South Carolina Trademark Security Agreement

Description

How to fill out Trademark Security Agreement?

Are you in a situation where you require documents for potential organizational or personal purposes almost daily.

There is a plethora of valid document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers a wide variety of form templates, including the South Carolina Trademark Security Agreement, which can be tailored to meet federal and state requirements.

You can find all the document templates you've acquired in the My documents menu.

You can obtain an additional copy of the South Carolina Trademark Security Agreement anytime, if needed. Just click the relevant form to download or print the document template.

- If you’re already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Trademark Security Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and verify it is for the correct city/state.

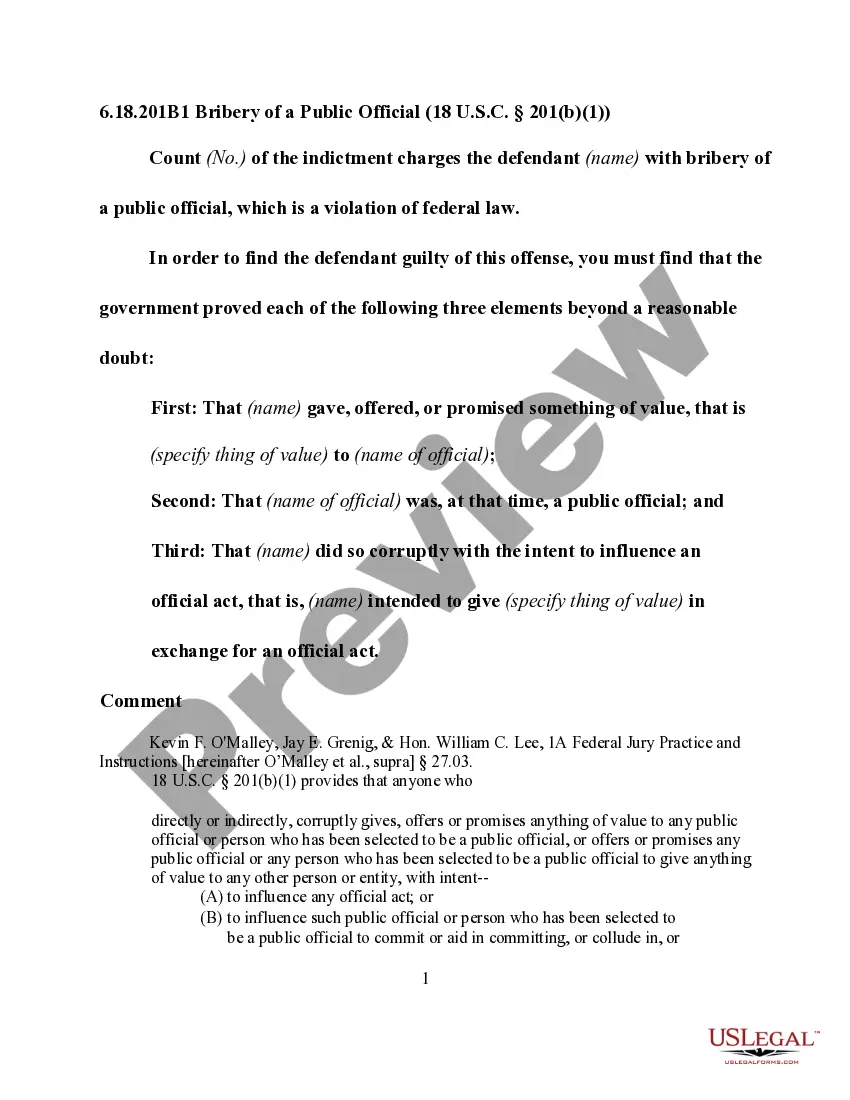

- Utilize the Preview button to check the form.

- Examine the details to make sure you have selected the right form.

- If the form isn't what you need, use the Lookup section to find the form that matches your requirements.

- When you find the correct form, click Purchase now.

- Choose the payment plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

A secured promissory note may include a security agreement as part of its terms. If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property. A security agreement mitigates the default risk faced by the lender.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.

Security agreements can be used to specify a collateral that is already in possession of the debtor, an intangible collateral or an after-acquired property.

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender.

A SECURITY AGREEMENT is an agreement that. creates or provides for an interest in personal property. that secures payment or performance of an obligation.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

Often, secured parties use UCC-1 financing statement forms to achieve perfection of security interest outlined in a security agreement. Prepared and signed by both parties, this form includes the following information: The debtor's name (either the name of an organization or an individual taking on debt).