A profit-sharing plan is a defined-contribution plan established and maintained by an employer to provide for the participation in profits by employees and their beneficiaries. The plan must provide a definite predetermined formula for allocating the contributions made to the plan among the participants and for distributing the funds accumulated under the plan.

South Carolina Profit-Sharing Plan and Trust Agreement

Description

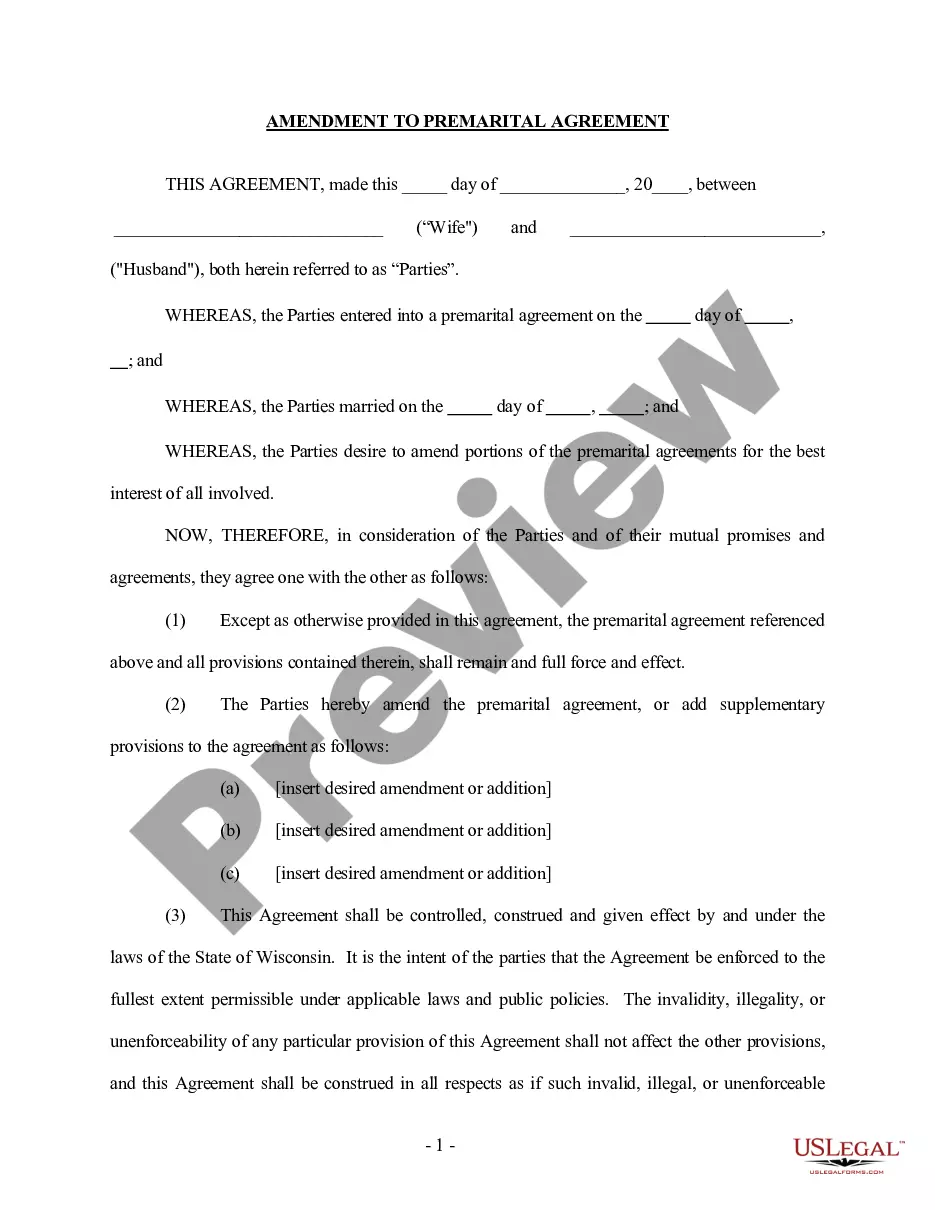

How to fill out Profit-Sharing Plan And Trust Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can obtain or create.

