sales Prospect File

Description

How to fill out Sales Prospect File?

Are you currently in a location where you need documentation for either business or personal purposes almost every day.

There is an abundance of legal document templates available online, but finding forms you can trust is quite challenging.

US Legal Forms offers thousands of document templates, including the South Carolina Sales Prospect Document, which are designed to comply with federal and state regulations.

Choose a suitable document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the South Carolina Sales Prospect Document at any time, if necessary. Simply click the desired form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you're already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the South Carolina Sales Prospect Document.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is appropriate for the correct city/state.

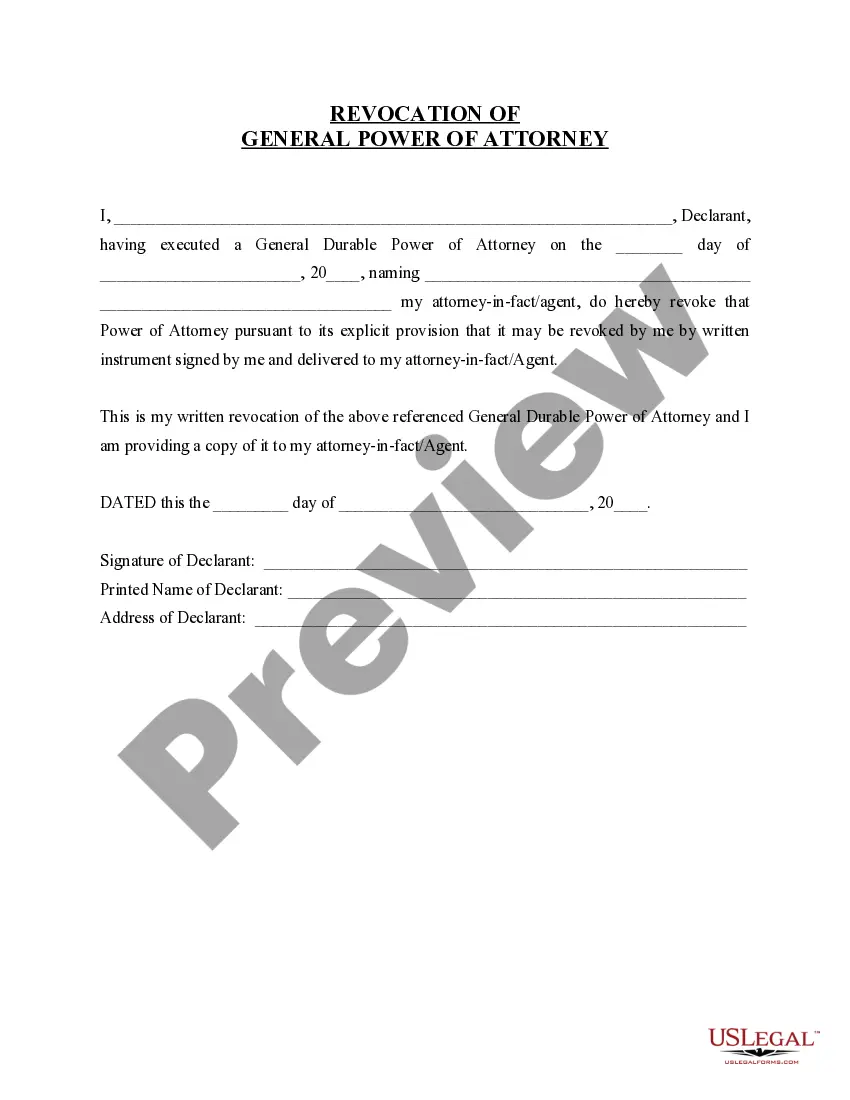

- Use the Preview button to examine the form.

- Check the description to verify you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that suits your needs and specifications.

- Once you find the right form, click Get now.

- Select the subscription plan you prefer, complete the details to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

exempt certificate allows organizations or individuals to make purchases without paying sales tax based on their taxexempt status. In contrast, a resale certificate permits businesses to buy goods without paying sales tax because they intend to resell them. It's crucial to understand these distinctions for proper compliance in South Carolina, and resources from US Legal Forms can help clarify these differences further.

Filling out the ST-3 form in South Carolina involves providing information about your business and the purchases for which you seek a resale exemption. You will need details such as your business name, address, and a description of the items purchased. For guidance and templates, US Legal Forms provides reliable resources to help ensure you complete this form correctly.

Certain entities and categories are exempt from South Carolina sales tax, including nonprofit organizations and government agencies. Additionally, specific goods, such as certain food items and prescription medications, also enjoy exemptions. Understanding these details can significantly benefit your business or personal finances, and platforms like US Legal Forms can offer further clarification and resources.

Yes, South Carolina does have a certificate of need, or CON, process. This requirement aims to control health care costs and promote effective resource allocation. If you plan to open a new facility or expand an existing one, obtaining a CON is essential. You can find guidance and forms related to this process through platforms like US Legal Forms.

A South Carolina sales agreement must include essential information such as the buyer's and seller's names, the legal description of the property, inspection contingencies, and any special terms agreed upon. It is vital to ensure all these details are accurately recorded to safeguard both parties in the transaction. For a comprehensive guide to these requirements, the South Carolina Sales Prospect File by US Legal Forms serves as an excellent resource.

The form C-278 in South Carolina is utilized for declaring the property's compliance with the state's disclosure requirements. This form is crucial for protecting both buyers and sellers by providing transparency about the property's condition and history. For guidance on completing this form correctly, consider utilizing the South Carolina Sales Prospect File available through US Legal Forms.

In the South Carolina residential sales contract, it is essential to clearly specify the property being sold. This includes the legal description of the property, the address, and any fixtures or appliances that are included in the sale. Additionally, a detailed description helps avoid misunderstandings between the buyer and seller. For more resources and templates, consider exploring the South Carolina Sales Prospect File offered by US Legal Forms.

Filling out the ST3 form requires you to provide your business details, explain the nature of your exemption, and list the purchases that qualify. The South Carolina Sales Prospect File offers guidance on how to accurately complete this form, ensuring you meet all necessary criteria for your sales tax exemption.

Calculating sales tax in South Carolina involves multiplying the taxable sale amount by the applicable sales tax rate, which may vary by location. With the South Carolina Sales Prospect File, you can easily find the correct rates for different regions, simplifying this essential process.

To calculate sales tax from a total, first determine the original amount before tax, then multiply it by the sales tax rate. For those using the South Carolina Sales Prospect File, this calculation becomes straightforward, giving you quick access to tools that help in accurate budgeting.