South Carolina Checklist - Key Employee Life Insurance

Description

Key-person insurance benefits are often used to buy out the insured person's shares or interest in the company. Buy-sell agreements, which require the deceased executive's estate to sell its stock to the remaining shareholders, legally facilitate this process. Proceeds from key-person insurance can also be used to recruit replacement management.

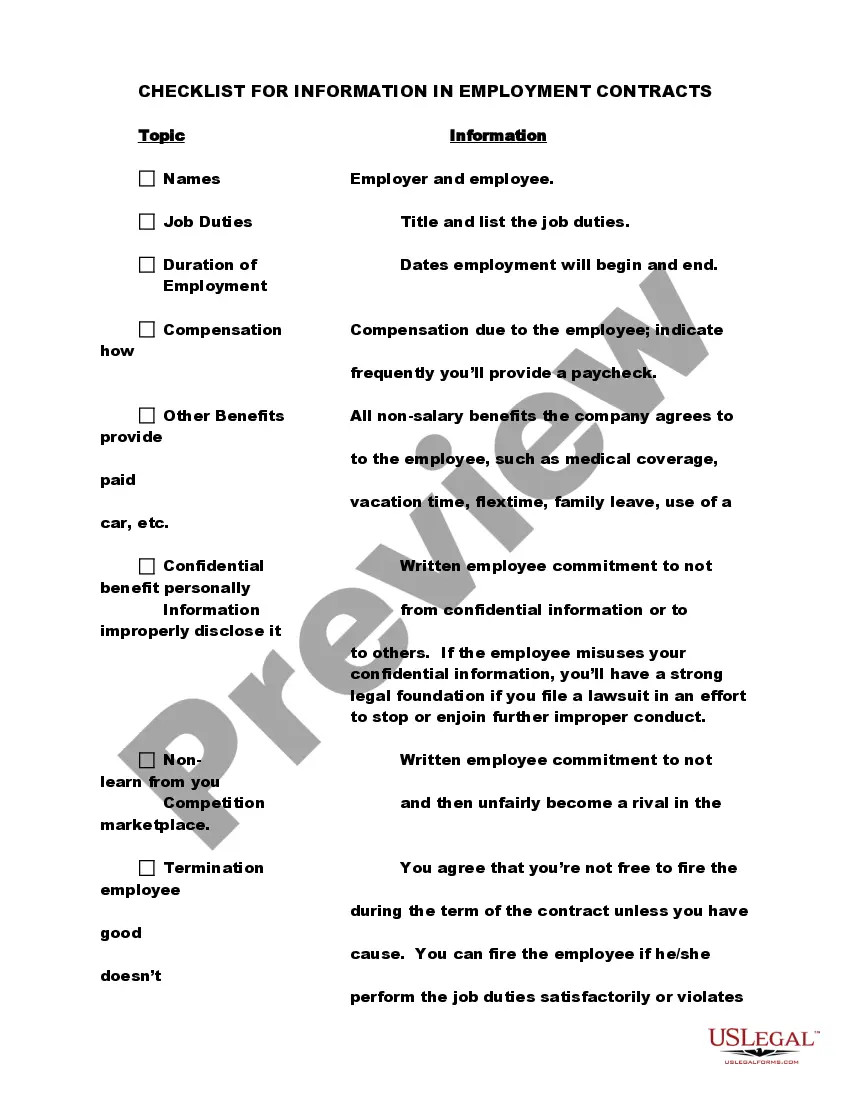

The following form contains some critical questions you should ask your agent or broker when considering this type of insurance.

How to fill out Checklist - Key Employee Life Insurance?

Are you presently in a scenario where you need documentation for various business or personal purposes on a regular basis.

There are numerous legal document templates accessible online, but finding versions you can rely on isn't easy.

US Legal Forms offers thousands of template documents, including the South Carolina Checklist - Key Employee Life Insurance, designed to meet state and federal regulations.

Choose a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents section. You can download another copy of the South Carolina Checklist - Key Employee Life Insurance at any time if required. Simply click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Checklist - Key Employee Life Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/region.

- Use the Preview button to review the document.

- Check the details to confirm that you have selected the right form.

- If the form isn’t what you need, use the Search field to locate the form that fits your requirements.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

Key employee life insurance premiums can often be deducted as business expenses in certain cases. However, it's important to grasp that the tax treatment can vary depending on the nature of the policy and business structure. While premiums may be deductible, the death benefit typically is not taxable to the company. To make informed choices, use our South Carolina Checklist - Key Employee Life Insurance for guidance on deductions and tax implications.

Yes, a business can take out life insurance on an employee, particularly if that employee plays a critical role in the operations. This type of insurance is known as key person insurance and protects a company's financial interests in case of an unexpected loss. It’s essential, however, to obtain consent from the employee before proceeding, ensuring ethical compliance and transparency. Explore the South Carolina Checklist - Key Employee Life Insurance to navigate the necessary steps in this process.

A business might choose key person life insurance to protect itself against financial losses. When a key employee, essential to the business, passes away unexpectedly, the policy can provide funds to cover lost revenue and assist in hiring or training a replacement. This security allows businesses to maintain stability during difficult times. Consider using our South Carolina Checklist - Key Employee Life Insurance to better understand how this insurance can benefit you.

Key employee life insurance is a policy designed to protect a business against the loss of its essential personnel. In buying this insurance, a business can ensure that funds are available to address immediate challenges after the loss. The South Carolina Checklist - Key Employee Life Insurance emphasizes that this coverage is vital for safeguarding business operations. Utilizing the USLegalForms platform can help simplify the process of obtaining the right insurance tailored to your business needs.

Life insurance is taken out on a key employee to protect a business from sudden financial loss. If a vital team member passes away unexpectedly, the company could face significant challenges. The South Carolina Checklist - Key Employee Life Insurance provides a safety net, enabling businesses to maintain stability and continuity. It allows organizations to cover expenses related to the loss and fund a search for a suitable replacement.

Obtaining Keyman insurance involves several steps. First, assess the key employees who contribute significantly to your business. Next, consult with a reputable insurance provider and refer to the South Carolina Checklist - Key Employee Life Insurance. This checklist can facilitate the conversation about necessary coverage and the details involved in securing a suitable Keyman insurance policy.

There are generally two types of life insurance for key employee indemnification: term life insurance and whole life insurance. Term life offers coverage for a set time, while whole life provides lifelong protection. By consulting the South Carolina Checklist - Key Employee Life Insurance, you can evaluate each option for its benefits and choose the most suitable for your business. This approach ensures that you make an informed decision regarding your key employees' coverages.

Typically, key employees indemnification involves the use of term life insurance. This type provides coverage for a specific period and ensures financial protection for your business in case of unforeseen events. Utilizing the South Carolina Checklist - Key Employee Life Insurance can help you identify the best options for your company's needs. It simplifies choosing the right policy that aligns with your indemnification strategy.

To access your life insurance policy, start by contacting your insurance provider directly. You may need necessary identification and policy number to retrieve the documents. Also, consider reviewing the South Carolina Checklist - Key Employee Life Insurance for streamlined steps. This checklist can guide you on how to efficiently manage your policy access.

To fill out a life insurance claim form, start by gathering the required documents, such as the policy and the death certificate. Carefully complete the form by providing accurate information about the deceased policyholder and the beneficiary. Utilizing resources like the South Carolina Checklist - Key Employee Life Insurance from US Legal Forms can help ensure you fill out the claim form correctly.