By using the website, you can access thousands of forms for business and personal applications, organized by categories, states, or keywords. You can find the latest versions of documents such as the South Carolina Profit-Sharing Plan and Trust Agreement within moments.

If you already hold a monthly subscription, Log In to access and obtain the South Carolina Profit-Sharing Plan and Trust Agreement from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Select the file format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded South Carolina Profit-Sharing Plan and Trust Agreement. Every template you saved in your account does not expire and is yours for as long as you need. Therefore, if you want to download or create another copy, just revisit the My documents section and click on the form you require.

- To use US Legal Forms for the first time, here are a few straightforward steps to get you started.

- Ensure you have selected the correct form for your area/county.

- Click the Preview button to review the content of the form.

- Check the description of the form to confirm that you have chosen the correct one.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Trusts in South Carolina are generally taxed as separate entities, so the trust must file its own income tax return using IRS Form 1041. Income generated by the trust is taxable at the trust level unless distributed to beneficiaries, who then report that income. A well-structured South Carolina Profit-Sharing Plan and Trust Agreement can guide you through the complexities of trust taxation and compliance.

In South Carolina, a trust does not require recording to be valid; however, you may want to keep it secure and accessible for beneficiaries. Many people choose to create a South Carolina Profit-Sharing Plan and Trust Agreement to ensure clarity about asset distribution and management. Keeping the document accessible is crucial for its effectiveness.

Establishing a trust in South Carolina comes with various benefits, such as avoiding probate, providing asset protection, and ensuring your wishes are respected after your passing. A South Carolina Profit-Sharing Plan and Trust Agreement also enables you to manage funds effectively and offers flexibility in distributing assets to beneficiaries. Overall, trusts can provide peace of mind and financial security.

In a trust, taxable income generally includes interest, dividends, rental income, and capital gains. However, some distributions to beneficiaries may be taxable to them rather than the trust itself. A carefully drafted South Carolina Profit-Sharing Plan and Trust Agreement helps to clarify what income is taxable and ensures compliance with tax regulations.

To file income from a trust, you must report the trust's income on the appropriate tax forms, typically IRS Form 1041 for estates and trusts. If you are a beneficiary receiving distributions, you will report the income on your personal tax return. Utilizing a South Carolina Profit-Sharing Plan and Trust Agreement can simplify reporting and ensure compliance with tax obligations.

The trust tax loophole refers to certain provisions in tax law that can allow for tax advantages when establishing trusts. These can include ways to defer taxes or reduce the taxable income of the trust. By setting up a South Carolina Profit-Sharing Plan and Trust Agreement, you may utilize available tax benefits, thus enhancing your financial strategy while complying with state laws.

To file a trust in South Carolina, you first need to create a detailed trust document that outlines the trust's terms and beneficiaries. After drafting the South Carolina Profit-Sharing Plan and Trust Agreement, you must sign it in the presence of a notary public. Finally, while you typically do not need to file the document with a court, it’s a good idea to keep it in a safe place and inform your beneficiaries of its existence.

Yes, profit-sharing plans can be worth the investment for many companies. By adopting the South Carolina Profit-Sharing Plan and Trust Agreement, businesses can enhance employee engagement and drive overall productivity. While there are challenges, the long-term benefits of fostering a shared interest in company success can outweigh the drawbacks.

A significant issue with profit-sharing plans is the potential unpredictability of contributions based on company profits. In years of low profitability, employees may receive little or no distribution, which can impact morale negatively. Understanding this fluctuation is crucial when considering the South Carolina Profit-Sharing Plan and Trust Agreement.

To establish a profit-sharing plan, you should start by defining the plan's objectives and eligibility criteria. Once you align your goals with the South Carolina Profit-Sharing Plan and Trust Agreement, you can draft plan documents, choose a trustee, and communicate the plan details to your employees. Utilizing platforms like uslegalforms can help simplify these steps and ensure compliance.